Launch The New Interactive Web Tool!

Note: Our taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. map series below will examine each of the five major components of our 2019 State Business Tax Climate Index.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeExecutive Summary

The Tax Foundation’s State Business Tax Climate Index enables business leaders, government policymakers, and taxpayers to gauge how their states’ tax systems compare. While there are many ways to show how much is collected in taxes by state governments, the Index is designed to show how well states structure their tax systems and provides a road map for improvement.

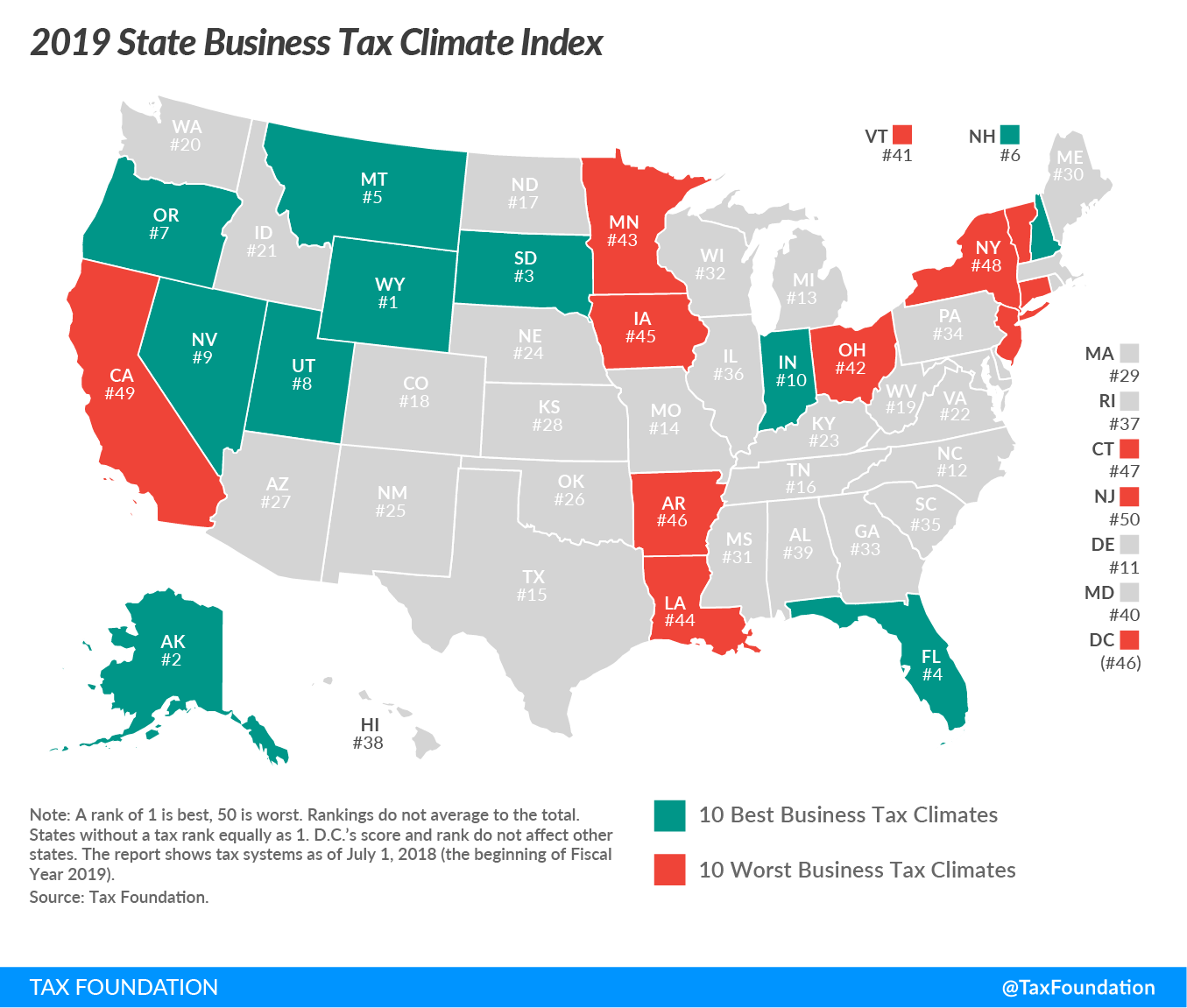

The 10 best states in this year’s Index are:

