Today, members of the Nebraska Unicameral will debate a bill (LB432 with Revenue Committee amendment AM774) that, among other provisions, would exclude Global Intangible Low-Taxed Income (GILTI) from taxation and reduce the state’s top marginal corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate by nearly one percentage point. These two taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. changes would improve the state’s economic competitiveness and are among the top income tax modernization priorities Nebraska policymakers ought to consider.

Nebraska currently performs below-average on our State Business Tax Climate Index, which ranks states according to the competitiveness of their tax structures. Excluding GILTI from taxation and reducing the top marginal corporate income tax rate to 6.84 percent would move Nebraska to the middle-of-the-pack, raising it from 32nd to 24th on corporate taxes and from 28th to 25th overall.

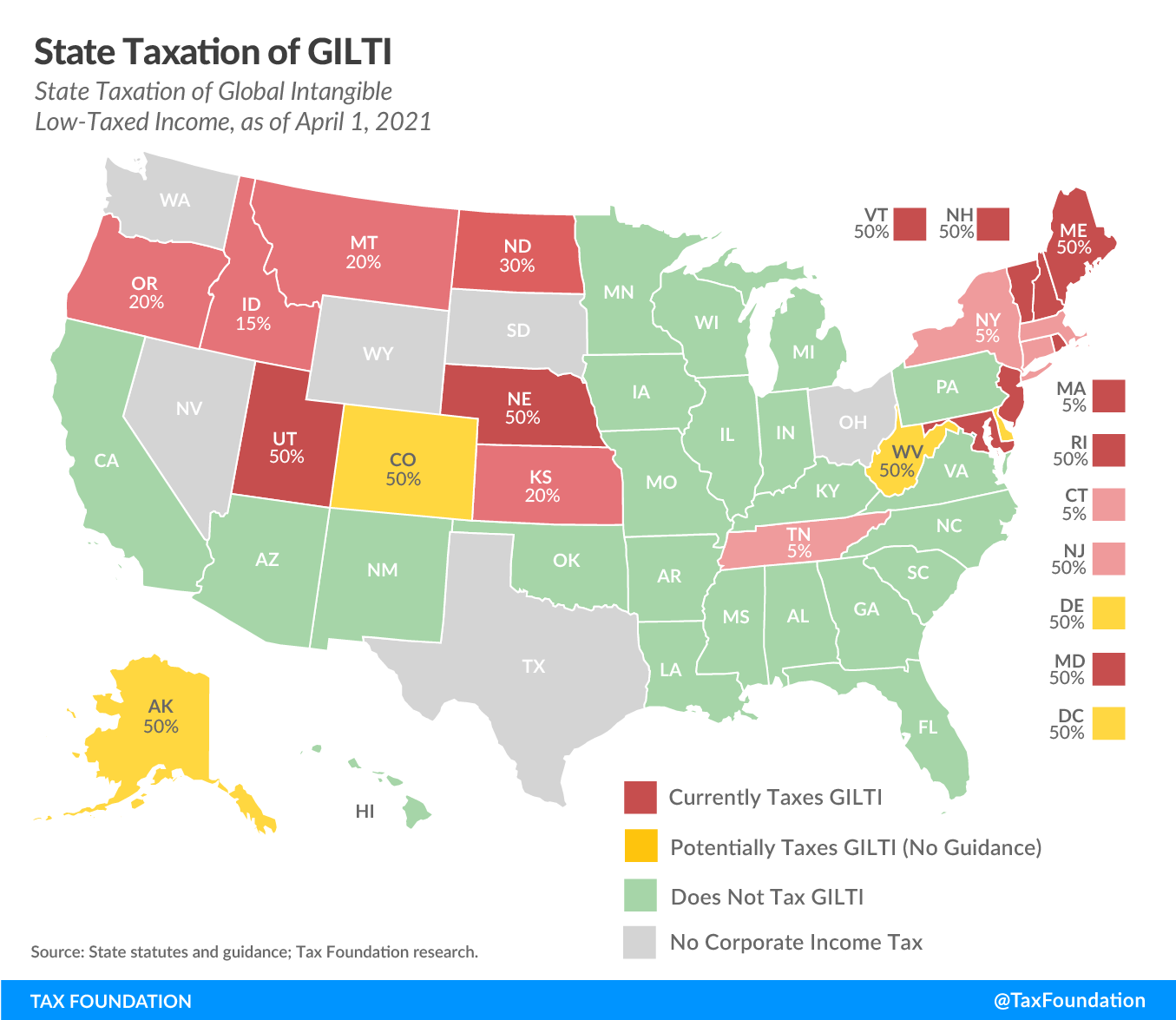

Currently, Nebraska is one of only 12 states plus the District of Columbia that includes 50 percent or more of GILTI in its corporate income tax base. The other nine states that tax GILTI tax a lesser portion (between 5 percent and 30 percent), as shown in the following map:

Over the past year, three states—including one of Nebraska’s neighbors—have either reduced or eliminated their tax on GILTI. Iowa excluded GILTI from taxation in 2020 (retroactive to the beginning of 2019), followed by Alabama in February 2021 (including limited retroactive relief). In March 2021, a bill was adopted in Utah to reduce the state’s GILTI inclusion from 100 percent to 50 percent, also applicable retroactively. Many other states had already acted to exclude GILTI before last year.

LB432 as amended would remove GILTI from Nebraska’s tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. by giving it the benefit of the state’s 100 percent dividends received deduction (DRD) beginning January 1, 2022. This would improve Nebraska’s competitiveness regionally and nationally, especially since most of Nebraska’s regional competitors in the Midwest do not tax GILTI.

While the Revenue Committee’s amendment to the bill would not provide the retroactive relief from GILTI that was written into a similar GILTI exclusion bill, it would exclude GILTI from the tax base moving forward, which would make Nebraska’s tax code less burdensome to multinational businesses and reduce the possibility of a legal challenge.

This is especially important for policymakers to consider given that the taxation of GILTI was never expressly authorized by the Unicameral but was a byproduct of the creation of a new category of taxable international income at the federal level. After the Tax Cuts and Jobs Act (TCJA) was enacted in late 2017, many states issued guidance saying their existing DRDs applied to GILTI, but the Nebraska Department of Revenue issued guidance in 2019 specifying that GILTI is not considered a foreign dividend and does not qualify for the DRD. This interpretation came as a surprise to many Nebraska policymakers.

Furthermore, Nebraska apportions GILTI by including only net taxable national GILTI in its denominator, thus inflating the state’s share of total GILTI. This disadvantages GILTI compared to other forms of income and could therefore be found to be in violation of the U.S. Constitution’s Dormant Commerce Clause, which prohibits states from discriminating against interstate or international commerce.

Beyond excluding GILTI from taxation, reducing the corporate income tax rate from 7.81 to 6.84 percent, as this legislation does, would be a step in the right direction toward creating a tax environment more conducive to economic growth. Nebraska’s current top marginal corporate income tax rate of 7.81 is high both regionally and nationally. Only 14 states and the District of Columbia have a top marginal corporate income tax rate higher than Nebraska’s, and two of its neighbors—South Dakota and Wyoming—levy no income tax at all.

Compared to other major taxes, the corporate income tax is one of the most economically harmful taxes states levy, because while corporations are legally responsible for paying the tax, the economic incidence of the corporate income tax falls on a firm’s shareholders, employees, and consumers in the form of lower investment returns, lower wages, and higher prices. In addition, high corporate income tax rates like Nebraska’s can create “sticker shock,” deterring potential investors.

It is worth noting that while a proposed corporate income tax rate reduction to 6.84 percent is being discussed as a way to achieve parity with the top marginal individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rate—since pass-through businesses pay taxes under the individual income tax code—rate parity in and of itself carries little weight. By default, individual and corporate income tax bases differ in many ways, so even if the top rates match, effective rates will continue to vary from business to business. Another factor making true parity difficult is the fact that corporate income is taxed twice—once at the entity level and again at the shareholder level—whereas pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. profits are taxed not at the entity level but on the owners’ individual income tax returns. This reduction would not, therefore, bring full parity.

Nevertheless, both Nebraska’s corporate and individual income taxes are high, as are the state’s corporate and individual income tax collections per capita. Reducing reliance on these taxes—while simultaneously removing GILTI from the tax base—would help improve Nebraska’s competitiveness moving forward.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe