State and Local Tax Ballot Measures to Watch on Election Day 2020

Here are the state tax ballot measures to watch on Election Day 2020. Explore the most notable 2020 state tax ballot measures in 15 states.

4 min read

Here are the state tax ballot measures to watch on Election Day 2020. Explore the most notable 2020 state tax ballot measures in 15 states.

4 min read

This Election Day, Colorado voters will weigh in on Proposition 116, which would permanently reduce the state’s flat income tax rate from 4.63 to 4.55 percent.

2 min read

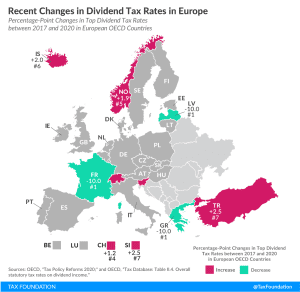

Over the last three years, eight European OECD countries have made changes to their dividend tax rates. Iceland, Norway, Slovenia, Switzerland, and Turkey increased their rates, each between roughly one and three percentage points. France, Greece, and Latvia cut their rates by 10 percentage points.

2 min read

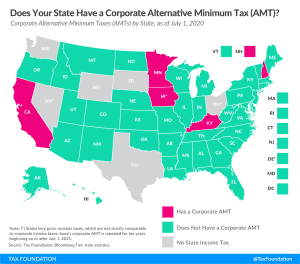

Five states currently collect corporate AMTs: California, Iowa, Kentucky, Minnesota, and New Hampshire. This is a significant drop from the eight states that levied AMTs in tax year 2017.

2 min read

After six unsuccessful tries at passage, it appears the coronavirus crisis has tipped the scales in favor of Gov. Phil Murphy’s (D) millionaires tax. New Jersey may be feeling the financial squeeze right now, but this large income tax change will not solve budget problems and may exacerbate funding issues by making the state even unfriendlier to businesses.

3 min read

One of the many policy questions Colorado voters will be tasked with deciding this November is whether to amend the state constitution to repeal the Gallagher Amendment, a provision within the Colorado constitution that, since 1982, has limited residential property to 45 percent of the statewide property tax base. Repealing the Gallagher Amendment would cause residential property taxes to rise over time but would also enhance the neutrality and overall competitiveness of the tax code.

4 min read

Making the Tax Cuts and Jobs Act’s individual provisions permanent combined with a carbon tax can be a revenue-neutral trade and increase the long-run size of the economy by 1 percent, making it a sustainable pro-growth option.

23 min read

Legalizing recreational marijuana is a hot topic in many states where the state budgets are in disarray because of the coronavirus pandemic and new revenue sources are being sought.

7 min read

A recent OECD report on 2020 tax reforms reveals an increase in the number of environmentally-related tax policies, including gas taxes, carbon taxes, and taxes on electricity consumption.

5 min read