Key Findings

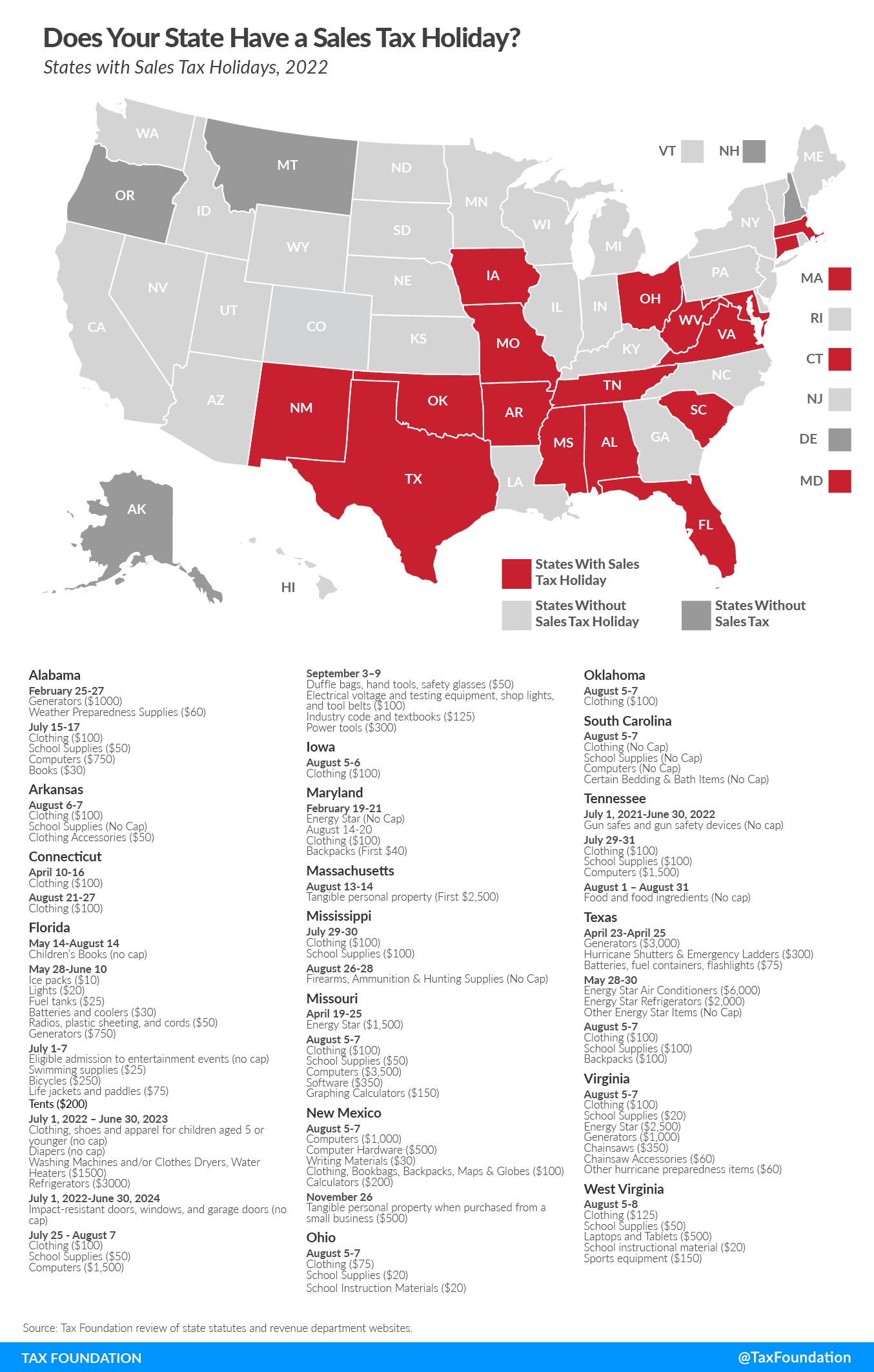

- Seventeen states will hold a sales tax holiday in 2022, down from a peak of 19 in 2010 and unchanged from last year.

- Sales tax holidays do not promote economic growth or significantly increase consumer purchases; the evidence (including a 2017 study by Federal Reserve researchers) shows that they simply shift the timing of purchases.

- Sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. holidays are an inefficient response to inflation that encourage spending to be concentrated in a limited window at a time when supply chains are already strained.

- Sales tax holidays create complexities for taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code compliance, efficient labor allocation, and inventory management. However, free advertising for what is effectively a 4 to 7 percent discount leads many larger businesses to lobby for the holidays.

- Most sales tax holidays involve politicians picking products and industries to favor with exemptions, arbitrarily discriminating among products and across time, and distorting consumer decisions.

- While sales taxes are somewhat regressive, this does not make sales tax holidays effective for providing relief to low-income individuals. To give small tax savings to those with lower in-comes, holidays give large savings to higher-income groups as well.

- Such political gimmicks distract from genuine, permanent tax relief. If a state must offer a “holiday” from its tax system, it is an implicit recognition that the tax system is uncompetitive. If policymakers want to save money for consumers, they should cut the sales tax rate year-round.

Table of Contents

- Executive Summary & State Map

- Principles of Sales Taxation

- History of Sales Tax Holidays

- Sales Tax Holidays Do Not Promote Economic Growth

- Sales Tax Holidays and the Post-Coronavirus Economy

- Sales Tax Holidays Discriminate Arbitrarily Among Products

- Sales Tax Holidays Can Mislead Consumers about Savings

- Sales Tax Holidays Cause Costly Complexity and Instability

- Sales Tax Holidays Discriminate Across Time

- Sales Tax Holidays Are Not an Effective Means of Relief for Low-Income Consumers

- Sales Tax Holidays Are Not Real Tax Cuts and Distract from Genuine Tax Reform

- Conclusion

Executive Summary

Sales tax holidays are periods when selected goods are exempted from state (and sometimes local) sales taxes. Such holidays have become an annual event in many states, with exemptions for such targeted items as back-to-school supplies, clothing, computers, hurricane preparedness supplies, products bearing the U.S. government’s Energy Star label, and even guns. New York State, which is known for high state taxes, sparked the trend in 1997 as a way to discourage border shopping.

In 2022, 17 states will conduct sales tax holidays, down from a peak of 19 in 2010 and unchanged from last year (see Table 1). Although Florida already offered multiple sales tax holidays in years past, it added several holidays this year, aimed at children’s books, children’s clothing, and Energy Star items. Notably, the sales tax holidays on children’s clothing and Energy Star products will last an entire year, and the holiday on impact-resistant doors, windows, and garage doors will last two years. The Sunshine State is not alone in its longer holidays—Tennessee instituted a year-long holiday on gun safety equipment last July that only recently ended.

At first glance, sales tax holidays seem like great policy. They enjoy broad political support, with backers arguing that holidays are a highly visible form of tax cuts and provide benefits to low-income consumers. Politicians and other supporters routinely claim that sales tax holidays improve sales for retailers, create jobs, and promote economic growth.

Despite their political popularity, sales tax holidays are based on poor tax policy and distract policy-makers and taxpayers from real, permanent, and economically beneficial tax reform. Sales tax holidays introduce unjustifiable government distortions into the economy without providing any significant boost to the economy. They represent a real cost for businesses without providing substantial benefits. They are also an inefficient means of helping low-income consumers and an ineffective means of providing savings to consumers.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe| State | Sales Tax Rate | Dates | Clothing | School Supplies | Computers | Energy Star | Miscellaneous | ||

|---|---|---|---|---|---|---|---|---|---|

| Alabama | 4% state + local rates up to 7.5% | February 25-27 | Generators ($1,000); weather preparedness supplies ($60) | ||||||

| July 15-17 | $100 | $50 | $750 | Books ($30) | |||||

| Arkansas | 6.5% state +local rates up to 6.125% | August 6-7 | $100 | No Cap | Clothing accessories ($50) | ||||

| Connecticut | 6.35% state | April 10-16 | $100 | ||||||

| August 21-27 | $100 | ||||||||

| Florida | 6% state + local rates up to 2% | May 14-August 14 | Children’s books (no limit) | ||||||

| May 28-June 10 | Generators ($750); radios, plastic sheeting, and cords ($50); batteries and coolers ($30); fuel tanks ($25); lights ($20); ice packs ($10) | ||||||||

| July 1-7 | Eligible admission to entertainment events; swimming supplies ($25); bicycles ($250); life jackets and paddles ($75); tents ($200) | ||||||||

| July 1, 2022-June 30, 2023 | Children’s clothing for children up to age 5 (no cap) | Clothes dryers, washing machines, and water heaters ($1,500); refrigerators ($3,000) | Diapers (no cap) | ||||||

| July 1, 2022-June 30, 2024 | Impact resistant doors, windows, and garage doors (no cap) | ||||||||

| July 25-August 7 | $100 | $50 | $1,500 | ||||||

| September 3-9 | Duffle bags, hand tools, safety glasses ($50); Electrical voltage and testing equipment, shop lights, and tool belts ($100); industry code and textbooks ($125); power tools ($300) | ||||||||

| Iowa | 6% state + local rates up to 1% | August 5-6 | $100 | ||||||

| Maryland | 6% state | February 19-21 | No Cap | ||||||

| August 14-20 | $100 | Backpacks (First $40) | |||||||

| Massachusetts | 6.25% state | August 13-14 | Tangible personal property (First $2,500) | ||||||

| Mississippi | 7% state + local rates up to 1% | July 29-30 | $100 | $100 | |||||

| August 26-28 | Firearms, ammunition, and hunting supplies (no cap) | ||||||||

| Missouri | 4.225% state + local rates up to 5.763% | April 19-April 25 | $1,500 | ||||||

| August 5-7 | $100 | $50 | Computers or peripheral devices ($3,500); software ($350) | Graphing calculators ($150) | |||||

| New Mexico | 5% state + local rates up to 4.313% | August 5-7 | $100 | $30 | Computers ($1,000); computer hardware ($500) | Writing materials ($30); bookbags, backpacks, maps, and globes ($100); calculators ($200) | |||

| November 26 | Various types of tangible personal property items, when purchased from a small business ($500) | ||||||||

| Ohio | 5.75% state + local rates up to 2.25% | August 5-7 | $75 | $20 | School instructional material ($20) | ||||

| Oklahoma | 4.5% state + local rates up to 7% | August 5-7 | $100 | ||||||

| South Carolina | 6% state + local rates up to 3% | August 5-7 | No Cap | No Cap | No Cap | Bedding and bath items (no cap) | |||

| Tennessee | 7% state + local rates up to 2.75% | July 1, 2021-June 30,2022 | Gun safes and gun safety devices (no cap) | ||||||

| July 29-31 | $100 | $100 | $1,500 | ||||||

| August 1-August 31 | Non-prepared food and food ingredients | ||||||||

| Texas | 6.25% state + local rates up to 2% | April 23-25 | Generators ($3,000); hurricane shutters and emergency ladders ($300); batteries, fuel containers, and flashlights ($75) | ||||||

| May 28-30 | Air conditioners ($6,000); refrigerators ($2,000); other items (No Cap) | ||||||||

| August 5-7 | $100 | $100 | Backpacks ($100) | ||||||

| Virginia | 5.3% state + local rates up to 0.7% | August 5-7 | $100 | $20 | $2,500 | Generators ($1,000); chainsaws ($350); chainsaw accessories ($60); other hurricane preparedness items ($60) | |||

| West Virginia | 6% + local rates to 1% | August 5-8 | $125 | $50 | $500 | School instructional material ($20); sports equipment ($150) | |||

| Source: Federation of Tax Administrators; Tax Foundation review of state statutes and revenue department websites. | |||||||||

Principles of Sales Taxation

Sales taxes are a type of consumption tax, or a tax on spending on goods and services purchased by the end user. The principle underlying the use of sales taxes to fund government is that individuals should pay taxes in proportion to the benefit they receive from government spending; this idea is known as the benefit principle. Personal consumption is considered an appropriate proxy for the amount of government services consumed by an individual.

Thus, a tax on consumption is considered an equitable method of paying for government services.[1] Consumption also has the advantage of being relatively easy to track, measure, and tax. Many economists also prefer a consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or an income tax where all savings is tax-deductible. over an income tax because consumption taxes do not tax (and thereby discourage) savings.

Sales taxes in the United States are consumption taxes, but they largely exempt certain transactions, such as higher education, housing, and health care. A properly structured sales tax, however, would tax all consumption by end users including services that are currently excluded.

Broadening the sales tax base while lowering the sales tax rate would mitigate both volatility in revenue collections and the economic harm caused by a high tax rate. A high tax rate increases distortions in the market and can inhibit growth by making a state less attractive for individuals and businesses.

Another important feature of good sales taxes is that they tax consumption once and only once. Business inputs, or business-to-business purchases that are used to create other products or services, should be excluded from the sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . Otherwise, final products will be taxed multiple times: once (or more) during production and again when purchased by the end user. In practice, this multiple taxation unfortunately occurs in many states.

Sales taxes tend to be inherently regressive with regard to income, as low-income individuals tend to spend a greater percentage of their income in taxable sales than high-income individuals. In an effort to reduce this regressivity, items viewed as basic necessities, such as groceries, utilities, clothing, and prescription drugs, are often exempted from sales taxes in the United States. But these exemptions also benefit high-income taxpayers, while narrowing the base and necessitating a higher tax rate.

Ideally, sales tax reform would broaden sales tax bases while lowering sales tax rates, to produce a system that collects stable revenue with minimal economic distortion. Sales tax holidays are an example of the opposite—base narrowing—in that they carve out exemptions for certain transactions during certain time periods.

The History of Sales Tax Holidays

Ohio and Michigan enacted the first sales tax holidays in 1980 when they offered one-time tax holidays for automobile purchases. But it was New York that sparked the modern trend, with the first sales tax holidayA sales tax holiday is a period of time when selected goods are exempted from state (and sometimes local) sales taxes. Such holidays have become an annual event in many states, with exemptions for such targeted products as back-to-school supplies, clothing, computers, hurricane preparedness supplies, and more. for clothing in 1997. New York’s objective was to tackle cross-border shopping, the phenomenon of residents traveling to nearby states to take advantage of lower sales tax rates (particularly clothing purchases in New Jersey). The sales tax holiday gave hope of reducing border shopping without the need to actually reduce the state’s sales tax rate.

While sales tax holidays are often defended on grounds of economic benefits, in reality, a key motivation has been attempting to stop cross-border shopping, and perhaps even lure shoppers from other states. In 2005, Massachusetts adopted an extremely generous weekend sales tax holiday applying to all goods up to $2,500, attempting to stop Massachusetts residents from shopping in next-door New Hampshire, which has no sales tax.[2].

Since the inception of sales tax holidays, many states have created them around certain products and industries.[3] In 2022, 16 states will hold clothing sales tax holidays, 12 states will have school supplies sales tax holidays, seven states will have computer sales tax holidays, and five states will have Energy Star products sales tax holidays.[4] Altogether, 17 states will conduct a holiday, two fewer than in 2010. (See Tables 2 and 3 for a chronicle of sales tax holidays.)

A number of states have tried sales tax holidays and then canceled them, a trend that accelerated during the 2007 recession and its related state government revenue downturn, although the number has remained more stable since, only fluctuating by about one holiday a year. Florida and Maryland canceled their holidays after that year (but have reinstated them since). Massachusetts canceled its 2009 holiday after it hiked its sales tax from 5 percent to 6.25 percent. In 2018, however, Massachusetts established a one-time sales tax holiday just ten days before the holiday was planned to start, and reinstated the annual holiday from 2019 onward in a separate bill.[5] Even before this official reinstatement, the state had a habit of reinstating it at the last minute most years since. In 2009, the District of Columbia, faced with declining revenue and a widening budget shortfall, announced the one-year suspension of its August sales tax holiday only weeks before it was scheduled to occur, later repealing it permanently. Meanwhile, Florida, having skipped holidays in 2008 and 2009, returned to having a tax holiday in 2010. Georgia canceled its annual holidays in 2017.[6]

In July 2013, North Carolina approved legislation ending future sales tax holidays, using the revenue instead for broad-based tax relief. In 2016, Massachusetts canceled its sales tax holiday (traditionally held in August), citing a lack of revenue as reason for its hiatus.[7] In June 2018, the Louisiana state legislature passed broad sales tax legislation which changed its state sales tax rate from 5 percent to 4.45 percent. As part of the sales tax changes, the state also suspended its sales tax holidays for seven years, so while the May holiday had already occurred in 2018, the August and September holidays did not. In 2019, West Virginia passed legislation to create a sales tax holiday in 2021, which has continued in 2022.

Many other localities, counties, towns, and even individual vendors (where permitted) have opted out of their state’s sales tax holidays.[8] As noted tax scholar John Mikesell put it, “State lawmakers are in the position of making a politically attractive decision with the cost of that decision being borne by someone else (local lawmakers), [a condition] ripe for poor policy choices.”[9]

| Year | States with a Sales Tax Holiday | ||||

|---|---|---|---|---|---|

| 1980 | 2 (MI, OH) | ||||

| 1981-1996 | None | ||||

| 1997 | 1 (NY) | ||||

| 1998 | 2 (FL, NY) | ||||

| 1999 | 3 (FL, NY, TX) | ||||

| 2000 | 7 (CT, FL, IA, NY, PA, SC, TX) | ||||

| 2001 | 7+DC (CT, FL, IA, NY, PA, SC, TX) | ||||

| 2002 | 8+DC (CT, GA, IA, NC, PA, SC, TX, WV) | ||||

| 2003 | 9 (CT, GA, IA, NY, NC, SC, TX, VT, WV) | ||||

| 2004 | 12+DC (CT, FL, GA, IA, MA, MO, NY, NC, SC, TX, VT, WV) | ||||

| 2005 | 12+DC (CT, FL, GA, IA, LA, MA, MO, NM, NY, NC, SC, TN, TX, VA) | ||||

| 2006 | 15+DC (AL, CT, FL, GA, IA, MD, MA, MO, NM, NY, NC, SC, TN, TX, VA) | ||||

| 2007 | 15+DC (AL, CT, FL, GA, IA, LA, MA, MO, NM, NC, OK, SC, TN, TX, VA) | ||||

| 2008 | 16+DC (AL, CT, GA, IA, LA, MA, MO, NM, NC, OK, SC,TN, TX, VT, VA, WV) | ||||

| 2009 | 16 (AL, CT, GA, IA, LA, MS, MO, NM, NC, OK, SC, TN, TX, VT, VA, WV) | ||||

| 2010 | 19 (AL, CT, FL, IL, IA, LA, MD, MA, MS, MO, NM, NC, OK, SC, TN, TX, VT, VA, WV) | ||||

| 2011 | 17 (AL, AR, CT, FL, IA, LA, MD, MA, MS, MO, NM, NC, OK, SC, TN, TX, VA) | ||||

| 2012 | 18 (AL, AR, CT, FL, GA, IA, LA, MD, MA, MS, MO, NM, NC, OK, SC, TN, TX, VA) | ||||

| 2013 | 18 (AL, AR, CT, FL, GA, IA, LA, MD, MA, MS, MO, NM, NC, OK, SC, TN, TX, VA) | ||||

| 2014 | 17 (AL, AR, CT, FL, GA, IA, LA, MD, MA, MS, MO, NM, OK, SC, TN, TX, VA) | ||||

| 2015 | 18 (AL, AR, CT, FL, GA, IA, LA, MD, MA, MS, MO, NM, OH, OK, SC, TN, TX, VA) | ||||

| 2016 | 17 (AL, AR, CT, FL, GA, IA, LA, MD, MS, MO, NM, OH, OK, SC, TN, TX, VA) | ||||

| 2017 | 16 (AL, AR, CT, FL, IA, LA, MD, MS, MO, NM, OH, OK, SC, TN, TX, VA) | ||||

| 2018 | 17 (AL, AR, CT, FL, IA, LA, MD, MS, MO, NM, OH, OK, SC, TN, TX, VA, WI) | ||||

| 2019 | 16 (AL, AR, CT, FL, IA, MD, MA, MS, MO, NM, OH, OK, SC, TN, TX, VA) | ||||

| 2020 | 16 (AL, AR, CT, FL, IA, MD, MA, MS, MO, NM, OH, OK, SC, TN, TX, VA) | ||||

| 2021 | 17 (AL, AR, CT, FL, IA, MD, MA, MS, MO, NM, OH, OK, SC, TN, TX, VA, WV) | ||||

| 2022 | 17 (AL, AR, CT, FL, IA, MD, MA, MS, MO, NM, OH, OK, SC, TN, TX, VA, WV) | ||||

| Source: Tax Foundation; Federation of Tax Administrators; state statutes and revenue departments. | |||||

| State | Items | Days | Date | Years |

|---|---|---|---|---|

| Alabama | Hurricane Supplies | 3 | July (2012), Early February, Late February (2018-2020) | 2012-2022 |

| Clothing, computers, school supplies, books | 3 | Early August, Mid July (2017-2020) | 2006-2022 | |

| Arkansas | Clothing, school supplies | 2 | Early August | 2011-2022 |

| Connecticut | Clothing, footwear | 7 | Mid August | 2000-2022 |

| Energy Star Appliances | 3 months | June – September | 2007 | |

| Clothing, footwear | 7 | Mid April | 2022 | |

| Florida | Clothing, footwear, books, and school supplies (beginning in 2004) | 7-9 (2004-2009), 3 (2010-2018) | End July (2004-2009), Early/Mid August (2010-2022) | 1998-2001, 2004-2022 |

| Emergency Supplies | 12, 3 (2017), 7 (2018) | Late May/early June | 2005-2007, 2014, 2017-2022 | |

| Summer activity accessories | 7 days | Early July | 2021-2022 | |

| Children’s books | 3 months | May to August | 2022 | |

| Workman’s supplies | 7 days | Early September | 2022 | |

| Children’s clothing up to age 5, Energy Star Appliances | 1 year | July to July | 2022-2023 | |

| Impact-resistant doors, windows, and garage doors | 2 years | July to July | 2022-2024 | |

| Energy Star Appliances | 7 | Early October | 2006, 2014 | |

| Georgia | Clothing, footwear, books, school supplies, and computers | 4, 2 (2016) | Late March (2002), late July/early August | 2002 (twice), 2003-2009, 2012-2016 |

| Energy Star Appliances | 4, 3 (2016) | Early/mid October | 2005, 2007-2009, 2012-2016 | |

| Illinois | Clothing, footwear, and school supplies | 10 | Early/mid August | 2010 |

| Iowa | Clothing, protective equipment, select sports equipment | 2 | Early August | 2000-2022 |

| Louisiana | Tangible personal property, first $2,500 | 2 | Mid December, Early August | 2005, 2007-2017 |

| Hurricane Supplies | 2 | Late May | 2008-2015, 2017-2018 | |

| Firearms | 3 | Early September | 2009-2017 | |

| Maryland | Clothing, footwear | 5-7 | Mid/late August | 2001, 2006, 2010-2022 |

| Energy Star Appliances | 3 | Mid February | 2011-2022 | |

| Massachusetts | Tangible personal property, first $2,500 | 1-2 | Mid August | 2004-2008, 2010-2015, 2018-2022 |

