The United Kingdom ranks 25th in our recently released 2019 International Tax Competitiveness Index, a study that measures and compares how well OECD countries promote sustainable economic growth and investment through competitive and neutral taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. systems. While the UK has improved its rank by one spot compared to last year, there are multiple measures that could make its tax system more competitive and neutral, including better treatment of capital investment, a broader VAT base, and a simplified property tax system.

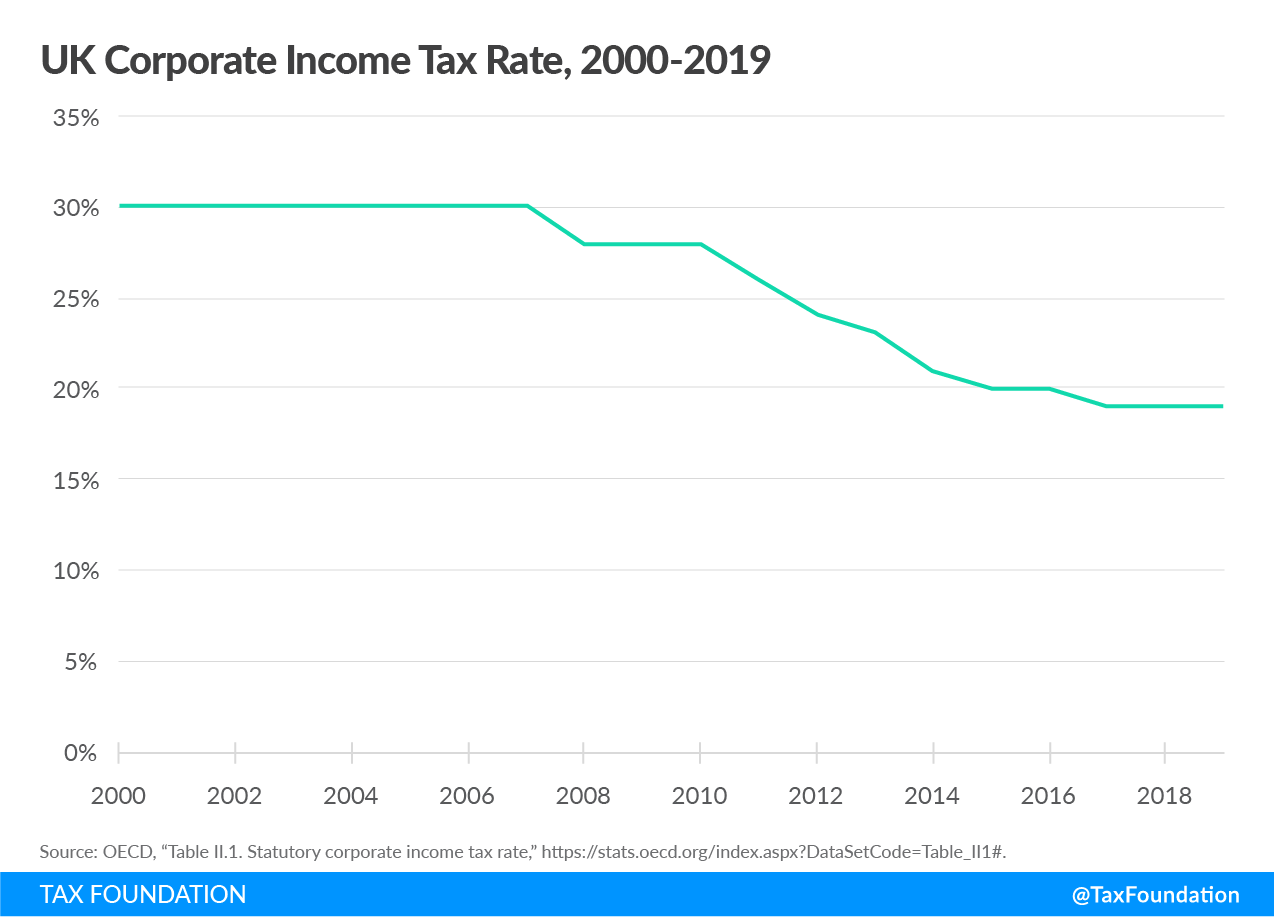

Over the past two decades, the UK has lowered its corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate from 30 percent in 2000 to 19 percent in 2017, with a further cut to 17 percent planned for 2020.

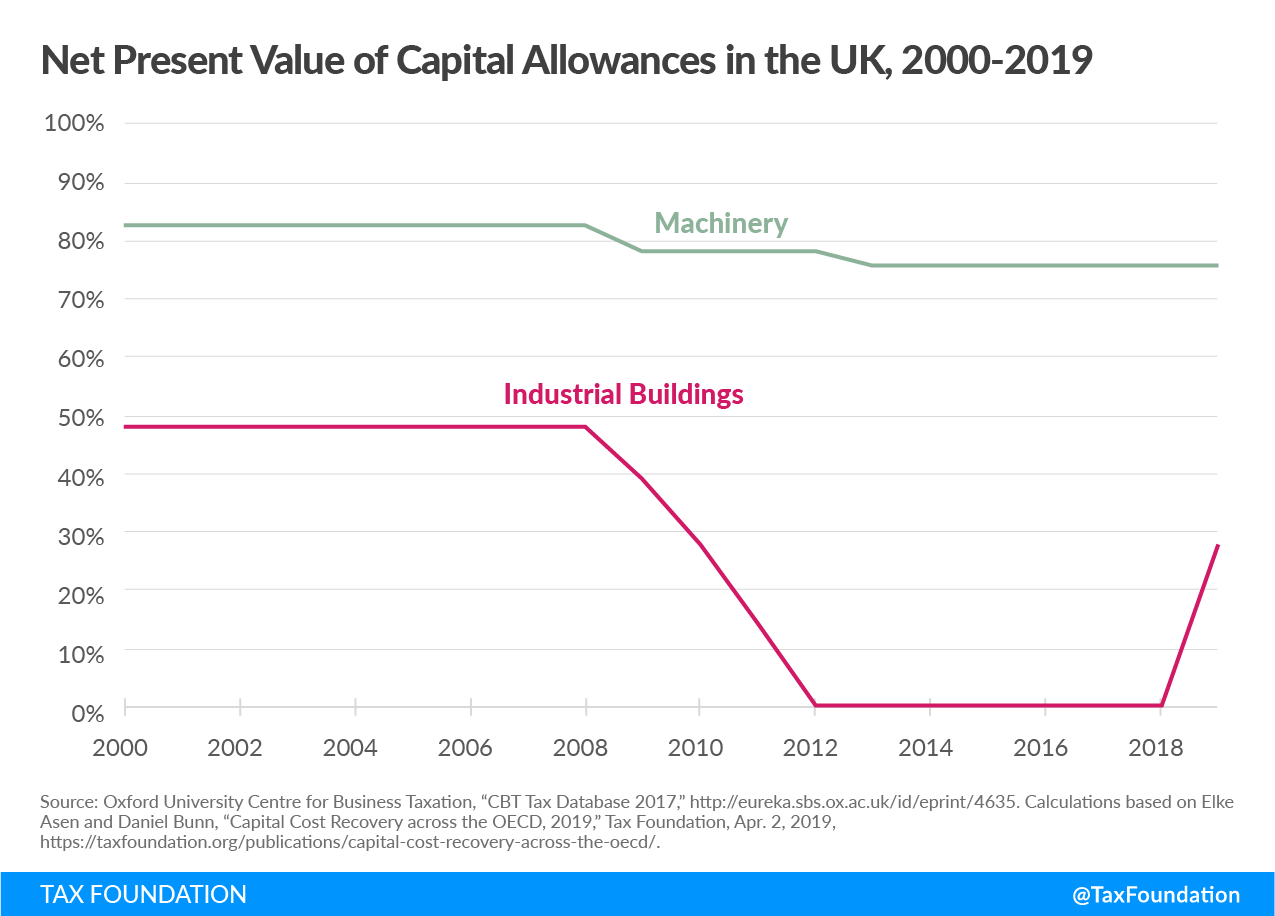

However, these reforms have often been paired with base-broadening measures that penalize new business investment. Between 2008 and 2013, the United Kingdom reduced the value of depreciation deductions for machines and industrial buildings. The present value deduction (the percent of the cost of an investment a company can deduct over its life) for machines fell from 83 percent to 76 percent between 2008 and 2013. Over the same period, the value deduction for industrial buildings fell from 48 percent to zero.

Only this year, the UK reinstated a 2 percent annual allowance for industrial buildings, allowing businesses a present value deduction of 28 percent. Despite this policy change, the UK still has on average the fourth lowest capital allowances in the OECD, after Japan, New Zealand, and Chile.

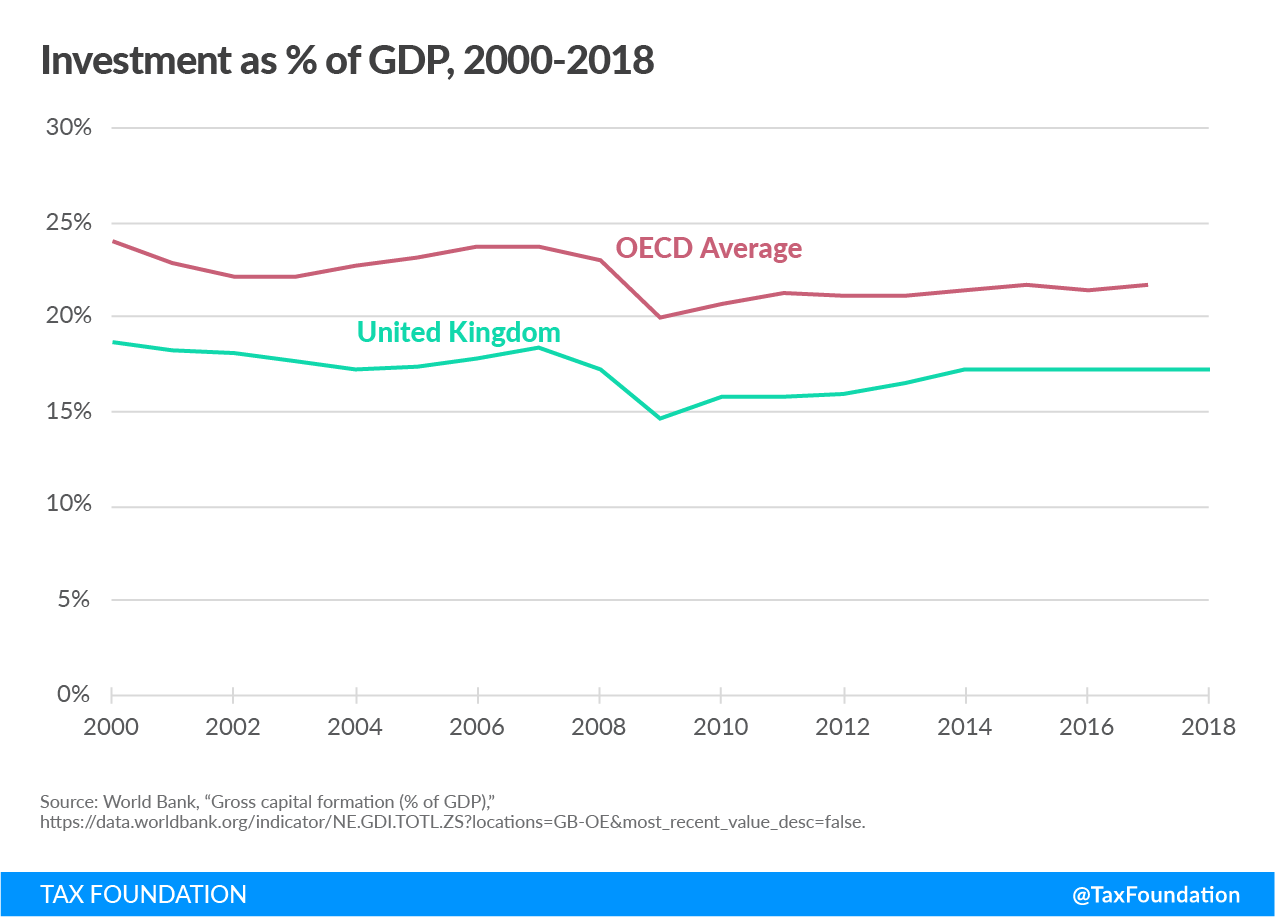

Low capital allowances increase the marginal effective tax rate on investment, making new investment more costly. In 2018, investment accounted for only 17 percent of GDP in the UK, the second lowest share in the OECD (only Greece has a lower share). Shortening asset lives or implementing full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. of capital investment could help spur UK’s investment and economic growth, potentially even more than a further rate cut.

In addition to its corporate tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , there is also room to improve the value-added tax (VAT) base. The UK’s VAT applies to less than half of final consumption. This is largely due to an unusually broad number of goods that are either VAT-exempt or subject to reduced VAT rates. Such exemptions and reduced rates create distortions, reduce tax revenue substantially, and require a higher standard VAT rate. Applying the standard VAT rate to a greater share of final consumption could significantly improve the efficiency of the UK’s VAT system.

Among OECD countries, the United Kingdom raises the highest property taxes as a share of its private capital stock. While most OECD countries’ property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. revenue amounts to less than 1 percent of the private capital stock, this measure is at 2.6 percent in the UK. In addition, the UK has distortionary levies on estates, transfer of real property, assets, and financial transactions. Simplifying the property tax system could lower the tax burden on investment and decrease compliance costs.

A tax code that is competitive and neutral promotes sustainable economic growth and investment while raising sufficient revenue for government priorities. Narrow policy changes such as cutting the corporate rate by a few percentage points tend to have limited effects on economic growth, especially if paired with measures that penalize new investments. Instead, more fundamental reforms of the corporate tax system, the VAT, and the property tax system could support economic growth in the UK.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe