Both the federal government and the states raise revenue for infrastructure spending through taxes on motor fuel and vehicles. The states also collect fees from toll roads and other road charges. This system constitutes a well-designed user fee system, as taxes paid by users of infrastructure are dedicated to building and maintaining infrastructure. However, neither the federal government nor the vast majority of states collect enough taxes through these levies to cover infrastructure-related spending.

Per tradition in Washington, D.C., every week is infrastructure week, but currently, this joking description holds especially true. Since President Biden unveiled his administration’s proposal for increased infrastructure spending in the American Jobs Plan, debate over how to fund investments in infrastructure has taken center stage. A similar discussion is happening in many states, where lawmakers are grappling with questions over the future of infrastructure revenue and spending.

Traditionally, revenue dedicated to infrastructure spending has been raised through taxes on motor fuel, license fees, and tolls, but revenue from motor fuel has proven less effective over the last few decades. Between developments in vehicles’ fuel economy, increased sales of electric vehicles, and inflation, taxes on motor fuel generally raise less revenue per vehicle miles traveled (VMT) than they did in the past. As a result, most states contribute revenue from other sources to make up differences between infrastructure revenue and expenditures.

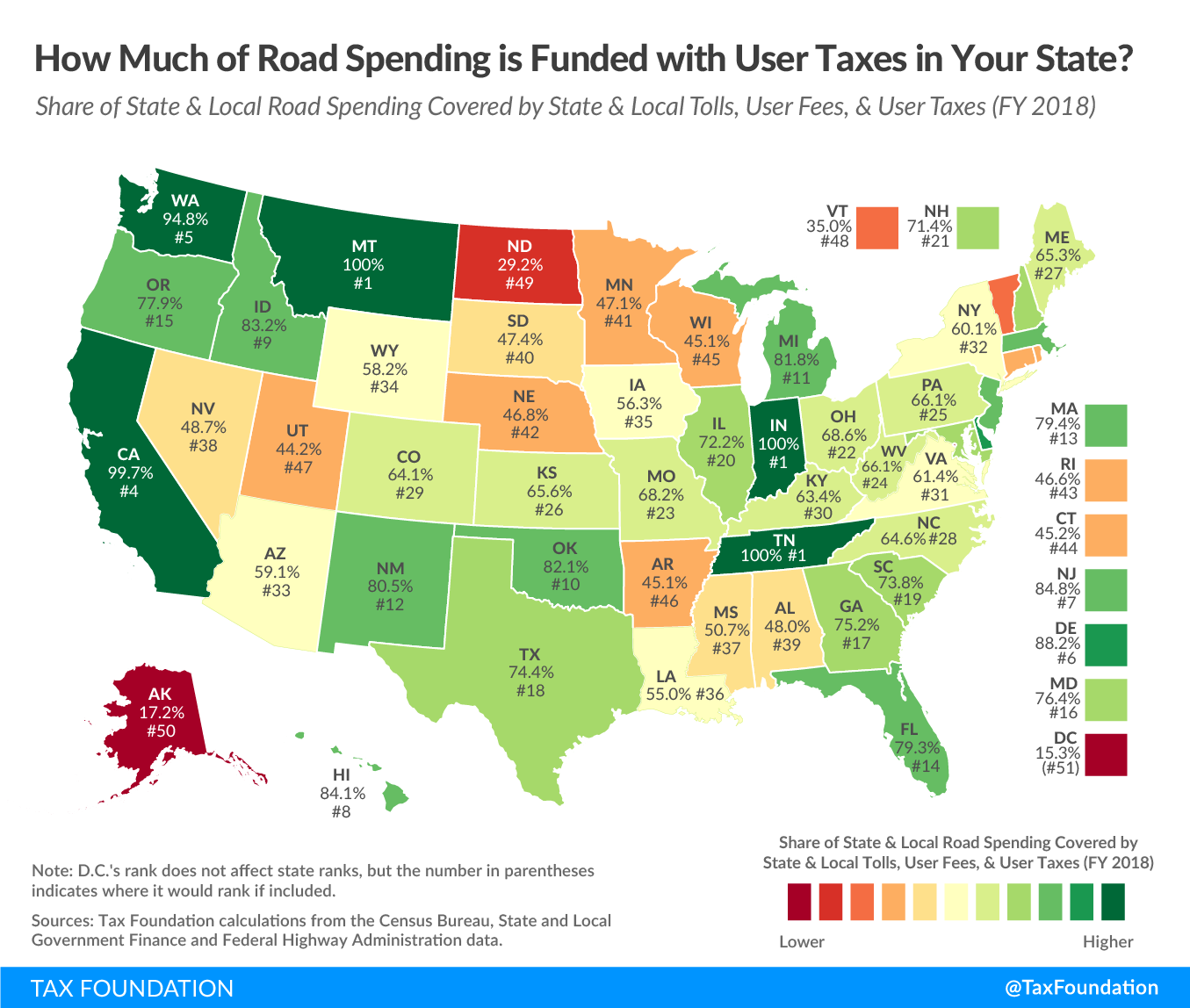

The amount of revenue states raise through taxes on infrastructure and transportation vary to a significant degree—as do the sources. Four states (California, Indiana, Montana, and Tennessee) raise enough revenue to cover their highway spending, but 46 states and the District of Columbia must cover the difference with taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue from other levies. Alaska (17 percent) and North Dakota (29 percent), which both rely heavily on revenue from severance taxes, raise the lowest proportion of highway funds from transportation taxes and fees.

States that cannot rely on the oil and gas industries for funding have tried a variety of funding sources to come up with the money necessary for infrastructure upkeep. Though politically unpopular, motor fuel taxes, license fees, and tolls are all relatively good applications of the benefit principle—the idea that the people paying the taxes and fees should be the ones to benefit from them. States should seek to fund infrastructure through user taxes and fees as much as possible, internalizing the costs associated with using the state’s transportation systems.

However, with the sustainability of established motor fuel taxes increasingly threatened, it may be time for lawmakers at both the state and federal levels to consider other options for transportation revenue. One such option is a vehicle miles traveled (VMT) tax. Instead of using fuel as a proxy for road usage, taxing actual road usage would better respect the benefit principle and guarantee that the tax acts as a user feeA user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service, directly raising funds from the people who benefit from the particular public good or service being provided. A user fee is not a tax, though some taxes may be labeled as user fees or closely resemble them. .

A few states have already begun pilot programs to study the feasibility of VMT taxes, and Pennsylvania Gov. Tom Wolf (D) recently announced a commission to study phasing out motor fuel taxes. On both a federal and a state level, imposing a VMT tax does require lawmakers to make some hard decisions on trade-offs. Significant concerns regarding privacy must be addressed and balanced against a desire for a targeted, equitable, and efficient tax.

For a more detailed breakdown of where states’ user-based road funding comes from, check out the following table.

| Share of State & Local Road Spending Covered by State & Local Tolls, User Fees, & User Taxes (FY 2018) | ||||||

|---|---|---|---|---|---|---|

| State | State Infrastructure Revenue | Motor Fuel Tax Revenue as % of Infrastructure Revenue | License Revenue as % of Infrastructure Revenue | Tolls and Charges as % of Infrastructure Revenue | State Share of Highway Spending | % of Highway Spending Funded with Transportation Taxes, Licenses, and Fees |

| Alabama | $1,005,256,000 | 74% | 24% | 1% | $2,096,229,538 | 48% |

| Alaska | $180,796,000 | 26% | 32% | 42% | $1,049,724,632 | 17% |

| Arizona | $1,121,782,000 | 77% | 21% | 2% | $1,897,356,648 | 59% |

| Arkansas | $665,839,000 | 74% | 25% | 1% | $1,475,428,608 | 45% |

| California | $11,994,405,000 | 53% | 39% | 8% | $12,028,601,965 | 100% |

| Colorado | $1,776,573,000 | 38% | 39% | 23% | $2,772,456,079 | 64% |

| Connecticut | $734,855,000 | 66% | 32% | 1% | $1,624,393,202 | 45% |

| Delaware | $514,989,000 | 26% | 11% | 63% | $583,560,989 | 88% |

| District of Columbia | $66,453,000 | 40% | 59% | 1% | $433,172,639 | 15% |

| Florida | $7,255,636,000 | 50% | 20% | 30% | $9,149,817,994 | 79% |

| Georgia | $2,285,872,000 | 79% | 17% | 4% | $3,041,441,116 | 75% |

| Hawaii | $588,588,000 | 30% | 69% | 1% | $700,173,043 | 84% |

| Idaho | $611,791,000 | 59% | 33% | 7% | $735,035,798 | 83% |

| Illinois | $4,587,377,000 | 33% | 36% | 31% | $6,351,456,099 | 72% |

| Indiana | $1,814,581,000 | 78% | 21% | 1% | $1,608,662,790 | 100% |

| Iowa | $1,359,242,000 | 49% | 50% | 0% | $2,413,757,285 | 56% |

| Kansas | $852,289,000 | 54% | 30% | 16% | $1,300,095,656 | 66% |

| Kentucky | $994,139,000 | 71% | 22% | 8% | $1,568,414,015 | 63% |

| Louisiana | $768,565,000 | 82% | 11% | 7% | $1,396,341,731 | 55% |

| Maine | $513,049,000 | 49% | 22% | 29% | $785,498,103 | 65% |

| Maryland | $2,346,694,000 | 46% | 21% | 32% | $3,073,226,970 | 76% |

| Massachusetts | $2,240,354,000 | 34% | 20% | 46% | $2,820,488,160 | 79% |

| Michigan | $2,914,169,000 | 50% | 45% | 5% | $3,561,316,511 | 82% |

| Minnesota | $1,956,224,000 | 48% | 42% | 10% | $4,154,896,242 | 47% |

| Mississippi | $623,279,000 | 71% | 25% | 3% | $1,229,031,074 | 51% |

| Missouri | $1,064,220,000 | 67% | 30% | 3% | $1,561,177,182 | 68% |

| Montana | $446,746,000 | 57% | 36% | 7% | $433,591,746 | 100% |

| Nebraska | $618,280,000 | 60% | 33% | 7% | $1,321,709,603 | 47% |

| Nevada | $836,044,000 | 75% | 24% | 1% | $1,717,267,299 | 49% |

| New Hampshire | $419,101,000 | 44% | 20% | 37% | $586,801,288 | 71% |

| New Jersey | $3,376,399,000 | 14% | 19% | 67% | $3,982,997,979 | 85% |

| New Mexico | $460,410,000 | 50% | 47% | 3% | $572,029,177 | 80% |

| New York | $7,836,570,000 | 21% | 20% | 59% | $13,034,850,267 | 60% |

| North Carolina | $2,994,714,000 | 66% | 32% | 2% | $4,638,624,873 | 65% |

| North Dakota | $335,827,000 | 59% | 37% | 5% | $1,149,956,181 | 29% |

| Ohio | $3,162,061,000 | 60% | 29% | 11% | $4,608,355,216 | 69% |

| Oklahoma | $1,586,164,000 | 31% | 49% | 20% | $1,931,412,570 | 82% |

| Oregon | $1,230,917,000 | 47% | 45% | 8% | $1,581,015,574 | 78% |

| Pennsylvania | $6,003,784,000 | 56% | 20% | 24% | $9,079,177,201 | 66% |

| Rhode Island | $147,305,000 | 54% | 14% | 32% | $316,365,174 | 47% |

| South Carolina | $1,211,199,000 | 53% | 35% | 12% | $1,642,141,422 | 74% |

| South Dakota | $315,547,000 | 59% | 37% | 4% | $666,259,918 | 47% |

| Tennessee | $1,613,688,000 | 67% | 33% | 0% | $1,602,780,484 | 100% |

| Texas | $8,591,051,000 | 43% | 32% | 25% | $11,542,374,988 | 74% |

| Utah | $736,694,000 | 68% | 30% | 2% | $1,665,680,229 | 44% |

| Vermont | $158,249,000 | 52% | 46% | 1% | $452,556,470 | 35% |

| Virginia | $2,755,628,000 | 40% | 25% | 35% | $4,484,927,457 | 61% |

| Washington | $3,525,274,000 | 49% | 36% | 16% | $3,716,875,084 | 95% |

| West Virginia | $559,850,000 | 75% | 1% | 24% | $846,427,681 | 66% |

| Wisconsin | $1,776,622,000 | 59% | 30% | 11% | $3,935,721,697 | 45% |

| Wyoming | $238,314,000 | 48% | 48% | 5% | $409,774,278 | 58% |

| U.S. | $101,773,461,000 | 49% | 30% | 21% | $145,331,426,925 | 70% |

|

Note: Federal highway funding to the states is subtracted from spending figures. Percentages reflect only the share of the spending that state and localities are responsible for. Sources: Tax Foundation calculations from the Census Bureau, State and Local Government Finance and Federal Highway Administration data. |

||||||