The absence of a major tax is a common factor among many of the top 10 states. Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. , the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. , or the sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. . Wyoming, Nevada, and South Dakota have no corporate or individual income tax (though Nevada imposes gross receipts taxA gross receipts tax, also known as a turnover tax, is applied to a company’s gross sales, without deductions for a firm’s business expenses, like costs of goods sold and compensation. Unlike a sales tax, a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases, leading to tax pyramiding. es); Alaska has no individual income or state-level sales tax; Florida has no individual income tax; and New Hampshire, Montana, and Oregon have no sales tax.

This does not mean, however, that a state cannot rank in the top 10 while still levying all the major taxes. Indiana and Utah, for example, levy all of the major tax types, but do so with low rates on broad bases.

The 10 lowest-ranked, or worst, states in this year’s Index are:

The states in the bottom 10 tend to have a number of afflictions in common: complex, nonneutral taxes with comparatively high rates. New Jersey, for example, is hampered by some of the highest property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. burdens in the country, recently implemented the second highest-rate corporate income tax in the country, levies an inheritance taxAn inheritance tax is levied upon an individual’s estate at death or upon the assets transferred from the decedent’s estate to their heirs. Unlike estate taxes, inheritance tax exemptions apply to the size of the gift rather than the size of the estate. , and maintains some of the nation’s worst-structured individual income taxes.

[newsletter_inline_widget campaign=”//TaxFoundation.us1.list-manage.com/subscribe/post?u=fefb55dc846b4d629857464f8&id=4b9873a934&SIGNUP=SBTCI” title=”Get Updates About Tax Policy in Your State”]

| Overall Rank | Corporate Tax Rank | Individual Income Tax Rank | Sales Tax Rank | Property Tax Rank | Unemployment Insurance Tax Rank | |

|---|---|---|---|---|---|---|

| Note: A rank of 1 is best, 50 is worst. Rankings do not average to the total. States without a tax rank equally as 1. DC’s score and rank do not affect other states. The report shows tax systems as of July 1, 2018 (the beginning of Fiscal Year 2019). | ||||||

| Source: Tax Foundation | ||||||

| Alabama | 39 | 20 | 30 | 48 | 15 | 12 |

| Alaska | 2 | 25 | 1 | 5 | 23 | 35 |

| Arizona | 27 | 17 | 19 | 47 | 5 | 13 |

| Arkansas | 46 | 40 | 40 | 44 | 26 | 34 |

| California | 49 | 31 | 49 | 43 | 14 | 17 |

| Colorado | 18 | 16 | 14 | 38 | 12 | 40 |

| Connecticut | 47 | 29 | 43 | 30 | 50 | 23 |

| Delaware | 11 | 50 | 41 | 2 | 9 | 3 |

| Florida | 4 | 6 | 1 | 22 | 11 | 2 |

| Georgia | 33 | 8 | 38 | 29 | 24 | 38 |

| Hawaii | 38 | 14 | 47 | 24 | 16 | 26 |

| Idaho | 21 | 26 | 23 | 26 | 4 | 48 |

| Illinois | 36 | 39 | 13 | 36 | 45 | 42 |

| Indiana | 10 | 18 | 15 | 12 | 2 | 11 |

| Iowa | 45 | 48 | 42 | 19 | 39 | 33 |

| Kansas | 28 | 34 | 21 | 31 | 20 | 15 |

| Kentucky | 23 | 27 | 17 | 14 | 35 | 47 |

| Louisiana | 44 | 36 | 32 | 50 | 32 | 4 |

| Maine | 30 | 41 | 24 | 7 | 41 | 24 |

| Maryland | 40 | 22 | 45 | 18 | 42 | 28 |

| Massachusetts | 29 | 37 | 11 | 13 | 46 | 50 |

| Michigan | 13 | 11 | 12 | 11 | 22 | 49 |

| Minnesota | 43 | 42 | 46 | 27 | 31 | 25 |

| Mississippi | 31 | 15 | 27 | 35 | 36 | 5 |

| Missouri | 14 | 4 | 25 | 25 | 7 | 8 |

| Montana | 5 | 12 | 22 | 3 | 10 | 21 |

| Nebraska | 24 | 28 | 26 | 9 | 40 | 9 |

| Nevada | 9 | 33 | 5 | 40 | 8 | 45 |

| New Hampshire | 6 | 45 | 9 | 1 | 44 | 44 |

| New Jersey | 50 | 47 | 50 | 45 | 48 | 32 |

| New Mexico | 25 | 21 | 31 | 41 | 1 | 10 |

| New York | 48 | 7 | 48 | 42 | 47 | 31 |

| North Carolina | 12 | 3 | 16 | 20 | 33 | 7 |

| North Dakota | 17 | 23 | 20 | 32 | 6 | 14 |

| Ohio | 42 | 46 | 44 | 28 | 13 | 6 |

| Oklahoma | 26 | 9 | 33 | 39 | 19 | 1 |

| Oregon | 7 | 30 | 36 | 4 | 17 | 37 |

| Pennsylvania | 34 | 43 | 18 | 21 | 34 | 46 |

| Rhode Island | 37 | 32 | 29 | 23 | 43 | 29 |

| South Carolina | 35 | 19 | 34 | 34 | 27 | 27 |

| South Dakota | 3 | 1 | 1 | 33 | 28 | 39 |

| Tennessee | 16 | 24 | 8 | 46 | 29 | 22 |

| Texas | 15 | 49 | 6 | 37 | 37 | 18 |

| Utah | 8 | 5 | 10 | 16 | 3 | 16 |

| Vermont | 41 | 38 | 37 | 15 | 49 | 20 |

| Virginia | 22 | 10 | 35 | 10 | 30 | 43 |

| Washington | 20 | 44 | 6 | 49 | 25 | 19 |

| West Virginia | 19 | 13 | 28 | 17 | 18 | 30 |

| Wisconsin | 32 | 35 | 39 | 8 | 21 | 41 |

| Wyoming | 1 | 1 | 1 | 6 | 38 | 36 |

| District of Columbia | 46 | 27 | 45 | 25 | 47 | 33 |

Notable Ranking Changes in this Year’s Index

Connecticut

A temporary corporate income tax surcharge in Connecticut was permitted to phase down from 20 to 10 percent in 2018, reducing the top marginal rate (surcharge-inclusive) from 9.0 to 8.25 percent. Originally set to expire at the end of 2015, legislation adopted that year postponed its elimination until 2019, with a phasedown in 2018. This year’s budget will further postpone the surcharge’s repeal, but the 2018 rate reduction helped the state improve four places on the corporate component of the Index, from 33rd to 29th. Connecticut’s overall rank remains unchanged at 47th.

Delaware

Delaware reversed its short-lived and counterproductive experiment with the estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. , repealing it as of January 1, 2018. First adopted less than a decade ago, the tax generated very little revenue while driving wealthy seniors out of the state. Legislators scrapped the tax this year, and its elimination is the driving force behind the state’s improvement from 20th to 9th on the property tax component of the Index, and from 16th to 11th overall.

Hawaii

Last year, Hawaii legislators voted to restore the higher rates and brackets associated with a temporary tax increase which had been allowed to expire a year ago. The legislation reestablished three individual income tax bracketA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. s that had been eliminated and restored the top marginal rate to 11 percent, up from 8.25 percent. These changes went into effect in calendar year 2018 and caused the state to slip four places overall, from 34th to 38th, and from 38th to 47th on the individual income tax component.

Idaho

Idaho improved from 23rd to 21st overall due to individual and corporate income tax rate cuts adopted in response to base-broadening provisions of federal tax reform. Policymakers trimmed both rates by 0.475 percentage points, from 7.4 to 6.925 percent.

Indiana

Indiana saw consistent rate reductions through a series of responsible tax reform efforts between 2011 and 2016. Subsequent legislation established a further schedule of corporate income tax reductions through fiscal year 2022. For 2018, the corporate income tax rate declined from 6 to 5.75 percent. This rate reduction, among other changes, drove an improvement of six places on the corporate component of the Index. The Hoosier State and Utah continue to post the best rankings among states which impose all the major taxes.

Kansas

Recurring revenue shortfalls precipitated by a shortsighted package of tax cuts adopted in 2012 which, among other things, exempted all pass-through income from taxation, prompted legislators to phase in individual income tax rate increases over the past two years. Last year’s rate increase, which also added an additional tax bracket, resulted in a decline in the state’s overall ranking. However, this year’s further rate increase, from 5.2 to 5.7 percent, had no effect on the state’s overall rank. It did, however, drop Kansas two places–from 19th to 21st–on the individual income tax component.

Kentucky

Kentucky adopted revenue-positive tax reform which increases tax collections (primarily to address unfunded pension liabilities) while improving the overall tax structure. The state moved from a six-bracket individual income tax with a top rate of 6 percent to a 5 percent single-rate tax and scrapped its three-bracket corporate income tax for a single-rate tax as well. Lawmakers also suspended several business tax credits, broadened the sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , and raised the cigarette tax, among other changes. These structural changes and tax simplifications yielded a 16-place improvement in Kentucky’s overall ranking, from 39th to 23rd, with a particularly strong improvement on the individual income tax component, where the state jumped from 37th to 17th nationwide.

New Jersey

New Jersey completed the phaseout of its estate tax in 2018 and reduced its sales tax rate from 6.875 to 6.625 percent, the culmination of a two-year swap involving higher gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. rates. At the same time, however, lawmakers created a new individual income tax bracket with a rate of 10.75 percent, the third-highest in the country, and added a corporate income tax surcharge on companies with income of $1 million or more, which brings their tax rate to 11.5 percent. The sales tax rate reduction improves the state one place on that component, while estate tax repeal drives an improvement from 50th to 48th on the property tax component. The state’s individual income tax rank drops from 48th to 50th, and its corporate income tax rank falls from 42nd to 47th with the new rate increases. The state continues to rank worst overall on the Index.

Vermont

Set to experience a substantial revenue windfall due to federal tax reform, Vermont eliminated an individual income tax bracket while changing the top rate to 8.75 percent, down from 8.95 percent. The rate reduction and bracket contraction drove an improvement of six places on the individual income tax component, from 43rd to 37th, and helped the state improve one place, from 42nd to 41st, overall.

District of Columbia

In 2014, the District of Columbia began phasing in a tax reform package which lowered individual income taxes for middle-income brackets, expanded the sales tax base, raised the estate tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax. , and reduced the corporate income tax rate. This year saw the final stage of those reforms implemented, with the corporate income tax declining to 8.25 percent and the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. increasing to match the new federal deduction of $12,000. The corporate income tax rate reduction helped D.C. improve one place, from 28th to 27th, on the corporate component of the Index.

Recent and Proposed Changes Not Reflected in the 2019 State Business Tax Climate Index

Arkansas

Arkansas legislators are closing in on a comprehensive tax reform package which would overhaul individual and corporate income taxes as well as state-imposed property and wealth taxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary. es, the culmination of the work of a state tax reform commission. Should the state adopt such a plan, it would be reflected in subsequent editions of the Index.

Georgia

This year, Georgia lawmakers approved a tax reform package which could reduce the individual income tax rate from 6.0 to 5.5 percent by 2020, among other changes. These changes will begin to go into effect in 2019 and will be reflected in next year’s edition of the Index.

Iowa

In 2018, Iowa legislators adopted a comprehensive tax reform package which will ultimately reduce both individual and corporate income tax rates and eliminate the state’s unusual provision of a deduction for federal income tax payments, subject to revenue availability. These changes are not in effect in 2018, but Iowa’s rankings can be expected to improve as reforms phase in over the next few years.

Louisiana

With a temporary one percentage-point sales tax increase known as the “clean penny” set to expire, lawmakers chose a partial extension, keeping the rate above where it was when the temporary increase was adopted, but lower than it was last year. While the state rate declined from 5 to 4.45 percent, Louisiana’s combined average state and local sales tax rate remains the second highest in the nation at 9.46 percent, and its exceedingly complex and uncompetitive sales tax structure is still ranked worst in the nation on the sales tax component of the Index.

Missouri

In the waning days of the legislative session, Missouri legislators approved bills which will overhaul both the individual and corporate income taxes in coming years. The legislation will eliminate the choice of apportionmentApportionment is the determination of the percentage of a business’ profits subject to a given jurisdiction’s corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders. factors for most corporate taxpayers, paying for a rate reduction from 6.25 to 4 percent, while the individual income tax is set on a path toward a top rate of 5.1 percent (from 5.9 percent this year). These changes, however, lay in the future, and will show up in subsequent editions of the Index.

New Mexico

New Mexico completed its phase-in of corporate income tax rate reductions that began in 2014, with the rate dropping from 6.2 to 5.9 percent. This final reduction was not enough to improve the state’s ranking on the corporate component of the Index, though the state has improved several places since the rate reductions began.

Tennessee

In 2016, Tennessee began phasing out its Hall Tax, a tax on interest and dividend income, though the state does not tax wage income. The Index includes this tax at a calculated rate to reflect its unusually narrow base. Initial reductions are too small to change any component rankings, but Tennessee’s rank will improve once the tax is fully phased out in 2022.

Utah

Utah shaved both its corporate and individual income tax rates from 5 to 4.95 percent in response to higher anticipated revenue in the aftermath of federal tax reform. These minor reductions were not enough to improve the state’s rank, but Utah continues to rank the best of any state which imposes all the major tax types.

| Note: A rank of 1 is best, 50 is worst. All scores are for fiscal years. DC’s score and rank do not affect other states. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Source: Tax Foundation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 Rank | 2016 Score | 2017 Rank | 2017 Score | 2018 Rank | 2018 Score | 2019 Rank | 2019 Score | Change from 2018 to 2019 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Rank | Score | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alabama | 38 | 4.69 | 37 | 4.77 | 37 | 4.73 | 39 | 4.61 | -2 | -0.12 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alaska | 2 | 7.34 | 3 | 7.25 | 3 | 7.15 | 2 | 7.35 | +1 | +0.20 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Arizona | 27 | 5.08 | 26 | 5.10 | 25 | 5.09 | 27 | 5.00 | -2 | -0.09 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Arkansas | 46 | 4.25 | 43 | 4.36 | 43 | 4.35 | 46 | 4.28 | -3 | -0.07 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| California | 48 | 3.91 | 48 | 3.91 | 48 | 3.88 | 49 | 4.00 | -1 | +0.12 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Colorado | 18 | 5.26 | 18 | 5.25 | 18 | 5.28 | 18 | 5.19 | 0 | -0.09 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Connecticut | 47 | 4.19 | 47 | 4.17 | 47 | 4.17 | 47 | 4.23 | 0 | +0.06 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Delaware | 11 | 5.53 | 16 | 5.34 | 16 | 5.34 | 11 | 5.55 | +5 | +0.21 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Florida | 4 | 6.78 | 4 | 6.82 | 4 | 6.82 | 4 | 6.86 | 0 | +0.04 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Georgia | 34 | 4.81 | 33 | 4.89 | 31 | 4.92 | 33 | 4.85 | -2 | -0.07 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | 35 | 4.72 | 31 | 4.90 | 34 | 4.86 | 38 | 4.66 | -4 | -0.20 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Idaho | 26 | 5.10 | 25 | 5.10 | 23 | 5.11 | 21 | 5.12 | +2 | +0.01 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Illinois | 30 | 4.97 | 28 | 4.99 | 33 | 4.86 | 36 | 4.74 | -3 | -0.12 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Indiana | 10 | 5.58 | 9 | 5.73 | 9 | 5.75 | 10 | 5.70 | -1 | -0.05 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Iowa | 42 | 4.40 | 45 | 4.29 | 46 | 4.30 | 45 | 4.33 | +1 | +0.03 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kansas | 25 | 5.11 | 24 | 5.11 | 28 | 5.04 | 28 | 4.99 | 0 | -0.05 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kentucky | 37 | 4.70 | 38 | 4.66 | 39 | 4.69 | 23 | 5.10 | +16 | +0.41 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Louisiana | 39 | 4.68 | 44 | 4.31 | 44 | 4.32 | 44 | 4.34 | 0 | +0.02 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Maine | 33 | 4.82 | 35 | 4.87 | 30 | 4.97 | 30 | 4.95 | 0 | -0.02 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Maryland | 41 | 4.51 | 40 | 4.47 | 40 | 4.48 | 40 | 4.53 | 0 | +0.05 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Massachusetts | 28 | 4.99 | 29 | 4.98 | 27 | 5.04 | 29 | 4.98 | -2 | -0.06 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Michigan | 13 | 5.46 | 12 | 5.50 | 12 | 5.50 | 13 | 5.45 | -1 | -0.05 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Minnesota | 45 | 4.36 | 46 | 4.29 | 45 | 4.31 | 43 | 4.37 | +2 | +0.06 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mississippi | 29 | 4.98 | 30 | 4.98 | 29 | 4.98 | 31 | 4.95 | -2 | -0.03 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Missouri | 16 | 5.29 | 15 | 5.36 | 15 | 5.34 | 14 | 5.38 | +1 | +0.04 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Montana | 5 | 6.25 | 5 | 6.22 | 5 | 6.21 | 5 | 6.30 | 0 | +0.09 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nebraska | 21 | 5.14 | 23 | 5.12 | 26 | 5.08 | 24 | 5.06 | +2 | -0.02 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nevada | 9 | 5.86 | 7 | 5.92 | 7 | 5.92 | 9 | 5.81 | -2 | -0.11 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Hampshire | 6 | 5.99 | 6 | 5.97 | 6 | 5.99 | 6 | 6.06 | 0 | +0.07 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Jersey | 50 | 3.51 | 50 | 3.51 | 50 | 3.44 | 50 | 3.20 | 0 | -0.24 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Mexico | 24 | 5.11 | 27 | 5.09 | 24 | 5.11 | 25 | 5.06 | -1 | -0.05 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York | 49 | 3.84 | 49 | 3.86 | 49 | 3.87 | 48 | 4.02 | +1 | +0.15 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North Carolina | 12 | 5.49 | 11 | 5.55 | 11 | 5.58 | 12 | 5.52 | -1 | -0.06 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North Dakota | 19 | 5.24 | 19 | 5.23 | 19 | 5.23 | 17 | 5.28 | +2 | +0.05 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ohio | 43 | 4.40 | 41 | 4.46 | 41 | 4.44 | 42 | 4.51 | -1 | +0.07 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oklahoma | 23 | 5.12 | 21 | 5.16 | 21 | 5.13 | 26 | 5.05 | -5 | -0.08 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oregon | 8 | 5.86 | 10 | 5.73 | 10 | 5.74 | 7 | 5.88 | +3 | +0.14 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pennsylvania | 36 | 4.72 | 32 | 4.90 | 36 | 4.82 | 34 | 4.85 | +2 | +0.03 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rhode Island | 40 | 4.53 | 39 | 4.50 | 38 | 4.70 | 37 | 4.71 | +1 | +0.01 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| South Carolina | 31 | 4.90 | 34 | 4.88 | 32 | 4.89 | 35 | 4.83 | -3 | -0.06 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| South Dakota | 3 | 7.33 | 2 | 7.34 | 2 | 7.34 | 3 | 7.27 | -1 | -0.07 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tennessee | 17 | 5.27 | 14 | 5.41 | 14 | 5.42 | 16 | 5.30 | -2 | -0.12 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Texas | 14 | 5.46 | 13 | 5.48 | 13 | 5.46 | 15 | 5.37 | -2 | -0.09 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Utah | 7 | 5.88 | 8 | 5.88 | 8 | 5.89 | 8 | 5.83 | 0 | -0.06 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Vermont | 44 | 4.39 | 42 | 4.38 | 42 | 4.39 | 41 | 4.53 | +1 | +0.14 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Virginia | 22 | 5.13 | 22 | 5.13 | 22 | 5.12 | 22 | 5.11 | 0 | -0.01 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington | 15 | 5.31 | 17 | 5.32 | 17 | 5.31 | 20 | 5.18 | -3 | -0.13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| West Virginia | 20 | 5.23 | 20 | 5.18 | 20 | 5.17 | 19 | 5.18 | +1 | +0.01 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wisconsin | 32 | 4.84 | 36 | 4.80 | 35 | 4.85 | 32 | 4.87 | +3 | +0.02 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wyoming | 1 | 7.62 | 1 | 7.64 | 1 | 7.70 | 1 | 7.62 | 0 | -0.08 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| District of Columbia | 45 | 4.37 | 48 | 4.03 | 48 | 4.04 | 46 | 4.32 | +2 | +0.28 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

