Before the pandemic, an estimated 5.8 million Americans worked outside their state of residence, while about 8.9 million people worked from home. By 2021, over 27.6 million Americans were working almost exclusively from home, while the number of workers commuting across state lines dipped to 4.5 million. Though the pandemic’s short-run effect was to reduce cross-border commutes—along with all commutes, as more people stayed home—the long-term effect is likely to run in the other direction.

As a growing number of white-collar employees settle into hybrid work environments, commuting to an office some but not all days, many are likely to prioritize living space at the cost of a somewhat longer (but less regular) commute. And even among those who once lived in one state but worked in another, some may now routinely work in both states—from home some days and out of the office on others.

This is a welcome change for many workers, but it can be a nightmare come tax season. An old idea—state reciprocity agreements—can come to the rescue of a new economic reality. Under these agreements, neighboring states could agree to taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. cross-border workers entirely based on residency, avoiding the complexities of taxpayers filing in two states. For decades, a growing number of states entered into these agreements, but the momentum stalled in the early 1990s. Reciprocity is an idea whose time has come again.

Table of Contents

Taxation of Commuting Workers

As a rule, income can be taxed (1) in one’s place of residence and (2) where it is earned. Absent any adjustment, this would frequently lead to double taxation, with two states levying taxes on income earned outside one’s domiciliary state. Fortunately, every state with a wage income tax offers credits for taxes paid to other states, designed to avoid double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. . Typically, these credits are not for the amount actually remitted to another state, but rather for the lesser of that amount or the amount that would have been paid on one’s income to one’s home state.

To demonstrate, imagine living in a state with a 5 percent income tax rate but working in a state with a 7 percent rate. If one earned $60,000 in the second state, it would be taxed at 7 percent for a tax bill of $4,200. One’s home state, however, would offer a credit reducing in-state tax liability by $3,000 (the $60,000 times the home state’s rate of 5 percent), not $4,200. If, on the other hand, the taxpayer lived in the higher-tax state and worked in the one with the lower rate, then she would pay $3,000 to the state where she works, receive a $3,000 credit from her home state, and pay a residual $1,200 to her home state. Either way, the total tax liability is the same—the higher of the two states’ taxes on that share of income—but the allocation to each state varies.

Graduated-rate taxes add some complexity to this process but do not alter the basic logic. The credit system requires taxpayers to file in both states, and frequently to owe taxes in both states, but is designed to avoid double taxation. The downsides of this system are (1) added cost and complexity for taxpayers and tax administrators and (2) tax revenue potentially going to states out of proportion to the services they provide to taxpayers.

Hybrid work complicates things even further. In an ordinary scenario in which one lives in State A but works exclusively in State B, filing in two states is necessary but the allocations are relatively straightforward. If, however, one works in State A one or two days a week, and in State B three or four days a week, then tax is owed in proportion to the days worked in each state. Complexity rises dramatically and withholding gets messy.

Fortunately, there is a solution, one many states have had on the books for years: income tax reciprocity. Under these reciprocal agreements, states cooperate with their neighbors to eliminate the need to file in two states. They simply agree to divide up their shared taxpayers based on residence, with taxpayers owing tax exclusively to their domiciliary state.

This is not only simpler but arguably more rational. While it is certainly true that commuters receive the benefit of some state services in their employer’s state, they typically benefit far more from services where they live. Therefore, it is reasonable that income taxes would primarily flow to the latter.

Existing State Reciprocity Agreements

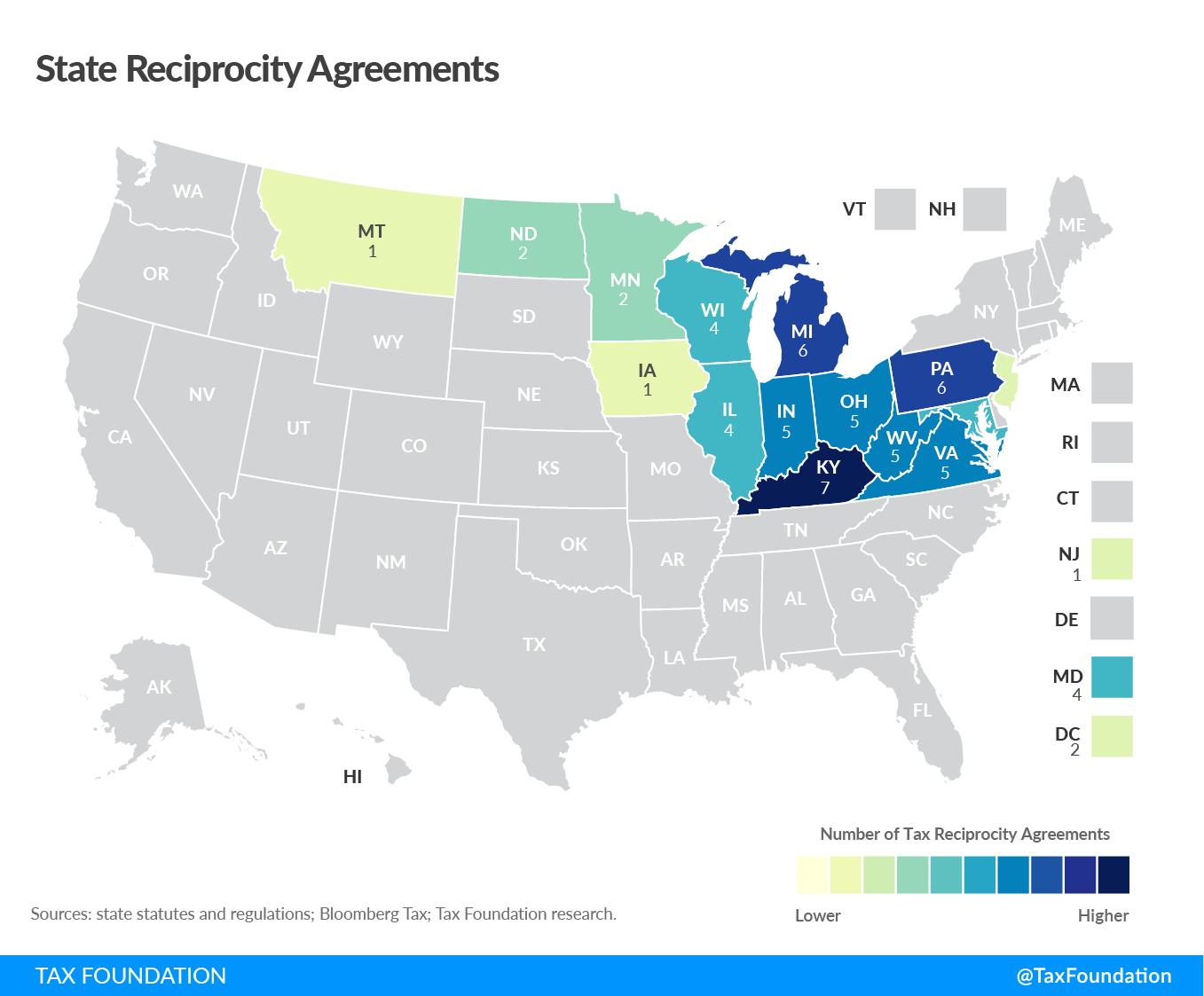

There are currently 30 reciprocal agreements across 16 states and the District of Columbia, in a corridor running from the Mid-Atlantic to the Mountain West. Kentucky participates in the most agreements with seven, followed by Michigan and Pennsylvania at six apiece. At the other end of the spectrum, Iowa, Montana, and New Jersey offer reciprocity with only one state each, while 25 states with wage income taxes do not offer such reciprocity to multistate taxpayers.

| IL | IN | IA | KY | MD | MI | MN | MT | NJ | ND | OH | PA | VA | WV | WI | DC | Count | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| IL | ✓ | ✓ | ✓ | ✓ | 4 | ||||||||||||

| IN | ✓ | ✓ | ✓ | ✓ | ✓ | 5 | |||||||||||

| IA | ✓ | 1 | |||||||||||||||

| KY | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 7 | |||||||||

| MD | ✓ | ✓ | ✓ | ✓ | 4 | ||||||||||||

| MI | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 6 | ||||||||||

| MN | ✓ | ✓ | 2 | ||||||||||||||

| MT | ✓ | 1 | |||||||||||||||

| NJ | ✓ | 1 | |||||||||||||||

| ND | ✓ | ✓ | 2 | ||||||||||||||

| OH | ✓ | ✓ | ✓ | ✓ | ✓ | 5 | |||||||||||

| PA | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 6 | ||||||||||

| VA | ✓ | ✓ | ✓ | ✓ | ✓ | 5 | |||||||||||

| WV | ✓ | ✓ | ✓ | ✓ | ✓ | 5 | |||||||||||

| WI | ✓ | ✓ | ✓ | ✓ | 4 | ||||||||||||

| DC | ✓ | ✓ | 2 | ||||||||||||||

| Sources: State statutes and regulations; Bloomberg Tax; Tax Foundation research. | |||||||||||||||||

State reciprocity agreements come in a variety of forms. Although not all approaches are of equal status, we employ a broad definition here, counting (1) bilateral agreements between specific states, (2) unilateral offering of reciprocity with any state that can reciprocate, and (3) policies that reciprocally exempt commuters from nonresident income tax. Some agreements extend to all income, while others are restricted to certain classes of income—typically wage and compensation income. Notably, we do not regard reverse credit arrangements as a form of income tax reciprocity as other sources tend to do (though inconsistently), for reasons explained later. Broader and more automatic policies are preferable to those that only benefit select taxpayers or certain classes of income. These different approaches are treated in turn.

Bilateral Agreements

Seventeen of the 30 existing reciprocal agreements are bilateral agreements entered into by Commissioners of Revenue or their equivalents upon broad statutory authorization. A typical approach is that of Illinois, which reads in part:

The Director may enter into an agreement with the taxing authorities of any state which imposes a tax on or measured by income to provide that compensation paid in such state to residents of this State shall be exempt from such tax; in such case, any compensation paid in this State to residents of such state shall not be allocated to this State.

Sometimes these statutes dictate which sources of income may be subject to the agreement, while others leave it to the discretion of revenue officers or conform to the policy of the reciprocating state. In some instances, there are additional restrictions: Montana’s Department of Revenue may only enter into such agreements with contiguous states, while Maryland’s provision does not apply if the taxpayer is in the non-domiciliary state for more than 183 days per year (with an exemption for West Virginia). New Jersey has an agreement with Pennsylvania but, unique among states, seems to rely on broader statutory authority regarding multistate agreements, whereas other states have more specific language authorizing agreements exempting nonresidents from select states from tax.

Unilateral Offers

Three states—Indiana, Minnesota, and Wisconsin—automatically extend reciprocity to any state that provides similar treatment to their own residents. Ironically, Minnesota and Wisconsin do not enjoy reciprocity with each other, since the Minnesota law permits the Commissioner of Revenue to rescind any such automatic reciprocity when they deem it to be “in the best interests of the people of this state.” Unusually, the two states entered into a revenue-sharing arrangement in which they compensated each other for the multistate activity, and disputes over payments led to a rescission of the agreement in 2009. In practice, Minnesota currently has specific agreements with two states, and essentially operates as a bilateral agreement state, while Wisconsin provides reciprocity with four states that have provided similar treatment to Wisconsinites.

Notably, since Wisconsin is not negotiating these agreements directly, their parameters are dictated by the other party’s generosity—or lack thereof. Wisconsin will exempt any personal service income to the extent that it is exempted or credited for Wisconsin residents in the other state. If one state chooses only to exempt Wisconsin residents’ wages and salaries, then Wisconsin will do likewise; if they also exempt commissions and fees, Wisconsin follows.

Indiana’s law is the broadest and serves as a good representative of the type. It has been interpreted to apply not only to reciprocal policies of other states, but also to reverse tax credits (discussed later). It reads:

The tax imposed by IC 6-3-2 on the adjusted gross incomeFor individuals, gross income is the total of all income received from any source before taxes or deductions. It includes wages, salaries, tips, interest, dividends, capital gains, rental income, alimony, pensions, and other forms of income. For businesses, gross income (or gross profit) is the sum of total receipts or sales minus the cost of goods sold (COGS)—the direct costs of producing goods, including inventory and certain labor costs. derived from sources within the state of Indiana by persons who are nonresidents of this state, shall not be payable if the laws of the state or territory of residence of such persons, at the time such adjusted gross income was earned in this state, contained a reciprocal provision by which residents of this state were exempted from taxes imposed by such state on income earned in such state.

Commuter Exemptions

Maryland and Virginia, both of which have bilateral agreements with multiple states, also have a commuter provision that reciprocally exempts nonresident commuters from income tax. Such policies could be implemented in any state, but Maryland and Virginia drew them up with the District of Columbia in mind. The federal district is not permitted to tax nonresident income, meaning that Washington, D.C., cannot tax a Virginia-domiciled employee regardless of Virginia law. The Maryland and Virginia commuter agreements with D.C., however, stipulate that these states will tax their own residents when they commute to work in the District and will exempt D.C. residents from tax if they commute into their respective states.

Reverse Credits

When an Arizona resident works in California, instead of Arizona providing a credit for taxes paid in California—up to the amount she would have paid on that income in Arizona—she pays Arizona taxes on the income and California provides a credit for taxes paid to Arizona. Because California taxes are higher than Arizona’s, she will still pay a residual amount to California, meaning she still has to file in and pay to two states, and that she is subject to the higher of the rates. If instead the two states participated in a reciprocity agreement, she would pay Arizona’s lower rate on income earned in both Arizona and California, with California forgoing taxes on the nonresident income. This, of course, obviates the need for Arizona to provide a credit.

We do not regard honoring or entering into reverse credit arrangements as a form of income tax reciprocity, which some other sources tend (inconsistently) to do. We disregard these arrangements because the benefit of the reverse credit system accrues largely to the resident’s state, and not to the resident. Arizona, in this example, generates tax revenue on income earned by a resident even when she works in select other states. But while the resident’s out-of-state tax burden may be commensurately reduced, it is not necessarily eliminated.

This approach may have certain points in its favor compared to traditional credits for taxes paid to other states, as the taxpayer will benefit more from the services provided by the domiciliary state. It is not, however, a solution to being required to file in multiple states or keep track of commuting days, and if the nonresident state has a higher effective tax rate than the domiciliary state, reverse credits do not shield taxpayers from those higher taxes. Arizona, California, Indiana, Oregon, and Virginia all respect reverse tax credits, though not universally; Indiana, for instance, withdrew recognition of California’s reverse credit and does not interact with Virginia’s willingness to recognize one.

| State | Type | Statutory Authority |

|---|---|---|

| Illinois | Bilateral Agreement | 35 ILCS 5/302(b) |

| Indiana | Unilateral Offer | Ind. Code Ann. § 6-3-5-1 |

| Iowa | Bilateral Agreement | Iowa Code Ann. § 422.8(5) |

| Kentucky | Bilateral Agreement | KRS 141.070(2) |

| Maryland | Bilateral Agreement + Commuter Exemption | MD Code, Tax – General, § 10-806 |

| Michigan | Bilateral Agreement | MCL 206.256 |

| Minnesota | Unilateral Offer | Minn. Stat. § 290.081 |

| Montana | Bilateral Agreement | MCA § 15-30-2621 |

| New Jersey | Bilateral Agreement | General Authority |

| North Dakota | Bilateral Agreement | N.D.C.C. § 57-38-59.1 |

| Ohio | Bilateral Agreement | R.C. 5747.05(A)(2) |

| Pennsylvania | Bilateral Agreement | 72 P.S. § 7356(b) |

| Virginia | Bilateral Agreement + Commuter Exemption | Code of Virginia §§ 58.1-342 and -342(A) |

| West Virginia | Bilateral Agreement | W. Va. Code § 11-21-40 |

| Wisconsin | Unilateral Offer | Wis. Stat. § 71.05 |

| District of Columbia | Nontaxability | n.a. |

| Sources: State statutes and regulations; Bloomberg Tax; Tax Foundation research. | ||

A Policy Solution for Today

State reciprocity agreements were originally created to deal with a different problem: a patchy system of credits for taxes paid to other states that sometimes lead to double taxation. That problem has been largely solved. But the other advantage of such agreements is more relevant today: they drastically simplify taxes for commuting workers.

The following scenario helps demonstrate the advantage of reciprocal agreements for multistate taxpayers. For simplicity’s sake, we imagine that both states in the example have flat taxes at rates of 4 and 6 percent in the domiciliary and nonresident state, respectively, and assume the taxpayer has $75,000 in taxable income to avoid burdening the example with deductions or other tax considerations. We only consider their wage income, not unearned income that would be attributable to their state of residence (State A) without regard to any reciprocity agreement.

| Tax Liability on $75,000 in Wage Income Under Three Scenarios | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Standard Credit System | Reverse Credit Recognition | Reciprocity Agreement | |||||||

| Worked in State B | State A | State B | Total | State A | State B | Total | State A | State B | Total |

| 100% of Time | $0 | $4,500 | $4,500 | $3,000 | $1,500 | $4,500 | $3,000 | $0 | $3,000 |

| 60% of Time | $1,200 | $2,700 | $3,900 | $3,000 | $900 | $3,900 | $3,000 | $0 | $3,000 |

| Source: Tax Foundation calculations. | |||||||||

First, assume that the taxpayer lives in State A but works exclusively in State B, commuting to an office across state lines every day. In the absence of any special rules, the full $75,000 would be taxable in State A (at 4 percent) and State B (at 6 percent), but State A would offer a credit for taxes paid to other states, wiping out any liability on that earned income. The result is $4,500 in tax liability to State B, where the taxpayer worked, and none to State A, where the taxpayer lives.

If, on the other hand, these states recognized a reverse credit system, then once again both states would begin by taxing all $75,000 at their respective rates, but instead of State A (the domiciliary state) providing a credit for taxes paid to State B (where the taxpayer earned the income), the credit would come from State B. Since State B, in our example, is a higher tax state, it would credit the $3,000 paid to State A, leaving a $1,500 residual owed to State B. In both cases, the taxpayer’s overall liability is $4,500—their tax burden under the higher of the two rates. What differs is where the money goes.

Finally, what if these states had a reciprocity agreement? In this case, the states would agree to forgo tax revenue from each other’s residents when they work in the state, leaving them to be taxed exclusively by their domiciliary state. In this example, therefore, the taxpayer would owe $3,000 to their home state and nothing to the state where they worked. Since their home state has a lower rate, this yields a lower tax rate. (If their home state’s rate was higher, there would be no tax savings, but the reciprocity agreement would not cost them anything.) Other than a possible requirement for their employer to submit paperwork acknowledging their eligibility under the reciprocal program, moreover, they would have no obligation to file in two states—unlike in the other two scenarios.

We also run each of these possibilities again under a scenario where an employee works in the out-of-state office 60 percent of the time but works from home the remaining days. Here, the reduced compliance costs of not having to file in both states are particularly noteworthy, as otherwise the taxpayer would be obligated to keep track of how many days they worked in each state.

In short, income tax reciprocity reduces taxpayer compliance costs, ensures tax dollars flow to the state that provides the taxpayer with the most benefits, and gives taxpayers the benefit of their own state’s tax system when it is preferable to that of the state in which they work.

Appealingly for lawmakers, the legislative work to advance reciprocity agreements is quite simple. Most frequently, the law simply takes the form of authorizing state tax administrators to enter into such mutual agreements either at their discretion or wherever possible. It is a simple yet powerful policy solution for a very real problem of taxation in the modern workplace.

Who Benefits from State Reciprocity Agreements?

Reciprocity agreements are strictly voluntary for states, and in most cases, tax administrators make the final determination, not lawmakers. It follows, then, that states must see mutual benefit in entering into these agreements.

That benefit could take several forms. It is possible, as some researchers believe, that higher tax states may anticipate additional revenue because the agreements reduce disincentives for businesses to expand their operations across state lines. Lower tax states may see an economic and revenue benefit in making it more attractive for people to live within their borders even if they continue to work elsewhere. And all states may value the relative administrative ease for revenue officials or want to give their own taxpayers the benefit of reduced compliance costs.

The implications for tax competition are not straightforward. Some scholars believe that reciprocity agreements may reduce tax competition, helping higher tax states by eliminating the tax wedge for those who might commute into the state for work (and thus may be the most tax-sensitive) while simultaneously removing the tax disadvantage associated with a pass-through business owner in a neighboring state expanding her operations across state lines. Even if some of these new roles are filled by nonresidents who do not contribute to the state’s coffers, this economic expansion creates additional jobs that can be filled by taxpaying residents as well.

Conversely, reciprocity agreements may encourage individuals to move across state lines, establishing residence in the lower-tax state now that their work location does not dictate their tax liability. A person working in the District of Columbia can pay D.C. income tax rates if they live in the District, or lower rates if they live across the river—and many do.

In practice, both can be true. State reciprocity agreements may increase employment opportunities—which benefit residents and nonresident commuters alike—in higher-tax states by those states choosing to forgo tax on nonresident owners and commuting employees. (The lower tax state also benefits, by retaining the tax revenue from their residents who work in the nonresident state.) Simultaneously, some people employed in the higher tax state may have a greater incentive to move across state lines if domicile determines their tax liability. And if reciprocity does stabilize tax competition along the income tax axis, it may increase competition within other taxes.

Finally, even when states’ tax systems are relatively similar, reciprocity provides an enormous benefit to commuting taxpayers, particularly those with hybrid schedules.

Conclusion

Remote and flexible work opportunities are here to stay, whether states like it or not. With enhanced opportunities to take their job with them wherever they please, more workers can factor tax burdens into their decision of where to live. Even those who do not move may find their work environment changing, particularly with hybrid office schedules that see them commuting across state lines some days but working from home on others.

Reciprocity agreements can help lower-tax states attract residents and may help higher-tax states retain job opportunities. But the most compelling reason to act is to relieve taxpayers of an onerous burden, revising tax codes to better align with the way we now live and work.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe