Key Findings:

- Most states that levy a general sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. offer an exemption for groceries, thereby removing qualifying “grocery” products from their sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . However, many states claw back their grocery exemption for certain categories of goods, such as candy and soda.

- As evidenced by arbitrary variations in the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. treatment of groceries, candy, and soda, selective application of sales taxes increases tax complexity while producing distortive effects. For example, most states apply the sales tax to Milky Way Midnight® bars but do not tax the sale of regular Milky Way® bars, which meet the definition of a grocery.

- The Streamlined Sales and Use Tax Agreement (SSUTA) was established to promote a basic level of uniformity among state sales tax practices, but even with nearly half the states abiding by SSUTA definitions, varying sales tax rates on different types of groceries make sales tax administration unnecessarily complex.

- Broad-based consumption taxes have the potential to be a relatively simple, transparent, neutral, and stable form of taxation, but differential tax treatment of groceries erodes the efficiency and effectiveness of state sales tax systems.

- While grocery sales tax exemptions are well-intended, in practice they are limited in their ability to help low-income consumers.

- For states that wish to offer a robust grocery-specific safety net, a well-administered grocery credit system may offer a simpler and more reasonable alternative to the status quo.

- For states and consumers alike, there are many benefits to sales tax systems that tax all final consumer products – including groceries – at a low, flat rate.

Introduction

In most states throughout the U.S., consumers visiting a supermarket would not pay state sales taxes on their bacon and eggs for the week, but often would pay sales tax on a ready-made rotisserie chicken. If they pick up a Hershey’s® bar in the checkout line, that is likely subject to the sales tax, but if they pick up a Twix® bar, that likely is not. A bag of potato chips is usually exempt from the sales tax when purchased at a grocery store, but if purchased at a deli across the street, the chips would likely be subject to the sales tax.

These examples illustrate that the application of state sales taxes to food items is anything but simple.

But why?

Generally, the answer is that political considerations are prioritized above desires for a simple tax system. One of the most prevalent sales tax exemptions among states is the “grocery” exemption: 38 states and the District of Columbia carve out full or partial sales tax exemptions for goods classified as groceries.

Proponents of grocery exemptions argue that taxing necessities like food and beverages is unfair to individuals with lower incomes, who spend a larger portion of their earnings on groceries than those with more discretionary income.[1]

While grocery exemptions are well-intended, implementation of these policies has proven cumbersome. Many states, in their effort to remain consistent with the “necessity” argument while recouping lost revenue, have clawed back their grocery exemptions for certain “nonessential” food products. Candy and soda are common targets for exclusion due to their perceived lack of nutritional value. Among the states with full or partial grocery exemptions, 62 percent exclude either candy or soda from the exemption, meaning those products are subject to sales tax.[2]

While the desire among states to exempt necessities from the sales tax base is understandable, haphazardly applying the sales tax to some consumables while exempting others makes tax compliance that much more difficult and might not best serve those citizens these policies are designed to help.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeComplexities Created by Grocery Exemptions

One challenge presented by exempting groceries from the sales tax is that each state defines groceries in its own way. Some states use the nature of the food itself, or how it is processed, as the basis of their definition. For example, Massachusetts exempts “food products” from its sales tax base, including “meat and meat products,” “fish and fish products,” “eggs and egg products,” “vegetables and vegetable products,” and “fruit and fruit products,” but not “meals sold by a restaurant or a restaurant part of a store.”[3] In South Carolina, “unprepared food that lawfully may be purchased with United States Department of Agriculture food coupons” is exempt from the state’s sales and use tax.[4] Meanwhile, other states categorize sales tax status based primarily on who the vendor is or where the food is consumed. Arizona specifies that foods “intended for home consumption” and sold by an “eligible grocery business” are exempt from that state’s sales tax.[5]

As there are many food products that do not fall squarely in one category, states issue pages of clarifying rules and regulations so vendors know how to comply with the law. For instance, a supermarket might wonder how to code rotisserie chicken, a “prepared food” (usually taxable) but one that is “intended for consumption off-site” (usually not taxable). In many states with a grocery sales tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax. , rotisserie chicken is taxable if heated by a warming device but exempt if it is cooled, packaged, and refrigerated before being sold.[6]

Further, in supermarkets with dining areas, identical products may be taxed differently according to the specific area in which they are purchased. For example, in states that treat San Pellegrino® Sparkling Natural Mineral Water like a tax-exempt grocery, it would likely be taxable if purchased in the dining area but tax-exempt if purchased at the general register. The Arizona Department of Revenue, for example, advises that “grocery stores, delicatessens and other retail outlets qualified to sell food tax exempt, but which also operate a restaurant on the premises, must keep separate records for the two activities.”[7]

With so many variations in the taxation of groceries, retailers must be well-versed in these definitions to remain in compliance with applicable laws.

To Tax or Not to Tax? A Slippery Slope

Grocery exemptions are complex in and of themselves, and tax administration and enforcement only grow more complicated when product-specific exclusions are added to the mix.

When the aim of a grocery exemption is to make it easier for low-income consumers to buy necessities, states find themselves in the position of having to decide which products to classify as essential. When foods are categorized as necessities based on nutritional value, soda and candy are among the first products to be added to the “taxable” list, raising immediate questions regarding the tax treatment of other foods like chips, baked goods, and ice cream. Many states do not stop at soda and candy but fall down a slippery slope of handpicking all kinds of goods for taxation, such as diet foods, health supplements, and bottled water.

When this type of “à la carte” taxation occurs, arbitrary and counterintuitive discrepancies inevitably arise. For example, Louisiana taxes bottled water, but not soda or candy, at the state’s 5 percent general sales tax rate.[8] Meanwhile, Wisconsin levies sales taxes on yogurt covered raisins but not ice cream or popsicles.[9]

When political considerations are used to determine sales tax applicability, tax codes become increasingly convoluted and less effective at generating revenue. A better approach would be to use the principles of sound tax policy as the basis for making policy decisions that impact a state’s bottom line.

Special Sales Tax Application to Soda and Candy

An examination of sales tax application to candy and soda provides a particularly salient look into the complexity that ensues when states selectively apply or disapply the sales tax on a product-specific basis.

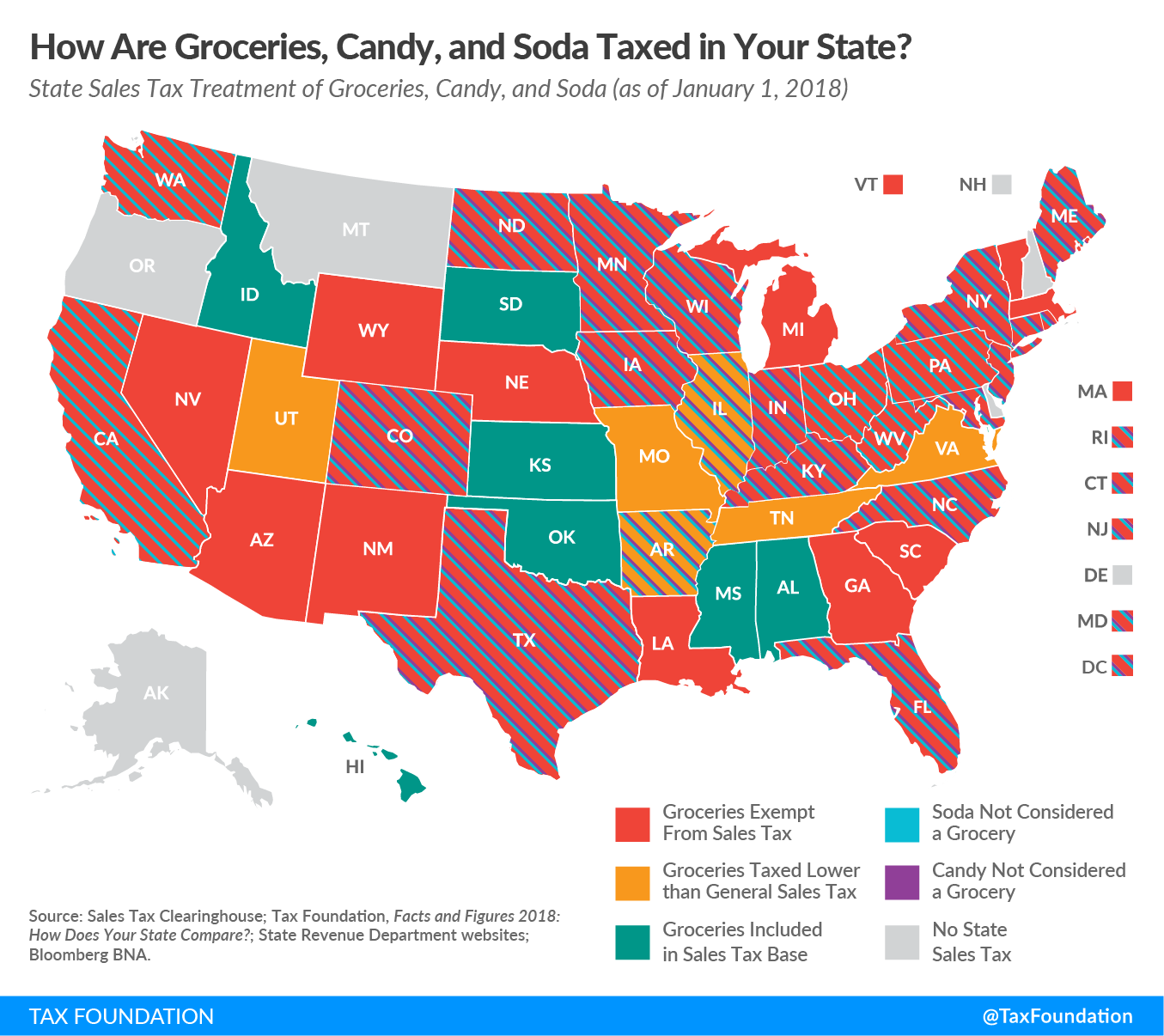

Table 1 shows state sales tax rates across the country and whether groceries are included in the sales tax base, exempt from the sales tax base, or included in the sales tax base but taxed at a rate that differs from the general sales tax rate. In the rightward columns, the table shows whether each state treats candy and soda as a “grocery” for purposes of sales tax collection.

| Unequal Treatment of Groceries, Candy, and Soda in State Tax Codes as of January 1, 2018 | ||||

|---|---|---|---|---|

| State | State General Sales Tax | Grocery Treatment | Candy Treated the Same as Groceries? | Soda Treated the Same as Groceries? |

|

(a) Three states levy mandatory, statewide, local add-on sales taxes at the state level: California (1.25%), Utah (1.25%), and Virginia (1%). Those rates are included in our calculation of the state general sales tax rate and the grocery rate where applicable. |

||||

|

Source: Sales Tax Clearinghouse; Tax Foundation, Facts and Figures 2018: How Does Your State Compare?; State Revenue Department websites; Bloomberg BNA. |

||||

| Alabama | 4% | Included in Sales Tax Base | Yes | Yes |

| Alaska | — | — | — | — |

| Arizona | 5.60% | Exempt | Yes | Yes |

| Arkansas | 6.50% | 1.50% | No | No |

| California (a) | 7.25% | Exempt | Yes | No |

| Colorado | 2.90% | Exempt | No | No |

| Connecticut | 6.35% | Exempt | No | No |

| Delaware | — | — | — | — |

| Florida | 6% | Exempt | No | No |

| Georgia | 4% | Exempt | Yes | Yes |

| Hawaii | 4% | Included in Sales Tax Base | Yes | Yes |

| Idaho | 6% | Included in Sales Tax Base | Yes | Yes |

| Illinois | 6.25% | 1% | No | No |

| Indiana | 7% | Exempt | No | No |

| Iowa | 6% | Exempt | No | No |

| Kansas | 6.50% | Included in Sales Tax Base | Yes | Yes |

| Kentucky | 6% | Exempt | No | No |

| Louisiana | 5% | Exempt | Yes | Yes |

| Maine | 5.50% | Exempt | No | No |

| Maryland | 6% | Exempt | No | No |

| Massachusetts | 6.25% | Exempt | Yes | Yes |

| Michigan | 6% | Exempt | Yes | Yes |

| Minnesota | 6.875% | Exempt | No | No |

| Mississippi | 7% | Included in Sales Tax Base | Yes | Yes |

| Missouri | 4.225% | 1.225% | Yes | Yes |

| Montana | — | — | — | — |

| Nebraska | 5.50% | Exempt | Yes | Yes |

| Nevada | 6.85% | Exempt | Yes | Yes |

| New Hampshire | — | — | — | — |

| New Jersey | 6.625% | Exempt | No | No |

| New Mexico | 5.125% | Exempt | Yes | Yes |

| New York | 4% | Exempt | No | No |

| North Carolina | 4.75% | Exempt | No | No |

| North Dakota | 5% | Exempt | No | No |

| Ohio | 5.75% | Exempt | Yes | No |

| Oklahoma | 4.50% | Included in Sales Tax Base | Yes | Yes |

| Oregon | — | — | — | — |

| Pennsylvania | 6% | Exempt | Yes | No |

| Rhode Island | 7% | Exempt | No | No |

| South Carolina | 6% | Exempt | Yes | Yes |

| South Dakota | 4.50% | Included in Sales Tax Base | Yes | Yes |

| Tennessee | 7% | 5% | Yes | Yes |

| Texas | 6.25% | Exempt | No | No |

| Utah (a) | 5.95% | 3% | Yes | Yes |

| Vermont | 6% | Exempt | Yes | Yes |

| Virginia (a) | 5.30% | 2.50% | Yes | Yes |

| Washington | 6.50% | Exempt | Yes | No |

| West Virginia | 6% | Exempt | Yes | No |

| Wisconsin | 5% | Exempt | No | No |

| Wyoming | 4% | Exempt | Yes | Yes |

| District of Columbia | 5.75% | Exempt | No | No |

Forty-five states and the District of Columbia levy a sales tax at the state level. Thirty-two states and the District of Columbia exempt groceries from their sales tax base. Twenty-two of those states treat either soda or candy differently than groceries. Five states exclude soda but not candy, and each state that excludes candy also excludes soda. Eleven of the states that exempt groceries from their sales tax base include both soda and candy in their definition of groceries: Arizona, Georgia, Louisiana, Massachusetts, Michigan, Nebraska, Nevada, New Mexico, South Carolina, Vermont, and Wyoming.

While 32 states exempt groceries, six additional states (Arkansas, Illinois, Missouri, Tennessee, Utah, and Virginia) partially exempt groceries by taxing them at a rate that is lower than that state’s general sales tax rate. Four of those six states include both soda and candy among the products eligible for the lower tax rate. Arkansas and Illinois exclude soda and candy from the lower rate.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeTax Patchwork on Soda and Candy Adds Complexity

When special carveouts are made for specific goods like candy and soda, retailers face a steep compliance burden as they work to collect and remit all the appropriate sales taxes at the correct rates without accidentally charging sales taxes on exempt items. To ensure vendors know how to code their existing merchandise and any new products that enter the market, states craft detailed definitions to be referenced when determining a product’s taxability.

Limitations of the Streamlined Sales and Use Tax Agreement

To bring some level of predictability to states’ sales tax definitions, the Streamlined Sales Tax Project (SSTP) was formed in 2000. The SSTP is a voluntary coalition of states that agree to a set of uniformity and simplification standards – the Streamlined Sales and Use Tax Agreement (SSUTA) – to achieve a higher level of sales tax consistency among states. Today, nearly half the states are members of the SSTP and have laws, rules, and regulations that comply with the SSUTA. [10]

To help retailers understand when to charge sales taxes, the Streamlined Sales Tax Governing Board (SSTGB) has adopted numerous definitions of specific products, including candy and soda. The SSUTA defines “candy” as “a preparation of sugar, honey, or other natural or artificial sweeteners in combination with chocolate, fruits, nuts or other ingredients or flavorings in the form of bars, drops, or pieces,” and “shall not include any preparation containing flour and shall require no refrigeration.”[11] Similarly, the SSUTA defines “soft drinks” as “non-alcoholic beverages that contain natural or artificial sweeteners.” Soft drinks “do not include beverages that contain milk or milk products, soy, rice or similar milk substitutes, or greater than fifty percent of vegetable or fruit juice by volume.”[12]

While the SSTGB’s aim in formulating these definitions is to enhance clarity, the practical effect of both the “candy” and “soft drink” definitions is that many products traditionally viewed as candy are not classified as candy, while some products traditionally considered to be “food” items are taxed like candy. The “soft drink” definition has also resulted in many non-soda beverages being taxed like soda.

While subscribing to the SSUTA offers member states the benefit of common definitions, a state’s status as a member of the SSTP does not necessarily indicate whether that state’s sales tax system is simpler or more complex than that of a nonmember state. SSTP states share common (albeit complex) definitions, but each member state decides for itself how it will tax various categories of goods.

Among SSTP member states, 18 states exempt groceries from their sales tax base, three states include groceries in their sales tax base, and two states include groceries but tax them at a lower rate. Among the 20 SSTP member states that have a full or partial grocery exemption, six states include candy and soda in that exemption, 11 states exclude candy and soda from that exemption, and three states include candy but not soda in their grocery tax exemption.

While familiarity with a state’s SSTP status gives retailers a general understanding of how a given state might define certain sales tax terms, complexity-reduction potential is limited when states enact numerous exemptions and exceptions.

What is Candy?

One limitation to the SSUTA’s definition of “candy” is that it relies on flour, an arbitrary ingredient, in determining whether to classify a food as either a “food product” or a “candy.” Though ostensibly used to try to delineate between candy and baked goods, when the presence of flour is used as an indicator, the result is that products like Kit Kat® bars and Twix® bars end up being tax-exempt, while Reese’s® Peanut Butter Cups and 3 Musketeers® products are taxable. Further, Milky Way Midnight® bars, which do not contain flour, are considered taxable candy, while classic Milky Way® bars are considered tax-exempt food products because they contain flour.

Pixy Stix,® composed of sugar and artificial flavors, are usually tax-exempt since they are not packaged as “bars,” “drops,” or “pieces.”[13] Meanwhile, Cracker Jacks® and kettle corn are taxed like candy because they are prepared with sweeteners and nuts in the form of “pieces,” and dried fruit is considered candy if sweetener is added.[14] Marshmallows are generally treated like candy because they are sold in “piece” form, but marshmallow crème is tax-exempt.

While the SSUTA’s candy definition makes no distinction for baking ingredients, some non-SSTP states, including Connecticut and Texas, reserve tax-exempt status for baking chocolate or similar products marketed for use in baking.[15]

What is Soda?

The SSUTA’s definition of “soft drink” is similarly complex and encompasses many beverages not generally viewed as soda. The SSUTA defines a “soft drink” as a nonalcoholic beverage containing natural or artificial sweeteners, with the specification that soft drinks do not contain “milk or milk products, soy, rice, or similar milk substitutes,” or more than 50 percent fruit or vegetable juice.[16] Under this definition, certain coffee, tea, and flavored water products are taxed as soft drinks when they are sweetened yet do not contain milk ingredients.

Based on this definition, a bottle of Starbucks® sweetened black iced coffee sold at a grocery store would be taxed like a soft drink, while a bottled Frappuccino® sold by the same grocer would not, despite the fact that Frappuccino® drinks generally contain more sugar and calories than sweetened coffee. In addition, sweetened sports drinks like Gatorade® and Powerade® would be treated like soda, regardless of their electrolyte-restoring function that supports exercise.

Further, according to the SSUTA’s parameters, V8 V-Fusion® would be tax-exempt because it contains 100 percent juice, while V8 V-Fusion Light® would be taxed like a soft drink because it contains only 50 percent juice. Minute Maid® lemonade would be taxable due to its low juice content and added sugar, while Country Time® lemonade mix would be tax-exempt because it is a powdered fruit drink.[17] The SSTGB ruled specifically that fruit-flavored cocktail mixes, such as Jose Cuervo® margarita mix, should be taxed like soft drinks since they could potentially be consumed on their own as nonalcoholic fruit-flavored beverages.[18]

Among non-SSTP states that have grocery exemptions but exclude soda, many additional variations exist when determining how a product is classified. Notably, sweetener is not always the primary indicator of soft drink status. In Connecticut, “food products for human consumption” are exempt from sales tax, but “carbonated beverages, including carbonated water,” are excluded from this definition, even if unsweetened.[19] As such, La Croix® natural fruit-flavored zero-calorie sparkling water would be taxable in states like Connecticut but tax-exempt under the SSUTA’s definition.

Even further, some states incorporate milk-based products or powdered beverage mixes in their soft drink definition. For example, in Florida, noncarbonated drinks made from milk derivatives, such as bottled Nesquik® milkshakes, are taxed as soft drinks.[20]

In some cases, products that would otherwise fall under a state’s soft drink definition are excluded based on medical merit. For example, in Texas, where groceries are tax-exempt, Pedialyte® is taxed as a soft drink when sold without a prescription (due to its sugar content), but with a prescription, the product is considered a tax-exempt drug or medicine.[21]

In addition, various states specify differing juice content requirements when determining which juices should be taxed like soda. In Pennsylvania, noncarbonated fruit drinks are taxed like soda if they contain less than 25 percent natural fruit juice, but they are considered tax-exempt groceries if they contain more than 25 percent juice.[22] However, the city of Philadelphia, which levies a local excise tax on sweetened beverages, includes juices with less than 100 percent juice in this definition. If purchased in Philadelphia, a Tropicana® Trop50® juice in blackberry cherry flavor (which contains 42 percent juice) would likely fall within the state’s grocery sales tax exemption while being subject to the city’s sweetened beverage tax.

All these variations highlight the sales tax complexity consumers experience on a daily basis, as well as the administrative burden states and vendors face when creating and complying with pages upon pages of seemingly trivial determinations.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeSoda and Candy Exclusions Do Not Exemplify the Key Principles of Sound Tax Policy

When states create broad sales tax exemptions – such as the grocery exemption – and then claw them back for goods like candy and soda, the resulting sales tax system usually lacks several important characteristics of sound tax policy: simplicity, transparency, neutrality, and stability.

States can promote simplicity through tax codes that are easy to comply with and administer. When states enact exemptions along with numerous exclusions, detailed definitions must be created, leading to administrative and enforcement complexity. As regulations become increasingly complex, retailers’ compliance burdens grow.

In addition, while sales taxes are among the more transparent forms of taxation, exemptions and exclusions detract from this transparency. After purchasing groceries, consumers can look at their receipt to see how much they paid in sales taxes and which items were taxed, but unless consumers are well-versed in state grocery tax laws, they are unlikely to know why their ready-to-eat rotisserie chicken was taxed while their microwave-ready mashed potatoes were not. This lack of transparency creates more room for error by vendors and makes it more likely that instances of sales tax misapplication may go unnoticed.

Further, sales tax exemptions and exclusions lead to preferential treatment for certain products – often on an arbitrary basis – which undermines the principle of neutrality. For example, when states designate flour as the ingredient that determines whether a product is taxed like a grocery or a candy, an incentive is created for consumers to choose a Milky Way® bar over a Hershey’s® bar, or perhaps a Little Debbie® dessert instead of candy.

States should avoid sales tax policies that intend to, or have the effect of, influencing behavior based on whether or how much a product is taxed. Currently, however, many state sales tax systems depart from this ideal, both by design and as an unintended consequence of misguided policies. For example, many proponents of product-specific grocery exemption carve-ins, such as for candy and soda, seek to influence consumer choice away from sugary food and beverages toward healthier options, although the effectiveness of such policies is the subject of much debate.[23] Meanwhile, if a well-informed consumer adjusts his or her purchasing decisions for tax reasons – perhaps choosing traditional Milky Way® over a Milky Way Midnight® bar, for example – the distortive effect of these policies would be so pervasive as to be impossible to measure.

Finally, when states trend toward collecting sales taxes on “nonessential” or “luxury” products only, the stability of the sales tax base becomes increasingly uncertain, as purchases of luxury goods decline during periods of economic weakness.[24]

As long lists of exemptions and exclusions detract from the simplicity, transparency, neutrality, and stability of a state’s sales tax system, policymakers should evaluate whether the political benefit of perpetuating such policies is truly worth the economic costs to taxpayers and the state.

Grocery Sales Tax Complexity is a Disservice to Taxpayers

As previously discussed, many states enact grocery exemptions to limit the regressivity of the sales tax, but just because a tax is regressive does not mean carveouts are an appropriate policy solution. In addition to detracting from the soundness of a state’s sales tax system, grocery exemption claw-backs limit the effectiveness of the underlying policy objective—in this case, mitigating the tax burden on low-income consumers.

When states exempt groceries from their sales tax base, all consumers receive the tax break, regardless of income level. Arguably, higher-income consumers receive more of the benefit than lower-income consumers, as their grocery bills tend to be higher, with more money spent on “expensive cuts of meat, fresh fruit out of season, exotic seafoods, and other items.”[25]

Similarly, when a state’s grocery exemption is clawed back for certain products like candy and soda, all purchasers of candy and soda are impacted, regardless of income level.

Of course, a federal grocery benefit already exists for many qualifying low-income households, as the Supplemental Nutrition Assistance Program (SNAP) can be used to purchase groceries, even if those groceries include candy, soft drinks, ice cream, baked goods, and other “nonessential” foods that commonly get clawed back from state grocery exemptions. Meanwhile, because federal law prohibits the taxation of SNAP benefits at any level, “nonessential” purchases and essential purchases alike are both free and tax-free when purchased using SNAP. Historically, Congress has considered limiting the types of groceries that can be purchased with SNAP benefits, but according to the U.S. Department of Agriculture, legislators “concluded that designating food items as luxury or nonnutrious would be administratively costly and burdensome.”[26]

If the SNAP program, designed to help those most in need, does not restrict benefit-eligible, tax-exempt purchases based on a product’s status as a “luxury” or “nonnutrious” good, it is reasonable to wonder why so many states willingly incur the administrative burden of creating grocery exemptions that apply to consumers of all income levels but then claw back those exemptions for certain categories of goods.

A Grocery Credit System is a Reasonable Alternative to Grocery Exemption Claw-Backs

For states that are considering sales tax reform but wish to retain some form of a grocery-specific safety net, a more reasonable option could be to tax all final consumer products – including groceries – at a low, flat rate while offering a targeted grocery assistance benefit to qualifying households. Such a program could provide relief to lower-income consumers while minimizing the administrative complexity in a state’s sales tax system. Further, by moving toward a system that taxes all final consumer goods at a low, flat rate, states could generate a stable stream of revenue from higher-income consumers who would not be unduly burdened by a sales tax on groceries.

This type of approach has been employed in Idaho, a state that includes groceries in its sales tax base. To offset the cost of grocery sales taxes paid by lower-income consumers, Idaho offers a grocery credit – which may be claimed on a taxpayer’s state income tax return – of $100 per individual under the age of 65 (including dependents) and $120 per individual for residents age 65 and older.[27] This credit is available to Idaho residents regardless of income level, and even Idaho residents not required to pay state income taxes (because their income is below the threshold at which a state income tax return must be filed) may claim the credit by submitting a form to the Idaho State Tax Commission. However, this credit may not be claimed simultaneously for months in which an Idaho resident receives SNAP benefits. While no credit is perfect, this credit is structured in such a way that consumers spending low to moderate amounts of money on groceries, and families with children, have more of their costs offset than consumers who spend more money on groceries or have fewer dependents.

Conclusion

In shaping or reshaping their sales tax system, states should remember that the primary purpose of taxation is to generate a stable source of revenue to fund government services. When policymakers get in the habit of handpicking goods for which the sales tax does or does not apply, the tax base simultaneously erodes and becomes more complex. As tax codes become increasingly complex, unintended consequences become more challenging to avoid.

Ultimately, taxpayers are best served not by tax policies that attempt to influence behavior or mitigate every perceived inequity, but by tax codes that maintain basic standards of simplicity, transparency, neutrality, and stability. At the same time, states are best served not by tax codes that reflect a mismatched patchwork of past and present lawmakers’ philosophical ideations, but by an easily administered tax code that generates a stable source of revenue.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeNotes

[1] John F. Due and John L. Mikesell, Sales Taxation: State and Local Structure and Administration (Washington, D.C.: Urban Institute Press, 1994), 9.

[2] The District of Columbia is included in this calculation.

[3] “830 CMR 64H.6.5: Sales Tax on Meals,” Mass.gov, Accessed May 30, 2018. https://www.mass.gov/regulations/830-CMR-64h65-sales-tax-on-meals.

[4] “2013 South Carolina Code of Laws :: Title 12 – Taxation :: CHAPTER 36 – SOUTH CAROLINA SALES AND USE TAX ACT :: SECTION 12-36-2120. Exemptions from Sales Tax,” Justia Law, Accessed April 19, 2018. https://law.justia.com/codes/south-carolina/2013/title-12/chapter-36/section-12-36-2120/.

[5] “Arizona Revised Statutes Title 42. Taxation § 42-5101,” Findlaw, 2018, Accessed April 19, 2018, https://codes.findlaw.com/az/title-42-taxation/az-rev-st-sect-42-5101.html.

[6] See Michigan Department of Treasury, “Sales Tax – Food for Human Consumption,” Oct. 21, 2009, https://www.michigan.gov/documents/treasury/RAB_2009-8_Food_for_Human_Consumption_Oct_09_299470_7.pdf; New York State Department of Taxation and Finance, “Food and Food Products Sold by Food Stores and Similar Establishments,” April 13, 2011, https://www.tax.ny.gov/pdf/tg_bulletins/sales/b11_283s.pdf.

[7] Arizona Department of Revenue, “Restaurants & Bars,” Pub 605, Revised July 2006, https://www.yumpu.com/en/document/view/4145481/restaurant-bars-arizona-department-of-revenue.

