All Related Articles

Biden-Harris Proposals Can Raise Taxes on the Middle Class

If we look at both the legal incidence of the Biden-Harris policy proposals and their economic incidence, we find both direct and indirect tax increases on many taxpayers who earn less than $400,000.

2 min read

2021 State Business Tax Climate Index

166 min read

Two Roads Diverge in the OECD’s Impact Assessment

The difference that the OECD presents between the potential impact in the context of agreement compared to a harmful tax and trade war should show policymakers the value of continuing multilateral discussions.

6 min read

Top Rates in Each State Under Joe Biden’s Tax Plan

President Joe Biden’s tax plan would yield combined top marginal state and local rates in excess of 60 percent in three states: California, Hawaii, and New Jersey (also New York City).

4 min read

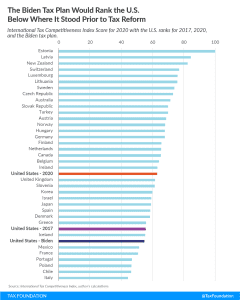

How Would Biden’s Tax Plan Change the Competitiveness of the U.S. Tax Code?

While the Biden campaign is certainly focused on increasing taxes on U.S. businesses and high-income earners, it is important that policymakers also understand what that reversal might do to U.S. competitiveness, and the competitive global environment in which U.S. companies and U.S. workers operate.

3 min read

Role of the 2017 Tax Reform in the Nascent U.S. Economic Recovery

While there is still plenty of work to be done to get unemployed Americans back to work, the U.S. economy as a whole is now recovering strongly from the pandemic-induced economic downturn, outperforming forecasts from earlier in the year and outperforming most other developed countries.

4 min read

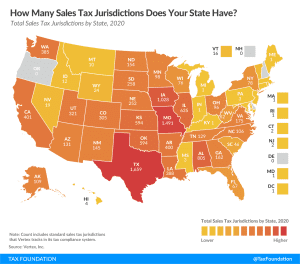

How Many Sales Tax Jurisdictions Does Your State Have?

Following the Wayfair decision, states’ move to tax online sales has increased the importance of simplicity in sales tax systems, as sellers now have to deal with differing regulations in multiple states. There are over 11,000 standard sales tax jurisdictions in the United States in 2020

2 min read

Reviewing the Commitment to American GROWTH Act

House Republicans recently introduced HR 11, the Commitment to American GROWTH Act, outlining an alternative to Democratic presidential nominee Joe Biden’s tax vision. The proposal would address upcoming expirations of the 2017 Tax Cuts and Jobs Act (TCJA) and create or expand other tax provisions designed to boost domestic investment.

5 min read

Arizona Proposition 208 Threatens Arizona’s Status as a Destination for Interstate Migration

Significantly raising the income tax through Proposition 208 will only serve to make Arizona less competitive, especially at a time when individuals and small businesses are already struggling. If Arizona is looking for a long-term way to increase education funding, it would do well to avoid overburdening struggling taxpayers and look toward more broad-based, stable sources of revenue.

5 min read