| Mississippi | Clothing, footwear | 2 | Late July/early August | 2009-2022 |

| Firearms | 3 | Late August (2016), Early September | 2014-2022 | |

| Missouri | Energy Star Appliances | 7 | Late April | 2009-2022 |

| School supplies, computer software and hardware, graphing calculators, clothing, and footwear (beginning in 2005) | 3 | Early/mid Augst | 2004-2022 | |

| New Mexico | Clothing, footwear, computers, school supplies | 3 | Early August | 2005-2022 |

| Personal property items, when purchased from a small business | 1 | Late November | 2018-2022 | |

| New York | Clothing, footwear | 7 | Mid January | 1997-2000, 2004-2006 |

| Clothing, and footwear (beginning in 1998) | 7 | Early September | 1997-1999, 2003-2005 | |

| Ohio | Clothing, school supplies, instructional material | 3 | Early August | 2015-2020 |

| Oklahoma | Clothing, footwear | 3 | Early August | 2007-2020 |

| Pennsylvania | Computers | 8 | Mid August (2000, 2001), Mid February (2001, 2002) | 2000, 2001 (twice), 2002 |

| South Carolina | Clothing, footwear, school supplies, computers, printers, software, various bath supplies, and bed linens | 3 | Early August | 2000-2022 |

| Most purchases | 2 | Late November | 2006 | |

| Firearms | 2 | Late November | 2008-2010 | |

| Tennessee | Clothing, school supplies, computers | 3 | Late July/early August | 2006-2020 |

| Clothing, school supplies, computers | 3 | Late April | 2006-2008 | |

| Retail sale of food and drink by restaurants | 3 | Early August | 2020 | |

| Gun safety devices | 1 year | July to July | 2021-2022 | |

| Non-prepared food and food ingredients | 31 | August | 2022 | |

| Texas | Clothing, footwear | 3 | Early/Mid August | 1999-2022 |

| Energy Star Appliances | 3 | Late May | 2008-2022 | |

| Batteries, flashlights, storm preparation tools, generators | 3 | Mid/Late April | 2016-2022 | |

| Vermont | Computers | 3 | Mid August/Mid October | 2003, 2004 (twice) |

| Tangible personal property | 1-2 | Mid July (2008), late August (2009), Early March (2010) | 2008-2010 | |

| Energy Star Appliances | 7 | Mid July | 2009 | |

| Virginia | School supplies, clothing, footwear | 3 | Early August | 2006-2020 |

| Energy Star Appliances | 3 (2017-2018), 4 | Early October (2007-2014), Early August (2016-2022) | 2007-2022 | |

| Hurricane Supplies | 3 (2017-2018), 7 | Late May (2008-2014), Early August | 2008-2022 | |

| West Virginia | Clothing, footwear, school supplies, computers, educational software | 3 | Early August | 2002-2004 |

| Energy Star Appliances | 7, 3 months (2009-2010) | Early September, September-November (2009-2010) | 2008-2010 | |

| Clothing, school supplies, computers, sports equipment | 2021-2022 | |||

| Wisconsin | Clothing, school supplies, computers | 5 | Early August | 2018 |

| District of Columbia | School supplies, clothing, footwear | 9-10 | Early/mid August | 2001-2002, 2004-2008 |

| Clothing and Shoes | 9-10 | Late November | 2001, 2004-2008 | |

| Source: Federation of Tax Administrators; Adam J. Cole, Sales Tax Holidays, 1997-2007: A History, 47 State Tax Notes 1001 (March 2008); Ala. Code § 40-23-210 et seq.; Ark. Code § 26-52-444; Conn. Gen. Stat. § 12-407E; Ga. Code § 48-8-3(75); Iowa Code § 423.3(68); La. Rev. Stat. § 47:305.54; Md. Code, Tax-Gen. § 11-228; Miss. Code § 27-65-111(Bb); Mo. Rev. Stat. § 144.049; N.M. Stat. § 7-9-95; N.Y. Tax Law § 1115(30) (Repealed); N.C. Gen. Stat. § 105-164.13C; Okla. Stat. tit. 68, § 1357.10; 72 Pa. Cons. Stat. § 7204(58) (Repealed); S.C. Code § 12-36-2120(57); Tenn. Code § 67-6- 393; Tex. Tax Code § 151.326, 151.327; Va. Code § 58.1-611.2; W. Va. Code § 11-15-9G; D.C. Code § 47-2005(32A) (Repealed). Florida did not codify its 2011 sales tax holiday. SeeH.b. 143, 2011 Leg. (Fla. 2011). Mass. Code § 121.6A. 2022 Fla. H.B. 7071. Tenn. Code Ann. § 67-6-393(i)(1), Tenn. Code Ann. § 67-6-393(h)(1). W. Va. Code § 11-15-9s. | ||||

Sales Tax Holidays Do Not Promote Economic Growth

Supporters claim that sales tax holidays stimulate the economy. They argue that, first, individuals will purchase more of the exempted goods than they would have in the absence of a holiday, and second, consumers will increase their consumption of nonexempt goods through “impulse” purchases, paying taxes that would otherwise not have been collected.

With inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. skyrocketing as a flood of dollars chases after scarce goods still suffering from supply chain bottlenecks, boosting consumption is not an obvious economic need at present, even if sales tax holidays served this purpose. Reducing the sting of inflation is important, but sales tax holidays do little to help on that front.

Rather than stimulating new sales, sales tax holidays simply shift the timing of sales. A 2009 University of Michigan study looking at computer purchases during sales tax holidays found that this timing shift “accounts for between 37 and 90 percent of the increase in purchases in the tax holiday states over [a] 30-week horizon,” depending on price caps and particular products.[10] The same study also notes that the reduction in sales tax revenue is consistent with both longer and shorter sales tax holidays, further solidifying the notion that consumers are timing their purchases to fall within the holiday period. Anecdotal evidence from other states supports these conclusions.[11]

What this means is that purchases which would have been made regardless will be concentrated in a shorter period. The standard market response, to avoid further shortages, is to raise prices until the market reaches equilibrium—the last thing consumers need right now. And where prices are sufficiently sticky that merchants may not raise them during a short sales tax holiday, consumers might see even more empty shelves.

Evidence also suggests that sales tax holidays attracted cross-border sales only when other states did not have their own holidays, which is no longer the case. Peter Morici, an economist at the University of Maryland, told the Washington Examiner in 2006 that a sales tax holiday “has to be a novelty to be a measurable success and it’s no longer.”[12] As the costs of squeezing a disproportionate number of sales into a short period of time have become clear, evidence suggests that fewer shoppers participate.[13] For the vast majority of those who shop during sales tax holidays, the holiday simply provides a modest windfall, or unexpected benefit, for doing something they would have done anyway.

“Impulse” purchases occur whenever consumers shop, and if consumers merely shift their purchases into a tax-free period, as the evidence suggests, their “impulse” purchases during a sales tax holiday are likewise shifted from other time periods. The increase in tax revenue would be far outweighed by the lost revenue from the much larger amount of tax-free purchases. It is therefore unlikely there is a net revenue gain from additional “impulse” purchases. And even if the “impulse” argument were true and consumers essentially were tricked into making extra unnecessary taxable purchases, that would contradict the argument that sales tax holidays are designed to provide a tax cut for consumers, or that it is responding to people’s needs at a time when inflation is rapidly eroding their purchasing power.

Job creation is a frequent argument in support of sales tax holidays. But this argument suffers from the same problems as the argument based on general economic growth. Any increase in employment will be modest and temporary, limiting the benefits. Temporary increases in labor associated with sales tax holidays are costly for businesses, more so than an equivalent increase spread over the whole year, because of the fixed cost associated with hiring and training multiple temporary employees. By focusing on encouraging a few days of temporary employment during sales tax holidays, lawmakers lose sight of and undermine policies that promote long-term economic growth and job creation.

Not every state is convinced of the merits of such holidays. Back in 2009, the District of Columbia Office of Taxation and Revenue estimated that it would save $640,000 in tax revenue when it canceled its sales tax holiday that year.[14] After eight years of sales tax holidays, District tax officials found the holiday did not spur enough economic growth to offset the costs. North Carolina officials found that repealing their sales tax holiday in 2013 would save the state $16.3 million the next year and put those dollars toward individual and corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. cuts.[15] Georgia later followed suit, discontinuing its tradition of sales tax holidays in 2017.[16] Other states would be wise to follow this lead and reevaluate the costs and benefits of sales tax holidays.

Sales tax experts and economists widely agree that there is little evidence of increased economic activity as a result of sales tax holidays.[17] Politicians claim that sales tax holidays largely pay for themselves through increased economic activity and new collections. But experience shows that the claims of economic stimulus, increased revenue, and consumer savings are greatly exaggerated. States see little net economic activity as a result of sales tax holidays; the holidays instead represent a costly-to-administer revenue loss for the government.

Sales Tax Holidays and the Post-Coronavirus Economy

While sales tax holidays have been politically popular for a long time, they have seen a boost this year as lawmakers look for ways to share surplus funds with taxpayers who are struggling to afford goods and services amid high inflation. But however well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

Currently, inflation is high because a lot of dollars are chasing after a limited number of goods. If sales tax holidays really did increase demand, as proponents say they do, they would be mildly inflationary, contributing to the problem instead of the solution. But even if they only shift demand, they run up against supply chain bottlenecks and become counterproductive. It would be far better for states to make changes to ensure their tax codes do not stand in the way of businesses trying to keep up with demand.

Policies which simply put additional dollars into the economy, or reduce tax costs on an extremely temporary basis, can induce additional demand under certain circumstances—insufficient demand is hardly the problem right now—but do nothing to address the supply problem. Businesses will not invest in additional productive capacity in response to states adopting some temporary sales tax holidays.

Sales Tax Holidays Discriminate Arbitrarily among Products

Sales tax holidays usually apply only to a specific list of products, such as school supplies, sports equipment, clothing, and computers. The number of categories has expanded in recent years to include specific appliances, hurricane preparedness supplies, and even firearms. Restaurant owners in Massachusetts have even pushed for a prepared food sales tax holiday.[18] These lists are a product of political forces. Politicians single out specific populations or industries and bestow targeted tax breaks on them. Such discrimination among products distorts consumer spending and reduces market efficiency by favoring certain products over others.

For example, the New Mexico sales tax holiday exempts computer microphones but not headsets, blank painting canvases but not dry erase boards, and backpacks but not duffel bags. Many states exempt backpacks during their “back to school” sales tax holidays even though students may prefer to purchase comparably priced messenger-style bags or duffel bags which accomplish the same functional goal but are not tax-exempt. The sales tax holiday raises the price of these items relative to backpacks and so students are influenced to purchase the backpacks. Though they save a little money on the purchases, they end up with less suitable products that they may not have purchased in the absence of the holiday.

Likewise, a low-income elderly or childless couple may not have a need for school supplies, a computer, or sports equipment, but presumably they are as deserving of tax cuts as a consumer purchasing any of the exempt products. Using the tax code to discriminate among products can easily translate into discrimination among certain types of consumers, driving sales taxes further from the ideal policy based on the benefit principle. Massachusetts gets the closest to avoiding this problem, as it exempts all tangible personal property up to a certain price cap.

The arbitrary selection of products granted a sales tax holiday runs into additional problems when the seasonality of demand is considered. The University of Michigan notes that taxes can be higher on products with relatively inelastic demand. Sales tax holidays are often offered when seasonal demand is greatest and the most inelastic: holidays for school supplies and clothing in late summer, for instance, or hurricane preparedness supplies shortly before hurricane season. These sales tax holidays, therefore, function as a tax break but do little to shift demand curves.

While it is true that consumers always face these cost-benefit tradeoffs in the market, tax policy should avoid adding unnecessary and discriminatory market distortions. In general, political efforts to manipulate the economy make markets less efficient by influencing consumers, retailers, and manufacturers to consume, sell, and produce more or less of a product than they otherwise would. While the economic costs of these distortions may be difficult to measure, they are real and economically damaging.

The fact that most sales tax holidays impose a price limit on the goods that are exempt only worsens the economic distortions. This encourages consumers to purchase cheaper goods over more expensive goods during sales tax holidays, even if they would prefer an item of better quality or suitability. Consumers should make consumption decisions for their individual economic reasons, not tax reasons.

Sales Tax Holidays Can Mislead Consumers about Savings

Large retailers are often the biggest supporters of sales tax holidays. Given that they are the beneficiaries of free marketing for what is essentially a modest 4 to 7 percent discount, this is not surprising. On items where prices fluctuate regularly, retailers may also increase prices during a sales tax holiday, though this is not always the case, and some may promote the holiday paired with their own sales. Either way, policymakers should not be convinced that a sales tax holiday is a good idea just because retailers support it.[19]

As weeks or months of sales cram into a weekend or a week, demand rises dramatically during sales tax holidays. Because the amount of inventory a retailer can have on hand is finite, some retailers understandably respond by raising prices rather than running out of stock too quickly. When lawmakers create sales tax holidays, the assumption is that the benefit will be passed on to consumers in the form of lower prices. In reality, some retailers absorb those benefits themselves.

For example, assume a pair of shoes costs $50, and that the total comes to $53 with tax. During a sales tax holiday, the shoes are exempt from the sales tax, so the consumer would expect to pay $50. But if the shoes are in very high demand, a retailer may have to raise the price to avoid running out of stock too quickly—or may choose to do so because a higher price is now revenue-maximizing. If the retailer raises the price to $51 or $52, the retailer absorbs a large share of the savings intended to go to the consumer.

A 2003 study from researchers at the University of West Florida reflects this when it examines the price effect of Florida’s sales tax holiday.[20] Using 10 types of apparel across 10 retail locations, data was collected over a three-week period to analyze whether before-tax prices were comparable before, during, and after the sales tax holiday. They found that retailers absorbed up to 20 percent of the benefit of a sales tax holiday, significantly reducing the benefit that consumers received. Their study is not conclusive for all tax holidays, but it does suggest that absorption of savings occurs in some cases.[21]

The aforementioned University of Michigan study[22] primarily looked at how tax holidays affected pre-tax prices on computer sales. While the results were not statistically significant, the author argues it is possible retailers actually overshift the benefit of sales tax holidays onto consumers by lowering prices before and during the holidays. A 2018 study from Indiana University later examined this same question, looking specifically at Tennessee.[23] Because the state hosted two school supply holidays—one in the spring and one in the fall—the researchers could better separate between increases caused by natural seasonal demand for school supplies, and increases caused solely by the sales tax holiday. The researchers assert that, in this instance, there was no significant overshifting, and very minor instances of retailers recapturing some of the savings.

Sales Tax Holidays Cause Costly Complexity and Instability

Tax codes should be as simple as possible. Tax complexity means additional tax compliance costs. Because of their impacts on labor allocation and inventory management, sales tax holidays add complexity to sales taxes and are accompanied by administrative costs, which can place a huge burden on businesses. This extra burden represents a real cost to businesses, particularly small businesses, as valuable resources are diverted to pay for compliance with and implementation of sales tax holidays. While technology continues to make this process easier than it was in the past, businesses must still take steps to ensure their register systems are in compliance with the temporary tax changes.

It’s worth noting that most states prohibit stores from advertising that they will pay the sales tax on a purchase for the consumer; during a sales tax holiday, however, what is normally prohibited becomes mandatory. Lawmakers are likely to be under strong political pressure to provide ever expansive exemptions, and businesses are required to track and comply with these year-to-year law changes. These costs are especially high for small businesses without the overhead to dedicate employees to tracking these changes and ensuring compliance.[24]

Sales tax holidays force businesses to operate under more than one set of sales tax laws each year. These include nonintuitive and sometimes absurdly minute regulations about the holiday’s operation. For example, Mississippi’s sales tax holiday regulations permit the use of coupons, prohibit layaway sales but permit rain checks, and exclude shipping costs from the holiday.[25] Virginia’s sales tax holiday permits layaway sales and rain checks, does not permit rebates to lower the sales price, and excludes shipping but includes handling.[26] South Carolina subjects layaway sales to tax during its holiday.[27] Texas exempts layaway sales as well as shipping, handling, and even installation costs as part of its Energy Star product tax holiday.[28]

Virginia’s hurricane preparedness holiday is ostensibly to help consumers stockpile needed supplies, but the list there is arbitrary as well.[29] Cell phone chargers are exempt, but laptop chargers are not. Duct tape is exempt but not masking or electrical tape. What some states include is somewhat unusual. South Carolina included “bath wash clothes, blankets, bed spreads, bed linens, sheet sets, comforter sets, bath towels, shower curtains, bath rugs and mats, pillows, and pillow cases” in its general sales tax holiday.[30] Virginia includes “clerical vestments” in its definition of clothing, along with suspenders.[31]

Besides the complexities of preparing for the sales tax holiday, businesses will have to deal with a distortion in consumer spending as shoppers shift their buying patterns to coincide with sales tax holidays. The increased activity during sales tax holidays may be accompanied by the need to hire temporary workers or pay their employees overtime compensation, as previously noted. But because this increase in consumption is largely a result of consumers shifting the timing of purchases, the result is simply a loss in efficiency for businesses without an overall boost in sales.

One retail establishment respondent in a 2015 survey of Massachusetts Retailers Association members said, “The sales tax holiday has created more problems than benefits for us. Business is nonexistent three weeks before and two weeks after. As a result, five weeks of business are crammed into two days, and the total amount of sales does not come close to five normal weeks of summer business.”[32]

Instability in tax law is costly to the economy not only because of complexity but also because it disrupts the plans and expectations of consumers and businesses. Not every state codifies its sales tax holiday in law; some instead pass a bill establishing it each year. Florida alternated from having a holiday, not having one, and now having one again.[33] New York did the same. Even states that have codified them can suspend them. Washington, D.C.’s last-minute cancellation of its 2009 sales tax holiday created more costs and left everyone involved uncertain.[34] The sudden change meant businesses had to change their pricing systems and registers yet again.

Lawmakers should avoid creating temporary tax laws like sales tax holidays. From the perspective of a business trying to operate at maximum efficiency, the extra administrative and labor costs associated with a sales tax holiday are an unjustifiable burden, considering the unlikelihood that sales tax holidays increase overall sales. Instead of creating a subset of tax laws that apply only temporarily and then creating ambiguity about whether those very laws will even be implemented on a year-to-year basis, lawmakers should focus on enacting real and permanent tax relief.

Sales Tax Holidays Discriminate Across Time

There is little economic justification for why a product purchased during one time period should be tax-exempt while the same product purchased in another time period should be taxable.[35] Experience with sales tax holidays shows that consumers will wait until a holiday to purchase the same goods they would have purchased earlier in the year, as outlined above. But purchases in one time period are no more beneficial to the economy, all else being equal, than purchases in another time period.

Time discrimination also has serious negative consequences for some consumers and businesses. Some consumers may be unable to shop during the sales tax holiday because they are working, out of town, or between paychecks. Presumably they are no less deserving of a tax break than consumers who can shop during the holiday, but the timing of the sales tax holiday excludes them from the tax relief.

A 2017 study by researchers at the Federal Reserve found “that sales-tax holidays are associated with significant shifts in the timing of purchases by consumers” and that “the patterns are suggestive that consumers adjust their spending behavior noticeably to take advantage of the temporarily lower prices.”[36] The study used credit transaction data gathered in the days before, during, and after the Massachusetts sales tax holidays in 2014 and 2015. Sales for high-priced durable goods, such as electronics or furniture items, more than doubled during the holiday compared to average daily sales. Sales of general merchandise also increased, suggesting the effects of the tax holiday on high-exposure goods caused reciprocal spillover effects on the sales of non-holiday goods. The study did not find a corresponding drop in purchases in the days before or after the holiday but noted that “some of the negative offsets in spending may have occurred outside the assumed time horizon. In particular, very long-lived durable goods such as furniture are likely purchased only intermittently, and these categories are where the spending response appears to have been concentrated.”[37]

Sales tax holidays result in government influencing consumers to change when they purchase goods, but in some cases, it might not be wise for consumers to put off the tax-free purchases until the holiday. (For example, it may not be the best idea to wait until the weekend before school begins to buy school supplies.) For others, it might be wiser to wait until after the holiday. For example, scholars Richard Hawkins and the late John Mikesell describe a working-class family that puts off repairing its only car so that it can take advantage of the holiday, or a single, low-income mother who runs up her credit card during the August tax holiday to buy winter coats for her children.[38]

Such government manipulation of consumer timing decisions is unwarranted and economically damaging. Experience shows that political decisions about holiday scheduling and product selection are often arbitrary and sometimes wholly unpredictable. Distorting consumer behavior with sales tax holidays is frequently not to consumers’ benefit.

Sales Tax Holidays Are Not an Effective Means of Relief for Low-Income Consumers

Some supporters claim that sales tax holidays provide tax relief to the working poor. However, sales tax holidays are an inefficient way to achieve that goal. Because sales tax holidays only provide a benefit for a short time, low-income consumers who may not be able to shop during the designated time for cost, mobility, or timing reasons cannot enjoy the benefits of the holiday.

Sales tax holidays provide savings to all income groups, not just low-income individuals. People of every income level can and do buy goods during sales tax holidays. If the purpose of sales tax holidays is to make school supplies and clothes cheaper for low-income individuals, then a 4 to 7 percent price reduction for all consumers, but only for a brief period, is an odd and ineffective way of achieving that. It’s an example of politicians using a fire hose when a garden hose will do a better job.

If the citizens of a state determine that there truly is a legitimate need to help low-income consumers obtain particular products, a more targeted and effective approach could be a rebate or voucher program. Such a program would be administratively similar to existing food stamp programs and would only be available to the needy, while avoiding costly tax relief for higher-income consumers. A rebate or voucher would make benefits available to low-income consumers regardless of when they shop. The poor would receive real benefits, while consumers and retailers would avoid the economic distortions and burdens associated with sales tax holidays.

If policymakers genuinely want to save money for consumers, they should cut the sales tax rate year-round. While the rate reduction may be modest, such a change would put the same money back in taxpayers’ hands without the distortions and complications associated with a sales tax holiday.

Sales Tax Holidays Are Not Real Tax Cuts and Distract Policymakers and Taxpayers from Tax Reform

Some advocates support sales tax holidays as a way of giving revenue back to taxpayers. However, if the ultimate policy goal is reducing government involvement in individual and market decisions, sales tax holidays are a poor choice due to their complexity, administrative burdens, distortions, and arbitrary government micromanaging. As scholars Hawkins and Mikesell put it, sales tax holidays are highly intrusive, going so far as to call them “a Soviet-style state-directed price reduction on items selected by the state.”[39]

Because states must balance their budgets, and because states rarely, if ever, cut spending to offset the revenue loss from sales tax holidays, the net result is that tax rates must rise elsewhere, now or in the future. Pushing for a sales tax holiday without associated spending cuts means that the government will have to raise revenue from other sources, creating even more complexity in the tax code.

Looking only at the amount of revenue raised provides an incomplete picture of the effects of sales tax holidays. One must also look at their broader consequences and the economic damage they cause, including the harmful effects of discrimination among different products and time periods, burdensome administrative and complexity costs on businesses, distortions of consumer behavior, and economically damaging uncertainty about tax policy. Real tax reform—broadening the sales tax base and lowering sales tax rates—can achieve desired revenue collection levels without these costs. Going further to eliminate the sales tax year-round for all consumers is another option to reduce negative effects.[40]

Tax holidays are a political gimmick that distract policymakers and taxpayers alike from real, sustainable, and economically beneficial tax reform. They were created as a way to avoid addressing the negative effects of high sales taxes, while politicians often receive favorable media attention for pushing these short-sighted policies, denigrating the hard work of those who support genuine tax relief. That distinction is particularly important when states could instead use their higher revenues to prioritize tax reform that promotes capital investment, using tax relief to increase productive output rather than just boost (or shift) demand.

Conclusion

Sales tax holidays have enjoyed political success, but recently, policymakers have been reevaluating them. Rather than providing a valuable tax cut or a boost to the economy, sales tax holidays impose serious costs on consumers and businesses without providing offsetting benefits.

Taxes should raise revenue, not micromanage a complex economy by picking winners and losers in the market. Lawmakers should aim to raise the necessary revenue in the least economically distortionary and destructive way. To achieve this goal, sales taxes should be neutral toward products and timing decisions—all end-user goods and services should consistently be subject to the same sales tax. Narrowing the tax base, by contrast, will likely lead to higher and more damaging taxes elsewhere.

Sales tax holidays neither promote economic growth nor increase purchases. They create complexities for all involved, while inserting the political process into consumer decisions. By distracting high-tax states from addressing real problems with their tax systems, holidays undermine efforts to provide legitimate relief to consumers in general and low-income individuals in particular. Sales tax holidays are not sound tax policy.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] See generally Nicolas Kaldor, An Expenditure Tax (London: Allen and Unwin, 1955).

[2] Nik DeCosta-Klipa, “There won’t be a sales tax holiday for Massachusetts this year, lawmakers say,” The Boston Globe, July 18, 2016, https://www.boston.com/news/business/2016/07/18/no-sales-tax-holiday-massachusetts-year-lawmakers-decide.

[3] Missouri Department of Revenue, “Back to School Sales Tax Holiday – Cities Opting Out,” http://dor.mo.gov/business/sales/taxholiday/school/cities.php (listing cities that opted out of the 2020 state sales tax holiday); in Larayne Brown, “Shoppers throng to state’s sales tax holiday,” The (Jackson, MS) Clarion-Ledger, Aug. 1, 2009: “Kathy Waterbury, spokeswoman for the [Mississippi] State Tax Commission, has gotten reports that some retailers weren’t participating in the event.” However, in most states with sales tax holidays, retailer participation is not optional.

[4] John L. Mikesell, “State Sales Tax Holidays: The Continuing Triumph of Politics Over Policy,” State Tax Notes 41 (July 10, 2006): 107, 112.

[5] In response, New Hampshire launched a $40,000 ad campaign emphasizing the number of days each state has with no sales tax (“New

Hampshire: 365, Massachusetts: 2”). See Jonathan Williams, “New Hampshire’s 365-Day Sales Tax Holiday,” Tax Foundation, Aug. 8, 2006, https://taxfoundation.org/new-hampshires-365-day-sales-tax-holiday-0/.

[6] Not included in our list are Ohio’s and Michigan’s 1980 sales tax holiday for car purchases, nor four state gas tax holidays adopted between 2000 and 2005 (Florida, Georgia, Illinois, and Indiana). For information on state gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. holidays, see Jonathan Williams, “Paying at the Pump: Gasoline Taxes in America,” Tax Foundation, Oct. 16, 2007, 14-16, https://taxfoundation.org/paying-pump-gasoline-taxes-america/.

[7] Massachusetts’ sales tax holiday includes all tangible personal property, and Tennessee’s includes non-prepared food and food ingredients.

[8] “An Act Relative to Minimum Wage, Paid Family Medical Leave and the Sales Tax Holiday,” Mass. Code § 121.6A, https://malegislature.gov/Laws/SessionLaws/Acts/2018/Chapter121; Jim Kinney, “Massachusetts tax-free weekend 2018: How, when and where to take advantage of the two-day savings,” MassLive, August 9, 2018, https://expo.masslive.com/news/erry-2018/08/370361fa8b4118/massachusetts-taxfree-weekend.html.

[9] In Michael King, “No tax-free weekend in Georgia this summer,” WXIA-TV, June 29, 2017, http://www.11alive.com/money/no-tax-free-weekend-in-georgia-this-summer/453010259: “State Rep. Jay Powell (R – 171st, Camilla), chairman of the committee, says ending the tax break has been discussed for years. ‘People are going to buy clothes for school. They are going to buy computers and supplies for school, and what the sales tax holiday did was it concentrated that activity—but it didn’t create any new activity.’”

[10] Adam J. Cole, “Christmas in August: Prices and Quantities During Sales Tax Holidays,” in Sales Tax Holidays: Timing Behavior and Tax Incidence, PhD dissertation, University of Michigan, May 2009, 23. In the same paper, Cole suggests the shifts are short-term ones, finding “no evidence that purchases are shifted across months to exploit the tax holiday in sufficient amounts to impact tax collections in months preceding or succeeding the month of a tax holiday.”

[11] See in Eryn Cooper, “Chattanooga shoppers prepare for tax free weekend,” News Channel 9, July 21, 2019: “‘We’re actually waiting for tax free so we can do all the clothes shopping,’ said Kimberly Russell, who was out shopping with her two daughters Sunday afternoon.”; in Cyrus Moulton, “On-the-fence shoppers jump at tax-free weekend in Massachusetts,” Telegram.com, Aug. 11, 2018: “‘Timing is everything, right?’ said Mike Mitchell, of Shrewsbury, picking up a 49-inch LG television at Percy’s on Glennie Street in Worcester. ‘I was waiting for a deal, and I knew the tax free holiday was coming up so I wanted to take advantage of it.’”; Jenny Kincaid Boone, “Virginia’s Sales Tax Holiday: Just The Icing On The Cake,” The Roanoke (Va.) Times, Aug. 5, 2009: “Larie Thompson…decided to get a head start on the sales tax holiday. She took her two daughters to the Bonsack Wal-Mart to scout out school deals, but she planned to wait until the tax-free weekend to buy them.”; In Emilie Bahr, “New Orleans Merchants Hope Sales Tax Holiday Brings Boost,” New Orleans CityBusiness, Aug. 3, 2009: “At The Garden Gate on Old Metairie Road, for example, manager Sara Draper said some customers will select a fancy fountain or bench but wait to swipe their credit cards until they can get the item during the tax-exemption period.”; In Emma Brown, “Shoppers Go For The Gold On Tax Holiday,” The Boston Globe, Aug. 17, 2008: “‘We’re going to come back again tomorrow’ for a stove, said Mariam Haddad of Somerville, who waited until this weekend to buy a crib for her day-care business and a digital camera for her 14-year-old daughter.”

[12] Dena Levitz, “Sales tax holiday returns to Maryland,” Washington Examiner, Aug. 23, 2006.

[13] See in Mary Worrell, “Sales Tax Holiday A Bust For Some Retailers,” Hampton Roads (Va.) Business Journal, Aug. 13, 2007: “Zenisek spent money advertising the tax-free weekend in area publications and had more employees in-store anticipating an influx of traffic, which she never saw.”; In Mark Albright, “Sales Tax Holiday’s Appeal May Be Slipping,” Tampa Bay Times, Aug. 2, 2007: “‘I’m done,’ proclaimed the Largo nurse and mother of three during a recent outing at Target. ‘I shop the sales year round for real deals. I’m trying to be more practical. I won’t be fighting crowds for the small savings during the sales tax holiday.’”; Jenny Munro, “Budget-Conscious Shoppers Welcome Sales Tax Holiday,” The Greenville (S.C.) News, Aug. 5, 2009: “Mel Lester, who was shopping for summer shorts for her two children, said she probably wouldn’t shop on the sales tax holiday weekend. ‘You don’t save enough to make it worth fighting the crowds,’ she said.”; In Christel Phillips, “Many East Texans Not Waiting For Tax Free Weekend To Shop,” KTRE (Lufkin, TX), Aug. 5, 2009: “‘Parents tend to do it two weeks in advance,’ said Maria Hernandez, a J.C. Penney store manager. She says many parents don’t want to take a risk when school is just around the corner…. Some store managers recommend shopping before the tax-free weekend to avoid missing out on items that could be out of stock.”

[14] See Micah Cohen, “A True Cause for Celebration: DC Cancels Sales Tax Holiday,” Tax Foundation, July 22, 2009, https://taxfoundation.org/true-cause-celebration-dc-cancels-sales-tax-holiday/.

[15] Sandra Johnson, Jonathan Tart, and Brian Slivka, “House Bill 998, 5th edition” (2013 sess.), Legislative Fiscal Note, North Carolina General Assembly Fiscal Research Division, July 2, 2013, http://www.ncleg.net/Sessions/2013/FiscalNotes/House/PDF/HFN0998v5.pdf.

[16] John Hammel, “No sales tax holiday for Georgia this year,” The Brunswick (Ga.) News, July 17, 2017, https://thebrunswicknews.com/news/local_news/no-sales-tax-holiday-for-georgia-this-year/article_0bb4a6f6-d131-5896-8a9b-0da72fa6f558.html.

[17] See David Brunori, “The Politics of State Taxation: Dumber Than a Bag of Hammers,” State Tax Notes 20 (Mar. 12, 2001): 48-63. After listing many of the flaws of sales tax holidays and citing scholars on the left and right, Brunori colorfully writes that sales tax holidays are “dumber than a bag of hammers.”

[18] See Kendall Hatch, “Restaurants Seek Their Own Tax Holiday,” The Taunton (MA) Daily Gazette, Feb. 7, 2011. See also S.B. 1528, 2011 Leg. (Mass. 2011).

[19] In December 2008, as interest groups of all kinds sought a piece of federal stimulus proposals under consideration, a group of large retailers pushed Congress to adopt three nationwide sales tax holidays for 2009. See Ann Zimmerman, “Retailers Want In on Stimulus Plan,” The Wall Street Journal, Dec. 24, 2008. The group stated its proposal would be stimulative and pointed to a survey that 82 percent of consumers favored a sales tax holiday and that 69 percent said they would make purchases they otherwise wouldn’t make. That consumers support receiving benefits when no costs are explained to them shouldn’t be surprising. The economic evidence from various studies provided in this report undermines the idea that many additional purchases would occur, especially in a recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. .

[20] See Richard Harper, et al., “Price Effects Around a Sales Tax Holiday: An Exploratory Study,” Public Budgeting & Finance 23, no. 4 (December 2003): 108-113.

[21] The University of Florida researchers noted that prices also rose in nearby Mobile, Alabama, suggesting that some of the price increase occurred for reasons other than the sales tax holiday. Cole found in his study of computer prices during sales tax holidays that the holiday induced retailers to raise prices of inexpensive laptop computers but lower prices of inexpensive desktop computers. See Cole, “Christmas in August,” note 12. Additionally, scholars Richard Hawkins and John Mikesell note that retailers’ ability to raise prices are more constrained during recessions. See Richard R. Hawkins and John L. Mikesell, “Six Reasons to Hate Your Sales Tax Holiday,” State Tax Notes 20 (Mar. 5, 2001): 801-803. Further research analyzing price effects before and during sales tax holidays would be valuable.

[22] Adam J. Cole, Sales Tax Holidays: Timing Behavior and Tax IncidenceTax incidence is a measure of who bears the legal or economic burden of a tax. Legal incidence identifies who is responsible for paying a tax while economic incidence identifies who bears the cost of tax—in the form of higher prices for consumers, lower wages for workers, or lower returns for shareholders. , PhD dissertation, University of Michigan, May 2009.

[23] Justin M. Ross and Felipe Lozano-Rojas, “Consumer Incidence in Sales Tax Holidays: Evidence from Tennessee,” June 15, 2017, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2986456.

[24] See in Worrell, “Sales Tax Holiday A Bust For Some Retailers”: “Corprew said larger corporations and department stores have the luxury of big computer systems to calculate tax-free items, but for a small business like her clothing shops, she and her partner spend hours photocopying receipts and organizing sales information just to make sure everything is accurate and in order. ‘We have to split all the details and it’s a tremendous amount of work for us,’ Corprew said.”

[25] See Mississippi Department of Revenue, Official Guide to the Sales Tax Holiday,

https://www.dor.ms.gov/sites/default/files/Sales%20Folder/2022%20Sales%20Tax%20Holiday.pdf.

[26] See Virginia Department of Taxation, “Virginia Sales Tax Holiday,” https://www.tax.virginia.gov/virginia-sales-tax-holiday.

[27] See S.C. Code § 12-36-2120(57)(a)(vi).

[28] See Texas Comptroller of Public Accounts, Energy Star Sales Tax Holiday,

http://www.window.state.tx.us/taxinfo/taxpubs/tx96_1331.

[29] ”Virginia Sales Tax Holiday,” https://www.tax.virginia.gov/virginia-sales-tax-holiday.

[30] See S.C. Code § 12-36-2120(57)(a)(vi).

[31] See Kail Padgitt, “VA Sales Tax Holiday,” Tax Foundation, Aug. 5, 2009,

https://taxfoundation.org/va-sales-tax-holiday/; Virginia Tax, “Guidelines for Combined Sales Tax Holiday,” May 31, 2018, https://www.tax.virginia.gov/sites/default/files/inline-files/2018-sales-tax-holiday-guidelines.pdf.

32 David Tuerck, Paul Bachman, and Frank Conte, “The Effects of the Massachusetts Sales Tax Holiday on the State Economy,” The Beacon Hill Institute at Suffolk University, June 2015, http://www.beaconhill.org/BHIStudies/TaxHoliday2015/BHISalesTaxHolidayReport2015.pdf.

33 See Pat Hatfield, “The Mystery of Florida’s Vanishing Sales Tax Holiday,” The Deland-Deltona (FL) Beacon, July 8, 2008.

[34] See “D.C. Shoppers Fuming Over Canceled Holiday Tax Relief,” WJLA, July 20, 2009,

https://web.archive.org/web/20090725043939/http://www.wjla.com/news/stories/0709/641909.html.

[35] An exception would be where there is a negative externality, or societal cost, caused by consumers postponing their purchase. For instance, as we noted in versions of this paper predating the COVID-19 pandemic, if a pandemic were raging and vaccines were available but too costly, immediately suspending governmental costs on vaccine purchases could encourage people to move up their vaccination, benefiting society. In most such cases, however, other policy solutions such as subsidies or outright government provision would be more effective than a tax holiday. Another example would be a desire to move the timing of consumer spending, such as with stimulus packages. Whether this would be effective economic policy can depend on one’s view about the effectiveness of stimulus packages, although sales tax holidays would likely be too small and too temporary for even a stimulative boost to aggregate demand.

[36] See Aditya Aladangady, Shifrah Aron-Dine, Wendy Dunn, Laura Feiveson, Paul Lengermann, and Claudia Sahm, “The Effect of Sales-Tax Holidays on Consumer Spending,” FEDS Notes, Board of Governors of the Federal Reserve System, Mar. 24, 2017, https://doi.org/10.17016/2380-7172.1941.

[37] Id.

[38] See Hawkins and Mikesell, note 22.

[39] See Hawkins and Mikesell, note 22.

[40] Broadening the base and lowering the rate, or eliminating the sales tax, could find support on the left side of the political spectrum, where individuals often view sales taxes as harmful to the working poor. The four states with no state or local sales taxes (Delaware, Montana, New Hampshire, and Oregon) are not all traditionally anti-tax states. The lack of a sales tax enjoys broad popular support in those states.

Share this article