[newsletter_inline_widget campaign=”//TaxFoundation.us1.list-manage.com/subscribe/post?u=fefb55dc846b4d629857464f8&id=4b9873a934″ title=”Get Updates About Tax Policy in Your State”]

Introduction

Taxation is inevitable, but the specifics of a state’s tax structure matter greatly. The measure of total taxes paid is relevant, but other elements of a state tax system can also enhance or harm the competitiveness of a state’s business environment. The State Business Tax Climate Index distills many complex considerations to an easy-to-understand ranking.

The modern market is characterized by mobile capital and labor, with all types of businesses, small and large, tending to locate where they have the greatest competitive advantage. The evidence shows that states with the best tax systems will be the most competitive at attracting new businesses and most effective at generating economic and employment growth. It is true that taxes are but one factor in business decision-making. Other concerns also matter–such as access to raw materials or infrastructure or a skilled labor pool–but a simple, sensible tax system can positively impact business operations with regard to these resources. Furthermore, unlike changes to a state’s health-care, transportation, or education systems, which can take decades to implement, changes to the tax code can quickly improve a state’s business climate.

It is important to remember that even in our global economy, states’ stiffest competition often comes from other states. The Department of Labor reports that most mass job relocations are from one U.S. state to another rather than to a foreign location.[1] Certainly, job creation is rapid overseas, as previously underdeveloped nations enter the world economy without facing the third-highest corporate tax rate in the world, as U.S. businesses do.[2] State lawmakers are right to be concerned about how their states rank in the global competition for jobs and capital, but they need to be more concerned with companies moving from Detroit, Michigan, to Dayton, Ohio, than from Detroit to New Delhi, India. This means that state lawmakers must be aware of how their states’ business climates match up against their immediate neighbors and to other regional competitor states.

Anecdotes about the impact of state tax systems on business investment are plentiful. In Illinois early last decade, hundreds of millions of dollars of capital investments were delayed when then-Governor Rod Blagojevich (D) proposed a hefty gross receipts tax.[3] Only when the legislature resoundingly defeated the bill did the investment resume. In 2005, California-based Intel decided to build a multibillion-dollar chip-making facility in Arizona due to its favorable corporate income tax system.[4] In 2010, Northrup Grumman chose to move its headquarters to Virginia over Maryland, citing the better business tax climate.[5] In 2015, General Electric and Aetna threatened to decamp from Connecticut if the governor signed a budget that would increase corporate tax burdens, and General Electric actually did so.[6] Anecdotes such as these reinforce what we know from economic theory: taxes matter to businesses, and those places with the most competitive tax systems will reap the benefits of business-friendly tax climates.

Tax competition is an unpleasant reality for state revenue and budget officials, but it is an effective restraint on state and local taxes. When a state imposes higher taxes than a neighboring state, businesses will cross the border to some extent. Therefore, states with more competitive tax systems score well in the Index, because they are best suited to generate economic growth.

