Key Findings

- Even two years after enactment of the federal Tax Cuts and Jobs Act (TCJA), many states have yet to issue guidance explaining how they conform to key provisions of the law, particularly those pertaining to international income.

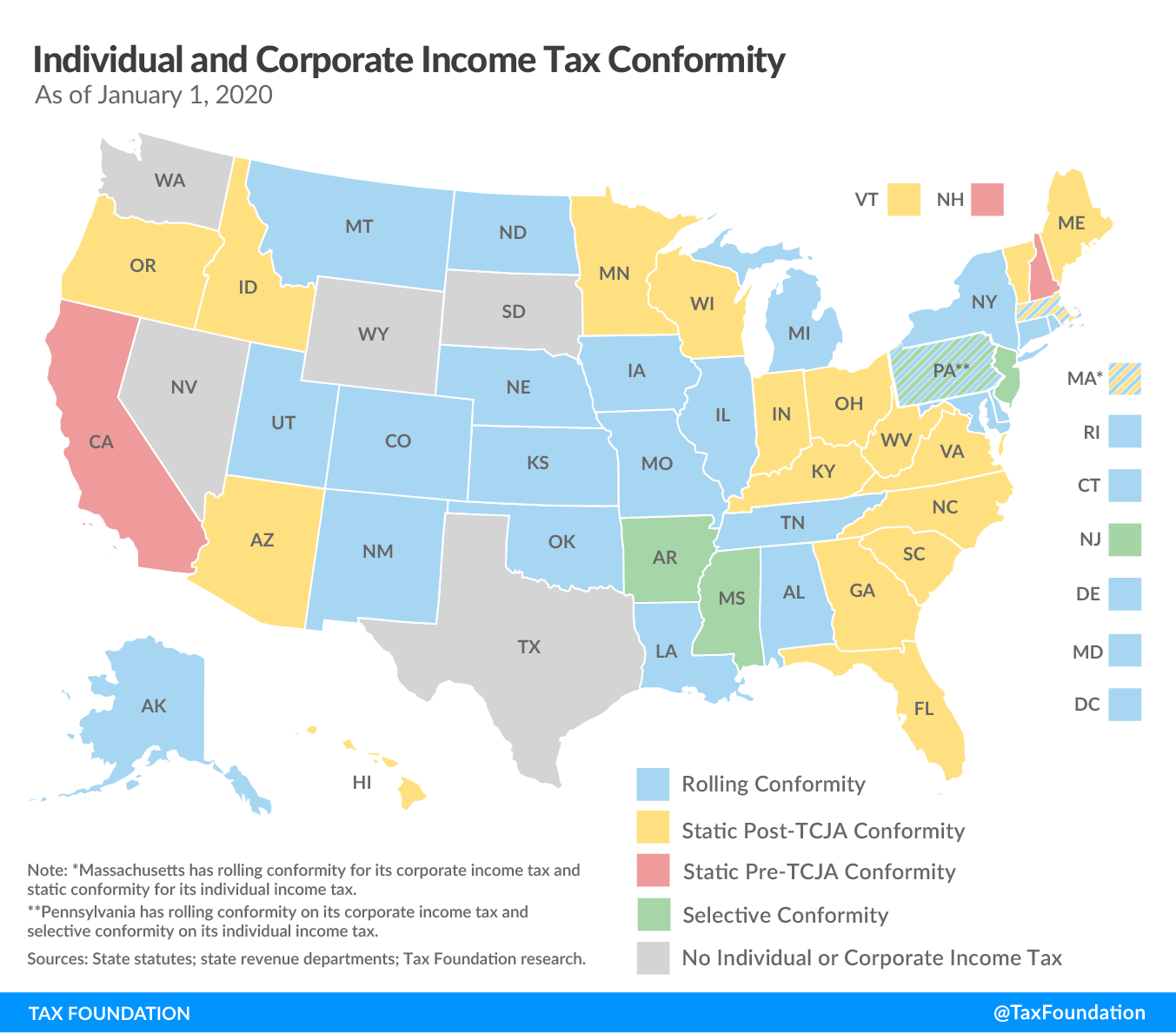

- Twenty-one states and the District of Columbia conform to changes in the federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code on a rolling basis, while 15 have what is known as “static conformity” and two have rolling conformity for corporate, but not individual, income taxes. The remaining states with income taxes only selectively conform to the federal tax code.

