Key Findings

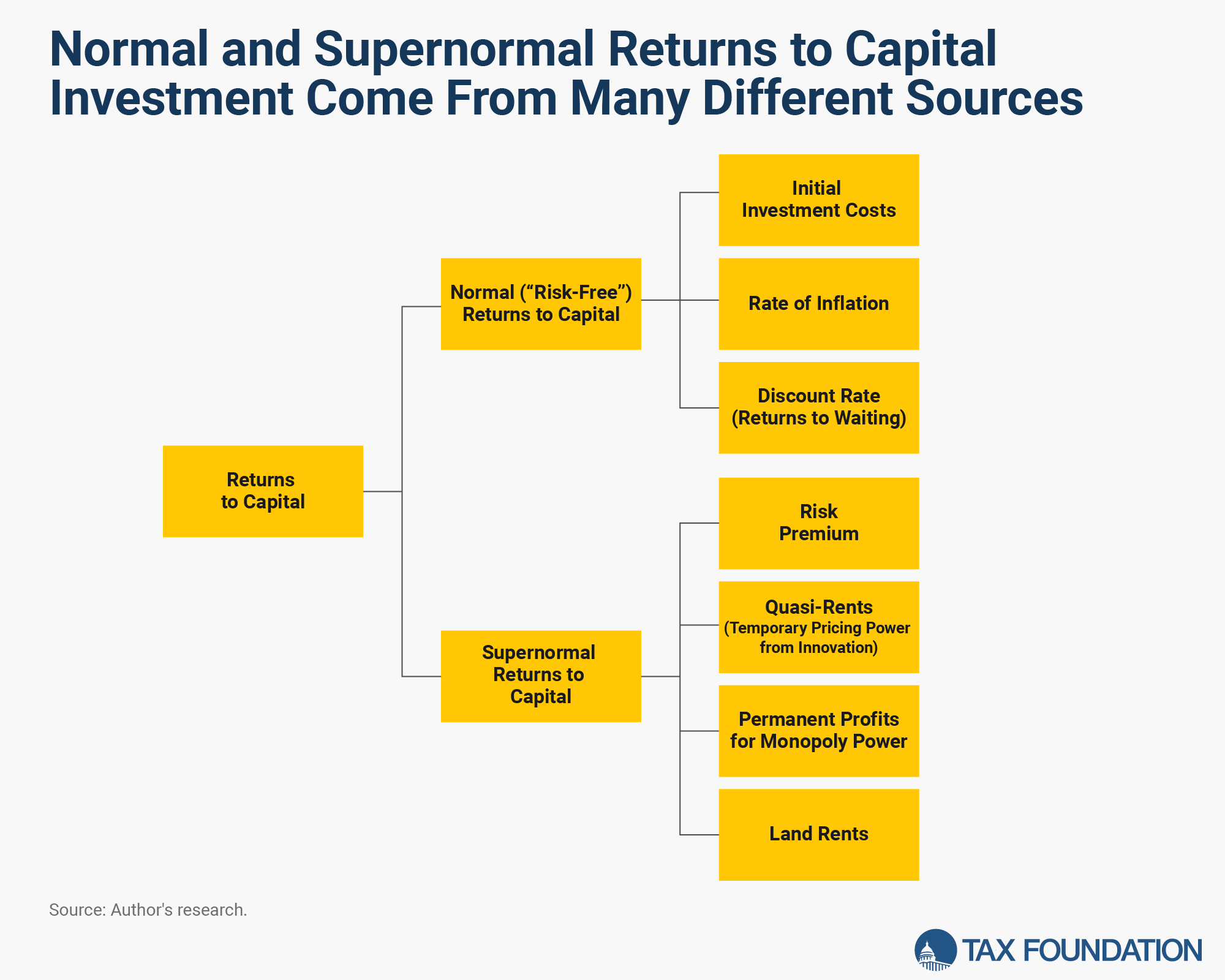

- Businesses invest now to earn future returns. For an investment to be worthwhile, it must at least “break even,” providing a risk-free return that covers the cost of capital, time, and inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. —known as the “normal” return to investment.

- Businesses can also earn supernormal returns, which exceed the normal return, often due to unique advantages like market power, rent-seeking, investment risk, or temporary pricing power due to innovation.

- The impact of taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policy on investment decisions depends on the type of return the investment generates. Normal returns are the most affected by taxes, supernormal returns from risk and innovation are still responsive, and supernormal returns from market power are the least responsive.

- To encourage investment, the tax system should exempt normal returns, as they directly impact new investments at the margin, or the breakeven point for businesses.

- Taxing supernormal returns can still be economically counterproductive, as these returns often come from risky or entrepreneurial activity.

- Accordingly, arguments that the corporate tax can be raised with few economic trade-offs because supernormal returns constitute a substantial share of corporate profits should be viewed with skepticism.

- As Congress prepares to debate the upcoming expirations of the 2017 tax law, two policies under consideration would help exempt the normal return to capital: returning to expensing for research and development (R&D) costs and reinstating 100 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. .

- Raising the corporate tax rate and other taxes on business investment would negatively impact innovation, entrepreneurship, and economic dynamism in the US, discouraging these productive activities.

Introduction

The future of the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. is a prominent issue in the presidential campaigns and debates over the expiring provisions of the 2017 Tax Cuts and Jobs Act (TCJA). Major parts of the conversation include the headline tax rate, the deductibility of research and development (R&D) costs, equipment investment, the new corporate alternative minimum tax, and the international reforms (GILTI, FDII, and BEAT).

Disagreement among policymakers and analysts about the economic impact of the corporate income tax clouds the debate. The disagreement often stems from different understandings of how the economy works, including who really pays the corporate income tax and how the corporate income tax affects behavior.

One source of disagreement is the type of returns to investment in the US economy. Advocates of levying higher taxes on corporations argue that an increasing share of the corporate tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. contains a certain type of profit—supernormal returns—that may be taxed without much concern about economic impact.

In this paper, we critically examine the contention over the taxation of supernormal returns, reviewing what we know about supernormal returns, surveying the literature on whether the US economy has seen an uptick in these returns, and discussing the implications for tax policy.

There are a few main points to consider. One, slight methodological differences lead to drastically different estimates of the supernormal share of the return to capital. Two, not all sources of supernormal returns are pure rents: some, like temporary returns to innovation, are still responsive to taxation. Accordingly, the view that corporate income tax mostly falls on supernormal returns and therefore can be raised without significant economic harm should be viewed with considerable skepticism. In the context of the upcoming tax debate, the corporate income tax matters greatly.

What Is a Supernormal ReturnSupernormal returns are payoffs to investment greater than the typical market rate of return. They are often approximated as company profits that exceed 10 percent. This additional return on capital or labor is above breaking even on an investment relative to the amount of risk and time that investment required. ?

To understand what a supernormal return is, one must first understand what a normal return is.

People value a dollar today more than a dollar a year from now. The future is uncertain, so you might want to spend that dollar today or have it with you in case of an emergency. Accordingly, people charge interest. For instance, if I want to borrow a dollar from you today, I might have to pay you back, say, a dollar and three cents a year from now, which equals a 3 percent interest rate.

By receiving interest, you are compensated for delaying your own consumption. The modern economy works according to this premise. Savers postpone their consumption to fund investments on the expectation that they will receive more than their dollar back in the future. Savers might fund investments through credit markets, lending money to businesses and institutions by buying bonds and receiving compensation in the form of interest payments. They might also fund investments through equity markets, by purchasing stock and receiving compensation through future dividend payments.[1] The compensation they receive is their return.

Normal and excess (or supernormal) returns are two basic types of returns.[2] The normal rate of return is simply the required payoff for delaying consumption. The normal rate of return is also often called the risk-free rate. Established and safe borrowers can borrow at the risk-free rate: they would like to make some form of investment or purchase today, and they will certainly (or with near certainty) be able to pay you back in a year, so you the saver only need compensation for delaying your consumption by a year. The supernormal return is anything earned on top of that normal return.

Under a perfect competition model, businesses earn a normal rate of return on investment: many firms sell non-differentiated products in the market, with prices driven down so profit margins are only wide enough to compensate investors for their delayed consumption. Under this model, therefore, any returns more than the normal rate of return must be a result of some violation of perfect competition. A firm may have market pricing power or even full monopoly power. It could also mean they benefit from pure economic rent, such as the appreciation of unimproved land. But not all violations of the perfect competition scenario or accruals of supernormal returns should be causes of concern.

One of the most common and important violations of perfect competition is risk. Investors are risk averse, as they do not have perfect information. Accordingly, to make a risky investment, the expected value of the return to a risky investment must be higher than the expected value of the return to a risk-free investment. The difference between the two is known as the risk premium. Some measures of normal returns include the risk premium to reflect a risk-adjusted normal return.[3]

Highly volatile commodities provide a good example of the returns to risk. In recent decades, the energy sector has been the most volatile of the stock market, as energy producers are both exposed to market risk (as demand for fossil fuels fluctuates with overall macroeconomic conditions) and geopolitical risk (as oil prices are heavily affected by certain international actors like OPEC).[4] In a year when oil prices unexpectedly boom, oil and gas producers may appear to earn supernormal profits, but the fat years of high profits are necessary to offset the heavy losses when oil prices collapse.[5]

R&D-intensive industries like biotechnology are also illustrative. Looking at the returns of major biotech companies in an individual year might lead one to conclude their high returns are the result of rents. But looking at successful biotech firms alone ignores the many biotech firms that fail—and the very real chance of failure necessitates a high return in the event of success. Companies need a very high potential return to risk investing billions in R&D that may not even yield a commercially viable product.

Fundamentally, companies need to deliver innovation to differentiate themselves. If a startup founder entered a pitch meeting with a venture capital firm and promised to deliver investors the returns of a Treasury bond or even the expected returns of the S&P 500 index, they would be laughed out of the room. Companies must offer the potential of greater returns to attract investment, usually in the form of some technological or process innovation that will grant at least temporary economic profit (i.e., supernormal returns) before the returns return to normal from competition.[6]

When looking only at the returns of profitable companies in an individual year, the profits of risk-takers and innovators may look indistinguishable from rents earned by market power. And at some level, they may be rents, at least temporarily. If an entrepreneur develops a new kind of product, they effectively have a monopoly on that product until competitors enter the market. In a pharmaceutical firm’s case, it may be a patent monopoly established legally through intellectual property law. New processes or technology can also take several years for other firms to integrate into their products or production.[7]

Once you subtract the risk premium and temporary rents (which are the same as returns to innovation), you are left with a remainder that more closely resembles true rents. Unimproved land is the classic example of economic rent: land appreciating without the owner making any investment or improvement. There also may be natural monopoly rents, when a company does hold a true monopoly on a good or service.

Supernormal Returns in the US Economy

Going beyond economic theory, what does the data say about supernormal returns in the US today? What share of the return to capital is supernormal, and of that share, which driving factors are most responsible?

These are difficult questions. William Gentry and Glenn Hubbard used 1980s stock market data to estimate that roughly 40 percent of corporate returns are normal returns.[8] Research using tax data from 1995 to 2001 showed normal returns constituted 32 percent of all corporate returns.[9] A 2012 Treasury Department update using tax data from 1999, 2000, 2001, 2004, and 2007 found 36 percent of the return to capital was from normal returns.[10] A 2016 Treasury Department update considering IRS data from 1992 to 2013 estimated the share of the normal returns had declined from 40 percent between 1992-2002 to 25 percent from 2003-2013.[11]

However, the existing literature has at least three methodological challenges. First, the studies rely largely on corporate sector data, ignoring the non-corporate business sector of the economy. Second, the Treasury’s methodology omits firms that are earning losses. And third, when looking at returns to capital, we should consider net rather than gross returns, which involves subtracting state and local taxes paid as well as interest paid. Changes to gross returns from factors not involving returns to capital should be excluded if we want to know how market returns have changed over time. When including the noncorporate sector, loss firms, and net returns, the estimated share of normal returns to capital is substantially higher, averaging 74 percent between 1968 and 2007.[12]

Setting these methodological debates aside, arguing about supernormal returns rising across the economy raises the question of what kind of supernormal returns are rising, and if that trend is necessarily harmful or necessitates a change in policy outlook. Factors other than monopoly power may explain the change.

The clearest missing piece of the analysis is changes in the risk premium. A rising share of supernormal returns might simply reflect the risk premium rising over time. Plenty of evidence points to a rising risk premium over the same period supernormal returns supposedly grew. In the years following the Great RecessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. , demand for risk-free assets grew and the risk-free rate of return fell dramatically, but the expected return on equities remained steady. Accordingly, the spread between the two (a solid benchmark for risk premium) grew.[13]

The 2016 Treasury Department study hypothesized the decline in the share of normal returns may have been due to the increasing importance of intangible investment.[14] In recent years, the composition of nonresidential business investment has shifted toward intellectual property, particularly research, development, and software. From 2007 to 2023, real business investment in intellectual property grew 153 percent, while real GDP grew 33 percent. R&D investment, a key subcomponent of intellectual property investment, grew 90 percent. Furthermore, intellectual property’s share of nonresidential fixed investment grew from 27 percent to 42 percent over the same window.[15]

We would reasonably expect a more R&D-intensive economy to produce more temporary quasi-rents. And industry-level analysis favors that hypothesis, as illustrated by an examination of the share of normal returns by industry in the 2016 Treasury Department study. It found normal returns were responsible for a large share of overall returns in utilities, construction, and mining; an average share of overall returns in wholesale and retail trade, transportation, and some forms of manufacturing; and a low share of overall returns in industries such as information, technology, and other forms of manufacturing, particularly chemical manufacturing.[16]

Not coincidentally, the share of normal returns appears to be negatively correlated with R&D intensity. Industries with high shares of normal returns (utilities, construction, and mining) all perform insignificant amounts of R&D, particularly relative to their sales. Industries like wholesale and retail trade with middling shares of normal returns are also middle-of-the-pack when it comes to R&D intensity. Meanwhile, information technology and chemical manufacturing are among the most R&D-intensive industries in the United States and have some of the smallest shares of normal returns.[17]

Three points are worth exploring further. First, returns to R&D investment, particularly in digital technology or services, may be higher than returns to physical capital. R&D investment could also involve taking more risk on average than physical capital, driving up required returns.

A second possible driver of an increase in supernormal returns is an increase in market concentration by larger firms, reducing competition and raising returns to capital investment. Proponents argue that concentration explains why investment has fallen despite rising returns to capital.[18] Economists have attempted to measure concentration via rising markups, but the literature suggests some of the apparent increase in price markups may be a mirage from technological changes.[19]

One final, curious theory would be the growth of pure land rents. Matthew Rogline’s finding that the supposed growth in the capital share of overall income was explained by appreciation in rental housing due to growing scarcity of land is consistent with this theory.[20] The theory is also consistent with (literal) rents in major “superstar” cities outpacing construction costs, as restrictions of land use and housing construction mean benefits accrue to surrounding landowners rather than productive investment.[21]

However, land appreciation as an explanation for increasing supernormal returns in corporate profits specifically falls short. The residential housing stock is heavily owned by households (roughly 65 percent of Americans own their own home), and the remaining rental housing stock is predominantly owned by pass-through businesses rather than corporations.[22]

The different sources of supernormal returns are difficult to measure, and there are plenty of plausible competing theories explaining why they may be rising (assuming they are indeed rising). However, it is a mistake to treat supernormal returns as a monopoly rent monolith.

What Do Supernormal Returns Mean for Tax Policy?

Before discussing the implications of supernormal returns for taxation, it makes sense to establish how normal returns should be taxed.

By reducing the returns to investment, taxes on the normal returns to capital reduce investment, thus reducing the capital stock and, in turn, productivity growth and wage growth. This dynamic is how a large share of the tax on capital is borne by labor.[23] Thanks to these negative effects, taxes on the normal return to capital should be limited or (ideally) fully eliminated.[24] There is strong empirical evidence to support capital’s responsiveness to taxation.[25]

However, if a large share of investment returns are economic rents or monopoly profits, then a large share of the corporate tax falls on the owners of capital without reducing incentives to invest.[26] The idea of most corporate profits being “supernormal” returns is particularly appealing for people advocating higher corporate income taxes. If most corporate profits are true economic rents, the corporate income tax would be a non-distortionary tax. But categorizing all “supernormal” returns as true economic rents is a mistake, and many of the other sources of supernormal returns are indeed responsive to taxation.

Supernormal returns to innovation or entrepreneurship (either from the founder of a start-up company or from creative employees within a larger firm) can roughly be characterized as returns to particularly productive labor or human capital.[27] Alternatively, one could describe their work as a return to skill or a return to “sweat equity.” While it is difficult to determine exactly how we should model this kind of income, such returns have both a labor and a capital component.[28] And both labor and capital are responsive to taxation.

An extensive literature demonstrates the responsiveness of research and development investment to taxation.[29] Analysis of staggered changes in state-level corporate taxes showed corporations reduced investment in R&D, patent activity, and new product introductions in response to tax increases.[30] A broader study of both personal and corporate income taxes found both reduced innovative activities, with corporate taxes having a worse effect.[31]

Tax policy can also impact innovative activity through the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. . For example, a study linking patent records with federal income tax returns of inventors found that income tax rates exceeding 30 percent lead to a notable decline in innovation.[32] An increase in the tax rate from 0 percent to 30 percent on an inventor’s earnings reduces forecasted total innovation by about 5 percentage points, while a tax hike from 30 percent to 60 percent reduces it by roughly another 15 percentage points.[33]

Implications for the Debates over TCJA Expirations

The state of supernormal returns may have implications for the upcoming debates over the expiring tax changes, but perhaps more notable is where they do not matter. Two of the most significant business provisions in the expirations debate are 100 percent bonus depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. for short-lived assets and amortization for research and development, which reduce tax on the normal return to capital.

In 2017, the TCJA introduced 100 percent bonus depreciation for investment in equipment, allowing companies to deduct the full cost immediately. The provision started to phase out in 2023 by 20 percentage points per year until it fully phases out; in 2024, companies can deduct 60 percent of their equipment investment immediately. Additionally, TCJA introduced amortization for R&D costs. Historically, companies were able to immediately deduct investment in R&D since 1954, but starting in 2022, businesses must spread the deductions out over 5 years (for domestic R&D) or 15 years (for foreign R&D).

Allowing companies to fully and immediately deduct their investment costs helps exempt the normal return to capital.

Regardless of the empirical questions surrounding the share of supernormal returns, the tax system should exempt the normal return to capital so it does not penalize new capital investment.[34] Making 100 percent bonus depreciation for equipment permanent and reintroducing expensing for R&D investment would be a substantial improvement, but it would not completely exempt normal returns because it would not cover all types of business investment.

For example, companies must spread deductions for investment in structures out over several decades: 27.5 years for residential structures and 39 years for commercial structures. If policymakers were feeling ambitious, they could adopt either full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. or the equivalent treatment known as neutral cost recoveryCost recovery refers to how the tax system permits businesses to recover the cost of investments through depreciation or amortization. Depreciation and amortization deductions affect taxable income, effective tax rates, and investment decisions. (NCR) for structures and reinstitute R&D expensing and 100 percent bonus depreciation for equipment to exempt the normal return to capital for the major asset categories. Extending full expensing to include land and inventories would fully exempt the normal return to capital.[35]

If instead the tax system does not provide full expensing for all capital investment, a portion of the corporate income tax (including both the regular corporate tax and the corporate alternative minimum tax, or CAMT) will fall on the normal return to capital. Even in a scenario with full expensing, though, the corporate rate and the CAMT would still matter. Returns to entrepreneurship and innovation would still be parts of the corporate tax base, and they are responsive to taxation.

There is also another angle to consider: the rest of the world.

QBAI Exemption and International Provisions

So far in this piece, supernormal returns have been a part of the debate about the impact of the corporate income tax on economic activity and real investment. One side argues supernormal returns are prevalent and attributable to monopoly rents, meaning the corporate income tax can be increased without harming investment and workers too much, and the other side argues supernormal returns are not as prevalent, not all attributable to monopoly rents, and ergo the corporate income tax is harmful to investment and workers. However, there is another way the corporate income tax can influence the US economy: profit shiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens. .

Multinational companies have operations in many different jurisdictions around the world, and it can be difficult to determine exactly which jurisdiction some income was generated in. This can be especially challenging when considering profits from intellectual property like a copyright or patent. This ambiguity means companies can classify income in different jurisdictions to minimize tax liability.[36] This is profit shifting: corporations book incomeBook income is the amount of income corporations publicly report on their financial statements to shareholders. It provides a picture of a firm’s financial performance and follows Generally Accepted Accounting Practices (GAAP). While it is a useful measure for assessing financial performance, it is not useful for assessing tax liability. abroad in low-tax jurisdictions, which leads to base erosion, or a reduction of corporate income subject to US tax, which subsequently leads to reduced tax revenue.[37]

Some forms of intangible income are particularly mobile, such as medical patents. Now, drug development is real investment activity, and high returns to drug development reflect returns to risk and innovation. However, once a drug is produced, the right to produce it is a highly mobile intangible asset. Companies often seek to move income generated by such intangible assets to jurisdictions with the lowest tax rates.[38]

The TCJA addressed highly mobile earnings from IP by introducing a tax on a newly defined category of income: global intangible low-taxed income (GILTI). GILTI reflects net tested income (a foreign subsidiary’s profits not yet taxed by the US) minus 10 percent of qualified business asset investment (QBAI). In effect, the GILTI minimum tax is intended to capture a form of supernormal profits by taxing profits above 10 percent of investment.[39] Ten percent is not a magic number differentiating between normal and supernormal returns. It simply reflects that profit-shifted intangible assets often have a return profile of that type.

Furthermore, there are other provisions of GILTI (such as the haircut on foreign tax credits) and the international tax code (such as expense allocation rules) that mean GILTI tax can fall to some degree on normal returns as well as returns to risk-taking and innovation. Under current law, the GILTI tax is scheduled to increase at the end of 2025, while the Biden-Harris administration has proposed increasing the GILTI tax further and raising other taxes that target the supernormal returns of US multinationals (such as the undertaxed profits rule). These changes would further penalize entrepreneurship and innovation over the long run and should be avoided.[40]

GILTI and provisions like it are complements to the most important anti-base erosion provision in the TCJA: the reduced corporate tax rate. The reduced corporate rate disincentivizes profit-shifting and inversions, for normal and supernormal profits alike, and the renaissance of corporate inversions and other schemes to book money abroad is another problem raising the corporate tax rate could reintroduce.

Putting It All Together

Supernormal profits are an important concept, but we should be wary of analysis that both defines supernormal profits very broadly and equates all supernormal profits with monopoly profits that can be easily taxed without negative economic effects. Correcting for flawed methodological assumptions shows supernormal returns are not as high as suggested by widely cited estimates.

Even so, monopoly profits may still be rising as a share of the economy, but a large share of so-called supernormal returns reflect temporary returns to innovation that come from a dynamic and growing economy. Policies that target supernormal returns, such as GILTI, are not a free lunch, but rather come with substantial downsides in the form of less innovation, risk-taking, and entrepreneurship.

Regardless of the debate over the growth of monopoly profits, the tax system should exempt the normal return to capital, which is far from the case currently. Until the corporate income tax—including the CAMT, GILTI, and other international provisions—features expensing, some of the tax burden will fall on normal returns. At a minimum, policymakers should prioritize, extend, and more broadly apply expensing to reduce the economic harm of the corporate tax.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Investors in equities may also receive a return through stock appreciation, but the traditional finance model focuses on dividends.

[2] See Laura Power and Austin Frerick, “Have Excess Returns to Corporations Been Increasing Over Time?,” Office of Tax Analysis Working Paper 111 (November 2016), https://home.treasury.gov/system/files/131/wp-111.pdf.

[3] Rachel Griffith, James Hines, and Peter Birch Sorensen, “International Capital Taxation” in Dimensions of Tax Design: The Mirrlees Review, ed. T.J. Besley (Oxford: Oxford Univ. Press, 2010), https://repository.law.umich.edu/cgi/viewcontent.cgi?article=1135&context=book_chapters; see also Hayley Reynolds and Thomas Neubig, “Distinguishing Between Normal and Excess Returns for Tax Policy,” OECD Taxation Working Papers No. 28, https://www.oecd-ilibrary.org/docserver/5jln6jct58vd-en.pdf?expires=1721142128&id=id&accname=guest&checksum=EEE73BBAF9C8305A9986670A9110976E.

[4] See, for instance, Fidelity Investments, “Investing in Equities with Sectors,” https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/investing-sector-guide.pdf.

[5] See, for instance, Yi Wen and Iris Arbogast, “How COVID-19 Has Impacted Stock Performance by Industry,” Federal Reserve Bank of St. Louis, Mar. 21, 2021, https://www.stlouisfed.org/on-the-economy/2021/march/covid19-impacted-stock-performance-industry.

[6] Baruch Lev and Suresh Radhakrishnan, “The Valuation of Organization Capital,” in Measuring Capital in the New Economy, National Bureau of Economic Research (Chicago: University of Chicago Press, 2005), https://www.nber.org/system/files/chapters/c10619/c10619.pdf.

[7] Ibid.

[8] William Gentry and Glenn Hubbard, “Distributional Implications of Introducing a Broad-Based Consumption TaxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or income taxes where all savings are tax-deductible. ,” Tax Policy and the Economy 11 (1997): 32, https://www.journals.uchicago.edu/doi/epdf/10.1086/tpe.11.20061844.

[9] Eric Toder and Kim Rueben, “Should We Eliminate Taxation of Capital Income,” Prepared for Conference on the Taxation of Capital Income (2005), https://www.researchgate.net/publication/242545292_Should_We_Eliminate_Taxation_of_Capital_Income.

[10] Julie-Anne Cronin, Emily Yin, Laura Power, and Michael Cooper, “Distributing the Corporate Income Tax: Revised U.S. Treasury Methodology,” Office of Tax Analysis Technical Paper 5 (May 2012), https://home.treasury.gov/system/files/131/TP-5.pdf.

[11] Laura Power and Austin Frerick, “Have Excess Returns to Corporations Been Increasing Over Time?”

[12] Stephen Entin, “Labor Bears Much of the Cost of the Corporate Tax,” Tax Foundation, Oct. 24, 2017, https://taxfoundation.org/research/all/federal/labor-bears-corporate-tax/.

[13] Richard Caballero, Emmanuel Farhi, and Pierre-Olivier Gourinchas, “The Safe Assets Shortage Conundrum,” Journal of Economic Perspectives 31:3 (2017), https://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.31.3.29; Fernando Duarte and Carlo Rosa, “The Equity Risk Premium,” Economic Policy Review 21:2 (December 2015), https://www.newyorkfed.org/research/epr/2015/2015_epr_equity-risk-premium.

[14] Laura Power and Austin Frerick, “Have Excess Returns to Corporations Been Increasing Over Time?”

[15] Author’s calculations, from Bureau of Economic Analysis, “Table 1.1.6: Real Gross Domestic Product, Chained Dollars,” revised Jun. 27, 2024, https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&categories=survey.

[16] Laura Power and Austin Frerick, “Have Excess Returns to Corporations Been Increasing Over Time?”

[17] National Center for Science and Engineering Statistics, “Business Enterprise Research and Development (BERD) Survey: 2021,” National Science Foundation, September 2023, https://ncses.nsf.gov/surveys/business-enterprise-research-development/2021#data.

[18] Jason Furman and Jason Orszag, “Slower Productivity and Higher Inequality: Are They Related?,” Peterson Institute for Institutional Economics Working Paper 18-4, June 2018, https://www.piie.com/publications/working-papers/slower-productivity-and-higher-inequality-are-they-related.

[19] Lucia S. Foster, John C. Haltiwanger, and Cody Tuttle,” Rising Markups or Changing Technology?” NBER Working Paper No. 30491, February 2024, https://www.nber.org/system/files/working_papers/w30491/w30491.pdf.

[20] Matthew Rogline, “Deciphering the Fall and Rise in the Net Capital Share: Accumulation or Scarcity?,” Brookings Papers on Economic Activity (2015), https://www.brookings.edu/wp-content/uploads/2016/07/2015a_rognlie.pdf.

[21] See, for instance, Edward Glaeser and Joseph Gyourko, “The Economic Implications of Housing Supply,” Journal of Economic Perspectives 32:1 (Winter 2018), https://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.32.1.3; Edward Glaeser and Joseph Gyourko, “The Impact of Building Restrictions on Housing Affordability,” Federal Reserve Bank of New York Economic Policy Review (June 2003), https://www.newyorkfed.org/medialibrary/media/research/epr/03v09n2/0306glae.pdf; Jason Furman and Peter Orzag, “An Firm-Level Perspective on the Role of Rents in the Rise of Inequality” in Toward A Just Society: Joseph Stiglitz and Twenty-First Century Economics, ed. Martin Guzman (New York: Columbia University Press, 2015), https://gabriel-zucman.eu/files/teaching/FurmanOrszag15.pdf.

[22] US Census Bureau, “Homeownership Rate in the United States,” retrieved from FRED, Federal Reserve Bank of St. Louis, Aug. 1, 2024, https://fred.stlouisfed.org/series/RHORUSQ156N; Mark Keightley, “Ownership of the U.S. Rental Housing Stock by Investor Type: In Brief,” Congressional Research Service, Dec. 13, 2022, https://sgp.fas.org/crs/misc/R47332.pdf.

[23] Stephen Entin, “Labor Bears Much of the Cost of the Corporate Tax,” Tax Foundation, Oct. 24, 2017, https://taxfoundation.org/research/all/federal/labor-bears-corporate-tax/.

[24] See, for instance, N. Gregory Mankiw, Matthew Weinzierl, and Danny Yagan, “Optimal Taxation in Theory and Practice,” Journal of Economic Perspectives 23:4 (2009), https://www.aeaweb.org/articles?id=10.1257/jep.23.4.147.

[25] William McBride, “What is the Evidence on Taxes and Growth,” Tax Foundation, Dec. 18, 2012, https://taxfoundation.org/research/all/federal/what-evidence-taxes-and-growth/; Alex Durante, “Reviewing Recent Evidence on Taxes and Growth,” Tax Foundation, May 21, 2021, https://taxfoundation.org/research/all/federal/reviewing-recent-evidence-effect-taxes-economic-growth/.

[26] James Nunns, “How TPC Distributes the Corporate Income Tax,” Tax Policy Center, Sep. 13, 2012, https://www.taxpolicycenter.org/publications/how-tpc-distributes-corporate-income-tax/full.

[27] Rachel Griffith, James Hines, and Peter Birch Sorensen, “International Capital Taxation”; see also Matthew Smith, Danny Yagan, Owen Zidar, and Eric Zwick, “Capitalists in the Twenty-First Century,” Quarterly Journal of Economics 134:4 (November 2019), https://eml.berkeley.edu/~yagan/Capitalists.pdf.

[28] Eric Toder, “Taxing Entrepreneurial Income,” Tax Policy Center, Jan. 3, 2017, https://www.taxpolicycenter.org/publications/taxing-entrepreneurial-income/full.

[29] Alex Muresianu and Garrett Watson, “Reviewing the Federal Tax Treatment of Research and Development Expenses,” Tax Foundation, Apr. 13, 2021, https://taxfoundation.org/research/all/federal/research-and-development-tax/.

[30] Abhiroop Mukherjee, Manpreet Singh, and Alminas Zaldokas, “Do Corporate Taxes Hinder Innovation?,” Journal of Financial Economics 124:1 (April 2017), https://www.sciencedirect.com/science/article/abs/pii/S0304405X17300041.

[31] Ufuk Akcigit, John Grigsby, Tom Nicholas, and Stefanie Stantcheva, “Taxation and Innovation in the 20th Century,” Quarterly Journal of Economics 137:1 (February 2022), https://www.hbs.edu/ris/Publication%20Files/Taxation_Innovation_66c3ca79-bde6-4f26-869d-1f88b7a72c3e.pdf.

[32] Alexander M. Bell, Raj Chetty, Xavier Jaravel, Neviana Petkova, and John Van Reenen, “Do Tax Cuts Produce More Einsteins? The Impacts of Financial Incentives vs. Exposure to Innovation on the Supply of Inventors,” National Bureau of Economic Research Working Paper 25493, January 2019, https://www.nber.org/papers/w25493.

[33] Garrett Watson, ”A High Tax Rate on Star Inventors Lowers Total Innovation,” Tax Foundation, Feb. 4, 2019, https://taxfoundation.org/blog/high-tax-rate-lowers-innovation/.

[34] See, for instance, Alan Cole, “Fixing the Corporate Income Tax,” Tax Foundation, Feb. 4, 2016, https://taxfoundation.org/research/all/federal/fixing-corporate-income-tax/; Jason Furman, “How to Increase Growth While Raising Revenue: Reforming the Corporate Tax Code” in Tackling the Tax Code: Efficient and Equitable Ways to Raise Revenue, Brookings Institution (2020), https://www.brookings.edu/wp-content/uploads/2020/01/Furman_LO_FINAL.pdf.

[35] Stephen J. Entin, “The Tax Treatment of Capital Assets and Its Effect on Growth: Expensing, Depreciation, and the Concept of Cost Recovery in the Tax System,” Tax Foundation, Apr. 24, 2013, https://taxfoundation.org/blog/tax-treatment-capital-assets-and-its-effect-growth-expensing-depreciation-and-concept-cost-recovery/.

[36] Alan Cole, “Fixing the Corporate Income Tax.”

[37] Alan Cole, “The Impact of GILTI, FDII, and BEAT,” Tax Foundation, Jan. 21, 2024, https://taxfoundation.org/research/all/federal/impact-gilti-fdii-beat/.

[38] Daniel Bunn, “US Cross-Border Tax Reform and the Cautionary Tale of GILTI,” Tax Foundation, Feb. 17, 2021, https://taxfoundation.org/research/all/federal/gilti-us-cross-border-tax-reform/.

[39] Kyle Pomerleau, “A Hybrid Approach: The Tax Treatment of Foreign Profits Under the Tax Cuts and Jobs Act,” Tax Foundation, May 3, 2018, https://taxfoundation.org/research/all/federal/treatment-foreign-profits-tax-cuts-jobs-act/.

[40] Daniel Bunn, “US Cross-Border Tax Reform and the Cautionary Tale of GILTI,” Tax Foundation, Feb. 17, 2021, https://taxfoundation.org/research/all/federal/gilti-us-cross-border-tax-reform/“; Garrett Watson, Erica York, William McBride, Alex Muresianu, Huaqun Li, and Alex Durante, “Details and Analysis of President Biden’s Fiscal Year 2025 Budget Proposal,” Tax Foundation, Jun. 21, 2024, https://taxfoundation.org/research/all/federal/biden-budget-2025-tax-proposals/.

Share this article