Georgia Implements Structurally Sound Tax Changes

Two bills in Georgia will lower the flat individual income tax rate and align the corporate income tax rate with the individual income tax rate.

4 min read

Two bills in Georgia will lower the flat individual income tax rate and align the corporate income tax rate with the individual income tax rate.

4 min read

The outcome of the digital tax debate will likely shape domestic and international taxation for decades to come. Designing these policies based on sound principles will be essential in ensuring they can withstand challenges arising in the rapidly changing economic and technological environment of the 21st century.

58 min read

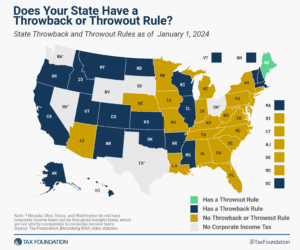

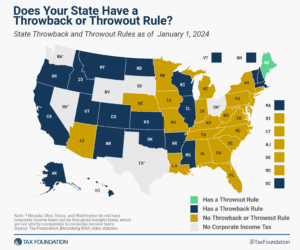

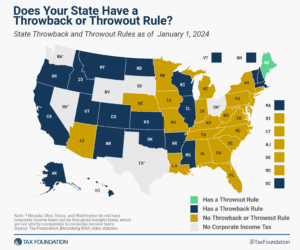

States have generally tried to encourage capital investment. Throwback and throwout rules are an unfortunate example of penalizing it.

4 min read

The TCJA improved the U.S. tax code, but the meandering voyage of its passing and the compromises made to get it into law show the challenges of the legislative process.

6 min read

All taxes tell a story, and today we’ll explore how taxes influenced Bob Dylan’s decision to sell his music catalog, how the “chicken tax” reshaped the auto industry, and how the historic “tax on air and light” had profound effects on architecture and living conditions.

BEAT is intended to address a legitimate problem, and there are virtues to BEAT’s overall strategic approach; however, its execution leaves room for improvement.

7 min read

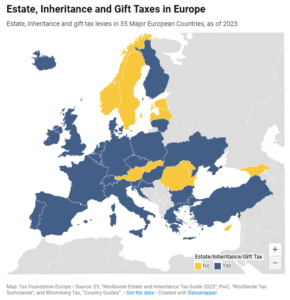

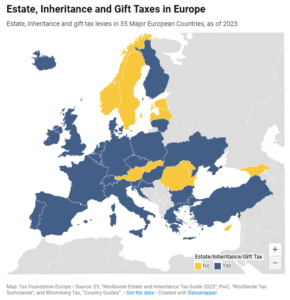

As tempting as inheritance, estate, and gift taxes might look—especially when the OECD notes them as a way to reduce wealth inequality—their limited capacity to collect revenue and their negative impact on entrepreneurial activity, saving, and work should make policymakers consider their repeal instead of boosting them.

2 min read

If reelected, President Trump would drastically escalate the trade war he started during his first term. But what often goes unnoticed is President Biden’s role in continuing Trump’s first trade war. In fact, more tax revenue from the trade war tariffs has been collected under Biden than under Trump.

5 min read

One relatively easy but meaningful step policymakers can take to make future tax seasons less burdensome is to modernize their state’s nonresident income tax filing, withholding, and reciprocity laws.

7 min read

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read

Over the next 10 years, the IRA’s energy tax credits are projected to cost north of $1 trillion, adding to the federal government’s budgetary challenges and burgeoning debt.

6 min read

When the tax code is stable and predictable, individuals, families, and businesses can set goals for the future and make plans to achieve them.

Lawmakers should aim for policies that support investment and hiring in the United States and refining anti-avoidance measures to improve administrability and lower compliance costs.

9 min read

EU Member States should seek to minimize the rate and broaden the base of electricity duties, consolidating their rates to the required minimum rate.

3 min read

Despite taxes playing a significant role in personal finances and being levied on a sizable portion of the U.S. population, most Americans are not just unhappy with the current tax code but also do not understand it.

4 min read

With proposals to adopt the nation’s highest corporate income tax, second-highest individual income tax, and most aggressive treatment of foreign earnings, as well as to implement an unusually high tax on property transfers, Vermont lawmakers have no shortage of options for raising taxes dramatically.

7 min read

Portugal’s personal income tax system levies high tax rates on an unusually narrow set of high earners, striking a poor balance between earnings incentives and revenue contributions.

4 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Focusing on competitiveness, neutrality, and efficient policies to raise revenue would go a long way in increasing economic growth and stabilizing public finances over the long term.

7 min read