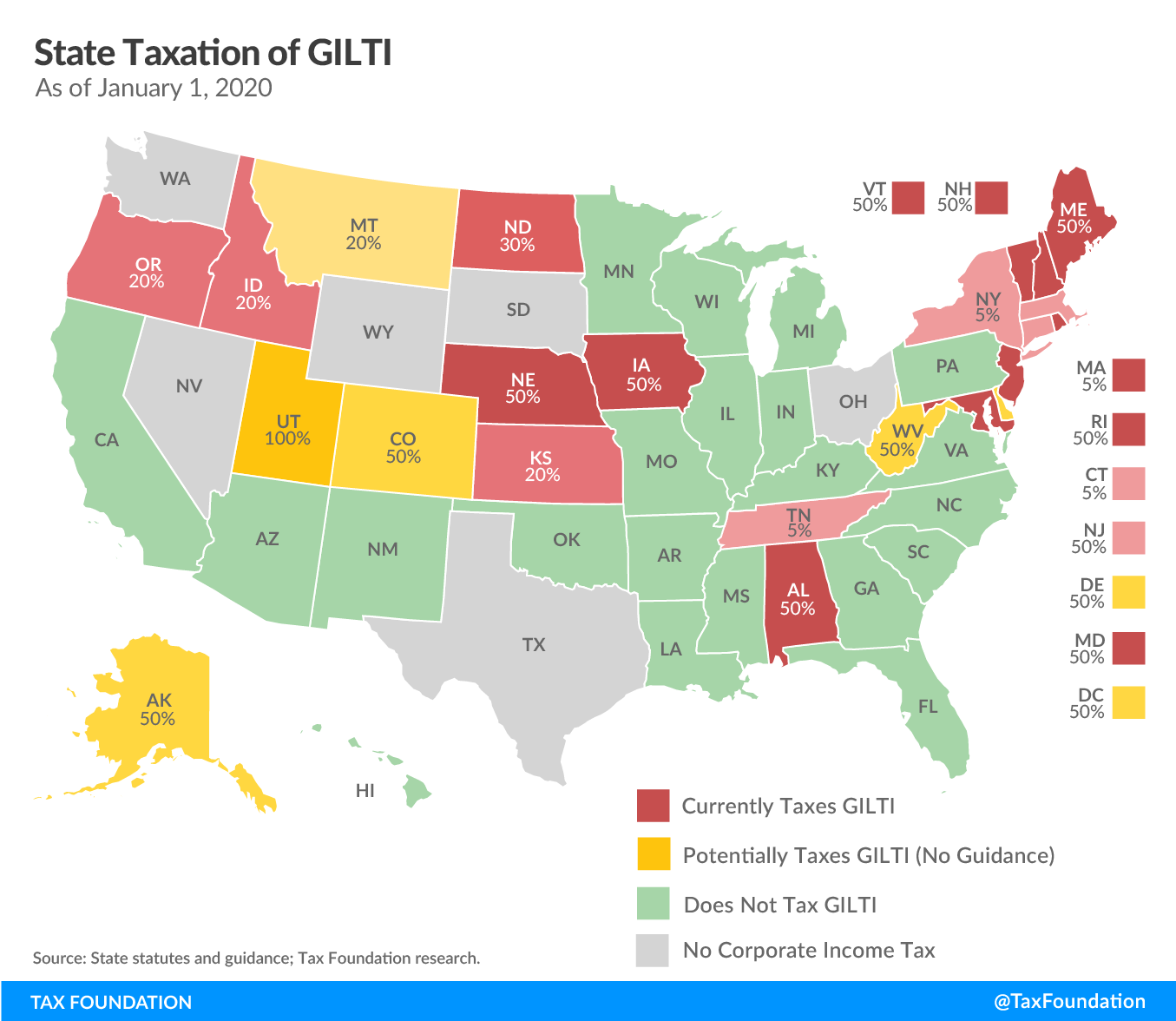

- Twenty-four states tax or potentially tax Global Intangible Low-Taxed Income (GILTI), of which 17 have issued guidance; in most cases, this represents the states’ first significant foray into the taxation of international income.

- State tax systems were not made to accommodate international income, and many of the resulting tax regimes give rise to serious constitutional questions.

- Twenty-four states provide a deduction for Foreign-Derived Intangible Income (FDII), though seven states which currently tax GILTI do not.

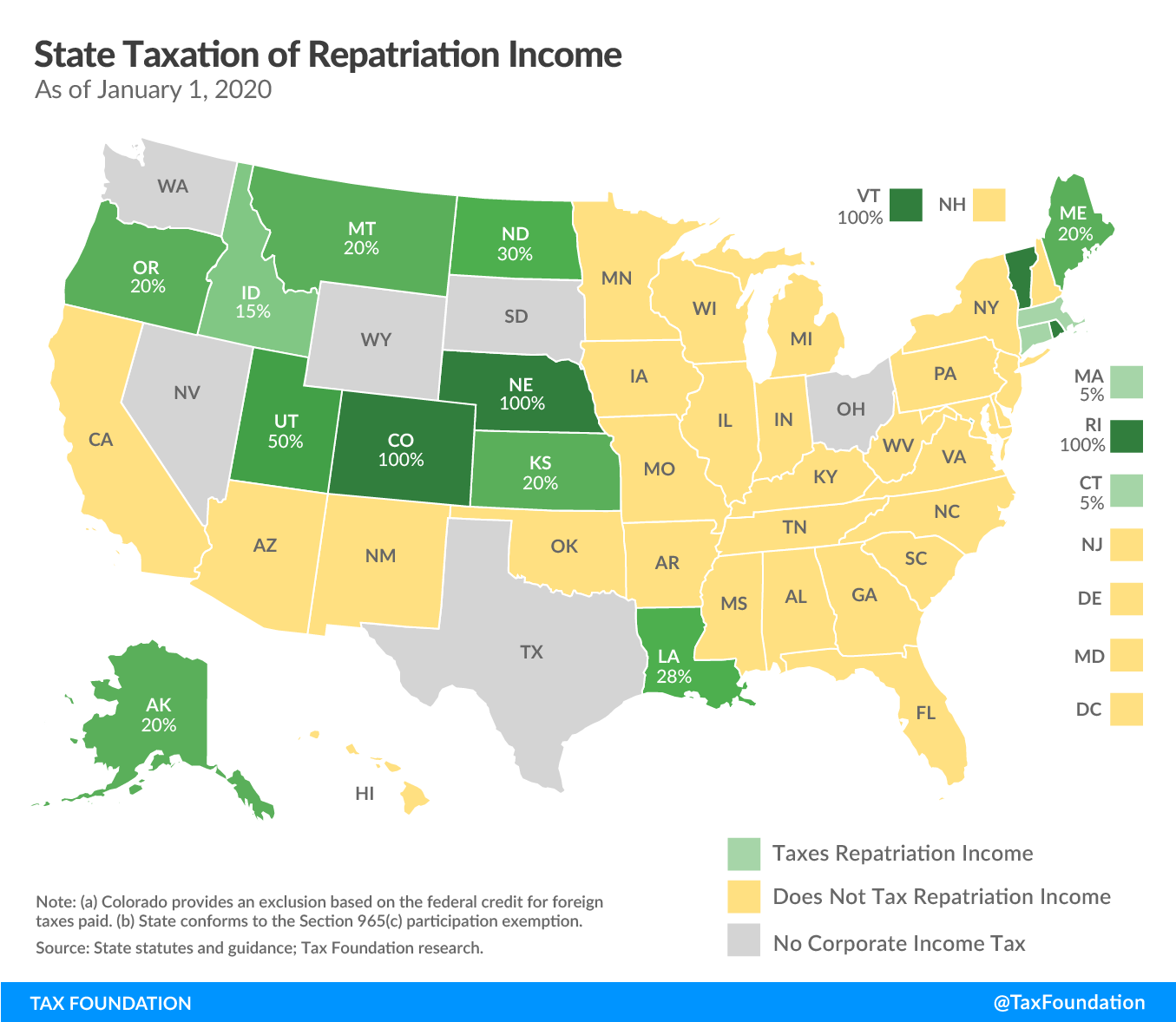

- When the federal tax code transitioned from a worldwide to a quasi-territorial system, deferred foreign earnings were “deemed” repatriated and taxed at a preferential rate, a provision captured in the tax codes of 14 states—often without the preferential rate.

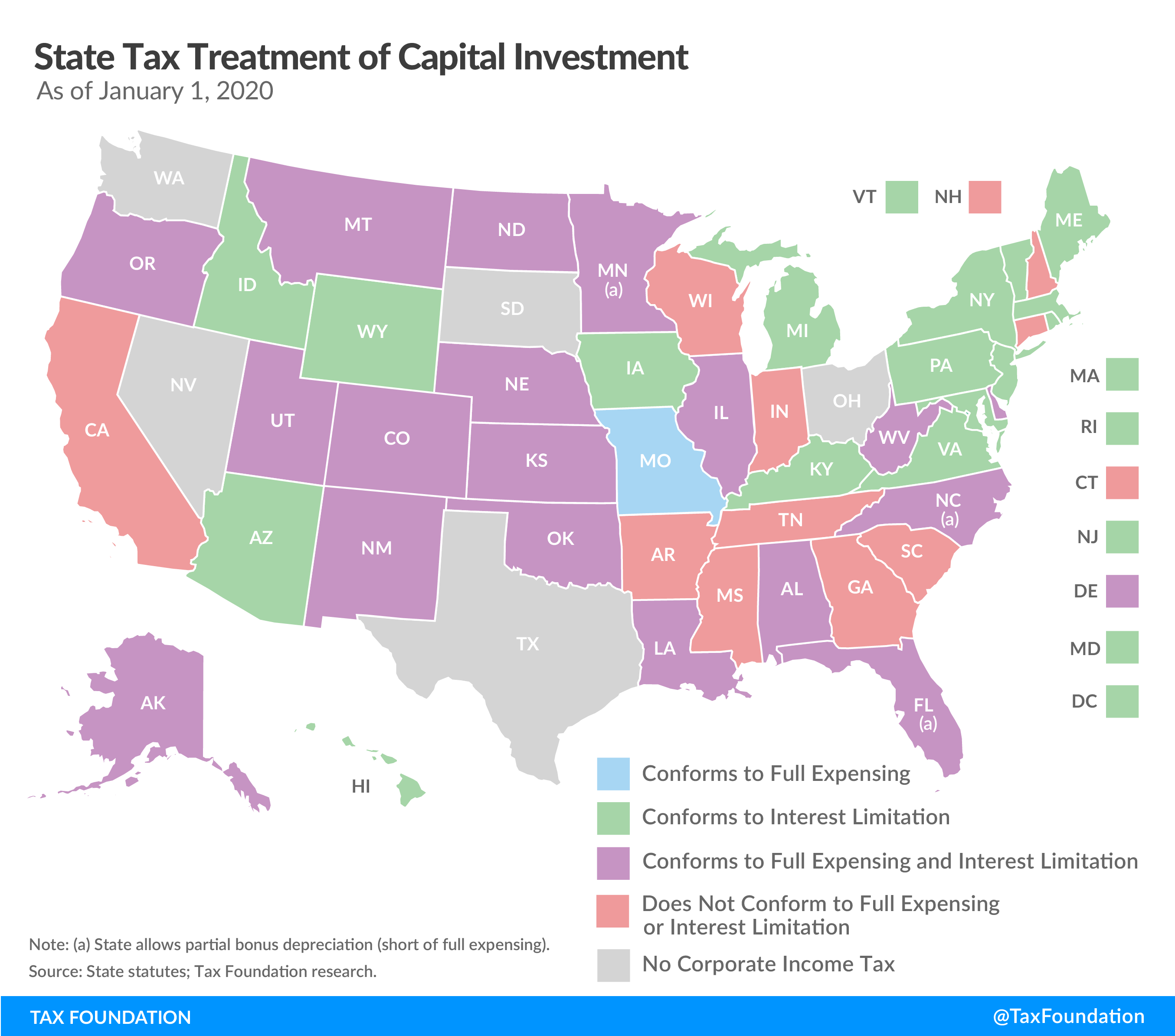

- Sixteen states conform to an important pro-growth element of federal tax reform, the provision providing for immediate expensing of investments in machinery and equipment. Another three states conform with partial addbacks.

- States have delayed long enough. In 2020, policymakers should clear up any remaining uncertainty and use the TCJA, however belatedly, to better orient their states toward growth.

Table of Contents

Introduction

Two years is an eternity in politics but a fleeting moment in state taxation, where systems can be slow to respond to exogenous shocks—particularly one like the Tax Cuts and Jobs Act (TCJA) of 2017, and especially when there are competing visions and goals in play. It is, therefore, unsurprising that even two years out, states are still grappling with whether and how to align their own tax codes with the new federal law. Nor is it surprising that the areas of greatest uncertainty would be ones like the treatment of international income.

But the normal churning of revenue decisions is a poor excuse for the glacial pace at which some states have offered guidance on how companies should calculate and remit tax on their Global Intangible Low-Taxed Income (GILTI), especially when the expectation is that liability is already accruing. States should, ideally, exclude GILTI from their tax codes—and should make it clear when they do so. Selective approaches to conformity which sever logically related provisions, moreover, continue to populate state tax codes.

Conformity with the Internal Revenue Code (IRC) has, historically, been a rote annual process in most states, if not one set on autopilot through “rolling conformity.” The Tax Cuts and Jobs Act temporarily upended this sleepy realm, breathing new life and outsized significance into a normally routine chore. In many states, conformity is falling back into its old routine, but in others, TCJA conformity remains front and center even though, in nearly all cases, the conformity dates now reflect a post-TCJA world, because those states have introduced complexities, uncertainties, and non-neutralities that have yet to be resolved.

This paper, which updates several key components of our January 2019 tax conformity paper,[1] examines how states have approached provisions closely tied to the competitiveness and neutrality of the tax code, including taxation of GILTI, provision of the deduction for Foreign-Derived Intangible Income (FDII), inclusion of income deemed repatriated under § 965, the first-year expensing of short-lived capital investment under § 168(k), and the § 163(j) net interest limitation. A particular emphasis is placed on state approaches to GILTI, which has often confounded lawmakers and revenue officials.

State Approaches to Federal Conformity

All states incorporate parts of the federal tax code into their own system of taxation, but how they do so varies widely. In broad terms, however, approaches to IRC conformity can be divided into three classes: rolling, static, and selective.[2]

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeStates with rolling conformity automatically implement federal tax changes as they are enacted, unless the state specifically decouples from a provision. This autopilot approach tends to provide the greatest clarity and predictability for taxpayers, though at a modest cost of state control.

Static (or “fixed date”) conformity also incorporates wholesale updates of the federal tax code as it existed at a specific point in time, rather than adopting all changes on a rolling basis. Some states with static conformity conform legislatively every year and are functionally identical to states with rolling conformity, albeit with a measure of added uncertainty. Others are inconsistent and may even conform to an outdated version of the IRC for many years.

Finally, a handful of states only conform selectively, incorporating certain federal provisions or definitions by reference, but omitting large swaths of the federal tax code and forgoing the use of federal definitions of income as their own starting points for calculation.

No state, of course, conforms to every provision of the Internal Revenue Code. Each state offers its own set of modifications, additions, and subtractions to the code. Each adopts its own set of rules and definitions, frequently layered atop those flowing through from the federal code. But from definitions of income to exemptions to net operating losses, and even what filing statuses are available and whether a taxpayer can itemize their deductions, the federal tax code consistently informs state-level taxation.

Twenty-one states and the District of Columbia use rolling conformity for both their individual and corporate income taxes, while two states—Massachusetts and Pennsylvania—employ rolling conformity exclusively for their corporate income taxes. Another 15 states use static conformity for both taxes, while the remaining states with income taxes use selective conformity, defining most major tax provisions independently of the federal tax code.

|

Note: FAGI = federal adjusted gross income; FTI = federal taxable income; NOLs and special deds. = net operating losses and special deductions. (a) Beginning tax year 2020. (b) Tax on interest and dividend income only. Sources: State statutes; state revenue departments; Tax Foundation research. |

|||

| State | Conformity Date | PIT Starting Point | CIT Starting Point |

|---|---|---|---|

| Alabama | Rolling | State calculation | FTI before NOLs |

| Alaska | Rolling | No tax | FTI before NOLs and special deds. |

| Arizona | 1/1/19 | FAGI | FTI |

| Arkansas | Selective | State calculation | FTI before NOLs and special deds. |

| California | 1/1/15 | FAGI | FTI before NOLs and special deds. |

| Colorado | Rolling | FTI | FTI |

| Connecticut | Rolling | FAGI | FTI before NOLs and special deds. |

| Delaware | Rolling | FAGI | FTI |

| Florida | 1/1/19 | No tax | FTI |

| Georgia | 1/1/19 | FAGI | FTI |

| Hawaii | 12/31/18 | FAGI | FTI before NOLs and special deds. |

| Idaho | 1/1/19 | FAGI | FTI |

| Illinois | Rolling | FTI | FTI |

| Indiana | 1/1/19 | FAGI | FTI before NOLs and special deds. |

| Iowa | Rolling (a) | FTI before NOLs and special deds. | |

| Kansas | Rolling | FAGI | FTI |

| Kentucky | 12/31/18 | FAGI | FTI |

| Louisiana | Rolling | FAGI | Federal gross receipts (Line 1a) |

| Maine | 12/31/18 | FAGI | FTI |

| Maryland | Rolling | FAGI | FTI |

| Massachusetts | Rolling (CIT); 1/1/05 (PIT) | State calculation | Federal gross income |

| Michigan | Rolling | FAGI | FTI |

| Minnesota | 12/31/18 | FAGI | FTI |

| Mississippi | Selective | State calculation | FTI before NOLs and special deds. |

| Missouri | Rolling | FAGI | FTI |

| Montana | Rolling | FAGI | Federal gross income |

| Nebraska | Rolling | FAGI | FTI |

| Nevada | No tax | No tax | Gross receipts tax |

| New Hampshire | 12/31/16 | (b) | FTI before NOLs and special deds. |

| New Jersey | Selective | State calculation | FTI before NOLs and special deds. |

| New Mexico | Rolling | FAGI | FTI before NOLs and special deds. |

| New York | Rolling | FAGI | FTI before NOLs and special deds. |

| North Carolina | 1/1/19 | FAGI | FTI before NOLs and special deds. |

| North Dakota | Rolling | FTI | FTI |

| Ohio | 3/30/18 | FAGI | Gross receipts tax |

| Oklahoma | Rolling | FAGI | FTI before NOLs and special deds. |

| Oregon | 12/31/18 | FTI | FTI before NOLs and special deds. |

| Pennsylvania | Rolling (CIT); Selective (PIT) | State calculation | FTI before NOLs and special deds. |

| Rhode Island | Rolling | FAGI | FTI before NOLs and special deds. |

| South Carolina | 12/31/18 | FTI | FTI |

| South Dakota | No tax | No tax | No tax |

| Tennessee | Rolling | (b) | State calculation |

| Texas | 1/1/07 | No tax | Federal gross receipts and sales |

| Utah | Rolling | FAGI | FTI before NOLs and special deds. |

| Vermont | 1/1/18 | FAGI | FTI before NOLs |

| Virginia | 12/31/18 | FAGI | FTI |

| Washington | No tax | No tax | Gross receipts tax |

| West Virginia | 12/31/18 | FAGI | FTI |

| Wisconsin | 12/31/17 | FAGI | FTI before NOLs and special deds. |

| Wyoming | No tax | No tax | No tax |

| District of Columbia | Rolling | State calculation | Federal gross receipts and sales |

State Taxation of GILTI

GILTI or not GILTI—in many states, the verdict is in doubt. Two years after enactment of the TCJA, many states would seem to conform to GILTI but have yet to issue any guidance to potential taxpayers, leaving them in the dark about any liability that may be accruing and giving rise to concerns of retroactivity should these states later determine that GILTI has been payable since tax year 2018. As a matter of sound policy, states should avoid taxing GILTI, which is far beyond the traditional scope of state taxation. Serious constitutional questions, and the prospect of costly litigation, give states an even stronger reason not to bring this international income provision into their tax base. If the intention is to avoid taxing GILTI, however, lawmakers should codify this commitment and clear up any uncertainty.

The Global Intangible Low-Taxed Income inclusion is one of two guardrails in the TCJA, along with the Base Erosion Anti-Abuse Tax (BEAT), which can return some international income to the federal tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . Although no state automatically conforms to the BEAT and states are unlikely to pursue such a provision on their own, the default position for many states is to incorporate GILTI, with profound consequences for the scope of their tax code.

At the federal level, the GILTI inclusion functions in tandem with other provisions which tend to be lacking in state codes, like the credit for foreign taxes paid. Consequently, not only does conformity to GILTI involve state taxation of international income, but it also tends to yield a far more aggressive international tax regime than the one implemented by the federal government. Moreover, its purpose—to discourage profit shiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens. by parking intangible property in low-tax jurisdictions overseas[3]—is not served by inclusion in state tax codes.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeAlthough the name GILTI implies that the tax applies specifically to returns on intangible property (like patents and trademarks) parked in low-tax countries, that effect is only approximated by the interaction of multiple IRC provisions. Although GILTI calculations can be highly complex, in simplified form the tax falls on what are deemed the supernormal returns of foreign subsidiaries, less a deduction, less a calculated partial credit for foreign taxes paid.

The inclusion (under IRC § 951A) is for what are considered “supernormal returns,” defined as income above 10 percent of qualified business asset investment less interest expenses. The rationale for this definition is that this is a reasonable rate of return on capital investment and that higher returns are likely to be royalty income or other income associated with profit shifting. (This is not, it bears noting, always the case.) A GILTI deduction is then offered at IRC § 250, currently worth 50 percent (declining to 37.5 percent after 2025), bringing the U.S. federal tax rate on this income from 21 to 10.5 percent (13.125 percent after 2025). Finally, business taxpayers may claim a credit equal to 80 percent of their foreign taxes paid on that income. These foreign tax credits are also subject to an overall limitation equal to U.S. tax liability times foreign profits divided by worldwide profits. In general, however, the higher the foreign tax liability, the lower the residual U.S. liability.

Many states conform to the corporate code before credits or deductions, thus bringing in GILTI under § 951A, but without the 50 percent deduction or the credits for foreign taxes paid. Consequently, state taxation of GILTI is far more aggressive than federal taxation, and in particular, lacks any pretense of only applying to low-taxed foreign income. In some cases, state effective rates could rival the federal rate on GILTI.[4] Any such taxation represents a substantial departure from states’ more typical water’s-edge tax systems, which generally avoid taxing international income, and raises serious constitutional questions.

The issue is exacerbated by how some states include GILTI in their apportionment formulas. State apportionmentApportionment is the determination of the percentage of a business’s profits subject to a given jurisdiction’s corporate income tax or other business tax. US states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders. regimes vary, but corporate income is always apportioned by states either on the basis of sales in the state as a percentage of total sales, or on some weighting of three factors: sales, payroll, and property. If, for instance, a U.S. company had $1 billion in domestic sales, and $100 million of that total was sold into a particular single sales factor state, then that state’s apportionment factor would be $100 million / $1 billion, or 10 percent, meaning that 10 percent of the company’s taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. would be apportioned to the state. Importantly, the $100 million in sales in that state appears both in the numerator (the full amount) and the denominator (along with sales elsewhere). Some states, however, are denying such factor representation for GILTI, including GILTI in the numerator while excluding it from the denominator or only including a narrower definition of net rather than gross GILTI in the denominator, which inflates the state’s share and discriminates against GILTI compared to other forms of income. Such discrimination conflicts with Dormant Commerce Clause jurisprudence, which prohibits discrimination against interstate or foreign commerce.

This also serves as a reminder that international income does not belong in state tax bases, as, in most instances, this anomalous treatment arises from tax codes founded on the assumption that state taxation stops at the water’s edge, which is to say that it does not extend to foreign income (or only in limited cases). When GILTI flows into a state tax system through inaction—by not proactively decoupling from the provision—nothing in the existing code is designed to take foreign factors of production into account.

Some states have implemented or are exploring “factor relief,” a better alignment of factors in the numerator with the productive factors in the denominator, to address these concerns. Still, taxing GILTI—even with, but especially without, the 50 percent § 250 deduction and factor relief—is onerous, uncompetitive, and inconsistent with the purposes and traditional scope of state taxation. There is, moreover, an added wrinkle for states with separate (rather than combined) reporting, also on discriminatory taxation grounds. If a state does not include U.S.-based subsidiaries in a unitary group for taxation, it cannot include international subsidiaries (controlled foreign corporations) within the filing group for tax purposes. Congress has the sole authority to regulate commerce with foreign nations, and states may not treat international income less favorably than domestic income. States which use separate reporting and nevertheless seek to tax GILTI face a serious constitutional challenge, particularly under the precedent of Kraft v. Iowa Department of Revenue (1992), a U.S. Supreme Court case striking down a business tax that allowed a deduction for dividends received for domestic, but not foreign, subsidiaries.[5]

Importantly, although it resides in the same part of the federal tax code and is treated similarly for federal tax purposes, GILTI is not Subpart F income, and a state’s inclusion or exclusion of Subpart F income in its tax base has no bearing on its taxation of GILTI.[6] A state’s treatment of the foreign dividends received deduction can, however, be relevant, as some states have eliminated GILTI liability by allowing it to be deducted as foreign dividend income.

The following table indicates whether a state’s tax code, as written, applies to GILTI, along with whether the state has issued any guidance to that effect. We also show the percentage of apportionable GILTI taxed by the state after taking into account the foreign dividend income deduction and the Section 250 deduction, if applicable. It should be noted, however, that this calculation does not consider whether a state provides any factor relief, the absence of which can increase liability dramatically. Twenty-four states and the District of Columbia potentially tax GILTI, though only 17 states have issued guidance. In some states, the application of a § 250 deduction and an 80 percent dividends received deduction (DRD) eliminates all but 5 percent of GILTI, but 12 states have issued guidance imposing tax liability on a share of GILTI above the 5 percent threshold.

|

(a) Separate reporting state, raising constitutional issues under Kraft. Sources: State statutes and guidance; Tax Foundation research. |

|||||

| State | Inclusion | In Starting Point | § 250 | DRD | Guidance |

|---|---|---|---|---|---|

| Alabama (a) | 50% | Yes | Yes | 0% | ✓ |

| Alaska | 20% | Yes | No | 0% | ✗(b) |

| Arizona | 0% | No | No | 100% | |

| Arkansas | 0% | No | No | 100% | |

| California | 0% | No (c) | No | 0% | |

| Colorado | 50% | Yes | Yes | 0% | ✗ |

| Connecticut | 5% | Yes | No | 95% | ✓ |

| Delaware (a) | 50% | Yes | Yes | 0% | ✗ |

| Florida | 0% | No | No | 100% | |

| Georgia | 0% | No | Yes | 100% | |

| Hawaii | 0% | No | No | 100% | |

| Idaho (d) | 15% | Yes | Yes | 85% | ✓ |

| Illinois | 0% | No | No | 100% | |

| Indiana | 0% | No | No | 100% | |

| Iowa (a) | 50% | Yes | Yes | 0% | ✓ |

| Kansas | 20% | Yes | Yes | 0% | ✗ |

| Kentucky | 0% | No | No | 100% | |

| Louisiana | 0% | Yes | Yes | 100% | ✓ |

| Maine | 50% | Yes | No | 0% | ✓ |

| Maryland (a) | 50% | Yes | Yes | 0% | ✓ |

| Massachusetts | 5% | Yes | No | 95% | ✓ |

| Michigan | 0% | No | Yes | 100% | |

| Minnesota | 0% | No | No | 100% | |

| Mississippi | 0% | No | No | 100% | |

| Missouri | 0% | No | Yes | 100% | |

| Montana | 20% | Yes | No | 80% | ✗ |

| Nebraska | 50% | Yes | Yes | 0% | ✓ |

| Nevada | n.a. | n.a. | n.a. | n.a. | |

| New Hampshire | 50% | Yes | Yes | 0% | ✓ |

| New Jersey | 50% | Yes | Yes | 0% | ✓ |

| New Mexico | 0% | No | Yes | 100% | |

| New York | 5% | Yes | No | 0% | ✓ |

| North Carolina | 0% | No | No | 100% | |

| North Dakota (e) | 30% | Yes | No | 70% | ✓ |

| Ohio | n.a. | n.a. | n.a. | n.a. | |

| Oklahoma | 0% | Yes | No | 100% | |

| Oregon | 20% | Yes | No | 80% | ✓ |

| Pennsylvania | 0% | No | No | 100% | |

| Rhode Island | 50% | Yes | No | 0% | ✓ |

| South Carolina | 0% | No | No | 100% | |

| South Dakota | n.a. | n.a. | n.a. | n.a. | |

| Tennessee | 5% | Yes | Yes | 95% | ✓ |

| Texas | 0% | No (c) | No | 0% | |

| Utah | 100% | Yes | No | 0% | ✗ |

| Vermont | 50% | Yes | Yes | 0% | ✓ |

| Virginia | 0% | No | Yes | 100% | |

| Washington | n.a. | n.a. | n.a. | n.a. | |

| West Virginia | 50% | Yes | Yes | 0% | ✗ |

| Wisconsin | 0% | No | No | 100% | |

| Wyoming | n.a. | n.a. | n.a. | n.a. | |

| District of Columbia | 50% | Yes | Yes | 0% | ✗ |

States which tax GILTI, particularly absent factor representation, cannot expect to escape a legal battle. The Supreme Court has made clear that “[t]he factor or factors used in the apportionment formula must actually reflect a reasonable sense of how income is generated,”[7] a requirement transparently violated if the denominator either omits or only includes a portion of the factors that generated the GILTI included in the numerator.

And while states possess limited authority to have distinct approaches for interstate (or international) commerce if intended to compensate for a provision that only burdens intrastate commerce, they operate with a short leash: “To justify a charge on interstate commerce as a compensatory tax, a State must, as a threshold matter, ‘identif[y] the [intrastate tax] burden for which the State is attempting to compensate.’ Once that burden has been identified, the tax on interstate commerce must be shown roughly to approximate—but not exceed—the amount of the tax on intrastate commerce.”[8] There is nothing compensatory about taxing GILTI without factor representation.[9]

Finally, even if states tailor their GILTI regimes narrowly enough to survive any legal challenge, its inclusion dramatically decreases the state’s tax competitiveness by markedly increasing the state tax burden on multinational companies with headquarters in the state. Discriminating against multinational companies which choose to headquarter in one’s state is not only bad tax policy but also clearly counterproductive, rendering the state’s corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. a far greater liability and encouraging corporate relocation.

Foreign-Derived Intangible Income

Whereas GILTI involves the taxation of the foreign intangible income of domestic corporations, the foreign-derived intangible income (FDII) deduction provides a benefit to companies that generate export-related income on U.S.-based intangible property. Many have termed this the carrot-and-stick approach to international taxation, where FDII is the carrot and GILTI the stick.[10]

Like the deduction against GILTI, the FDII deduction is located in IRC § 250, though the two are separate and should not be confused. States which conform to the GILTI deduction in that IRC section typically offer the FDII deduction as well, but a few have legislated the matter separately. Just as there is little justification for taxing GILTI at the state level, there is scant rationale for providing a FDII deduction, though denying FDII while taxing GILTI represents a particularly aggressive approach. Twenty-four states provide an FDII deduction.

Three states which deny the FDII deduction tax a nominal amount of GILTI (Connecticut, Massachusetts, and New York), while four others tax GILTI more broadly despite decoupling from the FDII deduction (Maryland, New Hampshire, Oregon, and Rhode Island). To date, Utah has not issued guidance on the taxation of GILTI, but its tax code would appear to tax it, while not bringing in the FDII deduction.

|

Sources: State statutes and guidance; Tax Foundation research. |

|

| State | FDII Deduction |

|---|---|

| Alabama | Yes |

| Alaska | Yes |

| Arizona | Yes |

| Arkansas | No |

| California | No |

| Colorado | Yes |

| Connecticut | No |

| Delaware | Yes |

| Florida | Yes |

| Georgia | Yes |

| Hawaii | No |

| Idaho | Yes |

| Illinois | No |

| Indiana | Yes |

| Iowa | Yes |

| Kansas | Yes |

| Kentucky | Yes |

| Louisiana | Yes |

| Maine | Yes |

| Maryland | No |

| Massachusetts | No |

| Michigan | Yes |

| Minnesota | No |

| Mississippi | No |

| Missouri | Yes |

| Montana | Yes |

| Nebraska | Yes |

| Nevada | n.a. |

| New Hampshire | No |

| New Jersey | Yes |

| New Mexico | No |

| New York | No |

| North Carolina | No |

| North Dakota | Yes |

| Ohio | n.a. |

| Oklahoma | Yes |

| Oregon | No |

| Pennsylvania | No |

| Rhode Island | No |

| South Carolina | No |

| South Dakota | n.a. |

| Tennessee | No |

| Texas | n.a. |

| Utah | No |

| Vermont | Yes |

| Virginia | Yes |

| Washington | n.a. |

| West Virginia | Yes |

| Wisconsin | No |

| Wyoming | n.a. |

| District of Columbia | No |

Repatriation Income

Prior to enactment of federal tax reform, American corporations had about $2.6 trillion in overseas reinvested earnings.[11] Under the old “worldwide” system of taxation, U.S. corporations paid the difference between the U.S. statutory corporate income tax rate of 35 percent and the statutory rate in the other nation where the income was earned. However, that liability was deferred so long as the income was reinvested. As part of the transition to a territorial tax code, these deferred earnings were “deemed” to have been repatriated, meaning they are immediately taxable by the federal government at rates of 15.5 percent on liquid assets and 8.0 percent on illiquid assets. This repatriated income is included in what is known as Subpart F income.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeWhether states include Subpart F income in their tax base and whether they conform to the new deduction for foreign dividends received helps dictate whether they receive additional revenue from income “deemed” repatriated. Deemed repatriationRepatriation is the process by which multinational companies bring overseas earnings back to the home country. Prior to the 2017 Tax Cuts and Jobs Act (TCJA), the US tax code created major disincentives for US companies to repatriate their earnings. Changes from the TCJA eliminate these disincentives. is a one-time event, based on income held overseas at the end of 2017, though its impact continues since states continue to assert a tax claim based on that event. Companies have the option to spread payments over eight years for federal tax purposes, but only two states—Oregon and Utah—conform to this installment payment option.

When a foreign subsidiary of a domestic corporation pays a dividend to its U.S. parent, the federal government provides a deduction for the foreign-source portion of dividends received, consistent with the principles of a territorial tax system. States can theoretically diverge from federal treatment in two ways: in their definitions of dividends received (Rhode Island, for instance, does not consider repatriation income a foreign dividend) and whether they provide the 100 percent deduction of foreign dividends. Anomalously, repatriation income is fully deductible under Connecticut’s dividends received deduction, but subject to a 5 percent addback under a 2018 law.[12]

At the federal level, the reduced effective rates of 15.5 and 8 percent are provided through a participation exemption at IRC § 965(c), but this exemption is only captured by five states, while other states impose their ordinary tax rate on whatever share of repatriated income is included in their base. Colorado stands alone in taking account of foreign taxes paid, as the federal government does. The tax codes of 14 states capture repatriated income as written.

|

(a) Colorado provides an exclusion based on the federal credit for foreign taxes paid. |

|||

| State | Taxed Share | 965(c) Exemption | Installments |

|---|---|---|---|

| Alabama | 0% | ||

| Alaska | 20% | ✗ | ✗ |

| Arizona | 0% | ||

| Arkansas | 0% | ||

| California | 0% | ||

| Colorado | 100% (a) | ✓ | ✗ |

| Connecticut | 5% | ✗ | ✗ |

| Delaware | 0% | ||

| Florida | 0% | ||

| Georgia | 0% | ||

| Hawaii | 0% | ||

| Idaho | 15% | ✓ | ✗ |

| Illinois | 0% | ||

| Indiana | 0% | ||

| Iowa | 0% | ||

| Kansas | 20% | ✗ | ✗ |

| Kentucky | 0% | ||

| Louisiana | 28% | ✗ | ✗ |

| Maine | 20% | ✗ | ✗ |

| Maryland | 0% | ||

| Massachusetts | 5% | ✗ | ✗ |

| Michigan | 0% | ||

| Minnesota | 0% | ||

| Mississippi | 0% | ||

| Missouri | 0% | ||

| Montana | 20% | ✗ | ✗ |

| Nebraska | 100% | ✓ | ✗ |

| Nevada | n.a. | ||

| New Hampshire | 0% | ||

| New Jersey | 0% | ||

| New Mexico | 0% | ||

| New York | 0% | ||

| North Carolina | 0% | ||

| North Dakota | 30% | ✗ | ✗ |

| Ohio | n.a. | ||

| Oklahoma | 0% | ||

| Oregon | 20% | ✗ | ✓ |

| Pennsylvania | 0% | ||

| Rhode Island | 100% | ✓ | ✗ |

| South Carolina | 0% | ||

| South Dakota | n.a. | ||

| Tennessee | 0% | ||

| Texas | n.a. | ||

| Utah | 50% | ✗ | ✓ |

| Vermont | 100% | ✓ | ✗ |

| Virginia | 0% | ||

| Washington | n.a. | ||

| West Virginia | 0% | ||

| Wisconsin | 0% | ||

| Wyoming | n.a. | ||

| District of Columbia | 0% | ||

Capital Investment and Manufacturing Activity

The TCJA also allows the full expensing of short-lived capital assets—essentially, investment in machinery and equipment—through 2022, after which the provision phases out. The corporate income tax is imposed on net income (after expenses), but traditionally, investment costs must be amortized over many years, following asset depreciation schedules. This creates a bias against investment, and this disparate treatment has long been in the crosshairs of reformers. The new law does not eliminate depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. schedules altogether but allows purchases of machinery and equipment to be expensed immediately. This new cost recovery system builds on the prior “bonus depreciation” regime, under which 50 percent of the cost of new machinery and equipment could be expensed in the first year.

The new federal law’s more favorable treatment of capital investment flows through to some states. Federal law now allows purchases of short-lived capital assets (machinery and equipment) to be expensed immediately, rather than depreciated over many years. This replaces the prior bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. regime, which offered accelerated (but not immediate) depreciation. Sixteen states conform to IRC § 168(k) and thus follow the federal government in offering full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. of machinery and equipment purchases. Another three states (Florida, Minnesota, and North Carolina) conform with partial addbacks, allowing a given percentage (for instance, 20 percent in Minnesota) of the bonus depreciation offered at the federal level.

Although full expensing reduces state revenue, it is also highly pro-growth because it reduces the tax code’s otherwise punitive treatment of investment compared to other business expenses,[13] and states that have yet to incorporate cost recoveryCost recovery refers to how the tax system permits businesses to recover the cost of investments through depreciation or amortization. Depreciation and amortization deductions affect taxable income, effective tax rates, and investment decisions. in their codes would do well to conform to this provision. Accepting this cost should be made easier in that most states enjoy a broader overall tax base due to federal tax reform. Within this context, it makes sense to incorporate provisions which drive economic expansion. Indeed, states should consider making their own expensing regimes permanent, retaining this competitive provision even if the federal policy is allowed to expire.

At the same time, federal law now restricts the deduction of business interest, limiting the deduction to 30 percent of modified income, with the ability to carry the remainder to future tax years. For the first four years, the definition of modified income is earnings before interest, taxes, depreciation, and amortization (EBITDA); afterwards, a more restrictive standard of gross incomeFor individuals, gross income is the total of all income received from any source before taxes or deductions. It includes wages, salaries, tips, interest, dividends, capital gains, rental income, alimony, pensions, and other forms of income. For businesses, gross income (or gross profit) is the sum of total receipts or sales minus the cost of goods sold (COGS)—the direct costs of producing goods, including inventory and certain labor costs. less depreciation or amortization (EBIT) goes into effect.[14]

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeThese changes mean that a greater share of interest costs will be taxable, increasing revenue. Of particular note, additional capital investment can limit interest deductibility under EBIT. Given this change, which increases the cost of investment, states would do well to ensure that they also conform to the new full expensing provision, which was intended as a counterbalance.

|

(a) Beginning tax year 2020. Sources: State statutes; Tax Foundation research. |

||

| State | Conforms to 168(k) Full Expensing | Conforms to 163(j) Interest Limitation |

|---|---|---|

| Alabama | Yes | Conforms |

| Alaska | Yes | Conforms |

| Arizona | No | Conforms |

| Arkansas | No | Not Included in Selective Conformity |

| California | No | Conforms to Prior Year IRC |

| Colorado | Yes | Conforms |

| Connecticut | No | Decouples |

| Delaware | Yes | Conforms |

| Florida | 1/7th of Federal | Conforms |

| Georgia | No | Decouples |

| Hawaii | No | Conforms |

| Idaho | No | Conforms |

| Illinois | Yes | Conforms |

| Indiana | No | Decouples |

| Iowa | No | Conforms |

| Kansas | Yes | Conforms |

| Kentucky | No | Conforms |

| Louisiana | Yes | Conforms |

| Maine | No | Conforms |

| Maryland | No | Conforms |

| Massachusetts | No | Conforms |

| Michigan | No | Conforms |

| Minnesota | Requires 80% add back | Conforms |

| Mississippi | No | Decouples |

| Missouri | Yes | Decouples |

| Montana | Yes | Conforms |

| Nebraska | Yes | Conforms |

| Nevada | Gross receipts tax | Gross Receipts Tax |

| New Hampshire | No | Conforms to Prior Year IRC |

| New Jersey | No | Conforms |

| New Mexico | Yes | Conforms |

| New York | No | Conforms |

| North Carolina | Requires 85% add back | Conforms |

| North Dakota | Yes | Conforms |

| Ohio | Gross receipts tax | Conforms |

| Oklahoma | Yes | Conforms |

| Oregon | Yes | Conforms |

| Pennsylvania | No | Conforms |

| Rhode Island | No | Conforms |

| South Carolina | No | Decouples |

| South Dakota | No tax | No tax |

| Tennessee | No | Decouples (a) |

| Texas | Gross receipts tax | Gross receipts tax |

| Utah | Yes | Conforms |

| Vermont | No | Conforms |

| Virginia | No | Conforms (b) |

| Washington | Gross receipts tax | Gross receipts tax |

| West Virginia | Yes | Conforms |

| Wisconsin | No | Decouples |

| Wyoming | No tax | Conforms |

| District of Columbia | No | Conforms |

Conclusion

The effects of the TCJA on state taxation have yet to be fully untangled. Many base-broadening provisions, discussed in our prior conformity updates, were relatively straightforward. Some states saw this federal-driven broadening of state tax bases as an opportunity to cut rates or make other changes; others reversed many or all the base adjustments; and still others quietly embraced the additional revenue.[15] All too often, states were happy to accept the additional revenue, but made no effort to incorporate offsetting provisions like full expensing of capital investment. Conforming to the expensing provision would improve states’ tax structure and, more importantly, enhance their business competitiveness.

But it is with the international provisions of the TCJA, and particularly with GILTI and deemed repatriation, where confusion still reigns. More than two years after enactment of the new federal tax law, seven states and the District of Columbia have yet to issue guidance on GILTI even though their tax codes appear to incorporate it, and 17 states have issued guidance or enacted legislation incorporating some amount of GILTI in their base, often without factor representation. States should avoid the temptation to see international income as an untapped source of revenue, taking steps to provide certainty and avoid punitive corporate taxation. States have delayed long enough; there is no time like the present to ensure that state tax codes are oriented toward economic growth.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Jared Walczak, “Toward a State of Conformity: State Tax Codes a Year After Federal Tax Reform,” Tax Foundation, Jan. 28, 2019, https://taxfoundation.org/state-conformity-one-year-after-tcja/.

[2] Harley T. Duncan, “Relationships Between Federal and State Income Taxes,” Federation of Tax Administrators, April 2005, 4-5, http://govinfo.library.unt.edu/taxreformpanel/meetings/pdf/incometax_04182005.pdf.

[3] Kyle Pomerleau, “A Hybrid Approach: The Treatment of Foreign Profits Under the Tax Cuts and Jobs Act,” Tax Foundation, May 3, 2018, https://taxfoundation.org/treatment-foreign-profits-tax-cuts-jobs-act/.

[4] Joseph X. Donovan, Karl A. Frieden, Ferdinand S. Hogroian, and Chelsea A. Wood, “State Taxation of GILTI: Policy and Constitutional Ramifications,” State Tax Notes, Oct. 22, 2018, https://www.cost.org/globalassets/cost/state-tax-resources-pdf-pages/cost-studies-articles-reports/state-taxation-of-gilti-policy-and-constitutional-ramifications.pdf.

[5] Kraft Gen. Foods, Inc. v. Iowa Dept. of Revenue and Finance, 505 U.S. 71 (1992).

[6] Linda Pfatteicher, Jeremy Cape, Mitch Thompson, and Matthew Cutts, “GILTI and FDII: Encouraging U.S. Ownership of Intangibles and Protecting the U.S. Tax Base,” Bloomberg Tax, Feb. 27, 2018.

[7] Container Corp. v. Franchise Tax Bd., 463 U.S. 159 (1983) at 169.

[8] Oregon Waste Systems, Inc. v. Department of Environmental Quality of Ore., 511 U.S. 93 (1994) at 104.

[9] See Karl A. Frieden and Joseph X. Donovan, “Where in the World is Factor Representation for Foreign-Source Income?” State Tax Notes, Apr. 15, 2019; and Lee A. Sheppard, “Is Taxing GILTI Constitutional?” State Tax Notes, July 30, 2018.

[10] Linda Pfatteicher, Jeremy Cape, Mitch Thompson, and Matthew Cutts, “GILTI and FDII: Encouraging U.S. Ownership of Intangibles and Protecting the U.S. Tax Base,” Bloomberg Tax, Feb. 27, 2018.

[11] Erica York, “Evaluating the Changed Incentives for Repatriating Foreign Earnings,” Tax Foundation, Sept. 27, 2018, https://taxfoundation.org/tax-cuts-and-jobs-act-repatriation/.

[12] Connecticut Public Act No. 18-49 (2018).

[13] Erica York, “Cost Recovery Treatment Short of Full Expensing Creates a Drag on Economic Growth,” Tax Foundation, Sept. 17, 2018, https://taxfoundation.org/cost-recovery-treatment-short-full-expensing-creates-drag-economic-growth/; and Kyle Pomerleau, “Why Full Expensing Encourages More Investment than a Corporate Rate Cut,” Tax Foundation, May 3, 2017, https://taxfoundation.org/full-expensing-corporate-rate-investment/.

[14] Stephen J. Entin, “Conference Report Limits on Interest Deductions,” Tax Foundation, Dec. 17, 2017, https://taxfoundation.org/conference-report-limits-interest-deductions/.

[15] Jared Walczak, “Tax Trends Heading Into 2019,” Tax Foundation, Dec. 19, 2018, https://taxfoundation.org/state-tax-trends-2019/.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe