The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Debunking Myths about the Trade Deficit

Politicians often bemoan the trade deficit, but their disdain for this economic statistic is largely misplaced. The trade deficit reflects deeper choices about how we use our money, and reducing it may require lowering our standard of living.

4 min read

California Is Trying to Redefine “Tax Rebates” in a Threat to Public-Private Partnerships

Recharacterizing a rather simple repayment transaction as a tax rebate is concerning, not just for sound tax policy, but also for the future of public-private financing partnerships.

4 min read

Trump’s Previous Tariffs Foreshadow the Economic Harm of Latest 10% Tariff Proposal

What can Former President Trump’s previous tariff efforts—specifically the safeguards he authorized on imported washing machines in 2018—tell us about his most recent proposal for a 10 percent tariff on all imports?

5 min read

How Bermuda’s New Corporate Income Tax Could Negatively Impact Some OECD Member States

Bermuda, long celebrated for its pristine beaches and offshore financial services, is embarking on a journey to recalibrate its tax mix. Spurred by the OECD’s Pillar Two initiative, the island will introduce its first-ever corporate income tax in 2025.

4 min read

Trump’s $300 Billion Tax Hike Would Threaten U.S. Businesses and Consumers

Former President Donald Trump’s proposed 10 percent tariff would raise taxes on American consumers by more than $300 billion a year—a tax increase rivaling the ones proposed by President Biden.

3 min read

Opportunity Zones “Make a Good Return Greater,” but Not for Poor Residents

The early evidence indicates that making a “good return greater” through Opportunity Zone tax incentives is an ineffective and poorly targeted way to raise the living standards of low-income residents.

6 min read

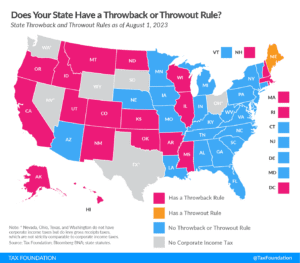

States Move Away from Throwback and Throwout Rules

As more and more states move away from throwback or throwout rules, those states that still impose these rules are becoming less attractive for businesses, which are incentivized to relocate their sales activities to non-throwback states.

6 min read

Section 179 Expensing: Good First Step?

The Small Business Jobs Act would improve the tax treatment of investment but the proposal stops short of full expensing, leaving room for improvement.

3 min read

Why Italy’s Latest Windfall Profits Tax Is Still Bad Tax Policy

For many Italian banks, there hasn’t been a significant “windfall” to tax. The profit margins of Italian banks have been lower compared to other industries for the past two decades.

5 min read

The Big Business of Tax-Free College Sports

Moving from one athletic conference to another can mean millions in additional revenue sharing from lucrative broadcasting contracts and other revenue streams, all tax-free.

6 min read