The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Five Things to Know About Trump’s Global Minimum Tax Order

This week, the incoming Trump administration issued a day-one executive order on the global minimum tax agreement known as Pillar Two, which seeks to ensure multinational corporations pay at least 15 percent in income tax.

6 min read

Mexico Proposes Best-Designed Alcohol Tax System in the World

The proposed ad quantum tax would be the system that most closely follows the global best practices for alcohol taxes we previously outlined.

4 min read

Governor Moore Proposes Major Tax Changes in Maryland to Address Chronic Budget Deficits

Facing a projected $3 billion budget deficit in fiscal year 2026, with forecasts of a growing gap over the next five years, Governor Wes Moore (D) has included about $1 billion in proposed tax increases in his budget proposal.

7 min read

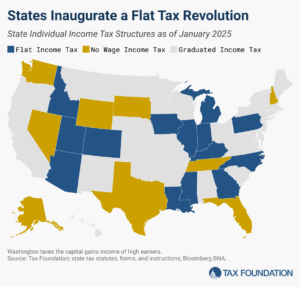

The State Flat Tax Revolution: Where Things Stand Today

From 2021-2024, within the span of 3.5 years, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

CBO and JCT Preview Economic Analysis of Extending TCJA

The analysis provides key insights into how their models work and the sort of outputs we can expect from their models as part of next year’s tax debate.

8 min read

FDA’s Proposed Cigarette Prohibition Would Cost $33 Billion in Annual Tax Revenue

The US already has massive problems with cigarette smuggling. A cigarette prohibition would be devastating to tax coffers while pushing smokers toward what could become the world’s largest illicit market.

4 min read

Are Tariffs the Ghost of Christmas Future?

The holiday season is marked by time with friends and family, joy, and gift-giving. But could tax policy make the sticker shock from your shopping list next year tariff-ying?

4 min read

Cigarette Smuggling Cost States Nearly $5 Billion in Forgone Excise Tax Revenue Each Year

Tax avoidance is a natural consequence of tax policy. Policymakers should consider the unintended consequences, both to public health and public coffers, of the excise taxes and regulatory regimes for cigarettes and other nicotine products.

5 min read

Louisiana Now Boasts a More Competitive and Pro-Growth Tax Code

Lawmakers will enter the 2025 fiscal legislative session with an opportunity to build on the successes of the November special session. Efforts should include addressing the outstanding issues within the corporate and sales tax codes that currently hold the state back.

7 min read

All About That Base(line)

If lawmakers are serious about pro-growth policies and fiscal responsibility, they will need to put policies forward that achieve those goals. Simply adjusting the baseline doesn’t reduce actual deficits in the coming years.

7 min read