What Sets the US and China Apart on Tax?

Broad, pro-investment tax policy matters for growth, and the US has plenty of opportunities to make improvements, particularly given the advantages our cross-Pacific rival confers on its firms.

5 min read

Broad, pro-investment tax policy matters for growth, and the US has plenty of opportunities to make improvements, particularly given the advantages our cross-Pacific rival confers on its firms.

5 min read

Supernormal profits are an important concept, but we should be wary of analysis that both defines supernormal profits very broadly and equates all supernormal profits with monopoly profits that can be easily taxed without negative economic effects.

23 min read

Allowing full deductibility of residential structures would mean more housing construction, particularly multifamily housing—a practical solution to address housing affordability challenges.

6 min read

Rather than adopt temporary policies that phase out and expire, policymakers should focus their efforts on long-term reforms to support investment.

6 min read

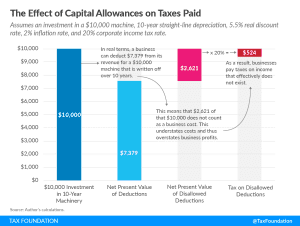

To recover from the pandemic and put the global economy on a trajectory for growth, policymakers need to aim for more generous and permanent capital allowances. This will spur real investment and can also contribute to more environmentally friendly production across the globe.

31 min read

As lawmakers consider which policies to prioritize in the upcoming tax policy debates, better cost recovery for all investment should be top of mind.

7 min read

While not perfect, Senator Scott provided a more detailed and sound tax plan than other 2024 candidates, and he prioritized pro-growth tax reforms like full cost recovery.

4 min read

By extending bonus depreciation and introducing neutral cost recovery, the RSC budget would significantly improve the treatment of investment leading to increased growth, expanded employment, and higher wages.

3 min read

Making expensing permanent is especially important now, when the economy is threatened with a recession and inflation remains high.

7 min read

We estimate that moving to permanent full expensing and neutral cost recovery for structures would add more than 1 million full-time equivalent jobs to the long-run economy and boost the long-run capital stock by $4.8 trillion.

4 min read

By updating the tax code to allow developers to more fully cover their investments, construction costs will fall, which, in turn, means that federal affordable housing assistance dollars will go that much further in helping low-income tenants.

3 min read

Studies have shown that accelerated depreciation helps increase wage growth. A recent report found that states that implemented accelerated depreciation in their tax codes led to a 2.5 percent increase in compensation per employee in manufacturing, relative to states that did not.

3 min read

A neutral cost recovery system lowers the short-term cost of the policy to the federal government while providing nearly equivalent economic benefits. While neutral cost recovery is not a new idea, there are several policy questions lawmakers will want to consider when designing this system.

6 min read

As stated by Rep. Jack Kemp in 1985, “Neutral cost recovery is designed to provide the present value of investment expensing without some of its practical problems.”

5 min read

Improving the tax treatment of structures is one of the most cost-effective tax policy changes available to lawmakers as they consider how to remove investment barriers in the tax code to hasten the economic recovery. Policymakers must weigh the trade-offs among long-run economic output goals, revenue constraints, and the existing stock of structures.

13 min read

Revenue shortfalls and deficits can be addressed best by considering when to consider the deficit as the primary priority and reevaluating how revenue can be raised most efficiently through sound tax policy principles.

5 min read

Other countries have shown that providing deductions in line with invested capital costs can have positive impacts both on investment and on debt bias.

7 min read