All Related Articles

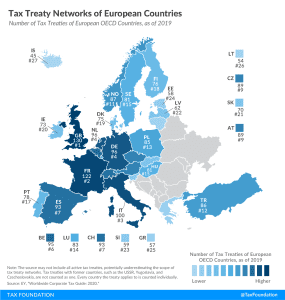

Tax Treaty Network of European Countries

Tax treaties usually provide mechanisms to eliminate double taxation and can provide certainty and stability for taxpayers and encourage foreign investment and trade. A broad network of tax treaties contributes to the competitiveness of an economy.

1 min read

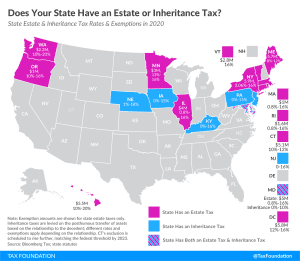

Estate and Inheritance Taxes by State, 2020

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

3 min read

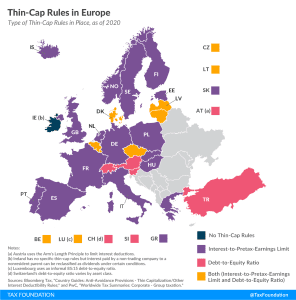

Thin-Cap Rules in Europe

To discourage a certain form of international debt shifting, many countries have implemented so-called thin-capitalization rules (thin-cap rules), which limit the amount of interest a multinational business can deduct for tax purposes.

4 min read

Proposals to Lure Foreigners to Greece Highlight Need to Reform Property Taxes

A more efficient property tax system in Greece is a better objective than just focusing on incentives for foreigners to change their tax residence.

4 min read

Biden’s Proposal Would Shift the Distribution of Retirement Tax Benefits

One of Biden’s tax proposals that has gotten little attention is a change that would shift the benefits of tax deferral in traditional retirement accounts toward lower- and middle-income earners. The plan would reduce the tax benefit for those earning above $80,250 but under $400,000, violating Biden’s tax pledge to not raise taxes on earners below the $400,000 threshold.

5 min read

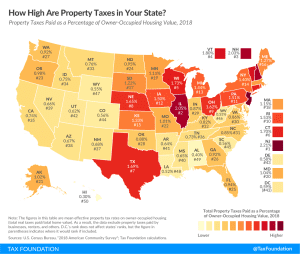

How High Are Property Taxes in Your State?

New Jersey has the highest effective rate on owner-occupied property at 2.21 percent, followed closely by Illinois (2.05 percent) and New Hampshire (2.03 percent).

2 min read

President Trump Outlines Second Term Tax Ideas

Broad themes of the president’s agenda include providing tax relief to individuals and tax credits to businesses that engage in desired activities, while the status of expiring TCJA provisions and tariffs seems uncertain.

4 min read

Who Will Pay for the Roads?

The highway trust fund is on track to run out of money by 2021, states are struggling to cover their transportation spending, and increased fuel economy, plus inflation, is chipping away at gas tax revenue year. How can Congress and state governments ensure they have the revenue necessary to fund our highways? One solution is the vehicle miles traveled (VMT) tax.

35 min read