Budget Reconciliation: Tracking the 2025 Trump Tax Cuts

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

12 min readThe 2017 Trump Tax Cuts, known as the Tax Cuts and Jobs Act (TCJA), reduced average tax burdens for taxpayers across the income spectrum and temporarily simplified the tax filing process through structural reforms. It also boosted capital investment by reforming the corporate tax system and significantly improved the international tax system.

At the end of 2025, the individual portions of the Tax Cuts and Jobs Act expire all at once. Without congressional action, 62 percent of filers could soon face a tax increase relative to current policy in 2026. At the same time, the price tag for extending the 2017 Trump tax cuts is in the trillions.

Explore our related resources below, including our tariff tracker, our budget reconciliation tracker, our latest analysis and reform options regarding TCJA permanence, our interactive tax calculator and congressional districts map, and how 2026 brackets would change if the TCJA expires.

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

12 min read

Permanently extending the Tax Cuts and Jobs Act would boost long-run economic output by 1.1 percent, the capital stock by 0.7 percent, wages by 0.5 percent, and hours worked by 847,000 full-time equivalent jobs.

6 min read

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

At the end of 2025, the individual tax provisions in the Tax Cuts and Jobs Act (TCJA) expire all at once. Without congressional action, most taxpayers will see a notable tax increase relative to current policy in 2026.

4 min read

Policymakers should have two priorities in the upcoming economic policy debates: a larger economy and fiscal responsibility. Principled, pro-growth tax policy can help accomplish both.

21 min read

If Congress allows the Tax Cuts and Jobs Act (TCJA) to expire as scheduled, most aspects of the individual income tax would undergo substantial changes, resulting in more than 62 percent of tax filers experiencing tax increases in 2026.

3 min read

Lawmakers should see 2025 as an opportunity to consider more fundamental tax reforms. While the TCJA addressed some of the deficiencies of the tax code, it by no means addressed them all.

8 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

The TCJA improved the U.S. tax code, but the meandering voyage of its passing and the compromises made to get it into law show the challenges of the legislative process.

6 min read

The Tax Cuts and Jobs Act’s changes to family tax policy serve as a reminder to avoid looking at tax reform provisions in a vacuum.

5 min read

The Tax Cuts and Jobs Act (TCJA) significantly lowered the effective tax rates on business income, but the impact was not the same for C corporations and pass-through businesses.

6 min read

As lawmakers consider which policies to prioritize in the upcoming tax policy debates, better cost recovery for all investment should be top of mind.

7 min read

Pro-growth tax reform that does not add to the deficit will require tough choices, but whether to raise the corporate tax rate is not one of them. If lawmakers want to craft fiscally responsible and pro-growth tax reform, a higher corporate tax rate simply does not fit into the puzzle.

3 min read

The 2017 Tax Cuts and Jobs Act (TCJA) was the largest corporate tax reform in a generation, lowering the corporate tax rate from 35 percent to 21 percent, temporarily allowing full expensing for short-lived assets (referred to as bonus depreciation), and overhauling the international tax code.

6 min read

As members of Congress prepare to address the expiration of the TCJA, they should appreciate how revenues have evolved since 2017.

4 min read

While the approaches differ, they share a reliance on similar linkages: new capital investment drives productivity growth, which grows the economy and raises wages for workers.

37 min read

The Tax Cuts and Jobs Act of 2017 (TCJA) reformed the U.S. system for taxing international corporate income. Understanding the impact of TCJA’s international provisions thus far can help lawmakers consider how to approach international tax policy in the coming years.

30 min read

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read

Over the next 10 years, the IRA’s energy tax credits are projected to cost north of $1 trillion, adding to the federal government’s budgetary challenges and burgeoning debt.

6 min read

When the tax code is stable and predictable, individuals, families, and businesses can set goals for the future and make plans to achieve them.

Lawmakers should aim for policies that support investment and hiring in the United States and refining anti-avoidance measures to improve administrability and lower compliance costs.

With proposals to adopt the nation’s highest corporate income tax, second-highest individual income tax, and most aggressive treatment of foreign earnings, as well as to implement an unusually high tax on property transfers, Vermont lawmakers have no shortage of options for raising taxes dramatically.

7 min read

With state tax revenues receding from all-time highs, there’s been a great deal of handwringing about whether states can afford the tax cuts adopted over the past few years. Given that 27 states reduced the rate of a major tax between 2021 and 2023, is there reason for concern?

4 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

In the context of the 2024 election year, what does President Biden’s 2025 budget proposal signify regarding his strategies and priorities as he seeks reelection? And how could these proposals shape the overall landscape of this election cycle?

The 2021 tax year was the fourth since the Tax Cuts and Jobs Act (TCJA) made many significant, but temporary, changes to the individual income tax code to lower tax rates, widen brackets, increase the standard deduction and child tax credit, and more.

9 min read

We’re examining the differences between the broad incentives provided by the Tax Cuts and Jobs Act and the targeted approach of the Inflation Reduction Act and the CHIPS and Science Act.

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

While the approaches differ, they share a reliance on similar linkages: new capital investment drives productivity growth, which grows the economy and raises wages for workers.

37 min read

Though providing permanent R&D expensing alone would not be a China-competition magic bullet, it is a no-brainer place to start. In this technological race, we should first make sure we have not tied our own shoes together.

4 min read

What does it mean to be an American company?

4 min read

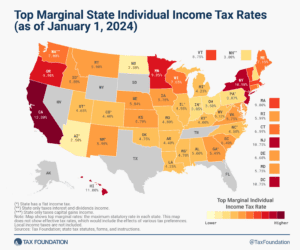

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

The CBO projects deficits will be higher than historical levels, largely due to growth in mandatory spending programs While some recent legislation has reduced the deficit, the Inflation Reduction Act is proving to be more expensive than originally promised.

5 min read

Limiting interest deductibility continues to be a worthwhile policy goal, but given the current climate, policymakers should opt to pair any further limitations with other pro-growth policies such as full expensing to ensure firms’ incentives to invest are preserved.

3 min read

The U.S. House of Representatives has passed a highly anticipated bipartisan tax deal. The Tax Relief for American Workers and Families Act now awaits action in the Senate.

6 min read

Historical evidence and recent studies have shown that retaliatory tax and trade proposals raise prices and reduce the quantity of goods and services available to U.S. businesses and consumers, resulting in lower incomes, reduced employment, and lower economic output.

5 min read

The Tax Cuts and Jobs Act of 2017 (TCJA) reformed the U.S. system for taxing international corporate income. Understanding the impact of TCJA’s international provisions thus far can help lawmakers consider how to approach international tax policy in the coming years.

30 min read