Since the Supreme Court’s 2018 decision in Murphy v. National Collegiate Athletic Association overturned the federal ban on sports betting, several states have legalized betting and introduced excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. es on the revenues. And some are considering doing that.

In 2019, eight states approved sports betting and taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. ation regimes, joining the existing 12 states and the District of Columbia which already had active sports betting markets. Of those 21 jurisdictions, 14 currently have active markets. Ten of those markets allow mobile betting while four only allow physical sportsbooks.

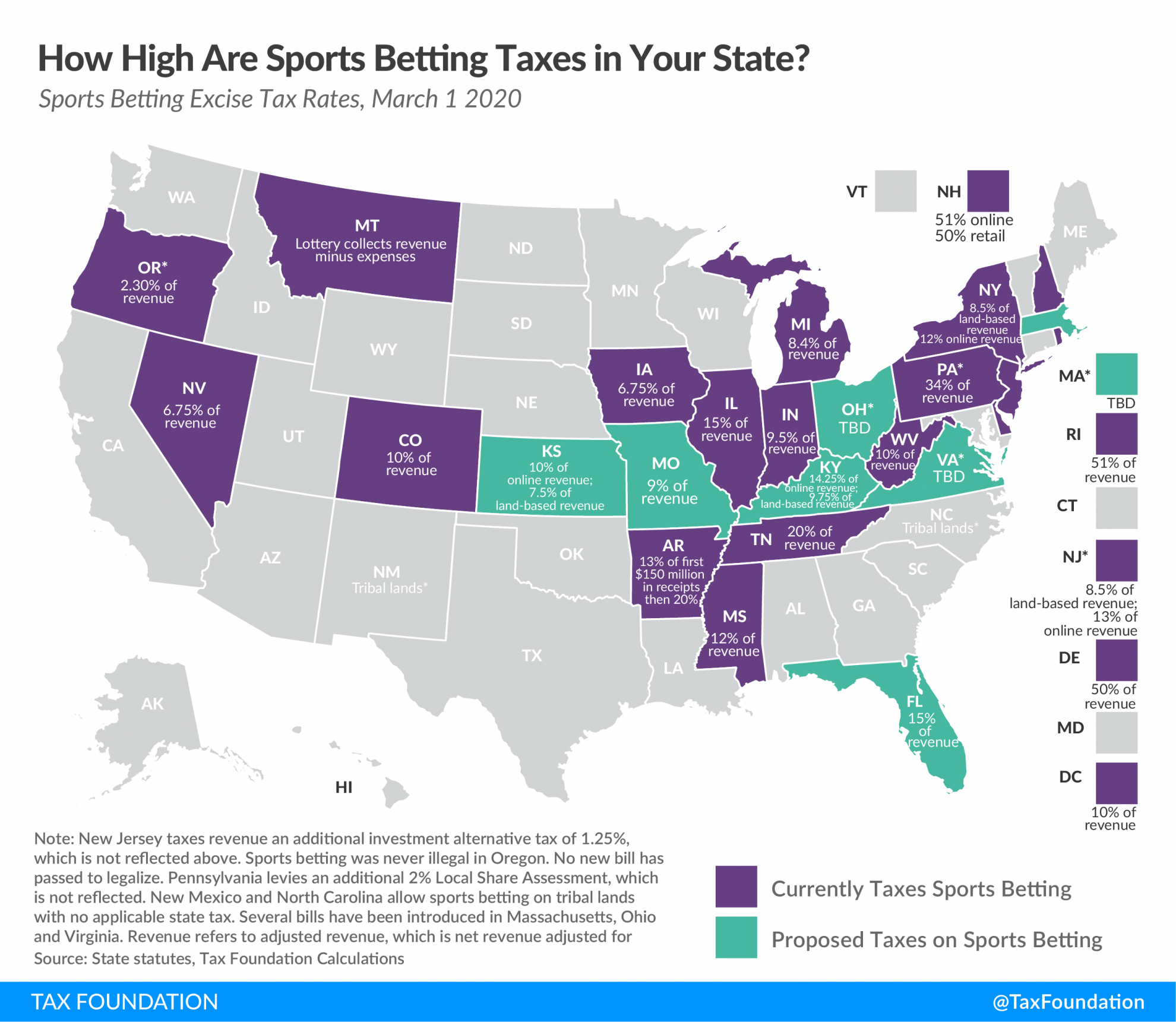

The majority of states have set their tax rates in the high single to low double digits. In 2019, the exception to this rule was New Hampshire, which decided on a monopoly grant to a single company. DraftKings will run New Hampshire’s legalized sports betting system and is required to remit 51 percent of gross revenue for online bets and 50 percent on in-person bets at casinos to the New Hampshire lottery fund. Delaware, Rhode Island, and Pennsylvania are the other states with uncommonly high rates. Delaware and Rhode Island created a “revenue sharing model” where revenue is shared among state, casinos, and operators with a very limited number of providers. Despite Pennsylvania’s high rate, that market has grown to be the third largest in the U.S after a slow start.

