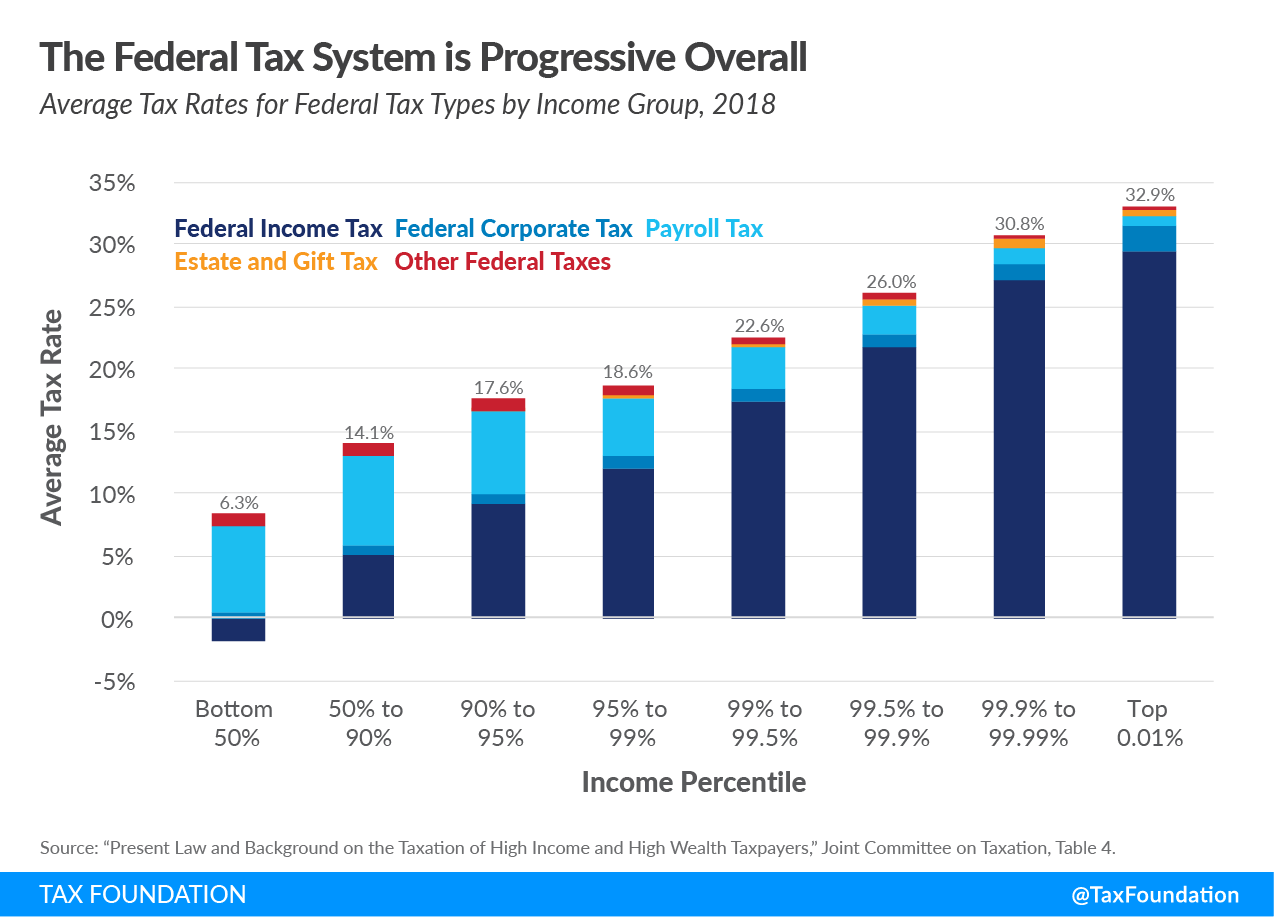

The Joint Committee on Taxation (JCT) recently released data on taxes paid at various levels of income, indicating the federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. system is progressive, consistent with similar analysis by the Congressional Budget Office (CBO), and the Organisation for Economic Co-operation and Development (OECD).

The JCT found that the bottom 50 percent of taxpayers faced an average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. of 6.3 percent at the federal level, compared to an average tax rate of 32.9 percent for the top 0.01 percent of income earners.

The income tax is the most progressive aspect of the federal tax system, providing an effective tax rate of -2 percent for the bottom 50 percent of earners. The tax rate is negative for this group because they receive more benefits through refundable tax creditA refundable tax credit can be used to generate a federal tax refund larger than the amount of tax paid throughout the year. In other words, a refundable tax credit creates the possibility of a negative federal tax liability. An example of a refundable tax credit is the Earned Income Tax Credit (EITC). s, such as the Earned Income Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. (EITC) and Child Tax Credit (CTC), than they pay in tax. By contrast, the top 0.01 percent faces a 29.5 percent effective average federal income tax rate.

Payroll taxes supporting Social Security and Medicare are regressive, as lower-income groups face higher average rates. The bottom 50 percent faces a 6.8 percent average payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. rate, while the top 0.01 percent’s average rate is just 0.08 percent. This is partly due to the wage cap on the 12.4 percent Social Security payroll tax, which is levied on wages up to $142,800. Overall, however, the progressivity of the income tax more than offsets the regressivity of the payroll tax.

The federal corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. is borne by people across the income spectrum, including the bottom 50 percent of taxpayers. The bottom 50 percent faces an average corporate tax rate of 0.5 percent, as they either own shares of corporate stock that are lower in value, or they earn lower wages. Those in the 50th to 90th income percentiles face a 0.7 percent average corporate tax rate, while the top 0.01 percent’s average rate is 1.9 percent.

The JCT report also shows that once the federal tax and transfer system is accounted for, the income share of those in the bottom 50 percent has declined only slightly since 1960. The income share for those in the 50th to 90th percentile has remained stable over that time, and is largely unaffected by taxes and transfers.

The top 10 percent of the income distribution, however, experience lower income shares after taxes and transfers are accounted for. The top 1 percent’s income share drops from about 14 percent before taxes and transfers to about 9 percent after taxes and transfers are accounted for, illustrating the progressive and redistributive nature of the federal tax and transfer system. This is also consistent with analysis by the CBO.

The JCT’s analysis does not include state and local taxes, which tend to be less progressive than taxes at the federal level. However, other analysis includes state and local taxes and finds the overall tax system is still progressive. Before policymakers consider options to change the federal tax code, it is important to keep in mind the progressivity of the code as it currently exists.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe