Even in 2020, jack-o’-lanterns and fake skeletons have popped up in neighborhoods as they do every October, although Halloween may look and play out differently this time around. According to the National Retail Federation, fewer people plan on partaking in Halloween activities, but those that do expect to spend more than usual—and that spending includes candy. After all, costume parties may be off the table, but there’s nothing stopping you from enjoying a nice evening at home with piles of nougat-based treats. And maybe passing out some of that loot to masked trick-or-treaters.

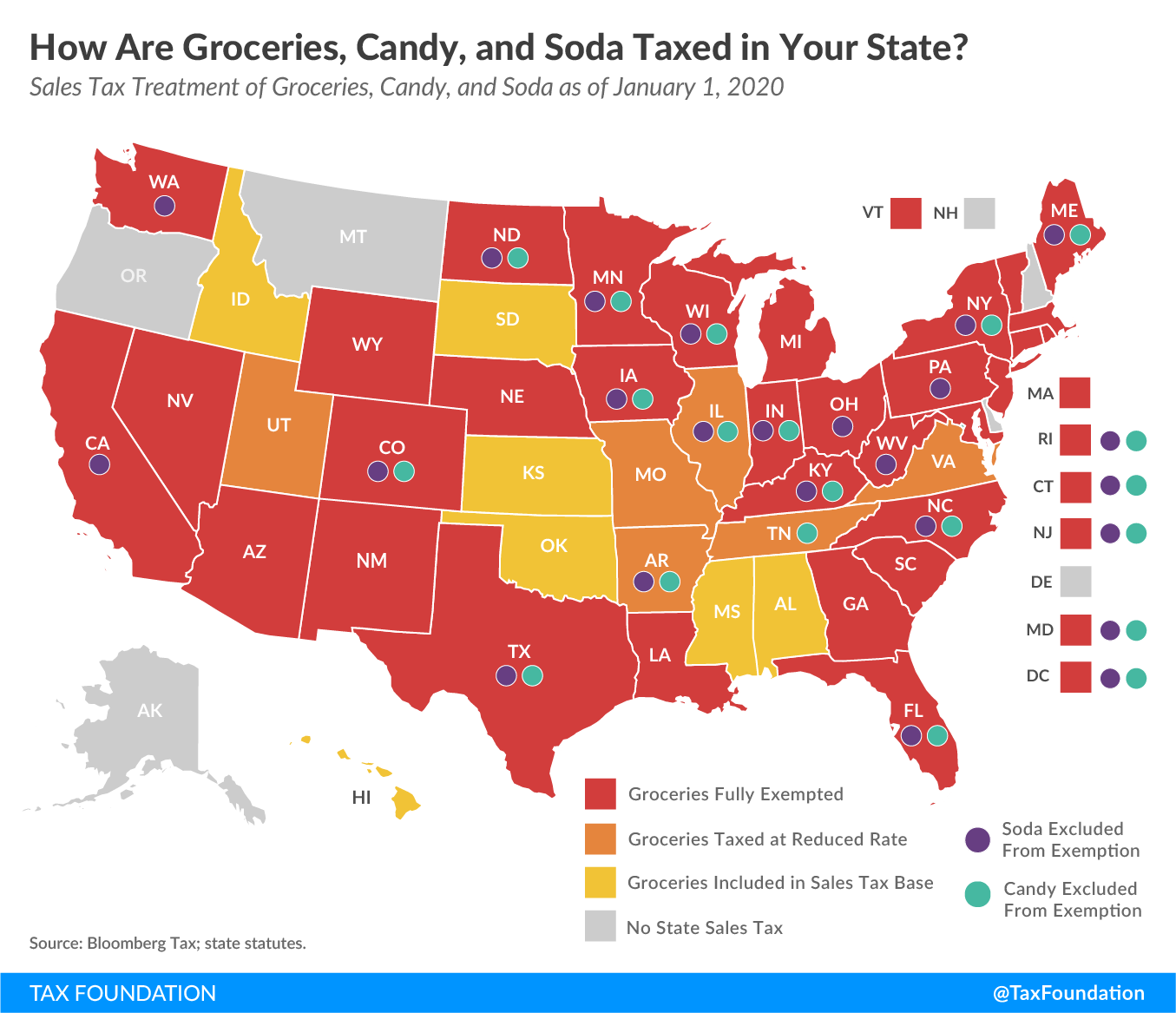

In other words, there’s no better time for a map looking at how different state sales taxes treat consumable goods like candy, groceries, and soda.

Forty-five states and the District of Columbia levy a state sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. . Of those, 32 states and the District of Columbia exempt groceries from the sales tax base. Twenty-four states and D.C. treat either candy or soda differently than groceries. Eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries: Arizona, Georgia, Louisiana, Massachusetts, Michigan, Nebraska, Nevada, New Mexico, South Carolina, Vermont, and Wyoming.

