Key Findings

- Taxpayers reported $12.7 trillion of total income on their 2020 taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. returns.

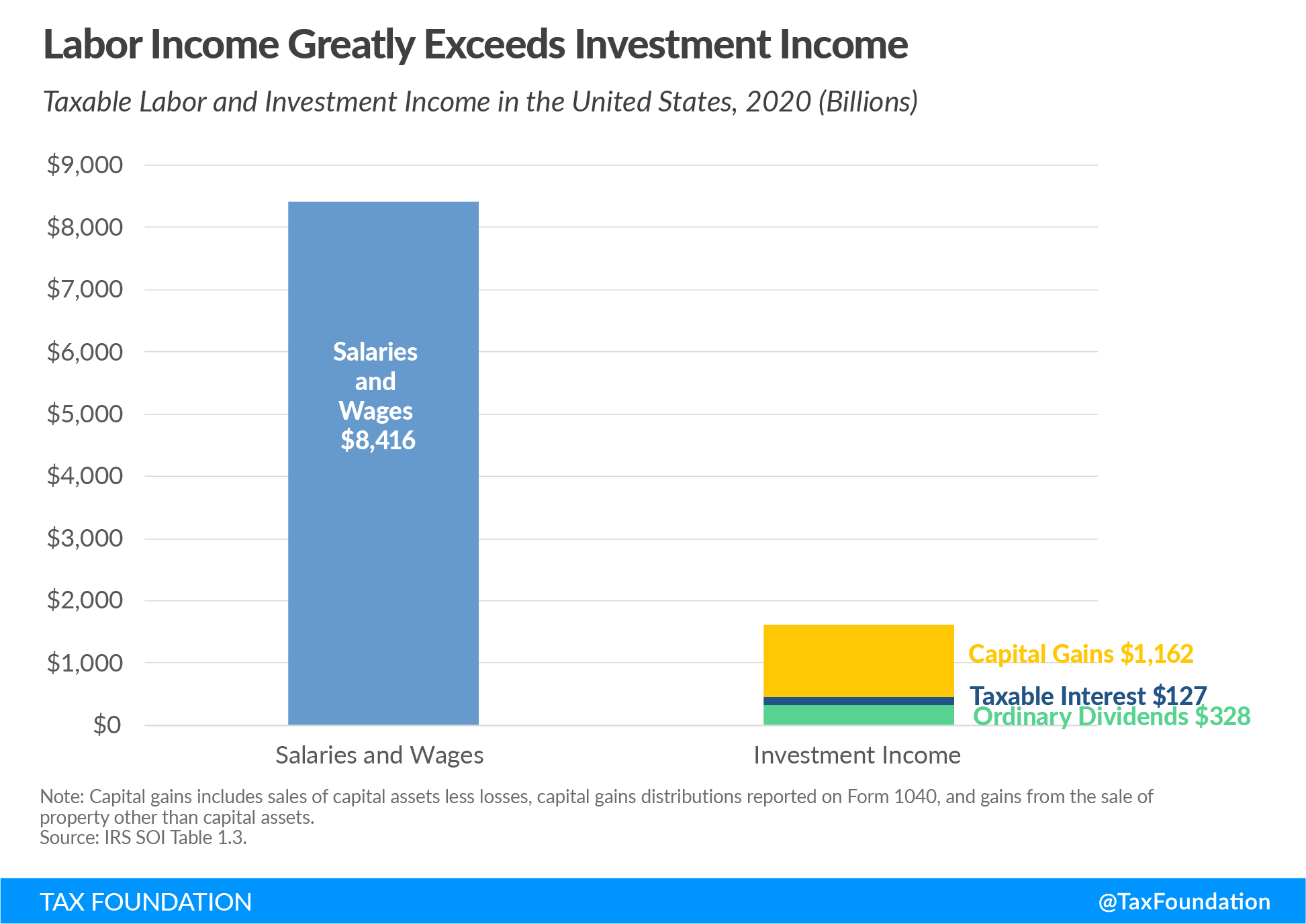

- About 66 percent ($8.4 trillion) of the total income reported on Form 1040 consisted of wages and salaries, and 79 percent of all tax filers reported earning wage income.

- Retirement accounts such as 401(k)s and pensions are important sources of capital income for the middle class. Taxable IRA (individual retirement account) distributions, pensions, and annuities (more than $1.1 trillion) and taxable Social Security benefits ($374 billion) accounted for nearly $1.5 trillion of income in 2020.

- Business income is another large component of reported personal income. Businesses that report income taxes through the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. system, like S corporations, sole proprietorships, and partnerships, accounted for $1 trillion of income in 2020.

- Investment income consisting of net capital gains, taxable interest, and ordinary dividends accounted for nearly $1.6 trillion of income in 2020, more than business income and slightly less than taxable retirement income.

- Several categories of income changed significantly from 2019 to 2020 as a result of the COVID-19 pandemic-related downturn and relief programs, including unemployment compensation, capital gains, wages and salaries, and taxable interest and retirement account distributions.

Introduction

The individual income tax is the federal government’s largest source of revenue. Taxpayers filed more than 164 million individual income tax returns for tax year 2020, the third year under the changes made by the Tax Cuts and Jobs Act (TCJA).

Each household with taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. must file a return to the Internal Revenue Service (IRS). On the IRS individual income tax form (Form 1040), taxpayers list and add all sources of taxable income to reach total income. From there, taxpayers figure their deductions and credits to determine tax liability and tax owed or refunded.

This report will focus on sources of reported total income on the Form 1040 in 2020, which amounted to more than $12.7 trillion.[1] Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income.[2] We divide income into four major categories—wages and salaries, business income, investment income, and retirement income—and review each category for tax year 2020.

| Income Type | Amount (Billions) |

|---|---|

| Salaries and Wages | $8,416 |

| Capital Gains Less Loss and Capital Gain Distributions | $1,128 |

| Taxable Pensions and Annuities | $828 |

| Partnership and S Corporation Net Income Less Loss | $707 |

| Unemployment Compensation | $405 |

| Taxable Social Security Benefits | $374 |

| Business or Profession Net Income Less Loss | $337 |

| Ordinary Dividends | $328 |

| Taxable Individual Retirement Account (IRA) Distributions | $284 |

| Taxable Interest | $127 |

|

Note: For 2020, not all unemployment compensation received was taxable. The American Rescue Plan of 2021 allowed a taxpayer to exclude up to $10,200 of unemployment compensation from income. The IRS excludes qualified dividends from total income, which amounted to $248 billion. Tax-free interest, such as interest on municipal bonds, adds another $59 billion to interest income. Source: IRS SOI Table 1.3. |

|

Wages and Salaries Make Up $8.4 Trillion of Personal Income

Wages and salaries comprise the largest overall source of total income. For most tax filers in the U.S., the largest income number on their own Form 1040 appears on the line where they report wages, salaries, tips, and other compensation for their work. In other words, most Americans report earning labor income, and most of their income comes from labor, as most of the American economy is made up of labor compensation. In total, more than 130 million tax filers in 2020 reported $8.4 trillion in wage income—66 percent of total income.

The amounts reported on Form 1040 reflect most, but not all, labor compensation. For example, businesses pay for employee health benefits and make contributions to Social Security, both of which are excluded from income taxation.

Wage and salary income is taxed at a progressive rate schedule with rates ranging from 10 percent to 37 percent. The top rate of 37 percent was levied on taxable income above $518,400 for single filers and above $622,050 for married couples filing jointly in tax year 2020.[3]

Business Income Makes Up $1 Trillion of Personal Income

In the U.S., pass-through entities are the dominant tax filing structure for businesses, so labeled because the income is not taxed at the business level, but instead, immediately “passed through” to individual owners’ tax returns using schedules C, E, and F.

Pass-through firms employ most of the private-sector workforce in the U.S., and account for most business income.[4] Partnerships and S corporations reported $707 billion of net income in 2020. Individuals reported an additional $337 billion of business or professional income (sole proprietorship income). Together, business income less losses totaled about $1.1 trillion when including income from estates, farms, trusts, rents, and royalties.[5]

Unlike corporations subject to the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. , pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. income is taxed as ordinary income on owners’ personal tax returns. Like salaries and wages, pass-through business income is taxed at the same progressive rate schedule. The TCJA established a temporary 20 percent tax deductionA tax deduction allows taxpayers to subtract certain deductible expenses and other items to reduce how much of their income is taxed, which reduces how much tax they owe. For individuals, some deductions are available to all taxpayers, while others are reserved only for taxpayers who itemize. For businesses, most business expenses are fully and immediately deductible in the year they occur, but others, particularly for capital investment and research and development (R&D), must be deducted over time. for pass-through business income, notwithstanding certain limits and qualifications.[6]

Investment Income Makes Up Nearly $1.6 Trillion of Personal Income

Overall taxable investment income amounted to $1.6 trillion in 2020, consisting of taxable interest, dividends, and capital gains income. Taxpayers reported $328 billion of taxable ordinary dividends and $1.1 trillion of net capital gains and capital gain distributions, only some of which comes from the sale of corporate stock.[7] Taxable interest accounted for $127 billion, and taxpayers reported $34 billion of net gains from sales of property other than capital assets, such as certain real business property or copyrights.

Taxable labor compensation is much larger than taxable investment income. While the returns to corporate stock and other capital assets found on individual income tax returns are substantial, they are small compared to the amount of labor income taxpayers earned, which totaled $8.4 trillion in tax year 2020.

Some investment income is subject to ordinary income tax rates, and some is subject to a separate schedule with lower tax rates. Taxable interest, ordinary dividends, and short-term capital gains (gains realized on assets held for less than one year) are taxed as ordinary income at a taxpayer’s marginal income tax rate, just like wage and salary income. Long-term capital gains (gains realized on assets held for more than one year) are taxed at lower rates, ranging from 0 percent to 20 percent, plus a 3.8 percent net investment income tax, depending on a taxpayer’s taxable income.[8]

Retirement Income Makes Up Nearly $1.5 Trillion of Personal Income

In 2020, taxpayers reported about $828 billion of taxable pensions and annuities income and $284 billion of taxable IRA distributions.[9] In addition to private saving, taxpayers reported about $374 billion in taxable Social Security benefits in tax year 2020, for a total of nearly $1.5 trillion in taxable retirement income.

America’s system of retirement accounts, while overly complex, is taxed neutrally, removing the income tax’s bias against saving.[10] Many retirement accounts offer tax-deferred status, and distributions from tax-deferred IRAs and withdrawals from pension and annuity accounts are taxed as ordinary income and face a progressive rate schedule with rates ranging from 10 percent to 37 percent. A portion of Social Security benefits may be taxable at ordinary income tax rates, depending on a taxpayer’s total amount of income and benefits for the tax year.[11]

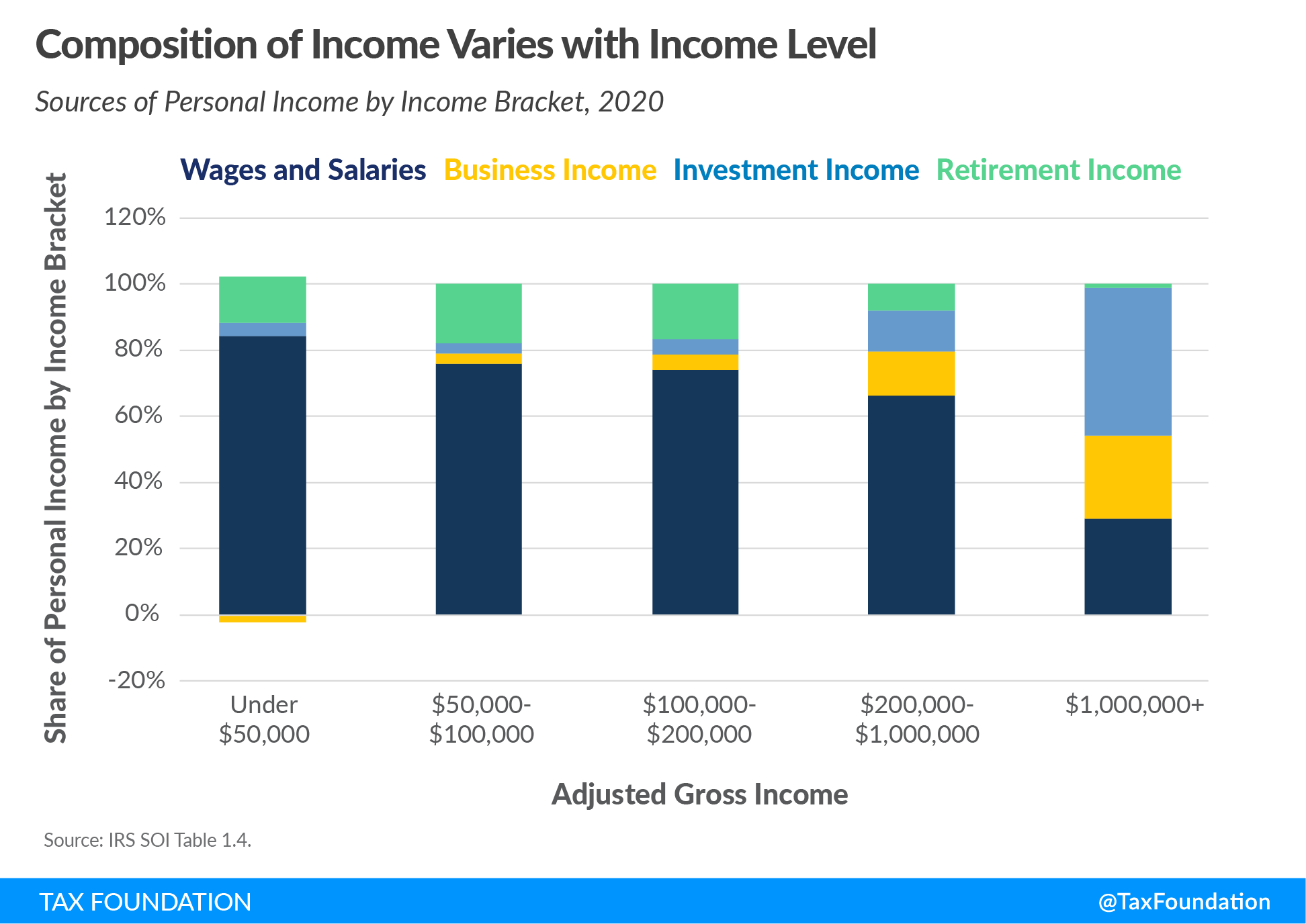

Composition of Income Varies with Income Level

Reviewing the sources of personal income by income bracket shows the varying importance of different sources of income by income level. For example, retirement income is most important as a source of personal income for taxpayers reporting between $50,000 and $100,000 of income, making up nearly 18 percent of the group’s total income. In practice, of course, a minority of middle-class taxpayers—retirees—rely on retirement income, while the majority of working-age taxpayers do not. Business income and investment income held outside of retirement accounts are most important to higher-income taxpayers, while wages and salaries comprise the largest share of income for lower-income taxpayers.

The Impact of the COVID-19 Pandemic

The COVID-19 pandemic had a profound impact on the economic stability of the United States in 2020, and it can be seen in the 2020 individual income tax return data.

For instance, reported unemployment insurance income rose dramatically—from $21 billion in 2019 to $405 billion in 2020, a more than 1,700 percent increase. As unemployment rose to record highs, lawmakers expanded unemployment benefits beginning in early 2020 and created a $10,200 income tax exclusion for the 2020 tax year, available to taxpayers with modified adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” below $150,000.[12]

Capital gains income (capital gains less losses and distributions) rose from $865 billion in 2019 to $1.1 trillion in 2020, a more than 30 percent increase. Though the stock market fell dramatically at the start of the pandemic, it quickly rebounded to reach record highs by the end of 2020.[13] On the other hand, several categories of income fell from 2019 to 2020, including gambling earnings, taxable IRS distributions, taxable interest, and sole proprietorship earnings.

Even amidst record-high unemployment, overall salaries and wages income grew marginally from 2019 to 2020. But the aggregate growth masks the different experiences across income groups. Taxpayers reporting less than $100,000 in income saw a decrease in wages and salaries. For example, in the group making under $50,000, reported salaries and wages fell by nearly 6 percent. In contrast, taxpayers with income above $100,000 saw an increase in salaries and wages from 2019, growing by 5.6 percent year over year.

Conclusion

Reviewing the sources of personal income shows that the personal income tax is largely a tax on labor, primarily because our personal income is mostly derived from labor. Varied sources of capital income also play a role in American incomes. While capital income sources are small compared to labor income, they are still significant and need to be accounted for, both by policymakers trying to collect revenue efficiently and by people attempting to understand the distribution of personal income.

[1] IRS, “SOI Tax Stats,” Table 1.3.

[2] Using data from Form 1040 to understand the nature of income in the U.S. economy comes with some limitations. Not all economic activity is found on personal income tax forms—for example, employer-provided health insurance and returns to owner-occupied housing are excluded. Both are substantial components of economic output that do not appear on income tax returns. As broad economic aggregates, though, the categories of income established on Form 1040 are still useful and instructive.

[3] Amir El-Sibaie, “2020 Tax Brackets,” Tax Foundation, Nov. 14, 2019, https://www.taxfoundation.org/2020-tax-brackets/.

[4] Scott Greenberg, “Pass-Through Businesses: Data and Policy,” Tax Foundation, Jan. 17, 2017, https://www.taxfoundation.org/pass-through-businesses-data-and-policy.

[5] IRS, “SOI Tax Stats,” Table 1.3.

[6] For more, see Scott Greenberg, “Reforming the Pass-Through Deduction,” Tax Foundation, Jun. 21, 2018, https://www.taxfoundation.org/reforming-pass-through-deduction-199a/.

[7] IRS, “SOI Tax Stats.”

[8] Qualified dividends are also taxed at preferential rates, but the IRS does not include qualified dividends in total income.

[9] IRS, “SOI Tax Stats,” Table 1.3.

[10] See generally, Erica York, “The Complicated Taxation of America’s Retirement Accounts,” Tax Foundation, May 22, 2018, https://taxfoundation.org/retirement-accounts-taxation/.

[11] See Internal Revenue Service, “Social Security Income,” https://www.irs.gov/faqs/social-security-income.

[12] Garrett Watson, Huaqun Li, and Daniel Bunn, “Congress Approves Economic Relief Plan for Individuals and Businesses,” Tax Foundation, Mar. 30, 2020, https://taxfoundation.org/cares-act-senate-coronavirus-bill-economic-relief-plan/.

[13] Hamza Shaban & Heather Long, “The Stock Market is Ending 2020 at Record Highs, even as the Virus Surges and Millions Go Hungry,” Tax Foundation, Dec 31, 2020, https://www.washingtonpost.com/business/2020/12/31/stock-market-record-2020/.

Share this article