Key Findings

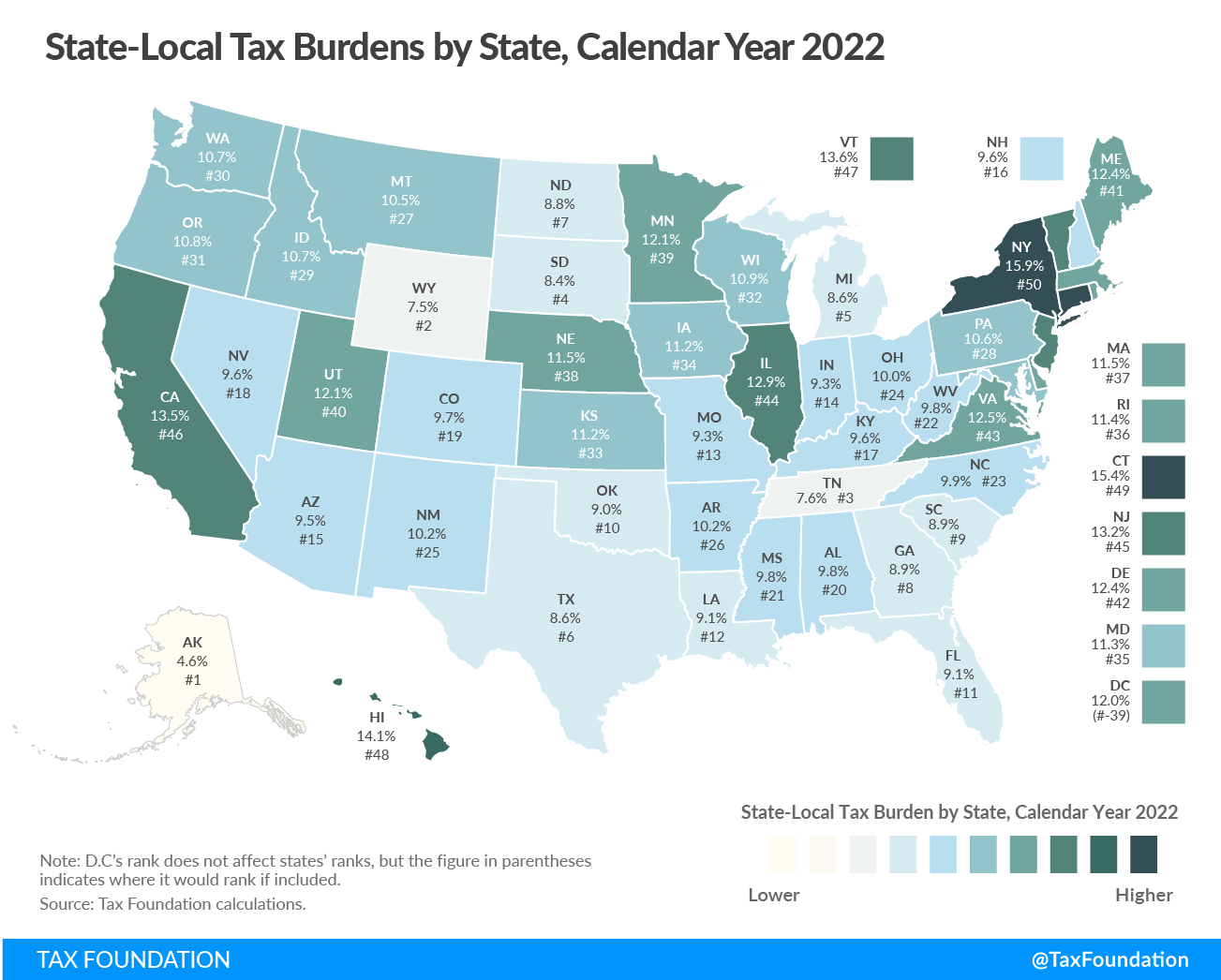

- In calendar year 2022, state-local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. burdens are estimated at 11.2 percent of national product.

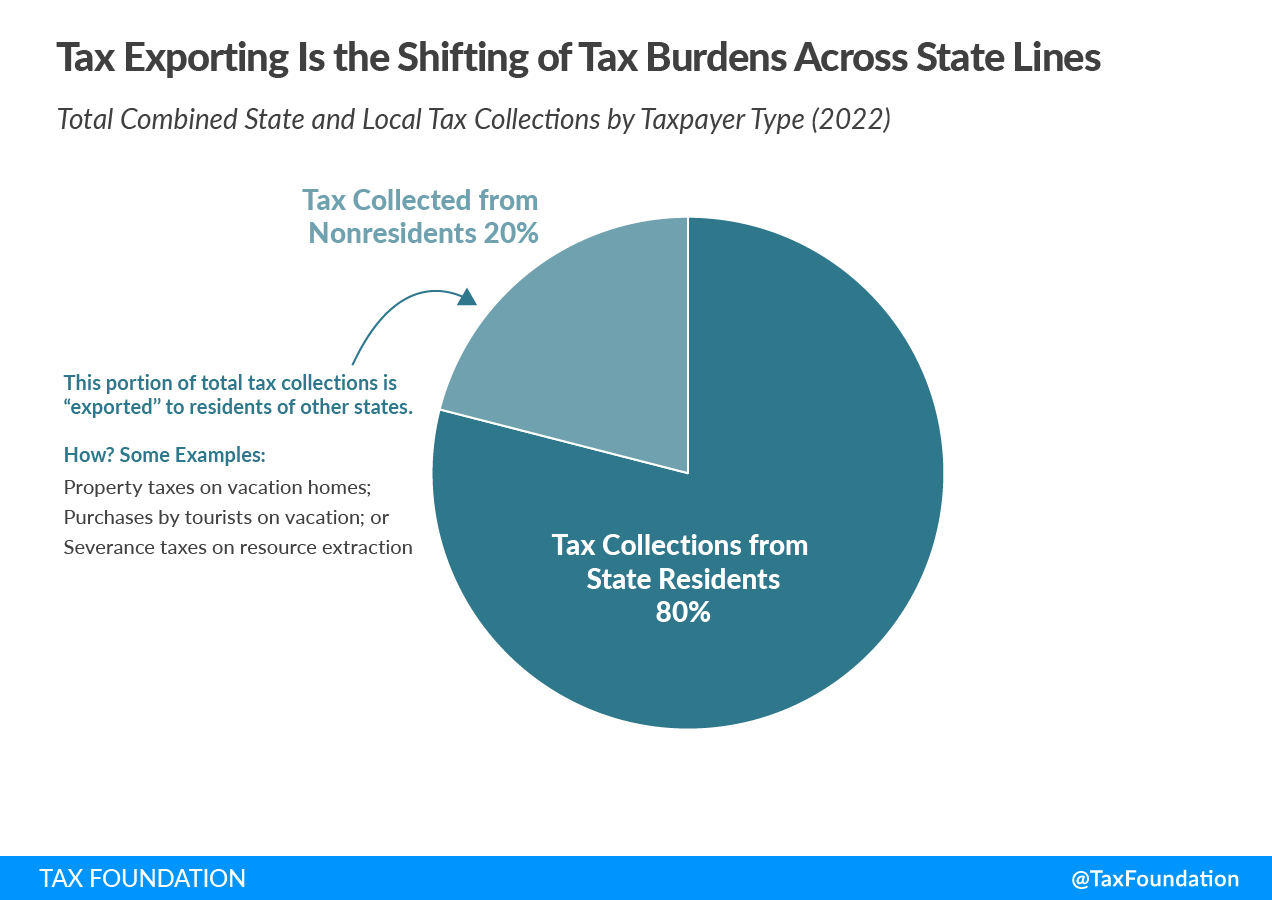

- Taxpayers remit taxes to both their home state and to other states, and about 20 percent of state tax revenue comes from nonresidents. Our tax burdens analysis accounts for this tax exporting.

- New Yorkers faced the highest burden, with 15.9 percent of net product in the state going to state and local taxes. Connecticut (15.4 percent) and Hawaii (14.9 percent) followed close behind.

- On the other end of the spectrum, Alaska (4.6 percent), Wyoming (7.5 percent), and Tennessee (7.6 percent) had the lowest burdens.

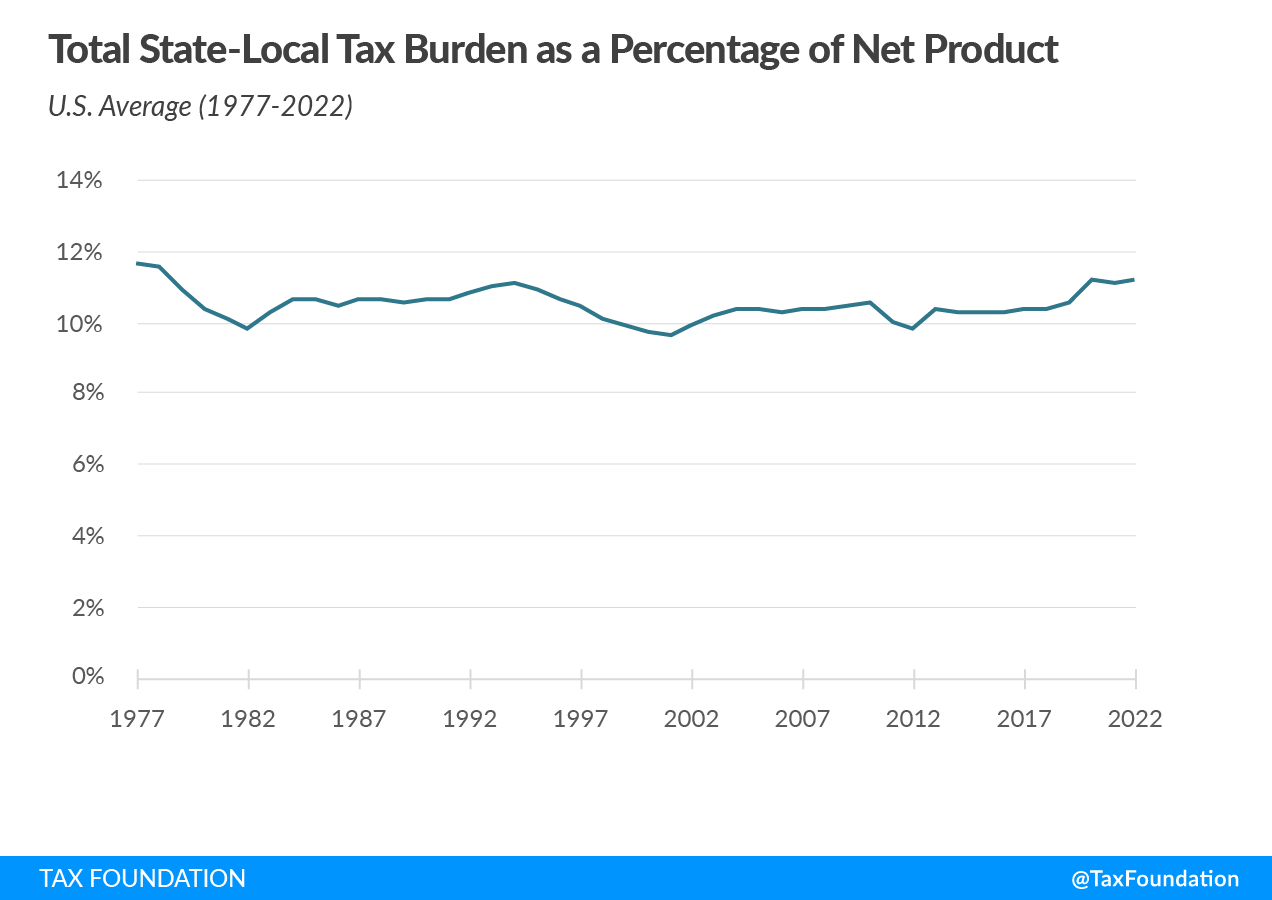

- Tax burdens rose across the country as pandemic-era economic changes caused taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. , activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

- State-local tax burdens are often very close to one another and slight changes in taxes or income can translate to seemingly dramatic shifts in rank. For example, Oklahoma (10th) and Ohio (24th) only differ in burden by just over one percentage point. However, while burdens are clustered in the center of the distribution, states at the top and bottom can have substantially different burden percentages.

| State | Effective Tax Rate | Rank |

|---|---|---|

| Alabama | 9.8% | 20 |

| Alaska | 4.6% | 1 |

| Arizona | 9.5% | 15 |

| Arkansas | 10.2% | 26 |

| California | 13.5% | 46 |

| Colorado | 9.7% | 19 |

| Connecticut | 15.4% | 49 |

| Delaware | 12.4% | 42 |

| District of Columbia | 12.0% | (39) |

| Florida | 9.1% | 11 |

| Georgia | 8.9% | 8 |

| Hawaii | 14.1% | 48 |

| Idaho | 10.7% | 29 |

| Illinois | 12.9% | 44 |

| Indiana | 9.3% | 14 |

| Iowa | 11.2% | 34 |

| Kansas | 11.2% | 33 |

| Kentucky | 9.6% | 17 |

| Louisiana | 9.1% | 12 |

| Maine | 12.4% | 41 |

| Maryland | 11.3% | 35 |

| Massachusetts | 11.5% | 37 |

| Michigan | 8.6% | 5 |

| Minnesota | 12.1% | 39 |

| Mississippi | 9.8% | 21 |

| Missouri | 9.3% | 13 |

| Montana | 10.5% | 27 |

| Nebraska | 11.5% | 38 |

| Nevada | 9.6% | 18 |

| New Hampshire | 9.6% | 16 |

| New Jersey | 13.2% | 45 |

| New Mexico | 10.2% | 25 |

| New York | 15.9% | 50 |

| North Carolina | 9.9% | 23 |

| North Dakota | 8.8% | 7 |

| Ohio | 10.0% | 24 |

| Oklahoma | 9.0% | 10 |

| Oregon | 10.8% | 31 |

| Pennsylvania | 10.6% | 28 |

| Rhode Island | 11.4% | 36 |

| South Carolina | 8.9% | 9 |

| South Dakota | 8.4% | 4 |

| Tennessee | 7.6% | 3 |

| Texas | 8.6% | 6 |

| Utah | 12.1% | 40 |

| Vermont | 13.6% | 47 |

| Virginia | 12.5% | 43 |

| Washington | 10.7% | 30 |

| West Virginia | 9.8% | 22 |

| Wisconsin | 10.9% | 32 |

| Wyoming | 7.5% | 2 |

What Are Tax Burdens?

In this study, we define a state’s tax burden as state and local taxes paid by a state’s residents divided by that state’s share of net national product. This study’s contribution to our understanding of true tax burdens is its focus on the fact that each of us not only pays state and local taxes to our own places of residence, but also to the governments of states and localities in which we do not live.

This tax shifting across state borders arises from several factors, including our movement across state lines during work and leisure time and the interconnectedness of the national economy. The largest driver of this phenomenon, however, is the reality that the ultimate incidence of a tax frequently falls on entities other than those that write the check to the government.

What is Tax Incidence?

The incidence of a tax is a measure of which entity pays the tax. But there are two very different types of tax incidenceTax incidence is a measure of who bears the legal or economic burden of a tax. Legal incidence identifies who is responsible for paying a tax while economic incidence identifies who bears the cost of tax—in the form of higher prices for consumers, lower wages for workers, or lower returns for shareholders. : legal incidence and economic incidence.

The legal incidence of taxes is borne by those with the legal obligation to remit tax payments to state and local governments. Legal incidence is established by law, and tells us which individuals or companies must physically send tax payments to state and local treasuries.

The legal incidence of taxes is generally very different from the final economic burden. Because taxes influence the relative prices facing individuals, they lead to changes in individual behavior. These tax-induced changes in behavior cause some portion (or all) of the economic burden of taxes to be shifted from those bearing the legal incidence onto others in society. For example, the legal incidence of corporate income taxes typically falls on companies. But economists agree that some portion of these taxes is shifted forward to others, in the form of higher prices for consumers, lower wages for workers, reduced returns to shareholders, or some combination of the three.

Once these tax-induced changes in behavior throughout the economy are accounted for, the final distribution of the economic burden of taxes is called the economic incidence. This measure is also referred to as the tax burden faced by individuals in their roles as consumers, workers, and investors.

What is Tax Exporting?

Beyond the fact that tax burdens often ultimately borne by many people who do not directly remit them, taxes imposed by state and local governments are often borne—in both their legal and economic incidence—by nonresidents. When some share of the burden of a tax imposed in one state is borne by those who live elsewhere, this phenomenon is known as tax exporting.

Alaska provides good examples of tax exporting. Sixty percent of Alaska’s state and local tax collections came from residents of other states in 2022. The main driver is state taxes on oil extraction (severance taxes and taxes on oil production and pipeline property). The burden of Alaska’s oil taxes does not fall predominantly on Alaska residents. Ignoring this fact and comparing Alaska tax collections directly to Alaska income makes the tax burden of Alaska residents look much higher than it actually is.

This study assumes that much of the economic burden of severance taxes falls on oil industry investors rather than on Alaska taxpayers. Notably, this study does not assume that the burden substantially falls on consumers (including drivers who purchase motor fuel), since these prices are set by global energy markets. The same is true for states like North Dakota and Wyoming where, once this allocation is made, the aggregate tax burden falls from among the nation’s highest to the lowest.

Resource-rich states such as these are only some of the more extreme examples of tax exporting. Major tourist destinations like Florida and Nevada are able to tax tourists, who are most often nonresidents, in addition to exporting many tax costs to investors. Some states have large numbers of residents employed out of state who pay individual income taxes to the states in which they work. When a metropolitan area attracts workers from nearby states, a large portion of wage income in a state can be earned by border-crossing commuters. On the other hand, some states have reciprocity agreements in which they tax their own residents, regardless of where they work. This study accounts for these types of agreements.

Every state’s economic activity is different, as is every state’s tax code. As a result, each varies in its ability to export its tax burden. Economists have been studying this phenomenon since at least the 1960s when Charles McLure estimated that states were extracting between 15 and 35 percent of their tax revenue from nonresidents.[1]

Much of this interstate tax collecting occurs through no special effort by state and local legislators or tax collectors. Tourists spend as they travel and many of those transactions are taxed. People who own property out of state pay property taxes in those states. And the burden of business taxes is borne by the employees, shareholders, and customers of those businesses wherever they may live. In many states, however, lawmakers have made a conscious effort to levy taxes specifically on nonresidents. Common examples include tax increases on hotel rooms, rental cars, and restaurant meals, and local sales taxes in resort areas.

What Is the Difference between Tax Burdens and Tax Collections?

