Note: The following is the testimony of Scott Hodge, President Emeritus and Senior Policy Advisor at the Tax Foundation, prepared for House Budget Committee hearing on March 29, 2023, titled, “The Fiscal State of the Union.”

Mr. Chairman and Ranking Member Boyle, Thank you for the opportunity to speak with you today about the nation’s fiscal state of the union.

Last week I was in Kyiv, Ukraine, as a guest speaker at the Ukrainian TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Reform and Anti-Corruption Summit. The goal of the Summit was to provide Ukrainian leaders with best practices on how to reform their tax system, strengthen their economy, and get their fiscal house in order.

They did not want theories, they wanted concrete examples of countries that have successfully reformed their tax codes and kept government finances in check. I presented them with a number of examples. The U.S. was not one of them. The U.S. may be a symbol of many things to people around the world, but it is not a model of fiscal discipline or restraint.

The Sad Fiscal State of America

Our current national debt, at roughly 100 percent of GDP, is the highest we’ve had since we were at war nearly 80 years ago. It is projected to rise to nearly 110 percent of GDP in a decade, higher than when we were fighting the Axis powers in WWII.

Our nearly $1.4 trillion deficit in 2022 was roughly equal to the GDP of Spain, and larger than the GDPs of 180 other countries.[1]

Bankrupt Entitlements Are a Major Driver of Our Fiscal Imbalance

Many of our budget problems are driven by entitlement programs that are already bankrupt on a cash basis and must rely on a massive infusion of general revenues to keep them afloat.

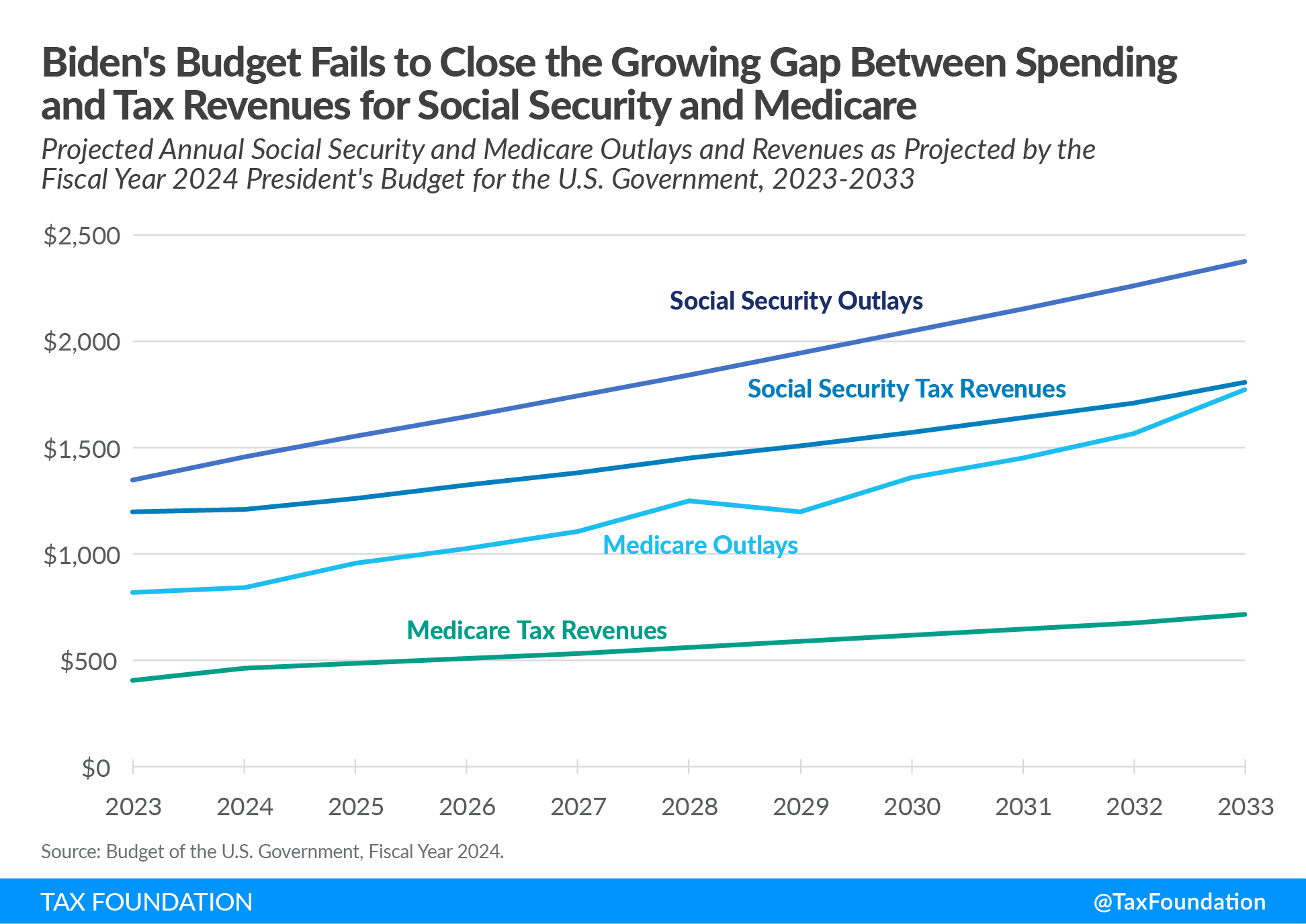

Over the next decade, Social Security outlays are expected to total $19 trillion while revenues are projected to total nearly $14.9 trillion. That means Social Security’s cash deficit—or drain on general tax revenues—will top $4 trillion over the next decade.

President Biden is proposing some $604 billion in new revenues to shore up Medicare. On paper, this only addresses the shortfalls in Medicare Part A. However, the financial problems in the other parts of Medicare are much worse. In 2021, for example, the shortfall in Part B was $295 billion while Part D’s shortfall was another $88 billion[2] because premiums cover only a fraction of the cost of these programs. Altogether, Medicare outlays are expected to total more than $12.5 trillion over the next decade, while revenues are expected to total nearly $5.8 trillion.

So even with these new taxes, the 10-year gulf between Medicare outlays and tax revenues will total $6.7 trillion under the Biden budget.

It takes some very magical accounting to claim that these measures add years to Medicare’s solvency. More taxes will not solve Medicare’s overall structural problems.

The Federal Budget Immortalizes America’s Past Priorities

The federal budget is more of a museum of American history than the Smithsonian. Name an era in American history and you can find an obsolete agency or program from that era still being funded in the federal budget today.

If Congress is serious about getting its fiscal house in order, members must start by scrutinizing programs from previous eras to see if they are still relevant. Prime examples include programs such as the Import-Export Bank (1934), Commodity Credit Corporation (1933), the Davis Bacon Act (1931), the Rural Electrification Administration (1935), the Essential Air Service (1978), and the Appalachian Regional Commission (1965).

If a program has not fulfilled its mission by now, it should be terminated. If it has fulfilled its original mission, then it should have been terminated years ago.

The Budget Is Full of Redundant Programs That Need to Be Streamlined

Every year, the Government Accountability Office (GAO) publishes a review of duplication and redundancy in federal programs. In their 2022 publication, the 12th annual report on the topic, GAO identified 44 federal employment and training programs, 15 agencies involved in food safety, 80 programs involved in economic development, and 100 programs involved in surface transportation, just to name a few.

GAO also identified 56 programs spanning more than 20 different agencies involved in financial literacy. Despite having put such a priority on financial literacy Congress is still incapable of balancing the budget.