State lawmakers are mindful of their states’ business tax climates, but they are sometimes tempted to lure business with lucrative tax incentives and subsidies instead of broad-based tax reform. This can be a dangerous proposition, as the example of Dell Computers and North Carolina illustrates. North Carolina agreed to $240 million worth of incentives to lure Dell to the state. Many of the incentives came in the form of tax credits from the state and local governments. Unfortunately, Dell announced in 2009 that it would be closing the plant after only four years of operations.[7] A 2007 USA TODAY article chronicled similar problems other states have had with companies that receive generous tax incentives.[8]

Lawmakers make these deals under the banner of job creation and economic development, but the truth is that if a state needs to offer such packages, it is most likely covering for an undesirable business tax climate. A far more effective approach is the systematic improvement of the state’s business tax climate for the long term to improve the state’s competitiveness. When assessing which changes to make, lawmakers need to remember two rules:

- Taxes matter to business. Business taxes affect business decisions, job creation and retention, plant location, competitiveness, the transparency of the tax system, and the long-term health of a state’s economy. Most importantly, taxes diminish profits. If taxes take a larger portion of profits, that cost is passed along to either consumers (through higher prices), employees (through lower wages or fewer jobs), or shareholders (through lower dividends or share value), or some combination of the above. Thus, a state with lower tax costs will be more attractive to business investment and more likely to experience economic growth.

- States do not enact tax changes (increases or cuts) in a vacuum. Every tax law will in some way change a state’s competitive position relative to its immediate neighbors, its region, and even globally. Ultimately, it will affect the state’s national standing as a place to live and to do business. Entrepreneurial states can take advantage of the tax increases of their neighbors to lure businesses out of high-tax states.

[newsletter_inline_widget campaign=”//TaxFoundation.us1.list-manage.com/subscribe/post?u=fefb55dc846b4d629857464f8&id=4b9873a934″ title=”Get Updates About Tax Policy in Your State”]

To some extent, tax-induced economic distortions are a fact of life, but policymakers should strive to maximize the occasions when businesses and individuals are guided by business principles and minimize those cases where economic decisions are influenced, micromanaged, or even dictated by a tax system. The more riddled a tax system is with politically motivated preferences, the less likely it is that business decisions will be made in response to market forces. The Index rewards those states that minimize tax-induced economic distortions.

Ranking the competitiveness of 50 very different tax systems presents many challenges, especially when a state dispenses with a major tax entirely. Should Indiana’s tax system, which includes three relatively neutral taxes on sales, individual income, and corporate income, be considered more or less competitive than Alaska’s tax system, which includes a particularly burdensome corporate income tax but no statewide tax on individual income or sales?

The Index deals with such questions by comparing the states on more than 100 variables in the five major areas of taxation (corporate taxes, individual income taxes, sales taxes, unemployment insurance taxes, and property taxes) and then adding the results to yield a final, overall ranking. This approach rewards states on particularly strong aspects of their tax systems (or penalizes them on particularly weak aspects), while measuring the general competitiveness of their overall tax systems. The result is a score that can be compared to other states’ scores. Ultimately, both Alaska and Indiana score well.

Launch The New Interactive Web Tool!

Note: Our tax map series below will examine each of the five major components of our 2019 State Business Tax Climate Index.

Notes

[1] See U.S. Department of Labor, “Extended Mass Layoffs, First Quarter 2013 ,” Table 10, May 13, 2013.

[2] Kyle Pomerleau, “Corporate Income Tax Rates Around the World, 2014,” Tax Foundation, Aug. 20, 2014.

[3] Editorial, “Scale it back, Governor,” Chicago Tribune, , Mar. 23, 2007.

[4] Ryan Randazzo, Edythe Jenson, and Mary Jo Pitzl, “Cathy Carter Blog: Chandler getting new $5 billion Intel facility,” AZCentral.com, Mar. 6, 2013.

[5] Dana Hedgpeth and Rosalind Helderman, “Northrop Grumman decides to move headquarters to Northern Virginia,” The Washington Post, Apr. 27, 2010.

[6] Susan Haigh, “Connecticut House Speaker: Tax ‘mistakes’ made in budget,” Associated Press, Nov. 5, 2015.

[7] Austin Mondine, “Dell cuts North-Carolina plant despite $280m sweetener,” TheRegister.co.uk, Oct. 8, 2009.

[8] Dennis Cauchon, “Business Incentives Lose Luster for States,” USA TODAY, Aug. 22, 2007.

Share