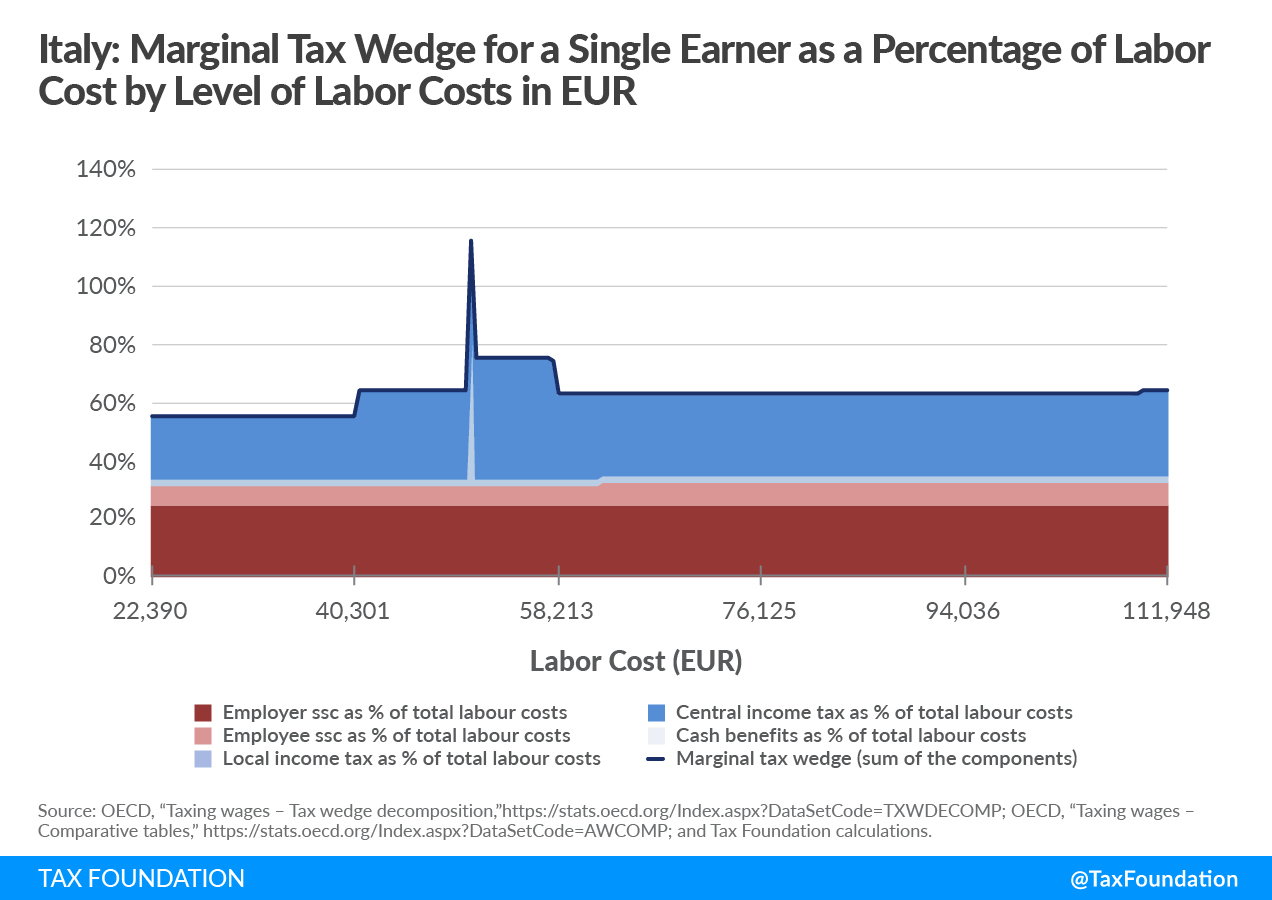

Imagine a worker who gets a raise and ends up paying more in taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. than their raise. This is the case for an Italian worker who earns just above the average wage. With an increase in pay of just EUR 448, he would face a 116 percent marginal tax rate. Therefore, despite the pay increase, this Italian worker will face a net loss and see his earnings cut by EUR 72.

This is why the marginal tax wedgeA tax wedge is the difference between total labor costs to the employer and the corresponding net take-home pay of the employee. It is also an economic term that refers to the economic inefficiency resulting from taxes. is relevant for understanding how workers might benefit (or not) from an increase in pay once taxes enter the picture.

High marginal tax rates like the one observed in the case of this Italian worker act as barriers to upward mobility, discouraging people from advancing in their careers. Very often these high rates are hidden in complex tax structures. However, a recently published study by Archbridge Institute and Tax Foundation highlights the underlying policies that drive the marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. spikes that workers are subject to in a number of countries.

| Italian Single Worker Average Labor Cost: EUR 44,779 (US$68,848) | |

|---|---|

| Total Labor Cost | EUR 50,601 |

| Net Earnings Before the Raise | EUR 26,043 |

| Amount of the Raise | EUR 448 |

| Amount of Additional Tax/Benefits Reduction Due to the Raise | EUR 520 |

| % of the Raise Eaten up by the MTR | 116.15% |

| Net Earnings After the Raise | EUR 25,970 |

| Source: OECD, “Taxing wages – Tax wedge decomposition,” https://stats.oecd.org/Index.aspx?DataSetCode=TXWDECOMP; OECD, “Taxing wages – Comparative tables,” https://stats.oecd.org/Index.aspx?DataSetCode=AWCOMP; and Tax Foundation calculations. | |

In 2021, while moving above the average wage, this Italian worker with no children living in Rome faced a marginal tax wedge of 116 percent for a 1 percent increase in gross earnings on top of the gross annual wage of EUR 38,456. The marginal tax rate spike occurred at 113 percent of the average wage and approximately 128 percent of the median wage. Therefore, this Italian worker faced the so-called “middle-income trap” where marginal tax rates are higher than 100 percent. This is because the local income tax rate rises drastically at this level of income.

In order to understand this “middle-income trap” an overview of how the tax wedge in Italy works is needed. The tax wedge is formed by social security contributions and central, regional, and local income tax.

The regional income surtax rates range between 1.23 percent and 3.33 percent. In some regions, the surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. is progressive with different tax brackets where the increased tax rate applies to the overall income instead of the corresponding bracket excess. For this reason, within a limited range of income, an increase in the gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” translates into a lower disposable income, creating the so-called “poverty trap.”

On the other hand, the local income surtax has, in general, a flat tax rate that can range, depending on the city, between 0.2 percent and 0.9 percent for incomes over EUR 12,000. This is especially problematic for low-income earners as one additional unit of income on top of the exemption threshold will create a local tax liability on the overall income, not only on the additional amount. In the case of a worker that moves from earning EUR 12,000 to EUR 12,001, depending on his residence, he might face a local tax liability of EUR 108. Therefore, the marginal tax rate will be larger than 100 percent.

Lazio, the region where Rome is, for which the marginal tax wedge was determined by the Organisation for Economic Co-operation and Development (OECD), applies a progressive income tax with five tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. and tax rates that go from 1.73 percent to 3.33 percent. Nevertheless, for taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. under the EUR 35,000 threshold, a 1.73 percent tax rate applies to the whole amount of taxable income. Additionally, Rome also applies a local income tax rate of 0.9 percent.

In order to eliminate this middle-income trap, regional and local income tax rates and thresholds need to be aligned with the central income tax. Additionally, regional and local income tax should not apply to the overall income once the threshold is reached but only to the excess income on top of the threshold amount like a truly progressive tax system.

Lesson from Finland

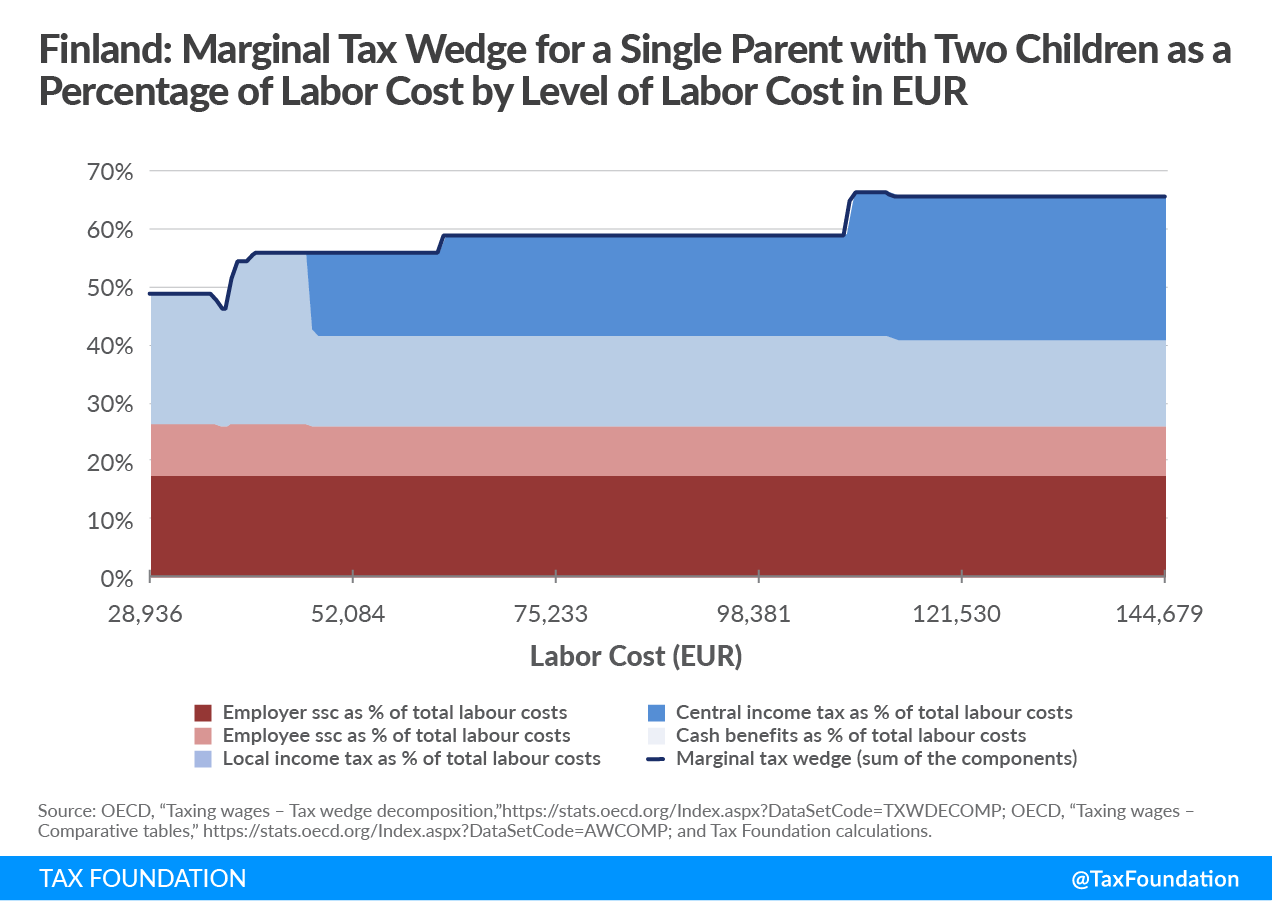

Italy could follow the example of Finland where both central and local income taxes operate together. However, in Finland, the local income tax and the central income tax are adjusted and well-coordinated and do not generate marginal tax rate spikes like the ones described in Italy. Nevertheless, marginal tax rates above 50 percent, as the ones observed both in Italy and Finland, might discourage employment and labor supply. Even if marginal rates do not spike in a way that trap people in poverty, high marginal rates still impact workers directly.

Financing regions and municipalities through income surtaxes can create, as in the case of Italy, complex tax structures contributing to high marginal tax rates and “income traps.” When planning to reform the Italian tax system, policymakers might want to consider aligning the regional and local income tax rates and thresholds with the central income tax. Eliminating this “middle-income trap” would likely encourage the upward mobility of the Italian average-income workers.

Note: This is part of a five-part blog series that highlights the findings of a recently published study by Archbridge Institute and Tax Foundation and explores the underlying policies that drive the marginal tax rate spikes that workers are subject to in a number of countries.