Last Friday, Maine Governor Paul LePage released his biennial $6.8 billion budget. Under his new budget, LePage introduces several changes to the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code, including changes to individual income taxes, corporate taxes, the sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. , and the elimination of the estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. .

One major reform proposal in the state’s tax code would be the adoption of a flat income tax rate of 5.75 percent by 2020. Last year, Maine voters approved Question 2, which imposed a 3 percent surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. on the top income tax bracket. In the budget, LePage has proposed delaying the enactment of Question 2 for one year. In the years following, the income tax would be simplified and reduced until 2020, when Maine would adopt a 5.75 percent flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets. .

| Tax Year | Proposed Rates | Proposed Brackets |

|---|---|---|

| 2017 | 5.8% | > $0 |

| 6.75% | > $21,050 | |

| 7.15% | > $50,000 | |

| 2018-2019 | 5.75% | > $0 |

| 6.15% | > $21,050 | |

| 2020 | 5.75% | > $0 |

On the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. , Governor LePage also proposes lowering the top rate from its current 8.93 percent to a new rate of 8.33 percent. Though still a high rate relative to the national average, this reduction would make Maine more regionally competitive with its neighbors.

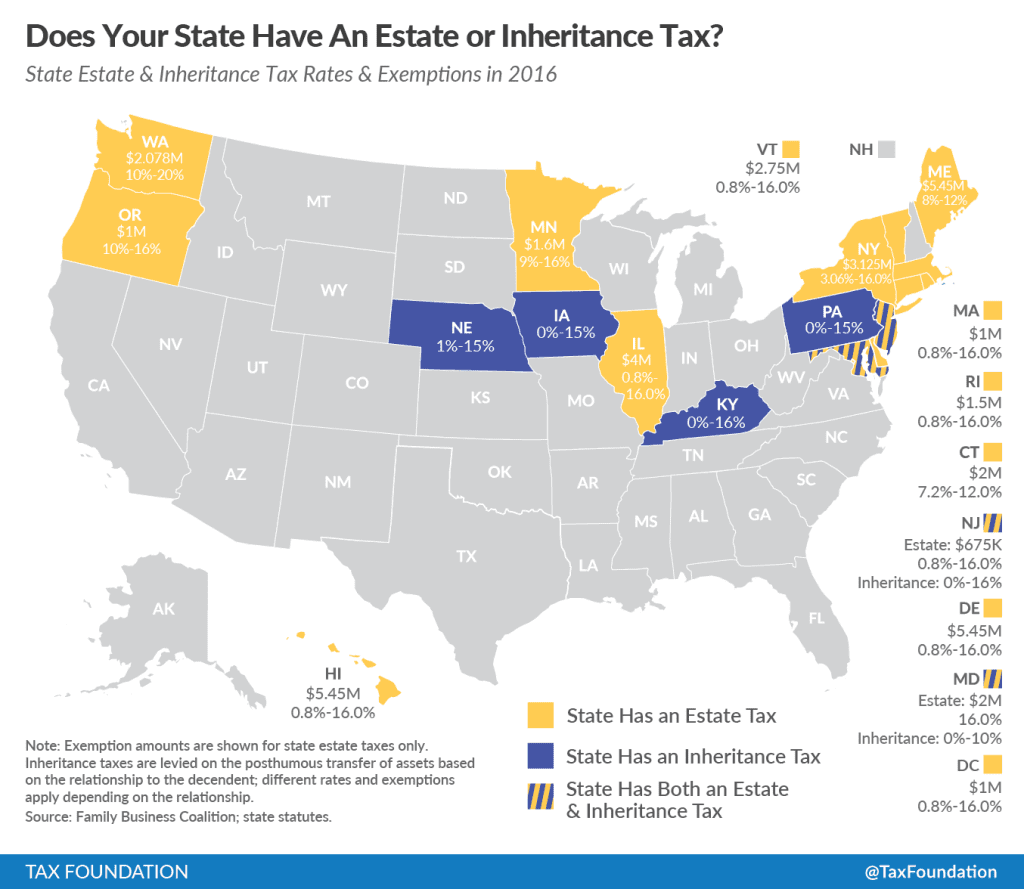

Additionally, LePage proposes that Maine eliminate its estate tax. Only fourteen states and D.C. impose an estate tax, and as a trend, states are moving away from a reliance on them. Estate taxes are harmful to economic growth and have large compliance costs, and are especially harmful for small- to medium-sized family businesses that do not have the resources to spend on estate tax planning.

In order to pay for these rate cuts, Maine’s sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. would be expanded to some services. The state’s 5.5 percent sales tax rate would apply to amusement and recreation services, household services, installation, repair and maintenance services, personal services, and personal property services. As we have noted here and here, broadening the sales tax base is the correct call for modernizing a state’s sales tax code.

Finally, the Governor’s budget also includes provisions to expand Maine’s Child Care Credit, expand Maine’s pension exemption to $35,000, and increase the lodging tax from 9 percent to 10 percent.

Following the release, the Governor has asked Republican lawmakers to unite to pass his budget “for once in their lives.” While these proposals are far-reaching, policymakers should seriously consider the core tenants of Governor LePage’s proposals. They represent an effort to broaden tax bases and lower rates overall—a recipe for a more competitive state.

Share this article