The savings from streamlining duplicative programs is not trivial. GAO reports that progress has been made and the efforts to reduce duplication have produced nearly $500 billion in savings over the past decade or so. Much more can be saved with a more dedicated effort says GAO:

To achieve these benefits, as of March 2022, Congress and executive branch agencies have fully addressed 724 (about 56 percent) of the 1,299 actions GAO identified from 2011 to 2022 and partially addressed 240 (about 18 percent) . . . GAO estimates that fully addressing the remaining 469 open actions could result in savings of tens of billions of dollars and improved government services, among other benefits.[3]

The Federal Government Is Still Running Failing Business Enterprises

While many governments around the world have privatized their state-owned enterprises, the U.S. federal government still owns some very poorly run businesses.

For example, it runs two Depression-era electric companies: the Tennessee Valley Authority and the Power Marketing Administration.

Since the 1970s, it has been running a highly subsidized passenger railroad, Amtrak.

At a time when people can stream music, TV, and movies on their cell phones, the federal government is still funding a TV and radio network called the Corporation for Public Broadcasting.

And at a time when online shoppers can get products delivered on the same day, the federal government is still running an unprofitable delivery company called the U.S. Postal Service.

These and many more federal assets should be sold off and the proceeds used to pay down our debt.

We Have an Analog Government in a Digital World

It is more than ironic that while Congress prides itself on passing the CHIPS Act, most federal agencies are decades behind the technological curve. The IRS and the Air Traffic Control system are the most glaring recent examples.

Congress first approved funds for technology upgrades at the IRS in 1986, yet IRS workers still must manually keystroke the contents of paper tax returns into their system today. Like the IRS, the Federal Aviation Administration (FAA) has been attempting to upgrade the Air Traffic Control system technology for decades.[4] Indeed, the NextGen modernization program was launched 20 years ago, yet the FAA’s Inspector General reported recently:

Since 2006, our office and others have identified a number of challenges to implementing NextGen programs and capabilities, which have led to program delays and lower usage of new capabilities. As a result, FAA has revised its projected benefits for NextGen multiple times.[5]

Congress needs to demand better and more timely results from these investments in new technologies.

Waste, Fraud, and Abuse Do Add up to Real Money

The U.S. government may not have problems with corruption like Ukraine, but it has plenty of fiscal incompetence.

The government’s PaymentAccuracy.gov[6] website, run by government CFOs, estimates that federal agencies paid out roughly $250 billion in improper payments last year. Nearly half of those improper payments were in Medicare. The IRS manages two programs with unacceptably high levels of improper payment, the Child Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. (CTC) and the Earned Income Tax Credit (EITC).

For example, in FY 2021, the EITC’s improper payments rate was 28 percent (or $19 billion) and the CTC’s was 13 percent (or $5.2 billion).[7] Historically, from 2004 to 2022, the EITC’s average rate of improper payments was 25 percent. In today’s dollars, these improper payments totaled $350 billion.[8]

Corporate Welfare Is Widespread in Tax and Spending Policy

For a nation that prides itself on being a beacon for free enterprise, both the tax code and the federal budget are chock full of corporate welfare. The InflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. Reduction Act (IRA) alone expanded or created 26 tax subsidy programs that personify corporate welfare. The Wall Street Journal reports that Goldman Sachs now estimates that these tax subsidy programs will cost taxpayers over $1.2 trillion over the next decade.[9]

But even well-intentioned programs such as the Low-Income Housing Tax Credit (LIHTC) and Opportunity Zones (OZs), have become tax shelters for big business at the expense of local communities. For example, one study tried to measure the impact of OZs on poor residents and concluded simply, “We find limited evidence of any impacts of zone investment to date on zone residents.”[10] Moreover, their study determined that many of the communities designated as OZs would have improved on their own without the special OZ designation.

As my colleague Garrett Watson recently testified about the LIHTC before the Senate Finance Committee, “Several studies have found that between one-third and three-quarters of the subsidy provided by LIHTC go to low-income households, with the rest accumulates to other stakeholders such as developers and investors.”[11]

President Biden’s Budget Plan Makes the Government’s Fiscal Crisis Worse

The Biden budget promises to raise $65 trillion in revenues over 10 years. This is $5 trillion more than the baseline estimates. The budget also promises to spend $82 trillion over 10 years. This is $2 trillion more than the baseline.

That math leaves a deficit of $17 trillion over 10 years. This is $3 trillion less than the baseline, so the White House is technically correct that Biden’s budget “reduces” the deficit by $3 trillion. But it does so only because a massive increase in spending is offset by one of the largest proposed tax increases in American history.[12]

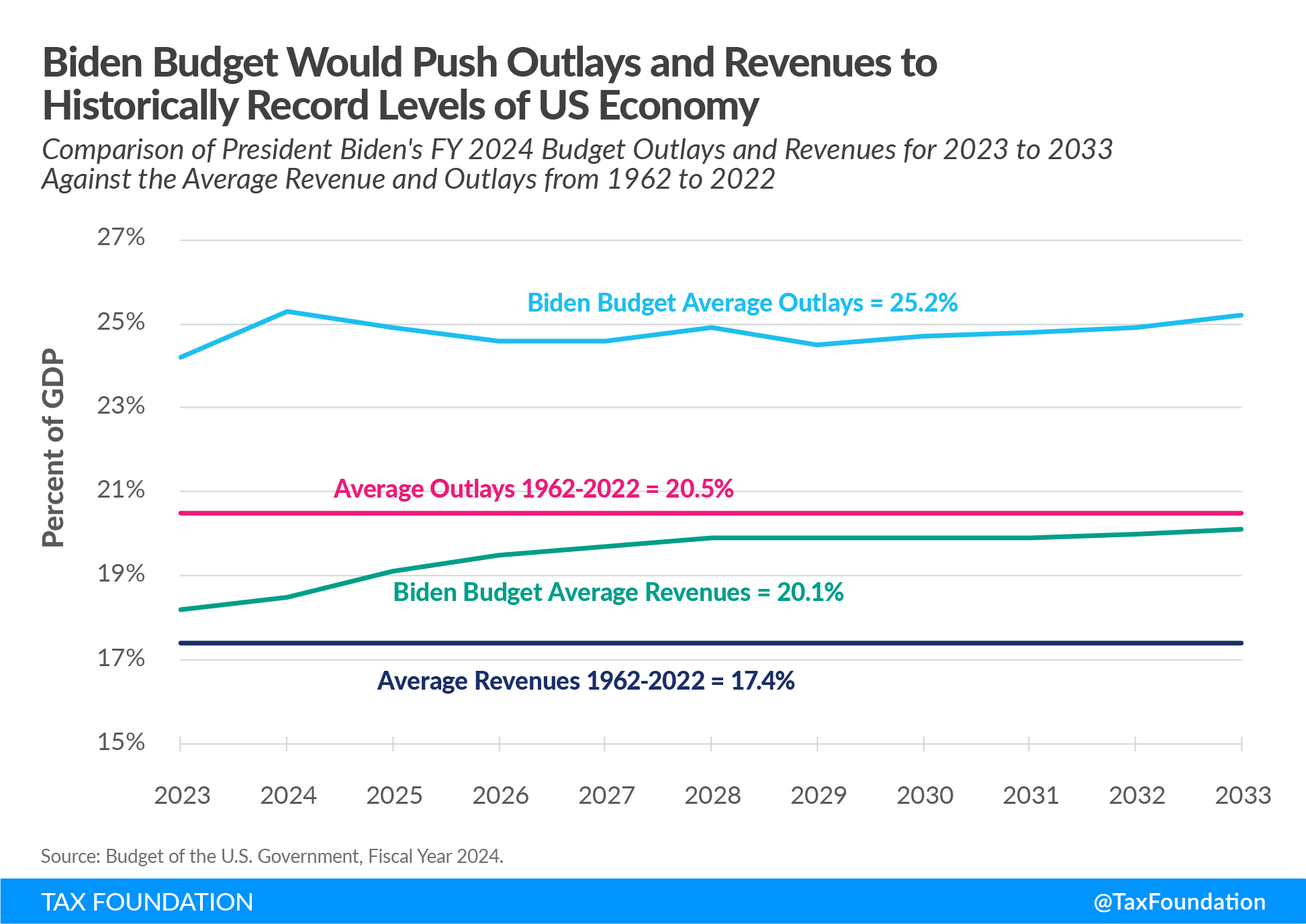

While we are talking about records, the Biden budget proposes the largest sustained levels of government spending and tax revenues in American history.

Under the budget plan, tax receipts would average 19.6 percent of GDP over the next decade, 1.2 percentage points more than any other 10-year period in U.S. history. Government spending would average 24.8 percent of GDP, 0.5 percentage points more than any other 10-year period in U.S. history, including World War II.[13]

This means that the federal deficit under Biden’s budget would average 5.2 percent of GDP over the next decade, about half as large as the deficits of World War II. By contrast, Biden’s defense budget would average just 2.9 percent of GDP over the next 10 years.

The budget adds further liabilities on our children by increasing the publicly held national debt from 98.4 percent of GDP to 109.8 percent by 2033.

Not Only Is the Biden Budget Bad for Taxpayers, but It Is Also Bad for the Economy

Using the Tax Foundation’s macroeconomic tax model, Tax Foundation economists estimate that the Biden budget plan would reduce the long-term size of the economy by 1.3 percent, reduce the capital stock by 2.4 percent, lower wages by 1 percent, and eliminate 335,000 private sector jobs.

Our model estimates that the proposed tax increases in the Biden budget would raise $3.9 trillion over 10 years on a conventional basis, net of about $700 billion in tax credits. However, after accounting for the tax hike’s impact on the economy, the revenue estimate would fall to $3.4 trillion. Still, this is an enormous tax increase.

The Biden budget is not a fiscally or economically responsible budget.

Congress Must Take Systematic and Deliberate Steps toward Fiscal Balance

As Congress begins to craft the FY 2024 federal budget, it needs to establish a process of systematically reviewing programs and priorities. I would suggest putting yourselves in the mindset of consultants overseeing an enterprise that has been put in receivership.

Ask tough questions about each program and agency:

- Has this program or agency outlived its original mission, or failed its original mission? Terminate it.

- Is it redundant or does it duplicate other agencies, programs, or functions? Eliminate it or merge it.

- Is it business-like, or does the program compete directly with private businesses? You should approach this question looking for ways to turn tax-guzzling federal enterprises into tax-paying private enterprises.

- Would this function be better served if done at the state or local level? Then it should be devolved to the state or local level.

- Can we change the incentives for agencies to improve their performance? For example, instead of an agency measuring success by how many people it enrolls, perhaps the metric is how many people it moves into self-sufficiency and independence.

- Is this program or tax expenditureTax expenditures are a departure from the “normal” tax code that lower the tax burden of individuals or businesses, through an exemption, deduction, credit, or preferential rate. Expenditures can result in significant revenue losses to the government and include provisions such as the earned income tax credit (EITC), child tax credit (CTC), deduction for employer health-care contributions, and tax-advantaged savings plans. contributing to broad-based economic growth or is it benefiting a specific industry or sector of the economy? If a company or industry cannot survive without taxpayer subsidies, it should not be allowed to survive.

It Is Past Time for Kicking the Entitlement Can Down the Road

Finally, you can no longer put off fixing our major entitlement programs. The looming “depletion” of the Social Security and Medicare trust funds is an accounting fiction. Their deficits don’t start in 2033 or whenever the actuaries now predict, the fact is that these programs are draining general revenues now.

No member of this body is in a position to criticize the management of Silicon Valley Bank for failing to foresee the crisis in its balance sheet when the financial crises in Social Security and Medicare have been known, and building, for years.

Failing to deal with the fiscal issues plaguing our major entitlement programs is a thousand times more negligent than any of the largest bank failures because it threatens the nation’s long-term economic health.

Conclusion

Mr. Chairman, the fiscal state of the union is, frankly, embarrassing. Federal spending, deficits, and debt are at unsustainable levels. The budget is laden with redundant programs, obsolete programs, corporate welfare, and nationalized industries. Moreover, Social Security and Medicare are not going bankrupt, they already are bankrupt.

The Biden 2024 budget would make all of these issues worse.

America’s ability to be a global moral authority is undermined by our lack of fiscal discipline and restraint. If the Ukrainians can stand up to corruption and the Russians, the U.S. Congress can muster the courage to provide leadership in fiscal responsibility.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] International Monetary Fund World Economic Outlook Database, https://www.imf.org/en/Publications/WEO/weo-database/2022/October.

[2] Jackson Hammond, “Medicare Malpractice,” American Action Forum, Mar. 27, 2023. https://www.americanactionforum.org/weekly-checkup/medicare-malpractice/.

[3] 2022 Annual Report: Additional Opportunities to Reduce Fragmentation, Overlap, and Duplication and Achieve Billions of Dollars in Financial Benefits, U.S. General Accountability Office, May 11, 2022. https://www.gao.gov/products/gao-22-105301.

[4] David Shepardson, “FAA has struggled to modernize computer, air traffic operations,” Reuters, Jan. 12, 2023. https://www.reuters.com/technology/faa-has-struggled-modernize-computer-air-traffic-operations-2023-01-12/.

[5] “NextGen Benefits Have Not Kept Pace With Initial Projections, but Opportunities Remain To Improve Future Modernization Efforts,” U.S. Department of Transportation Office of Inspector General, Mar. 30, 2021. https://www.oig.dot.gov/sites/default/files/FAA%20NextGen%20Delivery%20Study_03.30.2021.pdf.

[6] https://www.cfo.gov/payment-accuracy/payment-accuracy-high-priority-programs/.

[7] https://www.oversight.gov/sites/default/files/oig-reports/TIGTA/202240037fr.pdf.

[8] “Annual Improper Payments Data Sets,” (2022 Data Set) https://www.paymentaccuracy.gov/payment-accuracy-the-numbers/.

[9] The Editorial Board, “The Real Cost of the Inflation Reduction Act Subsidies: $1.2 Trillion,” The Wall Street Journal, Mar. 24, 3023. https://www.wsj.com/articles/inflation-reduction-act-subsidies-cost-goldman-sachs-report-5623cd29.

[10] Matthew Freedman, Shantanu Khanna, and David Neumark, “JUE Insight: The Impacts of Opportunity Zones on Zone Residents,” National Bureau of Economic Research, Nov. 2021. 17. http://nber.org/papers/w28573.

[11] Ed Olsen, “Does Housing Affordability Argue for Subsidizing the construction of Tax Credit Projects?,” American Enterprise Institute, March 24, 2017, https://www.aei.org/wp-content/uploads/2017/07/Ed-Olsen-AEI-Housing-Affordability.pdf and Gregory S. Burge, “Do Tenants Capture the Benefits from Low-Income Housing Tax Credit Program?,” Dec. 1, 2010, https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1540-6229.2010.00287.x.

[12] Erica York and Garrett Watson, “Placing Joe Biden’s Tax Increases in Historical Context,” Tax Foundation, Oct. 22, 2020, https://taxfoundation.org/joe-biden-tax-increases-historical-context/.

[13] The highest sustained federal tax revenue collections in history occurred over the period 1993-2002, when revenues averaged 18.4 percent of GDP. The highest sustained federal outlays in history occurred over the period 1942-1951, including World War II, when outlays averaged 24.3 percent.

Share