[8] Louisiana Department of Revenue, “Sales Tax Exemption for Food and Beverage Products,” Accessed May 30, 2018, http://www.rev.state.la.us/Miscellaneous/FoodExemptionFlyer.pdf.

[9] Wisconsin Department of Revenue, “Grocers: How Do Wisconsin Sales and Use Taxes Affect Your Operations?” March 2016, https://www.revenue.wi.gov/DOR%20Publications/pb220.pdf.

[10] StreamlinedSalesTax.org, “State Info: Streamline Sales Tax State Members,” Accessed April 19, 2018, http://www.streamlinedsalestax.org/index.php?page=state-info.

[11] StreamlinedSalesTax.org, “Streamlined Sales and Use Tax Agreement,” May 3, 2018, http://www.streamlinedsalestax.org/uploads/downloads/Archive/SSUTA/SSUTA%20As%20Amended%20Through%205-3-18%20with%20hyperlinks%20and%20Compiler%20Notes%20at%20end%20-%20Clean%20-%20Without%20Line%20Numbers.pdf, at 108.

[12] StreamlinedSalesTax.org, “Food Definition Issues,” Streamlined Sales Tax Project Discussion Paper, January 10, 2005, at 4, http://www.streamlinedsalestax.org/uploads/downloads/IP%20Issue%20Papers/IP05001_food_issues_paper_1_10_05.pdf.

[13] State of Indiana Department of Revenue, “Sales Tax,” Information Bulletin #29, April 2016, at 8, https://www.in.gov/dor/files/sib29.pdf.

[14] Id., at 9.

[15] Texas Comptroller of Public Accounts, “Grocery and Convenience Stores,” November 2012, at 7, https://comptroller.texas.gov/taxes/publications/96-280.pdf.

[16] StreamlinedSalesTax.org, “Streamlined Sales and Use Tax Agreement,” at 163.

[17] StreamlinedSalesTax.org, “Food Definition Issues,” at 4.

[18] StreamlinedSalesTax.org, “Streamlined Sales and Use Tax Agreement Compliance Review and Interpretations Committee, Interpretative Opinion 2009-02,” July 2, 2009, http://www.streamlinedsalestax.org/uploads/downloads/CI%20CRIC%20Meeting%20Docs/CI09012_Interp_Request_-Cocktail_Juice_7_16_09.pdf.

[19] Connecticut Department of Revenue Services, “Exemption of Food Products for Human Consumption; Taxability of Meals Sold by Eating Establishments or Caterers,” effective Dec. 26, 1985, http://www.ct.gov/drs/cwp/view.asp?A=1512&Q=269904.

[20] Florida Department of Revenue, “Changes in Sales and Use Tax Exemption for Food Products Beginning July 1, 1988,” June 19, 1998, https://revenuelaw.floridarevenue.com/LawLibraryDocuments/1998/06/TIP-104698_ba1a3222-8fe1-416c-a033-13bbaf88faa7.pdf.

[21] “Texas Administrative Code, Tax Code §151.313 – Drugs, Medicines, Medical Equipment, and Devices,”

[22] Pennsylvania Department of Revenue, “Retailer’s Information,” August 2016, at 20, http://www.revenue.pa.gov/FormsandPublications/FormsforBusinesses/SUT/Documents/rev-717.pdf.

[23] Katherine Loughead. “Soda Taxes Are Not a Sensible Solution to Combat Obesity,” Tax Foundation, May 17, 2018, Accessed May 31, 2018, https://taxfoundation.org/soda-taxes-not-sensible-solution-combat-obesity/.

[24] Nicole Kaeding. “Sales Tax Base BroadeningBase broadening is the expansion of the amount of economic activity subject to tax, usually by eliminating exemptions, exclusions, deductions, credits, and other preferences. Narrow tax bases are non-neutral, favoring one product or industry over another, and can undermine revenue stability. ,” Tax Foundation, Oct. 30, 2017, Accessed May 31, 2018, https://taxfoundation.org/sales-tax-base-broadening/.

[25] John F. Due and John L. Mikesell, Sales Taxation: State and Local Structure and Administration (Baltimore: The John Hopkins University Press, 1983), 68.

[26] United States Department of Agriculture, “Supplemental Nutrition Assistance Program (SNAP),” Accessed May 29, 2018, https://www.fns.usda.gov/snap/eligible-food-items.

[27] Idaho State Tax Commission, “Idaho Grocery Credit,” Accessed May 29, 2018, https://tax.idaho.gov/i-1043.cfm.

Share this article