On Wednesday, the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Policy Center (TPC) released estimates on the portion of households with no federal income tax liability, finding that in 2020, about 60.6 percent of households did not pay income tax, up from 43.6 percent of households in 2019. Much of the 2020 increase was due to pandemic-related factors, but the growing share of households paying no income tax should be kept in mind when evaluating the progressivity of the federal income tax system and proposed tax hikes on higher earners.

While 2020 was an unusual year due to expanded government support through the tax code to combat the pandemic’s economic effects and due to lower household incomes, it continues an ongoing trend of fewer households paying income tax due to long-running expansions in the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC). TPC finds that in 2020, out of 176.2 million individuals and married couples who could file a tax return, about 144.5 million of them actually filed a tax return. Of the 144.5 million, 75.1 million filers paid no taxes after deductions and credits. Another 32 million households did not file a tax return. In total, about 107 million Americans (or 60.6 percent of households) paid no federal income taxes.

Using adjusted Internal Revenue Service (IRS) data to include households that do not file tax returns and fewer filing households paying income tax, we arrive at a preliminary estimate of 61.1 percent of households not paying income tax in 2020, which is close to TPC’s model estimate.

The large portion of households paying no income tax illustrates that the U.S. income tax system is quite progressive, and that the tax system is increasingly being used to provide social benefits to households. In 2020, that included two rounds of economic impact payments, which were administered as advanced refundable tax credits.

Over the longer-run, both the CTC and EITC have been expanded to support households with children and low-income working households. For example, the CTC originally started as a $400 nonrefundable tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. for children under 17 in 1998, but grew to its current level of up to $3,600 fully refundable for younger children under the American Rescue Plan Act (ARPA) in 2021.

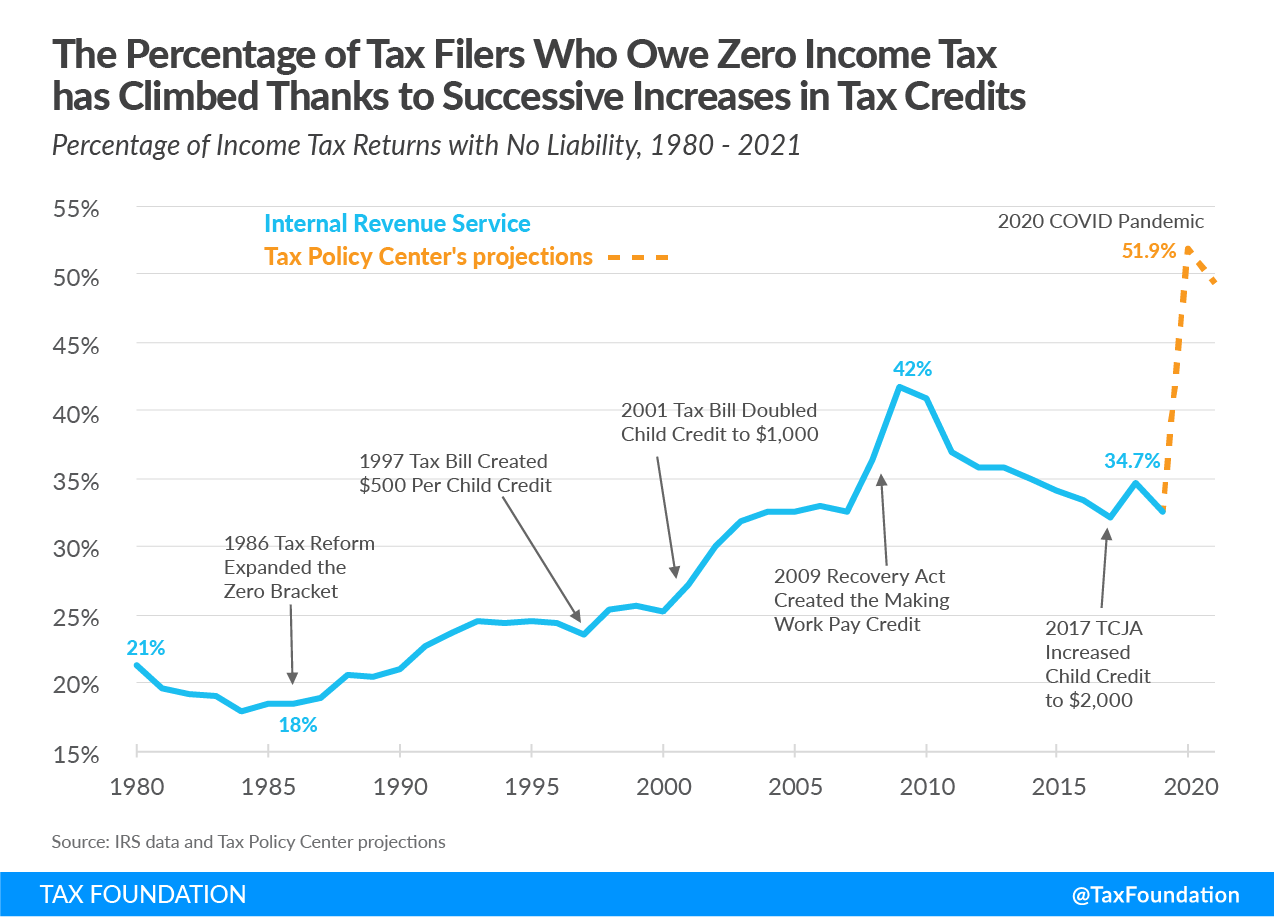

As a result, the share of tax filers who pay income taxes has dropped, largely due to expansions in refundable tax credits, which can more than offset tax liability for low-income households. For example, in 1990, about 21 percent of filers paid no income tax—that figure rose to 30 percent by 2002 and to 34.7 percent in 2018 (see accompanying chart).

TPC’s estimates project that the share of all households that pay no income tax is slated to drop under current law from 60.6 percent in 2020 to 57.1 percent in 2021, declining to 37.5 percent in 2031. However, President Biden’s tax proposals would make permanent or extend several tax credits, including the expanded CTC, EITC, Child and Dependent Care Tax Credit (CDCTC), and Premium Tax Credit provided originally through the Affordable Care Act (ACA).

TPC also found that extending these more generous credits would increase the number of households who pay no income tax from 42 percent to 45 percent in 2022. Notably, “the largest percentage increase would be among households with annual income between about $100,000 and $180,000.” The share of households not paying income tax in that income group would rise from about 4.5 percent under current law to 10.5 percent if the APRA credits were extended.

Lower-income households mostly do not pay income tax under current law, so a fewer number become non-payers from the extended tax credits in 2022. About 89 percent of households in the bottom 20 percent of income would not pay income tax in 2022 under current law, compared to 92 percent if the tax credits were extended.

Biden’s proposals would also raise tax rates on high earners, generally making an already progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. system still more progressive. Higher earners tend to pay a higher share of income taxes as a proportion of their share of adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” (AGI). For example, the top 1 percent of earners earned about 20.9 percent of adjusted gross income (AGI) in 2018 but paid 40.1 percent of income taxes. The bottom 5 percent earned 11.6 percent of AGI, but paid only about 2.9 percent of income taxes. The Joint Committee on Taxation found that when including refundable tax credits, the bottom 50 percent of earners actually faced a negative 2 percent effective tax rate for the federal income tax.

Advocates of higher taxes may argue that higher earners should pay more than a proportionate share of taxes relative to their incomes, but then the question becomes what “fair share” means moving forward. As Tax Foundation president Scott Hodge argues, “There is no objective standard for what defines ‘fair share’; it is a purely subjective concept. But there are facts, which are objective, and the facts suggest that the U.S. tax and fiscal system is very progressive and very redistributive.”

These facts should be kept in mind when considering tax increases and expansions in tax credits in the budget reconciliation process.

Share this article