The distinction between tax burdens and tax collections is crucial to understanding tax shifting across state lines. Because tax collections represent a tally of tax payments made to state and local governments, they measure legal incidence only. In contrast, our tax burdens estimates allocate taxes to states that are economically affected by them. As a result, the estimates in this report attempt to measure the economic incidence of taxes, not the legal incidence.

Tax collections are useful for some purposes and cited frequently. However, dividing total taxes collected by governments in a state by the state’s total income is not an accurate measure of the tax burden on a state’s residents as a whole because it does not accurately reflect the taxes that are actually paid out of that state’s income.

The authoritative source for state and local tax collections data is the Census Bureau’s State and Local Government Finance division, which serves as the main input and starting point for our tax burdens model. Here are a few additional examples of the difference between tax collections (tallied by the Census Bureau) and our tax burdens estimates:

- When Connecticut residents work in New York City and pay income tax to both New York State and the city, the Census Bureau will count those amounts as New York tax collections, but we count them as part of the tax burden of Connecticut’s residents.

- When Illinois and Massachusetts residents own second homes in nearby Wisconsin or Maine, respectively, local governments in Wisconsin and Maine will tally those property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. collections, but we shift those payments back to the states of the taxpayers.

- When people all over the country vacation at Disney World or in Las Vegas, tax collectors will tally the receipts from lodging, rental car, restaurant, and general sales taxes in Florida and Nevada, but we allocate these taxes partially to the vacation-goers themselves, partly to labor, and partially to holders of capital across the country.

In addition to allocating the taxes cited above, this study also allocates taxes on corporate income, commercial and residential property, tourism, and nonresident personal income away from the state of collection to the state of the taxpayers’ residences.

Which Taxes Are Included in the Tax Burdens Estimates?

We include all taxes reported by the Census Bureau’s State and Local Government Finance division, the most comprehensive resource on state and local tax collections data and our tax burden model’s starting point. These taxes are:

- Property taxes;

- General sales taxes;

- Excise taxes on alcoholic beverages, amusements, insurance premiums, motor fuels, pari-mutuels, public utilities, tobacco products, and other miscellaneous transactions;

- License taxes on alcoholic beverages, amusements, general corporations, hunting and fishing, motor vehicles, motor vehicle operators, public utilities, occupations and businesses not classified elsewhere, and other miscellaneous licenses;

- Individual income taxes;

- Corporate income taxes;

- Estate, inheritance, and gift taxes;

- Documentary and transfer taxes;

- Severance taxes;

- Special assessments for property improvements; and

- Miscellaneous taxes not classified in one of the above categories.

Our time unit of measure is the calendar year. Fiscal year data from states have been adjusted to match the calendar year. The state and local tax burden estimates for calendar year 2022 presented in this paper are based on the most recent data available from the Census Bureau, the Bureau of Economic Analysis, and all other data sources employed, and grossed up to the present based on the latest economic data.

Limitations

Tax burden measures are not measures of the size of government in a state, nor are they technically measures of the complete burden of taxation faced by a given state’s residents (this study excludes compliance costs and economic efficiency losses). Furthermore, the tax burden estimates presented here do not take into account the return to that taxation in the form of government spending. These drawbacks, however, are not unique to our tax burden estimates.

It is also worth noting that these tax burden estimates are not those of individual taxpayers. Our tax burden estimates look at the aggregate amount of state and local taxes paid, not the taxes paid by an individual. We collect data on the total income earned in a state (by all residents collectively) and estimate the share of that total that goes toward state and local taxes.

Calendar Year 2022 Results: Tax Burden by State

State-local tax burdens of each of the 50 states’ residents as a share of income are clustered quite close to one another. This is logical considering state and local governments fund similar activities such as public education, transportation, prison systems, and health programs, often under the same federal mandates. Furthermore, tax competition between states can often make dramatic differences in the level of taxation between similar, nearby states unsustainable in the long run.

| State | State-Local Effective Tax Rate | Rank | State-Local Tax Burden per Capita | Taxes Paid to Own State per Capita | Taxes Paid to Other States Per Capita |

|---|---|---|---|---|---|

| Alabama | 9.80% | 20 | $4,585 | $3,578 | $1,007 |

| Alaska | 4.60% | 1 | $2,943 | $1,527 | $1,416 |

| Arizona | 9.50% | 15 | $5,156 | $3,997 | $1,159 |

| Arkansas | 10.20% | 26 | $5,031 | $3,598 | $1,433 |

| California | 13.50% | 46 | $10,167 | $8,711 | $1,457 |

| Colorado | 9.70% | 19 | $6,699 | $5,010 | $1,689 |

| Connecticut | 15.40% | 49 | $12,151 | $9,883 | $2,268 |

| Delaware | 12.40% | 42 | $7,170 | $5,580 | $1,591 |

| District of Columbia | 12.00% | -39 | $11,654 | $9,060 | $2,594 |

| Florida | 9.10% | 11 | $5,406 | $3,533 | $1,873 |

| Georgia | 8.90% | 8 | $4,862 | $3,711 | $1,151 |

| Hawaii | 14.10% | 48 | $8,410 | $7,082 | $1,328 |

| Idaho | 10.70% | 29 | $5,402 | $4,140 | $1,262 |

| Illinois | 12.90% | 44 | $8,390 | $6,866 | $1,523 |

| Indiana | 9.30% | 14 | $5,030 | $3,965 | $1,064 |

| Iowa | 11.20% | 34 | $6,086 | $4,812 | $1,274 |

| Kansas | 11.20% | 33 | $6,353 | $4,971 | $1,382 |

| Kentucky | 9.60% | 17 | $4,669 | $3,679 | $990 |

| Louisiana | 9.10% | 12 | $4,762 | $3,705 | $1,056 |

| Maine | 12.40% | 41 | $6,906 | $5,712 | $1,194 |

| Maryland | 11.30% | 35 | $7,680 | $5,940 | $1,740 |

| Massachusetts | 11.50% | 37 | $9,405 | $7,565 | $1,840 |

| Michigan | 8.60% | 5 | $4,720 | $3,595 | $1,125 |

| Minnesota | 12.10% | 39 | $7,763 | $6,316 | $1,448 |

| Mississippi | 9.80% | 21 | $4,220 | $3,422 | $798 |

| Missouri | 9.30% | 13 | $4,953 | $3,666 | $1,287 |

| Montana | 10.50% | 27 | $5,795 | $4,200 | $1,595 |

| Nebraska | 11.50% | 38 | $6,720 | $5,327 | $1,393 |

| Nevada | 9.60% | 18 | $5,554 | $3,932 | $1,622 |

| New Hampshire | 9.60% | 16 | $6,593 | $4,784 | $1,809 |

| New Jersey | 13.20% | 45 | $9,648 | $7,696 | $1,952 |

| New Mexico | 10.20% | 25 | $4,835 | $3,859 | $977 |

| New York | 15.90% | 50 | $12,083 | $10,380 | $1,702 |

| North Carolina | 9.90% | 23 | $5,299 | $4,156 | $1,143 |

| North Dakota | 8.80% | 7 | $5,403 | $3,800 | $1,603 |

| Ohio | 10.00% | 24 | $5,530 | $4,380 | $1,149 |

| Oklahoma | 9.00% | 10 | $4,527 | $3,380 | $1,148 |

| Oregon | 10.80% | 31 | $6,572 | $5,191 | $1,381 |

| Pennsylvania | 10.60% | 28 | $6,723 | $5,354 | $1,369 |

| Rhode Island | 11.40% | 36 | $6,948 | $5,273 | $1,675 |

| South Carolina | 8.90% | 9 | $4,596 | $3,365 | $1,231 |

| South Dakota | 8.40% | 4 | $5,196 | $3,526 | $1,670 |

| Tennessee | 7.60% | 3 | $4,036 | $3,082 | $954 |

| Texas | 8.60% | 6 | $4,994 | $3,849 | $1,146 |

| Utah | 12.10% | 40 | $6,750 | $5,346 | $1,404 |

| Vermont | 13.60% | 47 | $7,958 | $6,532 | $1,426 |

| Virginia | 12.50% | 43 | $7,979 | $6,367 | $1,612 |

| Washington | 10.70% | 30 | $7,803 | $6,069 | $1,734 |

| West Virginia | 9.80% | 22 | $4,479 | $3,444 | $1,034 |

| Wisconsin | 10.90% | 32 | $6,231 | $4,911 | $1,320 |

| Wyoming | 7.50% | 2 | $4,691 | $2,647 | $2,045 |

Since we present tax burdens as a share of income as a relative ranking of the 50 states, slight changes in taxes or income can translate into seemingly dramatic shifts in rank. For example, Oklahoma (10th) and Ohio (24th) only differ in burden by just over one percentage point. Tax revenue growth during the pandemic, however, has not only increased overall tax burdens but also expanded variance among states. In our last pre-pandemic analysis, the 20 middle-ranked states differed by less than a percentage point on effective rate, but in 2022, the difference between New Hampshire (16th) and Maryland (35th) is 1.8 percentage points. While burdens are clustered in the center of the distribution, states at the top and bottom can have substantially different burden percentages: the state with the highest burden, New York, has a burden percentage of 15.9 percent, while the state with the lowest burden, Alaska, has a burden percentage of 4.6 percent.

Nationwide, 20 percent of all state and local taxes are collected from nonresidents. As a result, the residents of all states pay surprisingly high shares of their total tax burdens to out-of-state governments. Table 2 lists the per capita dollar amounts of total tax burden and income that are divided to compute each state’s burden, as well as the breakdown of in-state and out-of-state payments for calendar year 2022.

The residents of three states stand above the rest, experiencing the highest state-local tax burdens in the country: New York (15.9 percent of state income), Connecticut (15.4 percent), and Hawaii (14.1 percent). By contrast, the median state-local tax burden is 10.2 percent, and the national average is 11.6 percent. Three states are at or below 8 percent: Alaska (4.6 percent), Wyoming (7.5 percent), and Tennessee (7.6 percent)

New York, Hawaii, and Connecticut have occupied the top three spots on the list since 2017, with California, Maryland, Minnesota, New Jersey, and Vermont typically vying for the next five spots—though not always in the same order. This may be partially attributed to high expenditure levels, which must be sustained by high levels of revenue. Furthermore, in the case of states like Connecticut and New Jersey, relatively high tax payments to out-of-state governments add to already high in-state payments, both due to direct interactions with neighboring states like New York and because these are high-income states whose residents experience high levels of capital gains. High levels of capital gains will result in residents paying an increased share of other states’ business taxes.[2] Finally, a substantial portion of Hawaii’s tax burden is generated by the tourism industry and substantially exported to the rest of the country.

The states with the highest state-local tax burdens in calendar year 2022 were:

1. New York (15.9 percent)

2. Connecticut (15.4 percent)

3. Hawaii (14.1 percent)

4. Vermont (13.6 percent)

5. California (13.5 percent)

6. New Jersey (13.2 percent)

7. Illinois (12.9 percent)

8. Virginia (12.5 percent)

9. Delaware (12.4 percent)

10. Maine (12.4 percent)

The states with the lowest state-local tax burdens in calendar year 2022 were:

50. Alaska (4.6 percent)

49. Wyoming (7.5 percent)

48. Tennessee (7.6 percent)

47. South Dakota (8.4 percent)

46. Michigan (8.6 percent)

45. Texas (8.6 percent)

44. North Dakota (8.8 percent)

43. Georgia (8.9 percent)

42. South Carolina (8.9 percent)

41. Oklahoma (9.0 percent)

Generally, there are three reasons why a state’s ranking could change from year to year. First, there could have been a change in total collections by the state, either due to policy changes or economic fluctuations. Second, there may have been a change in the level of state product due to changing economic conditions. And third, other states to which residents pay state and local taxes could have seen changes in tax collections (again due to changing policy or economic conditions).

Our current data are for tax year 2022, based on prior-year complete Census tax revenue data, quarterly tax data through the end of calendar year 2021, up-to-date national accounts data and economic forecasts, and adjustments for recently adopted tax policies. This represents the first time that Burdens has been presented as a current year estimate rather than an analysis of prior-year data.

The effects of the COVID-19 pandemic and of the economic changes of the past two years can be seen in our data. Net national product rose 13.6 percent in nominal terms between 2019 and 2022, while state and local tax collections rose 19.9 percent. High-income, high-tax states saw collections soar as the stock market first recovered and then boomed after an early 2020 dip, and across the country, behavioral changes induced by the pandemic increased the share of taxable activity, while federal aid to individuals and businesses further boosted taxable income and activity. A hot housing market, moreover, has begun to show up in property tax assessments. The result is tax collections increasing faster than income growth, yielding higher overall burdens in 2020-2022 despite more states cutting tax rates than raising them in recent years. For each of these years, effective tax rates stood at 11.2 percent of net national product, higher than all years in our series except the first two for which data are available, 1977 (11.7 percent) and 1978 (11.6 percent).

Table 3 lists each state’s burden as a share of income, including rankings, for the three most recent calendar years available.

| Burden Percentages and Rankings | ||||||||

|---|---|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | |||||

| State | Rate | Rank | Rate | Rank | Rate | Rank | Rate | Rank |

| U.S. Average | 10.6% | 11.2% | 11.2% | 11.2% | ||||

| Alabama | 9.1% | 12 | 10.0% | 18 | 10.0% | 20 | 9.8% | 20 |

| Alaska | 5.6% | 1 | 5.0% | 1 | 4.1% | 1 | 4.6% | 1 |

| Arizona | 9.4% | 18 | 9.8% | 15 | 9.6% | 16 | 9.5% | 15 |

| Arkansas | 10.3% | 28 | 10.9% | 29 | 10.7% | 26 | 10.2% | 26 |

| California | 12.2% | 46 | 12.9% | 47 | 13.3% | 46 | 13.5% | 46 |

| Colorado | 9.6% | 22 | 10.1% | 19 | 10.0% | 21 | 9.7% | 19 |

| Connecticut | 12.5% | 48 | 13.7% | 48 | 14.7% | 49 | 15.4% | 49 |

| Delaware | 11.3% | 39 | 12.2% | 40 | 12.2% | 40 | 12.4% | 42 |

| District of Columbia | 11.0% | (37) | 11.6% | (34) | 11.7% | (36) | 12.0% | (39) |

| Florida | 8.9% | 8 | 9.2% | 5 | 9.1% | 9 | 9.1% | 11 |

| Georgia | 9.0% | 9 | 9.4% | 9 | 9.1% | 10 | 8.9% | 8 |

| Hawaii | 13.2% | 49 | 13.7% | 49 | 13.9% | 48 | 14.1% | 48 |

| Idaho | 9.5% | 19 | 10.2% | 23 | 10.8% | 29 | 10.7% | 29 |

| Illinois | 11.2% | 38 | 12.5% | 42 | 12.9% | 44 | 12.9% | 44 |

| Indiana | 9.0% | 10 | 9.3% | 6 | 9.3% | 12 | 9.3% | 14 |

| Iowa | 11.0% | 37 | 11.8% | 35 | 11.5% | 35 | 11.2% | 34 |

| Kansas | 10.2% | 26 | 10.8% | 27 | 11.1% | 31 | 11.2% | 33 |

| Kentucky | 9.8% | 23 | 10.2% | 21 | 10.0% | 19 | 9.6% | 17 |

| Louisiana | 8.9% | 7 | 9.3% | 8 | 9.1% | 11 | 9.1% | 12 |

| Maine | 11.6% | 41 | 12.1% | 39 | 12.4% | 42 | 12.4% | 41 |

| Maryland | 11.9% | 43 | 12.6% | 43 | 11.9% | 38 | 11.3% | 35 |

| Massachusetts | 10.8% | 34 | 11.4% | 30 | 11.4% | 34 | 11.5% | 37 |

| Michigan | 9.6% | 20 | 9.6% | 12 | 9.0% | 7 | 8.6% | 5 |

| Minnesota | 12.3% | 47 | 12.7% | 44 | 12.4% | 43 | 12.1% | 39 |

| Mississippi | 9.4% | 16 | 9.8% | 14 | 9.8% | 17 | 9.8% | 21 |

| Missouri | 9.0% | 11 | 9.5% | 11 | 9.4% | 14 | 9.3% | 13 |

| Montana | 10.2% | 27 | 10.8% | 26 | 10.7% | 27 | 10.5% | 27 |

| Nebraska | 10.8% | 33 | 11.7% | 34 | 11.7% | 37 | 11.5% | 38 |

| Nevada | 9.4% | 17 | 10.2% | 22 | 9.9% | 18 | 9.6% | 18 |

| New Hampshire | 9.2% | 15 | 9.4% | 10 | 9.5% | 15 | 9.6% | 16 |

| New Jersey | 11.9% | 44 | 12.8% | 45 | 13.0% | 45 | 13.2% | 45 |

| New Mexico | 10.5% | 30 | 11.6% | 32 | 10.5% | 25 | 10.2% | 25 |

| New York | 14.2% | 50 | 14.9% | 50 | 15.2% | 50 | 15.9% | 50 |

| North Carolina | 9.6% | 21 | 10.1% | 20 | 10.1% | 23 | 9.9% | 23 |

| North Dakota | 9.2% | 14 | 9.9% | 16 | 7.9% | 3 | 8.8% | 7 |

| Ohio | 10.1% | 25 | 10.6% | 24 | 10.4% | 24 | 10.0% | 24 |

| Oklahoma | 8.8% | 6 | 9.6% | 13 | 9.0% | 8 | 9.0% | 10 |

| Oregon | 11.7% | 42 | 11.9% | 37 | 11.1% | 32 | 10.8% | 31 |

| Pennsylvania | 10.4% | 29 | 10.8% | 28 | 10.7% | 28 | 10.6% | 28 |

| Rhode Island | 11.4% | 40 | 12.0% | 38 | 11.7% | 36 | 11.4% | 36 |

| South Carolina | 9.2% | 13 | 9.9% | 17 | 9.4% | 13 | 8.9% | 9 |

| South Dakota | 8.6% | 5 | 8.8% | 4 | 8.7% | 6 | 8.4% | 4 |

| Tennessee | 6.9% | 2 | 7.6% | 2 | 7.7% | 2 | 7.6% | 3 |

| Texas | 8.4% | 4 | 8.7% | 3 | 8.4% | 5 | 8.6% | 6 |

| Utah | 10.9% | 36 | 11.8% | 36 | 11.9% | 39 | 12.1% | 40 |

| Vermont | 12.0% | 45 | 12.8% | 46 | 13.4% | 47 | 13.6% | 47 |

| Virginia | 10.9% | 35 | 12.4% | 41 | 12.4% | 41 | 12.5% | 43 |

| Washington | 10.6% | 31 | 11.4% | 31 | 11.0% | 30 | 10.7% | 30 |

| West Virginia | 10.0% | 24 | 10.7% | 25 | 10.1% | 22 | 9.8% | 22 |

| Wisconsin | 10.8% | 32 | 11.6% | 33 | 11.3% | 33 | 10.9% | 32 |

| Wyoming | 7.9% | 3 | 9.3% | 7 | 8.3% | 4 | 7.5% | 2 |

Many of the least-burdened states forgo a major tax. For example, Alaska (1st), Wyoming (2nd), Tennessee (3rd), South Dakota (4th), Texas (6th), and Florida (11th) all do without taxes on individual income. Similarly, Wyoming and South Dakota do without a major business tax, and Alaska has no state-level sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. (though it does allow local governments to levy sales taxes). Notably, opting to not levy a personal income tax causes a state to rely more on other forms of taxation that might be more exportable.

Not every state with a significant amount of nonresident income uses it to lighten the tax load of its own residents. Maine and Vermont have the largest shares of vacation homes in the country,[3] and they collect a sizeable fraction of their property tax revenue on those properties, mostly from residents of Connecticut, Massachusetts, and other New England states. Despite this, Maine and Vermont still rank 41st and 47th, respectively, in this study.

Despite the importance of nonresident collections and the increasing efforts to boost them, the driving force behind a state’s long-term rise or fall in the tax burden rankings is usually internal and most often a result of deliberate policy choices regarding tax and spending levels or changes in state income levels. This study is not an endorsement of policies that attempt to export tax burdens. From the perspectives of the economy and political efficiency, states can create myriad problems when they purposefully shift tax burdens to residents of other jurisdictions. This study only attempts to quantify the amount of shifting that occurs and understand how it affects the distribution of state and local tax burdens across states.

Historical Trends

Nationally, average state-local tax burdens as a share of income have fallen slightly from 11.7 percent in 1977 to 11.2 percent in 2022, as the pandemic-era economy has yielded an increase in tax burdens to the highest level in decades. Chart 2 shows the movement of U.S. average state-local tax burdens since 1977.

Some states’ residents are paying the same share of their income to taxes now as they were three decades ago, but in other states, tax burdens have changed substantially over time. The tax burden in every state fluctuates as years pass for a variety of reasons, including changes in tax law, state economies, and population. Further, changes outside of a state can impact tax burdens as well. See Table 4 for historical trends in burdens by state (selected years).

| State | 1977 | 1980 | 1990 | 2000 | 2010 | 2015 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|

| U.S. Average | 11.7% | 10.4% | 10.7% | 9.7% | 10.6% | 10.3% | 10.6% | 11.2% | 11.2% | 11.2% |

| Alabama | 10.1% | 9.3% | 9.5% | 8.8% | 9.2% | 8.7% | 9.1% | 10.0% | 10.0% | 9.8% |

| Alaska | 12.7% | 8.9% | 6.1% | 5.1% | 7.2% | 5.8% | 5.6% | 5.0% | 4.1% | 4.6% |

| Arizona | 11.7% | 10.2% | 10.7% | 8.9% | 9.2% | 8.9% | 9.4% | 9.8% | 9.6% | 9.5% |

| Arkansas | 9.4% | 9.2% | 9.3% | 9.4% | 10.8% | 10.4% | 10.3% | 10.9% | 10.7% | 10.2% |

| California | 13.3% | 11.4% | 11.3% | 10.7% | 12.0% | 11.4% | 12.2% | 12.9% | 13.3% | 13.5% |

| Colorado | 11.6% | 10.0% | 10.4% | 8.9% | 9.5% | 9.4% | 9.6% | 10.1% | 10.0% | 9.7% |

| Connecticut | 12.1% | 10.5% | 11.1% | 11.3% | 12.9% | 11.9% | 12.5% | 13.7% | 14.7% | 15.4% |

| Delaware | 10.9% | 10.3% | 9.2% | 8.6% | 9.7% | 9.7% | 11.3% | 12.2% | 12.2% | 12.4% |

| District of Columbia | 13.4% | 13.8% | 12.9% | 11.5% | 9.8% | 10.1% | 11.0% | 11.6% | 11.7% | 12.0% |

| Florida | 10.2% | 8.7% | 9.2% | 8.6% | 10.0% | 9.0% | 8.9% | 9.2% | 9.1% | 9.1% |

| Georgia | 10.5% | 9.9% | 10.5% | 9.3% | 9.5% | 9.0% | 9.0% | 9.4% | 9.1% | 8.9% |

| Hawaii | 11.6% | 11.0% | 10.6% | 9.9% | 10.8% | 12.1% | 13.2% | 13.7% | 13.9% | 14.1% |

| Idaho | 11.7% | 10.5% | 11.0% | 10.2% | 10.0% | 9.7% | 9.5% | 10.2% | 10.8% | 10.7% |

| Illinois | 11.5% | 10.6% | 10.6% | 9.4% | 10.9% | 11.0% | 11.2% | 12.5% | 12.9% | 12.9% |

| Indiana | 9.4% | 8.3% | 9.5% | 8.4% | 9.9% | 8.9% | 9.0% | 9.3% | 9.3% | 9.3% |

| Iowa | 11.5% | 10.7% | 11.0% | 9.5% | 10.0% | 10.3% | 11.0% | 11.8% | 11.5% | 11.2% |

| Kansas | 10.6% | 9.6% | 10.3% | 9.6% | 10.1% | 9.1% | 10.2% | 10.8% | 11.1% | 11.2% |

| Kentucky | 10.7% | 9.8% | 10.3% | 10.0% | 9.7% | 9.7% | 9.8% | 10.2% | 10.0% | 9.6% |

| Louisiana | 8.6% | 8.0% | 8.5% | 8.4% | 8.2% | 8.4% | 8.9% | 9.3% | 9.1% | 9.1% |

| Maine | 11.4% | 10.9% | 11.5% | 10.9% | 10.9% | 11.2% | 11.6% | 12.1% | 12.4% | 12.4% |

| Maryland | 12.6% | 11.6% | 11.6% | 10.6% | 10.9% | 11.5% | 11.9% | 12.6% | 11.9% | 11.3% |

| Massachusetts | 13.4% | 12.1% | 11.4% | 10.0% | 10.9% | 10.7% | 10.8% | 11.4% | 11.4% | 11.5% |

| Michigan | 11.7% | 10.6% | 10.6% | 9.6% | 10.2% | 9.8% | 9.6% | 9.6% | 9.0% | 8.6% |

| Minnesota | 12.3% | 10.9% | 11.5% | 10.3% | 11.3% | 11.9% | 12.3% | 12.7% | 12.4% | 12.1% |

| Mississippi | 10.5% | 9.4% | 9.5% | 9.1% | 9.3% | 9.4% | 9.4% | 9.8% | 9.8% | 9.8% |

| Missouri | 10.3% | 9.4% | 9.9% | 9.3% | 9.5% | 9.0% | 9.0% | 9.5% | 9.4% | 9.3% |

| Montana | 10.8% | 9.6% | 10.0% | 8.9% | 9.5% | 10.1% | 10.2% | 10.8% | 10.7% | 10.5% |

| Nebraska | 12.1% | 10.8% | 10.3% | 9.6% | 10.2% | 10.1% | 10.8% | 11.7% | 11.7% | 11.5% |

| Nevada | 9.4% | 7.8% | 8.2% | 7.2% | 8.8% | 9.4% | 9.4% | 10.2% | 9.9% | 9.6% |

| New Hampshire | 9.9% | 8.5% | 8.6% | 7.7% | 8.8% | 9.8% | 9.2% | 9.4% | 9.5% | 9.6% |

| New Jersey | 13.9% | 12.1% | 11.9% | 11.0% | 13.0% | 11.5% | 11.9% | 12.8% | 13.0% | 13.2% |

| New Mexico | 10.1% | 9.3% | 10.8% | 9.9% | 9.1% | 9.3% | 10.5% | 11.6% | 10.5% | 10.2% |

| New York | 14.7% | 13.2% | 13.1% | 11.7% | 13.2% | 14.5% | 14.2% | 14.9% | 15.2% | 15.9% |

| North Carolina | 10.9% | 10.2% | 10.5% | 9.7% | 10.5% | 9.8% | 9.6% | 10.1% | 10.1% | 9.9% |

| North Dakota | 13.0% | 10.8% | 10.4% | 9.4% | 9.5% | 9.7% | 9.2% | 9.9% | 7.9% | 8.8% |

| Ohio | 9.9% | 9.2% | 10.5% | 10.2% | 10.2% | 10.1% | 10.1% | 10.6% | 10.4% | 10.0% |

| Oklahoma | 9.7% | 8.7% | 10.0% | 9.7% | 9.3% | 8.2% | 8.8% | 9.6% | 9.0% | 9.0% |

| Oregon | 12.4% | 11.2% | 11.8% | 10.1% | 10.9% | 11.2% | 11.7% | 11.9% | 11.1% | 10.8% |

| Pennsylvania | 11.5% | 10.7% | 10.6% | 9.9% | 10.6% | 10.1% | 10.4% | 10.8% | 10.7% | 10.6% |

| Rhode Island | 12.7% | 11.6% | 11.4% | 11.1% | 11.4% | 11.2% | 11.4% | 12.0% | 11.7% | 11.4% |

| South Carolina | 10.3% | 9.7% | 10.2% | 9.1% | 8.8% | 9.0% | 9.2% | 9.9% | 9.4% | 8.9% |

| South Dakota | 10.1% | 8.9% | 8.3% | 7.2% | 7.9% | 8.7% | 8.6% | 8.8% | 8.7% | 8.4% |

| Tennessee | 9.1% | 8.0% | 8.1% | 7.0% | 7.9% | 7.2% | 6.9% | 7.6% | 7.7% | 7.6% |

| Texas | 8.9% | 7.7% | 8.7% | 7.5% | 8.4% | 8.2% | 8.4% | 8.7% | 8.4% | 8.6% |

| Utah | 11.7% | 11.1% | 11.2% | 10.4% | 10.0% | 9.6% | 10.9% | 11.8% | 11.9% | 12.1% |

| Vermont | 13.0% | 10.8% | 11.1% | 10.1% | 10.8% | 11.7% | 12.0% | 12.8% | 13.4% | 13.6% |

| Virginia | 11.4% | 10.4% | 10.5% | 9.8% | 10.0% | 9.7% | 10.9% | 12.4% | 12.4% | 12.5% |

| Washington | 10.8% | 9.6% | 10.1% | 8.6% | 9.9% | 9.9% | 10.6% | 11.4% | 11.0% | 10.7% |

| West Virginia | 10.8% | 10.2% | 10.0% | 9.7% | 10.5% | 9.8% | 10.0% | 10.7% | 10.1% | 9.8% |

| Wisconsin | 14.1% | 12.2% | 12.3% | 11.5% | 11.7% | 10.5% | 10.8% | 11.6% | 11.3% | 10.9% |

| Wyoming | 9.0% | 7.9% | 6.9% | 6.7% | 8.3% | 8.8% | 7.9% | 9.3% | 8.3% | 7.5% |

States Where the Tax Burden Has Changed Dramatically Over Time

Among states with declining tax burdens, Alaska is the extreme example. Before the Trans-Alaska Pipeline system was finished in 1977, taxpayers in Alaska paid 11.7 percent of their share of net national product in state and local taxes. By 1980, with oil tax revenue pouring in, Alaska repealed its personal income tax and started sending out checks to residents instead. The tax burden plummeted, and now Alaskans are the least taxed with a burden of only 4.6 percent of income.

Similarly, North Dakota’s burden has fallen from 13.0 percent in 1977 to 8.8 percent of net state product in 2022.

Although the majority of states have seen a decrease in tax burdens over time, 16 have experienced increases since 1977, many of these likely to be temporary upticks due to the pandemic. Connecticut taxpayers have seen the largest increase, of 3.3 percentage points, followed by Hawaii at 2.5 percent.

Conclusion

When measuring the burden imposed on a given state’s residents by all state and local taxes, one cannot look exclusively to collections figures for the governments located within state borders. A significant amount of tax shifting takes place across state lines, and this shifting is not uniform. Furthermore, this shifting should not be ignored when attempting to understand the burden faced by taxpayers within a state.

[1] Charles E. McClure, “The Interstate Exporting of State and Local Taxes: Estimates for 1962,” National Tax Journal 20:1 (1967): 49–75.

[2] Business taxes collected by states are allocated nationwide based on each state’s share of capital and labor income. States with high capital gains tax rates will have larger capital income relative to other states.

[3] U.S. Census Bureau, “Historical Census of Housing Tables: Vacation Homes,” Census of Housing.

Share this article