Brick-and-mortar sports betting facilities will be competing with black and gray markets in a way that is analogous to how legal marijuana competes with illegal product. Setting gambling tax rates too high could keep bettors in untaxed markets. According to the American Gaming Association, Americans spend close to $150 billion on illegal bets each year. States, localities, and professional sports leagues all want a piece of that pie. To put the number in perspective, the much debated legal and illegal market for marijuana is around $50 billion.

|

(a) New Jersey taxes revenue an additional investment alternative tax of 1.25%, which is not reflected in these figures. (b) Sports betting was never illegal in Oregon. No new bill has passed to legalize it. (c) Pennsylvania levies an additional 2% Local Share Assessment, which is not reflected in these figures. Revenue refers to adjusted revenue, which is net revenue adjusted for winnings. Source: State statutes, Tax Foundation calculations. |

|

| State | Tax Rate |

|---|---|

| Arkansas | 13% of first $150 million in receipts, then 20% |

| Colorado | 10% of revenue |

| Delaware | 50% of revenue |

| District of Columbia | 10% of revenue |

| Illinois | 15% of revenue |

| Indiana | 9.5% of revenue |

| Iowa | 6.75% of revenue |

| Michigan | 8.4% of revenue |

| Mississippi | 12% of revenue |

| Montana | Lottery collects revenue minus expenses |

| Nevada | 6.75% of revenue |

| New Hampshire | 51% online; 50% retail |

| New Jersey (a) | 8.5% of land-based revenue; 13% of online revenue |

| New Mexico | Tribal Lands |

| New York | 8.5% on land-based revenue; 12% on online revenue |

| North Carolina | Tribal Lands |

| Oregon (b) | 2.3% |

| Pennsylvania (c) | 34% of revenue |

| Rhode Island | 51% of revenue |

| Tennessee | 20% of revenue |

| West Virginia | 10% of revenue |

States increasingly see sports betting as an easy way to obtain a modest revenue infusion, and in this legislative session seven states are seriously considering legalizing some form of sports betting. Those seven are: Florida, Kansas, Kentucky, Massachusetts, Missouri, Ohio, and Virginia.

|

(a) Several bills have been introduced in Massachusetts. (b) Senate bill proposes 6.25%, House bill proposes 10%. (c) Senate bill proposes 15%, House bill proposes 20%. Source: State statutes, Tax Foundation calculations. |

|

| State | Tax Rate |

|---|---|

|

Florida |

15% of revenue |

|

Kansas |

10% of online revenue; 7.5% of land-based revenue |

|

Kentucky |

14.25% of online revenue; 9.75% of land-based revenue |

|

Massachusetts (a) |

TBD |

|

Missouri |

9% |

|

Ohio (b) |

6.25% or 10% |

|

Virginia (c) |

15% or 20% |

Missouri and Virginia are the only states so far poised to implement so-called “integrity fees,” though a few states mandate the use of official sports league data for live betting (bets on propositions other than the final result). Integrity fees are advanced by professional sports leagues and means that a percentage of the “handle” (the total amount of bets taken) would be remitted to the league to offset the costs of maintaining the data on which bets are based, and in compensation for generating the product (the games) which make betting possible.

Lawmakers looking to capitalize on gambling should be careful when setting tax rates, as setting them too high could keep bettors in well-established untaxed markets. This was evident in Pennsylvania, where high tax rates discouraged investment early on. Four out of six states which launched legal sports betting in 2018 fell far short of revenue projections in the first year.

The same problems involved with relying on excise taxes are evident in many states which are increasing the rates of—and relying on revenue from—tobacco excise taxes. They continually face revenue shortfalls from declining smoking rates. As a rule of thumb: sin taxes generally do not generate stable revenue and should not be relied on to fund ongoing government programs.

States legalizing sports betting in hopes of balancing their budgets might get a bump in revenue, but it is not a long-term solution to fix budget woes. States should rely on broad-based, low-rate taxes instead. Gambling can be part of that revenue picture—but states shouldn’t bet the house on it.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe