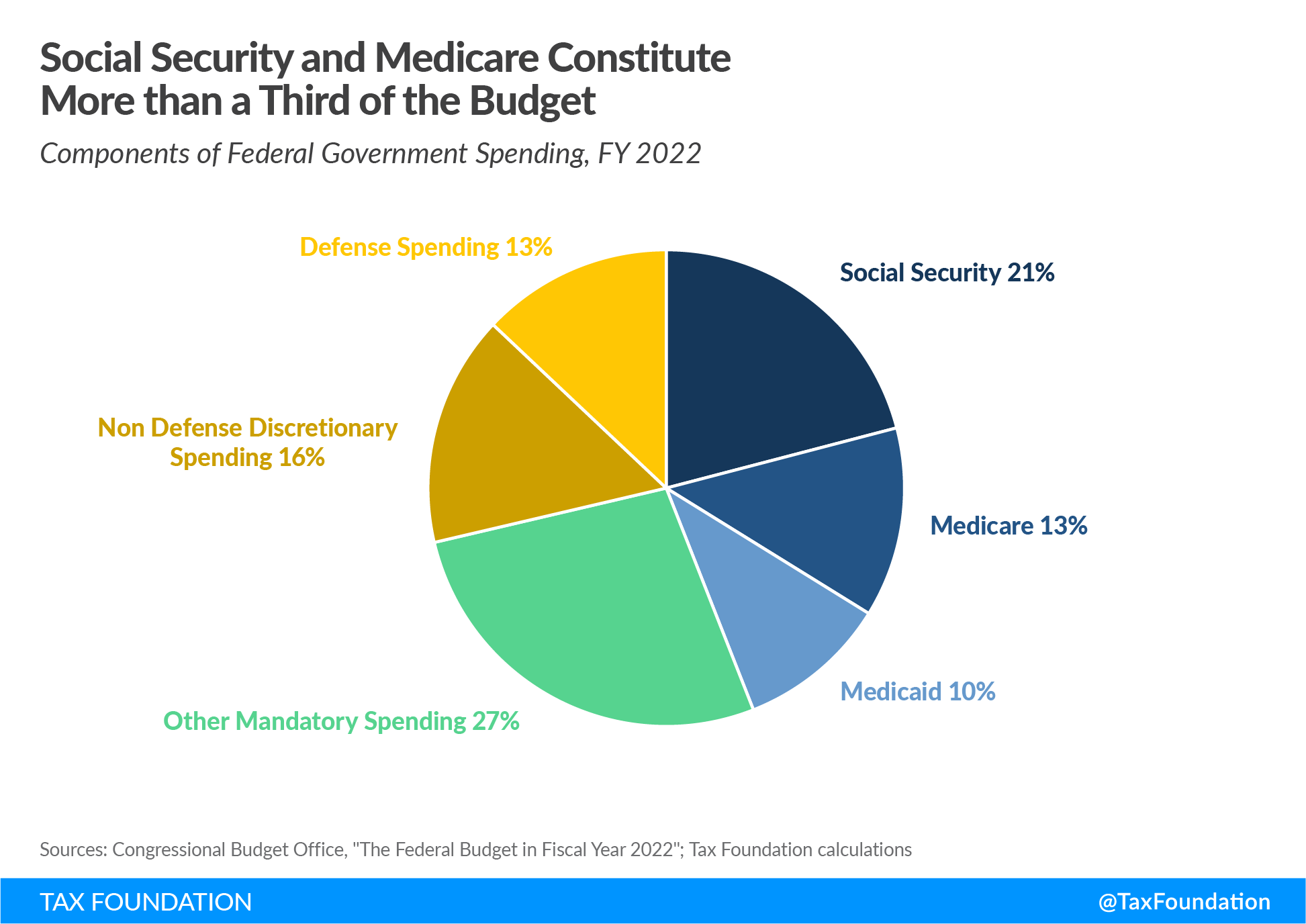

While current debt ceiling negotiations largely concern ways to restrain the discretionary parts of the budget, any serious proposal to tackle the emerging debt and deficit crisis must also address our largest mandatory spending programs: Social Security and Medicare. Together, these two programs will be responsible for nearly 80 percent of the deficit’s rise between 2023 and 2032, according to Congressional Budget Office (CBO) projections.

Social Security and traditional Medicare (Part A) are both funded by payroll taxes on a “pay-as-you-go basis.” That is, current payroll taxes fund today’s retirees. Unlike discretionary spending, which must be voted on by Congress every year during the appropriations process, Social Security and Medicare spending are mandated under current law. Mandatory spending in its entirety represents over two-thirds of the current U.S. budget.

An aging U.S. population and a declining worker-per-retiree ratio (now only 3 to 1) have contributed to the cost of financing Social Security and Medicare. Under current law, Medicare’s Hospital Insurance Trust Fund will be insolvent by 2031, and Social Security’s Old Age, Survivors, and Disability Insurance (OASDI) Trust Fund by 2033. Without reforms, Social Security benefits would be automatically reduced across the board by 20 percent, and Medicare hospital insurance payments would be cut by 11 percent. Absent any reforms, the 2023 Trustees Report shows that a significant payroll tax hike of 4.2 percent would be required to close the current funding gap for OASDI and Medicare.

Given the dire outlook presented in the Trustees Report, policymakers must reform these programs to ensure their long-run stability. Below, we briefly review various proposals over the past decade to reform Social Security and Medicare. The list is not exhaustive, but it illustrates the possibility of tackling this issue with a measured and bipartisan approach.

Social Security Reforms

In 2010, President Obama established the National Commission on Fiscal Responsibility and Reform to develop a plan to reduce the deficit. The bipartisan commission produced what became known as the Simpson-Bowles plan—named after then-Senators Alan Simpson (R-WY) and Erskine Bowles (D-NC)—which proposed significant changes to Social Security to ensure its fiscal sustainability. Although the plan was never enacted, many of its recommendations can be found in other proposals, and for this reason it is worth reviewing in full.

Simpson-Bowles would have slowed benefit growth for high-income earners, making Social Security more progressive. Currently, benefits are calculated using a three-bracket system, where higher earners receive a lower share of their lifetime earnings than lower earners. The plan would have gradually phased in a four-bracket structure of replacement rates starting in 2017, reducing the share of lifetime benefits for higher earners even further.

Additionally, the plan would have gradually raised the retirement age. Under current law, the normal retirement age is 67, but retirees can begin collecting benefits as early as 62. Simpson-Bowles would have indexed both the normal and early retirement ages to life expectancy, making the normal retirement age 68 by 2050.

Currently, all Social Security benefits are adjusted for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The plan would have switched to chained CPI for cost-of-living adjustments (COLAs) instead. The standard CPI typically overstates inflation as it doesn’t account for consumers’ ability to switch to cheaper substitutes for goods, whereas the chained CPI better captures these consumption dynamics. Switching to the chained CPI would slow benefit growth and therefore reduce the overall cost of the program.

On the revenue side, the plan would have gradually raised the payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. cap. Currently, wages and salaries above $160,200 do not face the payroll tax for Social Security. As a result, the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. applies to about 83 percent of all wages earned. Simpson-Bowles would have raised the cap to ensure that 90 percent of all wages were covered by 2050.

Another more recent proposal by Senator Bill Cassidy (R-LA) would attempt to shore up Social Security by borrowing $1.5 trillion and placing it in a diversified investment fund that would be used to replenish the Social Security trust fund. Cassidy characterizes the proposal as a bridge between President Bill Clinton’s proposal to invest part of the trust fund in stocks, and President George W. Bush’s proposal to partially privatize Social Security. However, the plan does not include private accounts, a key feature in successful pension reforms implemented in several countries including Sweden and Australia. Lawmakers should look to those experiences for guidance on this promising direction of reform.

Medicare Reforms

Currently, physicians who serve patients under traditional Medicare are reimbursed under a fee-for-service system, where they are compensated for the quantity of services they provide rather than the quality. This leads to physicians often providing unnecessary treatments or tests that do little to improve health outcomes for their patients, driving up the costs of Medicare. Proposals to reform this included switching to a system of bundled payments, where physicians are reimbursed based on a fixed price for specific medical episodes. The Center for Medicare and Medicaid Services began experimenting with such a system for hip and knee replacements in 2016 and announced further expansions for other types of care, but expanding it even more broadly could help keep costs down.

Alternatively, reforms could go even further by switching to a system of capitation, where physicians are paid a set amount per patient, regardless of how much care is provided. Currently, Medicare Advantage (Medicare Part C) functions this way. Under Medicare Advantage, recipients select among a variety of mostly managed care plans and private insurers receive a fixed payment through Medicare to cover the medical expenses. This incentivizes doctors to serve their patients in the most efficient way possible.

Other proposals call for simply increasing premiums. Premiums for Medicare Part B (which covers outpatient care) currently only cover about 25 percent of the program’s outlays. The CBO estimated that increasing the basic premium to cover 35 percent of the outlays would reduce the deficit by $406 billion from 2023 to 2032.

Similarly, reforming cost sharing would reduce health-care overutilization and lower expenditures. Under the current system, Medicare patients face a high deductible when admitted to a hospital, but no cap on out-of-pocket expenses. As a result, 90 percent of patients acquire additional private coverage known as Medigap. These plans are often expensive because the government is picking up the tab, and only a few plans are available, leading patients to consume more health care than necessary. The Committee for a Responsible Federal Budget offered a proposal that would implement an out-of-pocket cap and a higher deductible for non-hospital services, reducing the need to purchase additional coverage.

One of the more ambitious plans to reform Medicare is to transition to a “premium support” model. Such a system was proposed by Senators Ron Wyden (D-OR) and Paul Ryan (R-WI) and the Bipartisan Policy Center (BPC) in 2011. The Ryan-Wyden plan would have allowed traditional Medicare plans to compete with private insurance plans in a competitive bidding process, and then the government would have provided vouchers to seniors to purchase coverage. The value of the vouchers would have grown at a rate of GDP plus one percent, and the expectation was that allowing private insurers to compete would help lower costs. To keep costs down even further, the BPC plan would have required Medicare beneficiaries earning above 150 percent of the poverty level to pay higher premiums if spending exceeded the growth limit.

Finally, numerous proposals have been offered to reduce the price of drugs purchased through Medicare. While some of these policies can actually harm innovation in the pharmaceutical sector (e.g., the Inflation Reduction Act’s price controls on specific drugs), more modest reforms could encourage physicians to prescribe cheaper generics. Under Medicare B, doctors purchase drugs for their patients and then get reimbursed based on the average sales price of the drug (net of all rebates and discounts), plus 6 percent of the drug cost. This incentivizes physicians to recommend more expensive, branded drugs since they will receive a larger reimbursement.

One proposed reform from the Committee for a Responsible Federal Budget would implement “clinically comparable drug pricing,” where physicians would be reimbursed based on a weighted average sales price for clinically similar classes of drugs. This would remove the incentive for physicians to recommend more expensive drugs, as they would incur all the additional costs of purchasing a drug above that weighted average sales price.

Conclusion

While policymakers should also continue to focus on wasteful and counterproductive discretionary spending that continues to raise deficits, we should not lose sight of the fact that Social Security and Medicare are the largest contributors to our growing deficit and debt crisis. For too long politicians on both sides of the aisle have chosen to ignore the problem. The risks to our economy will only continue to grow the longer we wait to address them.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeRelated Resources:

This blog post is the fourth in a series in which our experts explore the issues and potential solutions for America’s growing debt and deficits.

- Fast Approaching Debt Limit Deadline and Growing Debt Demand Action

- How America’s Debt Problem Compares to Other Countries—and Why It Matters

- Design Matters When Raising Taxes to Reduce the Deficit and Stabilize the Debt

- Debt Ceiling Deal Reduces Deficits in the Short Term But Delays a More Comprehensive Budget Reckoning

- Testimony: Taxes, Spending, and Addressing the U.S. Debt Crisis