Key Findings

- On average, in the Organisation for Co-operation and Development (OECD) and select European Union countries, long-term capital gains from the sale of shares are taxed at a top rate of 18.78 percent, and dividends are taxed at a top rate of 23.85 percent.

- There are two layers of taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on investment income. First, corporations pay the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. on their profits. Second, shareholders pay an income tax on both the dividends and capital gains they receive.

- Since corporate income is taxed twice, on average, the OECD and select EU countries tax corporate income distributed as dividends at 41.16 percent and capital gains derived from corporate income at 37.38 percent.

- To encourage long-term retirement savings, countries commonly provide tax preferences for private retirement accounts. These usually provide a tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax. for the initial principal investment amount and/or for the investment returns.

- Tax-preferred private retirement accounts often have complex rules and limitations. Universal savings accounts could be a simpler alternative—or addition—to many countries’ current system of private retirement savings accounts.

Introduction

Long-term savings and investment play an important role in individuals’ financial stability and the economy overall. Taxes often impact whether, and how much, individuals set income aside for savings and investments. Various factors determine the amount of taxes one is required to pay on these savings and investments, such as the type of asset, the individual’s income level, the period over which the asset has been held, and the savings purpose.

While long-term savings and investment can come in many forms, this paper generally focuses on the tax treatment of stocks in publicly traded companies.[1] Each country approaches the taxation of stocks differently, but most countries levy some form of capital gains and dividend taxes on individuals’ income from owning stocks. Capital gains and dividend taxes are levied after corporate income taxes are paid on profits at the entity level, and thus constitute a second layer of taxation.

However, lawmakers have recognized the need to incentivize long-term savings—particularly when it comes to private retirement savings. Thus, countries commonly provide tax preferences for individuals who save and invest within dedicated private retirement accounts—usually by exempting the initial principal investment amount or the investment returns from tax. These tax-preferred private retirement accounts play a significant role when looking at an economy’s total savings and investments. For example, in the United States, about 30 percent of total U.S. equity is held in tax-preferred retirement accounts. Foreigners hold 40 percent of U.S. equity, and only about 25 percent is estimated to be in taxable accounts.[2]

This paper will first explain how dividends and capital gains taxes impact one’s investment income, and how tax-preferred private retirement accounts lower the tax burden on such investments. Second, a survey of capital gains taxes, dividends taxes, and the tax treatment of private retirement accounts shows how the taxation of savings and investments differs across countries. Finally, we briefly highlight the importance of simplicity when it comes to retirement savings and explain how universal savings accounts could be a step in that direction.

Understanding the Tax Treatment of Savings and Investment

Savings and investment can come in many forms. This paper focuses on saving in the form of owning stocks in publicly traded companies. Stocks provide two ways for investors to get income.

The first is by buying a stock and selling it later at a higher price. This results in a capital gain. An investor who buys a stock for €100 and later sells it for €110 has earned a €10 capital gain.

The second way to get income from stocks is to purchase stocks in companies that regularly pay out dividends to shareholders. A company that pays out annual dividends at €1 per share would provide an individual that owned 10 shares of that company €10 each year.

Two types of taxes apply to those different earnings: capital gains taxes and dividends taxes, respectively. A capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. applies to the €10 in gains the investor made, and a dividends tax applies to the €10 in dividends that were paid out.

Both taxes create a burden on savings. If an individual has a savings goal and needs a 5 percent total return on investment to reach that goal, a capital gains tax would require that individual’s actual return on investment to be higher than 5 percent to meet the goal. If the capital gains tax is 20 percent, then the individual’s before-tax return on investment would need to be 6.25 percent.

Similarly, taxes on dividends reduce earnings for investors.

For workers who are investing their money after paying individual income taxes, taxes on capital gains and dividends represent an additional layer of tax on their earnings.

However, when it comes to retirement savings, governments regularly provide tax exemptions for either the wages used to contribute to a savings account or an exemption on the gains.

Table 1 shows there are four basic tax regimes for investors. The two dimensions of taxation concern the principal, or the initial deposit, and the returns to investment. Systems generally fall into one of the four categories in the table.

Some investments are taxed both on the initial principal and on the return. These include investments in brokerage accounts. For this type of investment, there is usually no exemption or deduction for the initial cost of purchasing stocks, and the income from the investment (whether a capital gain or a dividend) is taxable.

Private retirement savings, on the other hand, usually face an exemption from tax on the initial principal investment amount or on the returns to that investment. In the U.S., this is referred to either as “traditional” or “Roth” treatment for individual retirement arrangements (IRAs). With traditional treatment, there is no tax on the initial investment principal, but there is a tax on the total amount (principal plus gains) upon withdrawal. Roth treatment includes taxable principal investments and no tax upon withdrawal.

In the U.S., health savings accounts provide an exemption from tax both on the principal and the returns upon contribution as well as withdrawal, representing the fourth type of tax treatment on investment where neither the principal nor the returns are taxed at any point.

Table 1. Four Tax Regimes for U.S. Investors

| Tax on Principal Investment Amount | No Tax on Principal Investment Amount | |

|---|---|---|

| Tax on Returns/Withdrawal | Individual Brokerage Accounts | Defined Benefit Pensions,Traditional IRAs, and 401(k)s |

| No Tax on Returns/Withdrawal | Roth IRAs and Roth 401(k)s | Health Savings Accounts |

The Multiple Layers of Taxes on Investment

Individual investors who save outside of a retirement account will face several layers of taxation. If an investor buys stock in a corporation, that company will owe the corporate income tax, and the investor will owe dividends tax on any dividend income or capital gains tax if the investor sells the stock at a higher price.

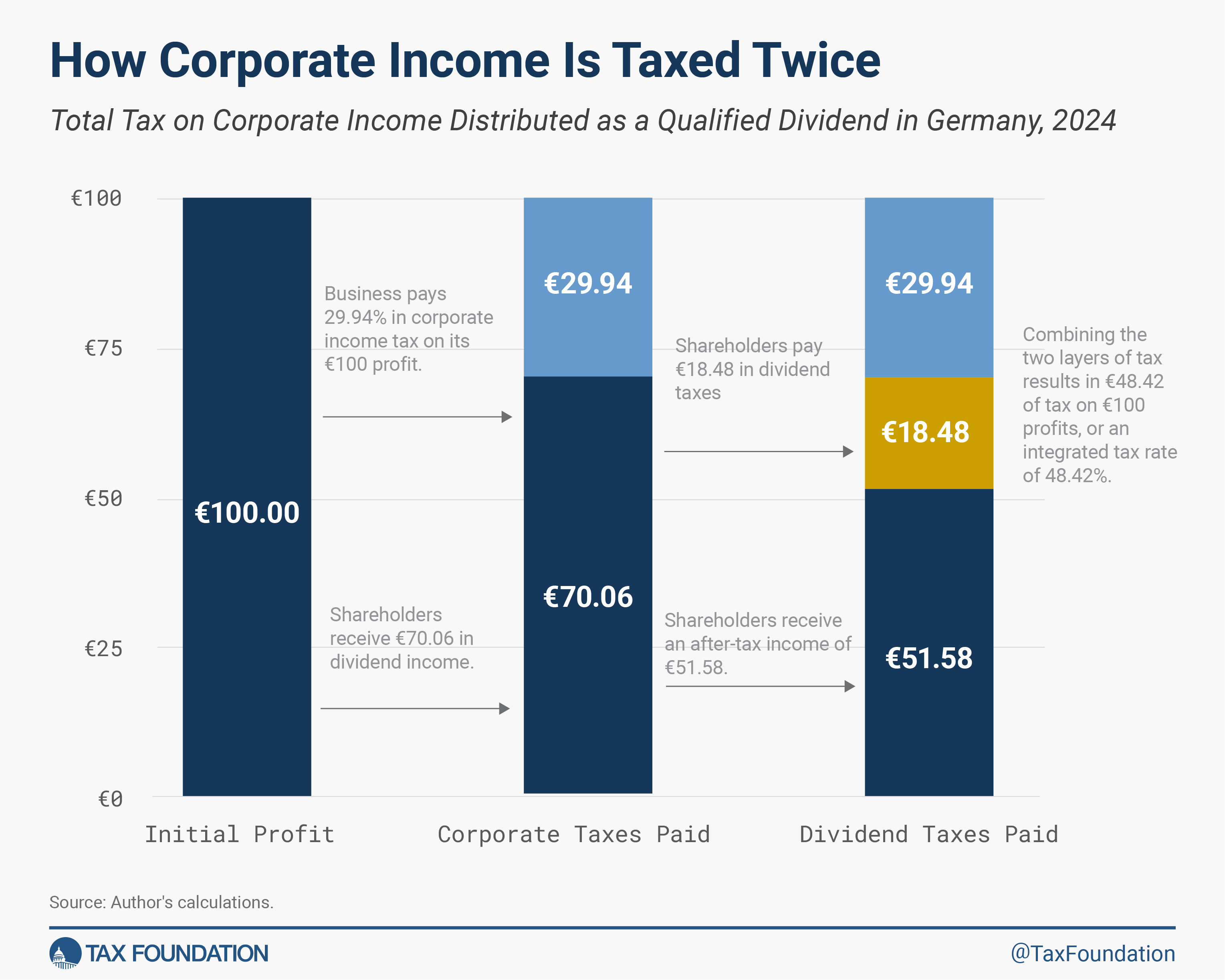

The following example shows how €48.42 in tax would apply to €100 in corporate profits when accounting for both corporate taxes and taxes on dividends. First, the corporation earns €100 in profits. If it is a German company and faces the corporate income tax rate, it would pay €29.94 in corporate taxes on that income.

This leaves €70.06 available for a dividend. The shareholder would owe an additional €18.48 in dividend taxes.

From the €100 in profits, just €51.58 in after-tax profits remain for the shareholder in the form of a dividend.

However, some countries have integrated tax systems. This means that if a company pays corporate taxes on its profits, an investor can claim a (partial or full) credit against taxes on capital gains and dividends. This results in investors only paying taxes to the extent that capital gains or dividends tax liabilities are more than the (partial or full) credit for corporate taxes paid.

Tax Treatment of Private Retirement Accounts

Most individuals in OECD countries can utilize a tax-preferred savings account to build up individual retirement savings—often in addition to public pensions. Two general forms of tax treatment are the most common and fall into the categories discussed earlier.

One approach allows individuals to contribute to retirement accounts using money that has already been taxed as wages. However, returns on the investment and withdrawals from the account are tax-exempt. This is what is called a taxed, exempt, exempt (or TEE) approach, referring to the policy’s treatment of contributions, returns on investment, and withdrawals from a retirement account. In the U.S., this is referred to as the “Roth” treatment for retirement savings.[3]

The other approach allows individuals to contribute to accounts with either pre-tax earnings or provide a tax deductionA tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state and local taxes paid, mortgage interest, and charitable contributions. for contributions. Returns on the investment do not face tax, but withdrawals from the account (principal plus earnings) are taxed. This is called an exempt, exempt, taxed (EET) approach. In the U.S., “traditional” retirement vehicles follow this approach.

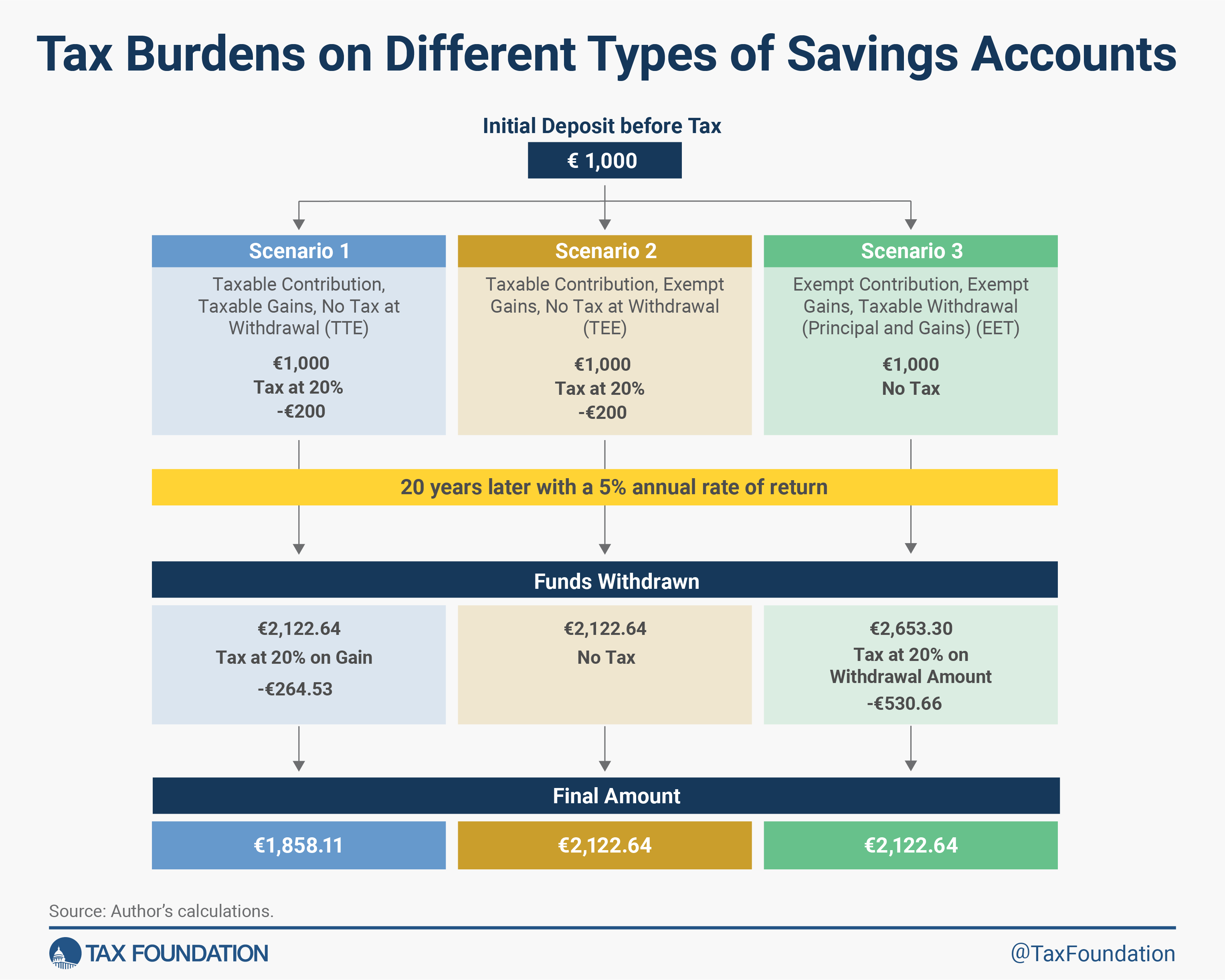

Figure 2 compares how these two preferences for retirement savings impact an investor and compares them to an investor who is saving outside a retirement account.

In each scenario, €1,000 is the initial deposit. In the first and second scenarios, a 20 percent tax applies to that initial deposit. Think of this as a tax on the wages that are being used to fund the investment.

So, right off the bat, Scenarios 1 and 2 have €800 for investing. Scenario 3 does not include a tax on wages used for contributing to a retirement account and allows the full €1,000 to be invested because it is an EET approach (meaning that contributions are tax-exempt).

In each scenario, the investor leaves the funds in their investment account for 20 years and earns a 5 percent annual return. At the end of this period, both Scenarios 1 and 2 have the same amount of money in their investment account, €2,122.64. Because Scenario 3 started off with a larger initial deposit, that scenario has €2,653.30 in their investment account.

Now, when funds are withdrawn, taxes apply both to amounts withdrawn in Scenario 1 and Scenario 3, but not Scenario 2. Scenario 2 operates as a TEE account, so withdrawals are exempt from tax.

Upon withdrawal, Scenario 1 pays a 20 percent tax on the gains (final amount minus the €800 initial investment). This results in final, after-tax earnings of €1,858.11. Scenario 2 does not owe taxes on gains or principal upon withdrawal; the final earnings are €2,122.64. Scenario 3 owes a 20 percent tax on the withdrawn amount which includes both the principal and gains—so the total withdrawal amount—and has final earnings of €2,122.64, the same as in Scenario 2.

This example shows two things. First, because fully taxable accounts have more than one layer of taxes, they result in lower after-tax investment earnings. Second, if the tax rate on the principal in Scenario 2 and the tax rate on principal and gain upon withdrawal in Scenario 3 is the same, then the earnings from both will be equivalent.

The tax rates on deposit and withdrawal may not always be the same, however. Many tax systems have a progressive rate structure for wages which may mean an individual will be in a different tax bracketA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. when the investment is made than when they have retired and begin making withdrawals.

If an individual faces a 30 percent tax rate when they invest, but a 15 percent tax rate when they withdraw their earnings, it would be advantageous to use an investment account as in Scenario 3.

Other Types of Tax-Preferred Savings Accounts

In addition to retirement accounts, some countries offer tax preferences for other savings purposes. Examples include savings for future education and health-related costs.

For example, the United States offers so-called “qualified tuition plans” for future education costs, also known as “529 plans.”[4] Depending on the U.S. state and type of 529 plan, savers may be able to deduct contributions from state income taxes or receive matching grants; gains are not subject to tax; and withdrawals are exempt from state and federal income taxes.

Similarly, Canada offers a registered education savings plan (RESP), which exempts earnings as they accrue, and a government savings bonus (earnings and bonus are taxed at the student’s tax rate upon withdrawal).

In the United States, there is also a health savings account (HSA), which can be used to pay for qualified medical expenses. As shown in Table 1, contributions are made from pre-tax earnings, gains are tax-exempt, and withdrawals are not taxed either.

Survey of Capital Gains Taxes, Dividend Taxes, and Retirement Savings in OECD Countries

While most countries levy some form of tax on savings and investment, the tax treatment differs not only between countries but also between types of investment income and savings purposes.

For example, the average top long-term capital gains tax rate in the OECD and select EU countries is 18.78 percent, while dividends face an average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. of 23.85 percent. When it comes to private retirement savings, the tax treatment as well as contribution limits also vary significantly.

Capital Gains Tax Rates

Many countries tax capital gains at various rates depending on the holding period, the individual’s income level, and the type of asset sold.

Recognizing the importance of long-term savings, some countries tax the gains from long-term savings at a lower capital gains tax rate than those from short-term savings. For example, in Slovenia, capital gains on the disposition of immovable property, shares, or other capital participations are taxed at 25 percent if held for up to five years, at 20 percent if held between five and 10 years, at 15 percent if held between 10 and 15 years, and at 0 percent if held for more than 15 years.

While some countries levy flat capital gains tax rates regardless of an individual’s income level, others include capital gains when calculating personal income taxes—which in most countries results in the progressive taxation of capital gains. Still, other countries have a separate progressive capital gains tax structure. Some countries have an annual exempt amount for capital gains. For example, in the United Kingdom, the first £6,000 ($7,532) of realized capital gains are tax-free (this exemption will be reduced to £3,000 starting April 6, 2024).

Many countries exempt owner-occupied residential property from capital gains tax.

Table 2 shows the top marginal capital gains tax rates levied on individuals in the OECD and select EU countries, taking into account exemptions and surtaxes. If a country has more than one capital gains tax rate, the table shows the tax rate applying to the sale of listed shares after an extended period of time.

Denmark levies the highest top marginal capital gains tax on long-held shares in the OECD, at a rate of 42 percent. Chile’s top capital gains tax rate is the second highest, at 40 percent, followed by Norway at 37.48 percent and Finland and France at 34 percent each.

Roughly one-fourth of all countries analyzed do not levy capital gains taxes on the sale of long-held shares. These are Belgium, the Czech Republic, Korea, Luxembourg, New Zealand, Slovakia, Slovenia, Switzerland, and Turkey.

On average, long-term capital gains from the sale of shares are taxed at a top marginal rate of 18.78 percent in the OECD and select EU countries.

Table 2. Capital Gains Tax Rates, as of January 2024

Top Marginal Capital Gains Tax Rates on Individuals Owning Long-Held Listed Shares without Substantial Ownership (includes Exemptions and Surtaxes)

| Country | Top Marginal Capital Gains Tax Rate | Additional Comments |

|---|---|---|

| Australia (AU) | 23.50% | Capital gains are subject to the normal PIT rate and there is a 50% exemption if the asset was held for at least 12 months. |

| Austria (AT) | 27.50% | - |

| Belgium (BE) | 0.00% | Capital gains are only taxed if they are regarded as professional income. |

| Bulgaria (BG) | 10.00% | - |

| Canada (CA) | 26.75% | Capital gains are subject to the normal PIT rate but only 50% of the gains are included as taxable income. |

| Chile (CL) | 40.00% | Only certain gains on the sale of traded shares of Chilean corporations are tax-exempt. |

| Colombia (CO) | 15.00% | The 15% rate applies for assets that were held for two or more years, otherwise capital gains are taxed as ordinary capital income at 39%. |

| Costa Rica (CR) | 15.00% | Capital gains are subject to a 15% tax. |

| Croatia (HR) | 12.00% | - |

| Czech Republic (CZ) | 0.00% | Capital gains are included in PIT but exempt if shares of a joint stock company were held for at least three years (five years if limited liability company). |

| Denmark (DK) | 42.00% | Capital gains are subject to PIT. |

| Estonia (EE) | 20.00% | Capital gains are subject to PIT. |

| Finland (FI) | 34.00% | - |

| France (FR) | 34.00% | Flat 30% tax on capital gains, plus 4% for high-income earners. |

| Germany (DE) | 26.38% | Flat 25% tax on capital gains, plus a 5.5% solidarity surcharge. |

| Greece (GR) | 15.00% | - |

| Hungary (HU) | 15.00% | Capital gains are subject to a flat PIT rate of 15%. |

| Iceland (IS) | 22.00% | - |

| Ireland (IE) | 33.00% | - |

| Israel (IL) | 28.00% | Flat 25% tax on capital gains, plus a 3% surtax for high-income earners. |

| Italy (IT) | 26.00% | - |

| Japan (JP) | 20.32% | Flat 20.315% tax on capital gains (15.315% national tax and 5% local inhabitant's tax) |

| Korea (KR) | 0.00% | Capital gains on listed shares owned by non-large shareholders are not taxed. Other types of capital gains are taxed. |

| Latvia (LV) | 20.00% | - |

| Lithuania (LT) | 20.00% | Capital gains are subject to PIT, with a top rate of 20%. |

| Luxembourg (LU) | 0.00% | Capital gains are tax-exempt if a movable asset (such as shares) is held for at least six months and is owned by a non-large shareholder. Taxed at progressive rates if held <6 months. |

| Mexico (MX) | 10.00% | - |

| Netherlands (NL) | 33.00% | Two tax brackets have been introduced in 2024: a basic rate of 24.5% for the first €67,000 and a 33% rate for the remainder. |

| New Zealand (NZ) | 0.00% | Does not have a comprehensive capital gains tax. |

| Norway (NO) | 37.84% | Capital gains are subject to PIT (an adjustment factor applies). |

| Poland (PL) | 19.00% | - |

| Portugal (PT) | 28.00% | - |

| Romania (RO) | 10.00% | Capital gains are subject to the normal PIT rate. |

| Slovakia (SK) | 0.00% | Shares are exempt from capital gains tax if they were held for more than one year and are not part of the business assets of the taxpayer. |

| Slovenia (SI) | 0.00% | Capital gains rate of 0% if an asset was held for more than 15 years (rate up to 25% for periods less than 15 years). |

| Spain (ES) | 28.00% | - |

| Sweden (SE) | 30.00% | - |

| Switzerland (CH) | 0.00% | Capital gains on movable assets such as shares are normally tax-exempt. |

| Turkey (TR) | 0.00% | Shares that are traded on the stock exchange and that have been held for at least one year are tax-exempt (two years for joint stock companies). |

| United Kingdom (GB) | 20.00% | - |

| United States (US) | 28.74% | 28.74% applies if the asset was held for more than one year; includes federal and state taxes on capital gains, as well as the 3.8% net investment income tax (NIIT) for high-income earners. |

Source: Bloomberg Tax, “Country Guide,” https://www.bloomberglaw.com/product/tax/toc_view_menu/3380/; and PwC, “Worldwide Tax Summaries Online,” https://www.taxsummaries.pwc.com/.

Dividend Tax Rates

While some countries tax dividends at the same rate as capital gains, other countries differentiate between the two forms of income. In addition, as previously mentioned, several countries have integrated their taxation of corporate profits and dividends paid. Table 3 shows the top marginal dividends tax rates levied in each country, taking into account credits and surtaxes.

As with capital gains taxes, some countries levy personal income taxes on dividend income, while others levy a flat, separate dividends tax. Exemption thresholds are also relatively common. For example, the United Kingdom provides a £1,000 ($1,255.35) dividend allowance, above which a progressive dividend tax is levied (this dividend allowance will be reduced to £500 starting April 6, 2024).

On average, the OECD and select EU countries levy a top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. of 23.85 percent on dividend income. However, as with capital gains, there is significant variation. Ireland’s top dividend tax rate is the highest, at 51 percent.

Estonia and Latvia are the only OECD countries that do not levy a tax on dividend income. This is due to their cash-flow-based corporate tax system. Instead of levying a dividend tax, Estonia and Latvia impose a corporate income tax of 20 percent when a business distributes its profits to shareholders.

Of the OECD and select EU countries with a tax on dividend income, Greece’s is the lowest, at 5 percent. Second and third are Slovakia and Croatia, at 7 percent and 12 percent, respectively.

Table 3. Dividends Tax Rates in the OECD and Select EU Countries, 2024

Top Marginal Dividends Tax Rates on Individuals (Includes Credits and Surtaxes)

| Country | Top Marginal Dividends Tax Rates |

|---|---|

| Australia (AU) | 24.28% |

| Austria (AT) | 27.50% |

| Belgium (BE) | 30.00% |

| Bulgaria (BG) | 5.00% |

| Canada (CA) | 39.34% |

| Chile (CL) | 23.90% |

| Colombia (CO) | 39.00% |

| Costa Rica (CR) | 15.00% |

| Croatia (HR) | 12.00% |

| Czech Republic (CZ) | 23.00% |

| Denmark (DK) | 42.00% |

| Estonia (EE) | 0.00% |

| Finland (FI) | 28.90% |

| France (FR) | 34.00% |

| Germany (DE) | 26.38% |

| Greece (GR) | 5.00% |

| Hungary (HU) | 15.00% |

| Iceland (IS) | 22.00% |

| Ireland (IE) | 51.00% |

| Israel (IL) | 33.00% |

| Italy (IT) | 26.00% |

| Japan (JP) | 20.32% |

| Korea (KR) | 43.95% |

| Latvia (LV) | 0.00% |

| Lithuania (LT) | 15.00% |

| Luxembourg (LU) | 21.00% |

| Mexico (MX) | 17.14% |

| Netherlands (NL) | 26.90% |

| New Zealand (NZ) | 15.28% |

| Norway (NO) | 37.84% |

| Poland (PL) | 19.00% |

| Portugal (PT) | 28.00% |

| Romania (RO) | 8.00% |

| Slovakia (SK) | 7.00% |

| Slovenia (SI) | 27.50% |

| Spain (ES) | 28.00% |

| Sweden (SE) | 30.00% |

| Switzerland (CH) | 22.29% |

| Turkey (TR) | 20.00% |

| United Kingdom (GB) | 39.35% |

| United States (US) | 28.97% |

Source: OECD, “Tax Database: Table II.4. Overall statutory tax rates on dividend income,” updated Apr. 11, 2023, https://stats.oecd.org/Index.aspx?DataSetCode=TABLE_II4.

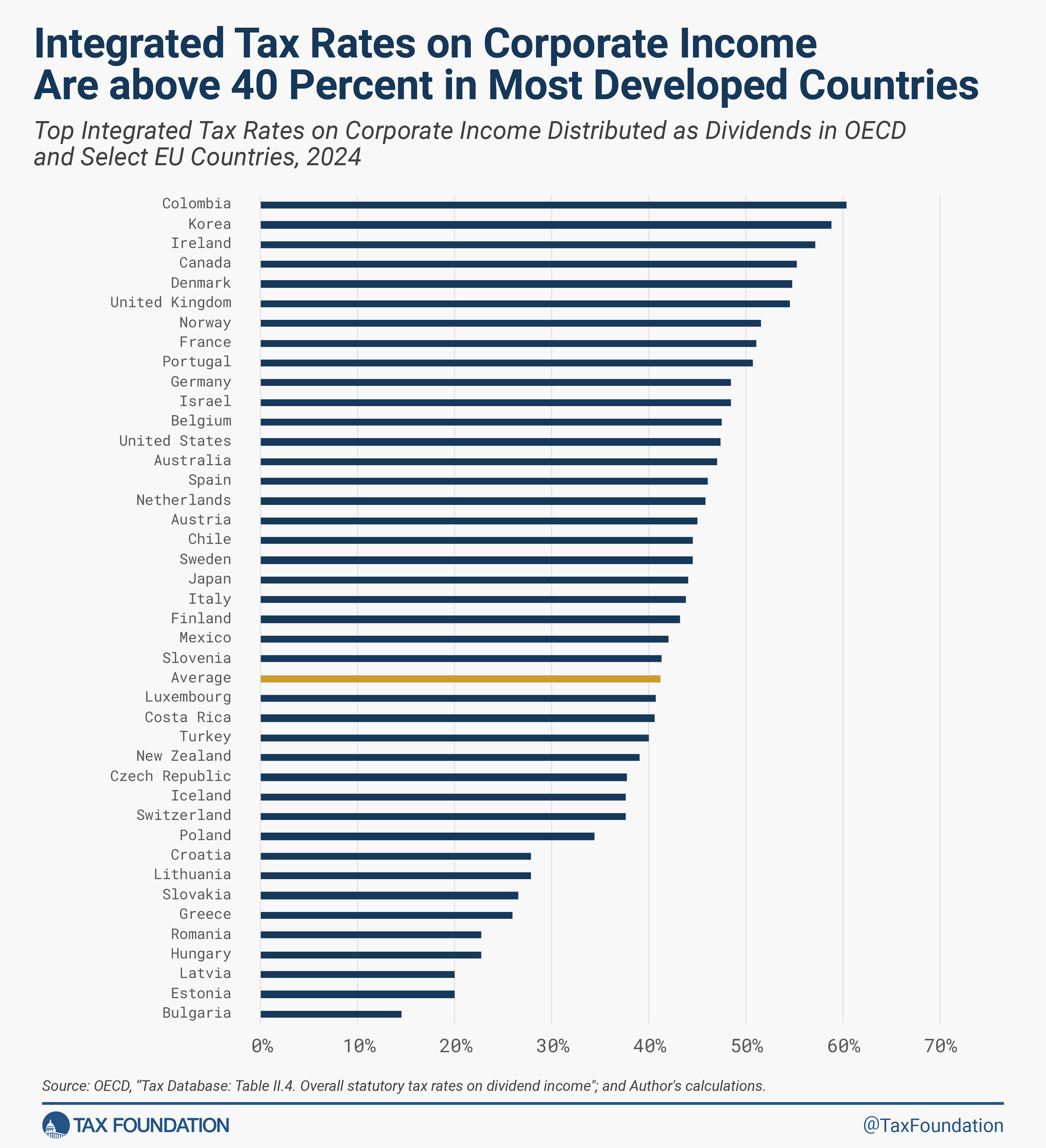

Integrated Rates

Most countries double tax corporate income by taxing it at the entity and at the shareholder levels. On average, OECD and select EU countries tax corporate income distributed as dividends at a rate of 41.16 percent and capital gains derived from corporate income at 37.38 percent.

For capital gains, Chile (56.2 percent), Denmark (54.76 percent), Norway (51.52 percent), and France (51.04 percent) have the highest integrated rates in the OECD, while Bulgaria (19 percent), the Czech Republic (19 percent), Slovenia (19 percent), Switzerland (19.65 percent), and Slovakia (21 percent) levy the lowest rates. Several countries—namely Belgium, the Czech Republic, Luxembourg, New Zealand, Slovakia, Slovenia, South Korea, Switzerland, and Turkey—do not levy capital gains taxes on long-term capital gains, making the corporate tax the only layer of tax on corporate income realized as long-term capital gains.

For dividends, Colombia’s top integrated tax rate of 60.35 percent was highest in the OECD and select EU countries, followed by South Korea (58.8 percent), Ireland (57.13 percent), and Canada (55.24 percent). Bulgaria (14.5 percent) Estonia (20 percent), Latvia (20 percent), Hungary (22.65 percent), and Romania (22.72 percent) levy the lowest rates. Estonia and Latvia’s dividend exemption system means that the corporate income tax is the only layer of taxation on corporate income distributed as dividends.

Tax Treatment of Retirement Savings in the OECD

In addition to universal pension systems, most OECD countries provide tax preferences for private retirement savings. As explained above, the most common tax treatment of retirement savings accounts is TEE (contributions are taxed, but gains are tax-exempt and there is no tax upon withdrawal) and EET (contributions and gains are tax-exempt, but withdrawals—principal plus gains—are taxed).

OECD and select EU countries generally limit the amount of savings one can place in tax-preferred retirement accounts. This is done through annual contribution caps. For example, in Spain, total employer and employee contributions made to personal and occupational pension plans are limited to €8,500 ($9,121) per year. Ireland and the United Kingdom are the only two OECD countries that also have a lifetime contribution limit for tax-preferred retirement savings accounts, at €2 million ($2.15 million) and £1,073,100 ($1.35 million), respectively.

Some countries impose penalty fees on withdrawals made before a certain age is reached. For example, in the United States, early withdrawal from an IRA prior to age 59½ is subject to being included in gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” plus a 10 percent additional tax penalty.

Details on the tax treatment of private retirement savings in each OECD country can be found in Appendix Table 2.

Simplifying the Tax Treatment for Savings and Investments

Long-term savings and investments play an important role in individuals’ financial stability and the economy overall. Lawmakers have recognized the need to incentivize saving through tax- and non-tax-related policies. However, in many cases, tax-preferred savings accounts come with a myriad of complex rules and limitations, which ultimately may deter individuals from opening such tax-preferred savings accounts and potentially lower the amount of total savings.

Universal savings accounts can significantly simplify a country’s tax-preferred savings system. These accounts are not limited to a certain type of savings (e.g., retirement savings) and have no income limitations or withdrawal penalties. Returns to the account would not be subject to tax, mirroring the tax treatment of most tax-preferred private retirement savings accounts in the OECD. Annual contribution limits could be set to ensure that the tax benefits are capped at a certain level.[5]

Since 2009, Canada has had a type of universal savings account—the tax-free savings account (TFSA). The annual contribution limit in 2024 is CAD 7,000 ($5,166). Contributions are made with after-tax dollars, earnings grow tax-free, and withdrawals can be made for any reason without triggering additional taxes or penalties. If someone makes less than the maximum contribution one year, the remaining contribution eligibility is added to the next year’s maximum contribution.[6]

The United Kingdom has had a similar program of individual savings accounts (ISAs) since 1999. ISAs have an annual contribution limit of £20,000 ($25,115). As with TFSAs, contributions are made with after-tax dollars, and earnings grow tax-free; unlike TFSAs, however, the rollover option is not allowed.[7]

U.S. lawmakers have made several proposals to introduce a universal savings account, though none have been enacted.[8] Establishing a universal savings account in the United States that has an annual contribution limit of $2,500 per year, uses after-tax contributions, and allows earnings to grow tax-free would reduce federal revenue by about $15.1 billion over the next 10 years. Due to the annual contribution limit of $2,500, the losses in federal tax revenue would be relatively small. However, it would slightly increase the after-tax return to saving, leading to small increases in output and after-tax incomes.[9]

Conclusion

Due to the importance of long-term savings and investment for individuals and the economy overall, dividend and capital gains taxes should be kept at a relatively low level—particularly when taking into account the corporate taxes paid at the entity level. On average, in the OECD and select EU countries, long-term capital gains from the sale of shares are taxed at a top rate of 18.78 percent, and dividends are taxed at a top rate of 23.85 percent. However, since corporate income is taxed twice, on average, OECD and select EU countries tax corporate income distributed as dividends at a rate of 41.16 percent and capital gains derived from corporate income at 37.38 percent.

To encourage private retirement saving, countries commonly provide tax-preferred retirement accounts. However, in many countries, the system of tax-preferred retirement accounts is complex, which may deter savers from using such accounts—and potentially lower overall savings. Canada and the United Kingdom have implemented universal savings accounts, and thus provide an example for how the system of tax-preferred retirement accounts can be simplified while providing more flexibility for what the funds can be used for. Policymakers could simplify the tax system and encourage saving with the goal of building financial security for low and middle-income households.

Subscribe to get insights from our trusted experts delivered straight to your inbox.Stay informed on the tax policies impacting you.

Appendix

Appendix Table 1. Top Integrated Tax Rates on Corporate Income in OECD and Select EU Countries, 2024

| Country | Statutory Corporate Income Tax Rate | Capital Gains | Dividends | ||

|---|---|---|---|---|---|

| Top Personal Capital Gains Tax Rate | Integrated Tax on Corporate Income (Capital Gains) | Top Personal Dividend Tax Rate | Integrated Tax on Corporate Income (Dividends) | ||

| Australia (AU) | 30.00% | 23.50% | 46.45% | 24.28% | 47.00% |

| Austria (AT) | 24.00% | 27.50% | 44.90% | 27.50% | 44.90% |

| Belgium (BE) | 25.00% | 0.00% | 25.00% | 30.00% | 47.50% |

| Bulgaria (BG) | 10.00% | 10.00% | 19.00% | 5.00% | 14.500% |

| Canada (CA) | 26.21% | 26.75% | 45.95% | 39.34% | 55.24% |

| Chile (CL) | 27.00% | 40.00% | 56.20% | 23.90% | 44.45% |

| Colombia (CO) | 35.00% | 15.00% | 44.75% | 39.00% | 60.35% |

| Costa Rica (CR) | 30.00% | 15.00% | 40.50% | 15.00% | 40.50% |

| Croatia (HR) | 18.00% | 12.00% | 27.84% | 12.00% | 27.84% |

| Czech Republic (CZ) | 19.00% | 0.00% | 19.00% | 23.00% | 37.63% |

| Denmark (DK) | 22.00% | 42.00% | 54.76% | 42.00% | 54.76% |

| Estonia (EE) | 20.00% | 20.00% | 36.00% | 0.00% | 20.00% |

| Finland (FI) | 20.00% | 34.00% | 47.20% | 28.90% | 43.12% |

| France (FR) | 25.83% | 34.00% | 51.04% | 34.00% | 51.04% |

| Germany (DE) | 29.94% | 26.38% | 48.42% | 26.38% | 48.42% |

| Greece (GR) | 22.00% | 15.00% | 33.70% | 5.00% | 25.90% |

| Hungary (HU) | 9.00% | 15.00% | 22.65% | 15.00% | 22.65% |

| Iceland (IS) | 20.00% | 22.00% | 37.60% | 22.00% | 37.60% |

| Ireland (IE) | 12.50% | 33.00% | 41.38% | 51.00% | 57.13% |

| Israel (IL) | 23.00% | 28.00% | 44.56% | 33.00% | 48.41% |

| Italy (IT) | 24.00% | 26.00% | 43.76% | 26.00% | 43.76% |

| Japan (JP) | 29.74% | 20.32% | 44.01% | 20.32% | 44.02% |

| Korea (KR) | 26.50% | 0.00% | 26.50% | 43.95% | 58.80% |

| Latvia (LV) | 20.00% | 20.00% | 36.00% | 0.00% | 20.00% |

| Lithuania (LT) | 15.00% | 20.00% | 32.00% | 15.00% | 27.75% |

| Luxembourg (LU) | 24.94% | 0.00% | 24.94% | 21.00% | 40.70% |

| Mexico (MX) | 30.00% | 10.00% | 37.00% | 17.14% | 42.00% |

| Netherlands (NL) (a) | 25.80% | 33.00% | 50.29% | 26.90% | 45.76% |

| New Zealand (NZ) | 28.00% | 0.00% | 28.00% | 15.28% | 39.00% |

| Norway (NO) | 22.00% | 37.84% | 51.52% | 37.84% | 51.52% |

| Poland (PL) | 19.00% | 19.00% | 34.39% | 19.00% | 34.39% |

| Portugal (PT) | 31.50% | 28.00% | 50.68% | 28.00% | 50.68% |

| Romania (RO) | 16.00% | 10.00% | 24.40% | 8.00% | 22.72% |

| Slovakia (SK) | 21.00% | 0.00% | 21.00% | 7.00% | 26.53% |

| Slovenia (SI) | 19.00% | 0.00% | 19.00% | 27.50% | 41.28% |

| Spain (ES) | 25.00% | 28.00% | 46.00% | 28.00% | 46.00% |

| Sweden (SE) | 20.60% | 30.00% | 44.42% | 30.00% | 44.42% |

| Switzerland (CH) | 19.65% | 0.00% | 19.65% | 22.29% | 37.56% |

| Turkey (TR) | 25.00% | 0.00% | 25.00% | 20.00% | 40.00% |

| United Kingdom (GB) | 25.00% | 20.00% | 40.00% | 39.35% | 54.51% |

| United States (US) (b) | 25.77% | 28.74% | 47.10% | 28.97% | 47.27% |

| Average | 22.97% | 18.78% | 37.38% | 23.85% | 41.16% |

Integrated tax rates are calculated as follows: (Corporate Income Tax) + [(Distributed Profit – Corporate Income Tax) * Dividends or Capital Gains Tax].

In some countries, the capital gains tax rate varies by the type of asset sold. The capital gains tax rate used in this report is the rate that applies to the sale of listed shares after an extended period of time. While the integrated tax rate on dividends captures subcentral taxes, this may not be the case for all integrated tax rates on capital gains due to data availability.

(a) In the Netherlands, the net asset value is taxed at a flat rate on a deemed annual return.

(b) The integrated top tax rate on corporate income distributed as dividends or as capital gains includes both federal and state dividend and capital gains taxes.

Source: OECD, “Tax Database: Table II.4. Overall statutory tax rates on dividend income,” updated Apr. 11, 2023, https://stats.oecd.org/Index.aspx?DataSetCode=TABLE_II4; PwC, “Quick Charts: Capital gains tax (CGT) rates,” https://taxsummaries.pwc.com/quick-charts/capital-gains-tax-cgt-rates; Author's calculations.

Appendix Table 2. Tax Treatment of Funded Private Retirement Savings in the OECD and Select EU Countries, as of July 2023

| Country | Type of Fund/Contributions | Contributions | Returns on Investments/Funds Accumulated | Withdrawals | Annual Contribution Limit | Lifetime Contribution Limit |

|---|---|---|---|---|---|---|

| Australia (AU) | Concessional Contributions | T | T (15%) | E | AUD 27,500 (15% tax rate on contributions up to cap, individual's marginal tax rate for contributions above cap; 30% tax rate on contributions from high-income earners). | None |

| Austria (AT) | Pension Companies (Pensionskassen) and Occupational Group Insurance (Betriebliche Kollektivversicherung) | T | E | T | Employee contributions are capped to the sum of annual employer contributions (cap does not apply for first EUR 1,000). | None |

| Belgium (BE) | Occupational Pension Plans | E | E | T | Tax benefits limited to total retirement contributions (including the statutory pension) not exceeding 80% of the last gross annual salary. | None |

| Bulgaria (BG) | All | E | E | E | Employee contributions into voluntary pension funds are tax deductible up to 10% of the individual’s taxable income. | None |

| Canada (CA) | All | E | E | T | Tax benefits limited by various caps based on annual income (18% of income plus dollar amount caps) and monthly contributions (in some cases limited to CAD 2,000); 1% penalty for monthly excess over-contributions can apply. | None |

| Chile (CL) | Mandatory Individual Accounts | E | E | T | 10% of an individual's salary up to 81.6 UF (UF—Unidad de Fomento—is a price-indexed unit of account). | None |

| Colombia (CO) | All | E | E | E | Voluntary contributions (which are in addition to mandatory contributions) cannot exceed 30% of the annual taxable income up to UVT 3,800 annually (value of each tax unit UVT—Unidad de Valor Tributario—is equivalent to COP 38,004 in 2022); different cap applies if individual makes contribution to private pension fund that also receives his/her mandatory contributions. | None |

| Costa Rica (CR) | Mandatory Supplementary Pension (ROP) | T | E | E | Employees’ contributions to the mandatory scheme (ROP) are not tax-deductible, while employer contributions are not included in the employee’s taxable income. | None |

| Croatia (HR) | Mandatory Pension Plans | E | E | T | Contributions into mandatory pension funds (5% of wages) are tax exempt. The maximum monthly earnings considered to compute contributions are EUR 8,203.08 (in 2023). | None |

| Czech Republic (CZ) | Supplementary Plans (Individual's Contributions) | T | E | E | Tax benefits capped at CZK 24,000 annually. | None |

| Denmark (DK) | All Plans Except "Age Savings Plans" | E | T (15.3%) | T | Tax benefits capped at DKK 60,900 (in 2023) for contributions to funds that have programmed withdrawal. | None |

| Estonia (EE) | Mandatory Pension Plan | E | E | T | No cap per se, but fixed contribution rates (employee contributions are set at 2% of the gross salary and government matching contributions are set at 4% of the gross salary). | None |

| Finland (FI) | Mandatory Occupational Plans and Voluntary Occupational Group Plans | E | E | T | Tax benefits capped for individuals at the lesser of 5% of salary or EUR 5,000 per year for voluntary occupational group plans. | None |

| France (FR) | All | T | E | T | Tax benefits capped at 10% of earnings net of professional | None |

| costs of the previous year, with a maximum deduction of EUR 35,149. | ||||||

| Germany (DE) | Pension Funds and Direct Insurance | E | E | T | Tax benefits capped at 8% of the social security contribution ceiling (SSC ceiling was EUR 87,600 in 2023). | None |

| Greece (GR) | Occupational Insurance Funds and Group Pension Insurance Contracts | E | T (5%) | T | None. | None |

| Hungary (HU) | All | T | E | E | Total tax relief (taking into account all types of personal pension plans) is capped at HUF 280,000 per year, additional caps apply for each plan; tax refund cannot exceed personal income tax liability. | None |

| Iceland (IS) | All | E | E | T | Tax relief for employees limited to 4% of their salaries. | None |

| Ireland (IE) | All | E | E | T | Contributions are capped at % of earnings and a value amount (both vary by age); there is also an upper limit on the amount of earnings that are taken into account (EUR 115,000). | Lifetime limit of EUR 2 million on tax-relieved pension products |

| Israel (IL) | All | T | E | E | Tax benefits capped at 7.5% of the salary (max. of 2.5 times the national average salary) for employer contributions and employee contributions are capped at 20.5% of twice the national average salary. | None |

| Italy (IT) | All | E | T (0%/12.5%/20%) | T | Contributions (employer and employee) exempt from personal income tax up to EUR 5,165 per year. | None |

| Japan (JP) | All | E | E | T | Contributions to defined benefit corporate pension funds are deductible up to a yearly limit of JPY 40,000. | None |

| Korea (KR) | All | T (13.2% or 16.5% credit depending on income) | E | T | Individual contributions to occupational defined contribution pension plans cannot exceed KRW 18,000,000 per year. Individual contributions are not possible in a defined benefit pension plan. | None |

| Latvia (LV) | Mandatory Contributions | E | E | T | The joint limit for contributions to voluntary pension funds and insurance premiums may not exceed 10% of annual taxable income with a cap of EUR 4,000. | None |

| Lithuania (LT) | Pillar Two" Plans | T | E | E | Individual contributions must equal at least 3% of gross salary or income. The total amount of deductible pension contributions, life insurance premiums, and educational expenses must not exceed 25% of taxable income, with an annual cap of EUR 1,500 per year. | None |

| Luxembourg (LU) | Occupational Plans | T (20%) | E | E | Employer contributions of up to 20% of employee earnings are taxed at 20% but not taxable for the employees. Employee contributions are tax deductible up to EUR 1,200 per year. | None |

| Mexico (MX) | Mandatory Contributions | T | E | E | The maximum deductible amount of voluntary contributions to occupational plans is 12.5% of an employee's salary. The cap applies jointly to employee and employer contributions. | None |

| Netherlands (NL) | All | E | E | T | The maximum income for eligibility in the EET system is EUR 128,810. Above that threshold, a TEE system applies. The maximum contributions to the EET system depend on age and range from 3.9% to 27.5% of annual income. The maximum contributions to the TEE system depend on age and range from 2.3% to 13.9% of annual income. | None |

| New Zealand (NZ) | All | T | T (10.5% - 28%) | E | Employee contributions are taxed at the individual's marginal income tax rate. Employer contributions are taxed at rates ranging from 10.5% to 39%. No annual contribution limit applies. | None |

| Norway (NO) | Occupational Defined Contribution Plans (Contributions from Employers) | E | E | T | When employees are required to contribute, contributions must not exceed 2% of salary in the municipal and public sector defined benefit plans and 4% of salary or the contribution made by the employer. | None |

| Poland (PL) | OFE Plans | E | E | T | Contributions into OFE plans are tax deductible without a limit. | None |

| Portugal (PT) | All | T | E | T | Annual employer contributions are subject to a cap of 15% of annual total costs of wages and salaries (25% if employees are not covered by social security). Employee contributions to private pension plans are subject to a 20% cap on deductible contributions and a yearly limit based on the individual's age. | None |

| Romania (RO) | Mandatory Private (Pillar Two) | E | E | E | Contributions into mandatory private pension funds are tax deductible. The contribution rate is 4.75% of gross earning in 2024. | None |

| Slovakia (SK) | Pillar Two" Plans | E | E | E | Employers are required to make annual contributions of 5.5% of salary in 2024, increasing by 0.25 percentage points each year until reaching 6% in 2027. Mandatory contributions are tax deductible. Employees can make additional contributions that are not subject to a cap and not tax deductible. | None |

| Slovenia (SI) | All | E | E | T | Employer contributions are not included in employee's taxable income up to 5.844% of employee's gross wages. The amount cannot exceed EUR 2,903.66 (in 2023) per year. | None |

| Spain (ES) | All | E | E | T | The general limit on individual and employer contributions to personal and occupational plans is the lowest of 30% of total net income, and EUR 1,500 per year. Total employee and employer contributions are limited to EUR 8,500 per year if the contribution is done by the employer or by the employee into the same occupational plan. | None |

| Sweden (SE) | Plans Other Than Premium Pension | E | T (15%) | T | For individual pension savings plans, the annual cap on individual contributions is 35% of eligible income (SEK 525,000 in 2023). | None |

| Switzerland (CH) | All | E | E | T | Individual contributions to occupational pension plans are tax-deductible but capped at CHF 7,056. If an individual does not have an occupational plan, tax-deductible contributions are capped at 20% of annual earnings and the deduction cannot exceed CHF 35,280. | None |

| Turkey (TR) | Personal Plans | T | T (5%/10%/15%) | E | There is no limit on contributions, but contributions are post-tax and subject to the stamp tax rate of 0.759%. | None |

| United Kingdom (GB) | All | E | E | T | The maximum among of pension contributions that an individual can get tax relief on annually is the higher of GBP 3,600 and 100% of taxable UK earnings. Pension contributions of more than GBP 60,000 (tax year 2023-2024) are subject to taxes that effectively limit relief in a year. | The lifetime allowance for private pension plans is GBP 1,073,100 (until 2025-2026). Savings worth more than the lifetime allowance pay a charge on the excess. |

| United States (US) | Traditional Plans (Not Roth Treatment) | E | E | T | Elective deferral contribution limits depend on the type of plan, but range from USD 15,500 (SIMPLE plans) and USD 22,500 in 2023. Some plans allow additional contributions for individuals age 50 years and older. | None |

Source: OECD, “Annual Survey on Financial Incentives for Retirement Savings: OECD Country Profiles 2023,” Dec. 31, 2023,

https://www.oecd.org/finance/private-pensions/Financial-incentives-retirement-savings-country-profiles-2023.pdf.

[1] Often, the tax treatment of stocks or ownership shares of private companies or other tradeable properties receive similar tax treatment to that of publicly traded stocks.

[2] Steve Rosenthal and Theo Burke, “Who’s Left to Tax? US Taxation of Corporations and Their

Shareholders,” New York University School of Law, Oct. 27, 2020, https://www.law.nyu.edu/sites/default/files/Who%E2%80%99s%20Left%20to%20Tax%3F%20US%20Taxation%20of%20Corporations%20and%20Their%20Shareholders-%20Rosenthal%20and%20Burke.pdf.

[3] Named for the late Senator William Roth (R-DE).

[4] Named for the relevant section of the U.S. tax code.

[5] For more details on universal savings accounts, see Robert Bellafiore, “The Case for Universal Savings Accounts,” Tax Foundation, Feb. 26, 2019, https://www.taxfoundation.org/case-for-universal-savings-accounts/.

[6] Government of Canada, “The Tax-Free Savings Account,” https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/tax-free-savings-account.html.

[7] Gov.uk, “Individual Savings Accounts (ISAs),” https://www.gov.uk/individual-savings-accounts.

[8] See H.R. 937, H.R. 6757, and S. 232 from the 115th Congress and Alex Durante, William McBride, and Garrett Watson, “Dwindling Savings and Increasing Financial Stress Highlights Need for Tax Reforms,” Tax Foundation, Nov. 9, 2023, https://taxfoundation.org/blog/personal-saving-retirement-taxes/.

[9] See Option 63 in Tax Foundation, “Options for Reforming America’s Tax Code 2.0,” Apr. 19, 2021, https://taxfoundation.org/research/federal-tax/tax-reform-options/?option=63.

Share