Six additional states (Arkansas, Illinois, Missouri, Tennessee, Utah, and Virginia) tax groceries at a lower, preferential rate. Three of those six include both candy and soda in the rate applied to those lower-taxed groceries. Arkansas and Illinois exclude soda and candy from the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. preference, taxing them at the standard rate.

The aim of a grocery exemption is to reduce tax burdens on necessities, particularly those which take up a large share of overall consumption for low-income consumers, which obligates states to decide which products are essential. When foods are categorized as necessities based on nutritional value, soda and candy are among the first products to be added to the “taxable” list. This raises obvious questions about a host of other food items like chips, baked goods, and ice cream. In the interest of narrowing the exemption to necessities, most states end up excluding certain foods and beverages.

Some state definitions can make food and candy taxation counterintuitive. Twenty-four states align with the Streamlined Sales and Use Tax Agreement (SSUTA), which determines that candy is different from other sweet foods because it comes in the form of bars, drops, or pieces, and does not contain flour. Base uniformity across states is good, but this particular definition leads to some interesting distinctions: If you bought a Hershey’s® bar, it would be subject to sales tax. If you bought a Twix® bar, it would be tax-free. Similar conundrums appear when you get into the difference in definitions between prepared food and food intended for off-site consumption: a rotisserie chicken would be taxed if it’s heated by a warming device but untaxed if it’s packaged and refrigerated.

Ultimately, states and consumers alike would benefit from a low, single-rate sales tax that captures all final consumer products. Such a tax would be easy to administer, providing a stable source of revenue through a neutral and transparent structure.

See the table below for more specific information on how groceries are treated in different states.

| State | State General Sales Tax | Grocery Treatment | Candy Treated as Groceries? | Soda Treated as Groceries? |

|---|---|---|---|---|

| Ala. | 4.00% | Included in Base | Yes | Yes |

| Alaska (a) | — | — | — | — |

| Ariz. | 5.60% | Exempt | Yes | Yes |

| Ark. | 6.50% | 1.50% | No | No |

| Calif. (b) | 8.25% | Exempt | Yes | No |

| Colo. | 2.90% | Exempt | No | No |

| Conn. | 6.35% | Exempt | No | No |

| Del. (a) | — | — | — | — |

| Fla. | 6.00% | Exempt | No | No |

| Ga. | 4.00% | Exempt | Yes | Yes |

| Hawaii | 4.00% | Included in Base | Yes | Yes |

| Idaho | 6.00% | Included in Base | Yes | Yes |

| Ill. | 6.25% | 1.00% | No | No |

| Ind. | 7.00% | Exempt | No | No |

| Iowa | 6.00% | Exempt | No | No |

| Kans. | 6.50% | Included in Base | Yes | Yes |

| Ky. | 6.00% | Exempt | No | No |

| La. | 4.45% | Exempt | Yes | Yes |

| Maine | 5.50% | Exempt | No | No |

| Md. | 6.00% | Exempt | No | No |

| Mass. | 6.25% | Exempt | Yes | Yes |

| Mich. | 6.00% | Exempt | Yes | Yes |

| Minn. | 6.875% | Exempt | No | No |

| Miss. | 7.00% | Included in Base | Yes | Yes |

| Mo. | 4.225% | 1.225% | Yes | Yes |

| Mont. (a) | — | — | — | — |

| Nebr. | 5.50% | Exempt | Yes | Yes |

| Nev. | 6.85% | Exempt | Yes | Yes |

| N.H. (a) | — | — | — | — |

| N.J. | 6.625% | Exempt | No | No |

| N.M. | 5.125% | Exempt | Yes | Yes |

| N.Y. | 4.00% | Exempt | No | No |

| N.C. | 4.75% | Exempt | No | No |

| N.D. | 5.00% | Exempt | No | No |

| Ohio | 5.75% | Exempt | Yes | No |

| Okla. | 4.50% | Included in Base | Yes | Yes |

| Ore. (a) | — | — | — | — |

| Pa. | 6.00% | Exempt | Yes | No |

| R.I. | 7.00% | Exempt | No | No |

| S.C. | 6.00% | Exempt | Yes | Yes |

| S.D. | 4.50% | Included in Base | Yes | Yes |

| Tenn. | 7.00% | 4.00% | No | Yes |

| Tex. | 6.25% | Exempt | No | No |

| Utah (b) | 5.00% | 1.75% | Yes | Yes |

| Vt. | 6.00% | Exempt | Yes | Yes |

| Va. (b) | 5.30% | 2.50% | Yes | Yes |

| Wash. | 6.50% | Exempt | Yes | No |

| W.Va. | 6.00% | Exempt | Yes | No |

| Wis. | 5.00% | Exempt | No | No |

| Wyo. | 4.00% | Exempt | Yes | Yes |

| D.C. | 6.00% | Exempt | No | No |

| (a) Alaska, Delaware, Montana, New Hampshire, and Oregon do not levy taxes on groceries, candy, or soda. (b) Three states levy mandatory, statewide, local add-on sales taxes: California (1%), Utah (1.25%), and Virginia (1%). We include these in their state sales tax. Source: Bloomberg Tax. | ||||