With record inflation now squeezing American household budgets, you can thank our Senior Fellow Emeritus Steve Entin for shielding U.S. workers from being pushed into higher tax brackets. If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

It all started some 40 years ago. After Ronald Reagan was elected President, Steve Entin, who had previously served as a staff economist on the Joint Economic Committee and studied under notable professors like Milton Friedman at the University of Chicago, was invited to work at the Department of the Treasury as Deputy Assistant Secretary for Economic Policy.

As many at the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Foundation can attest, Steve’s stories about his time in the Reagan administration are legendary, but one stands out. Steve did something that every household in America should be grateful for—he convinced President Reagan to call for indexing the tax code to inflation.

At the time, American taxpayers were subject to bracket creep, which occurs when inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. pushes taxpayers into higher income tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. or reduces the value of credits, deductions, and exemptions. The bracket thresholds failed to keep pace with inflation, resulting in an increase in income taxes without an increase in real income.

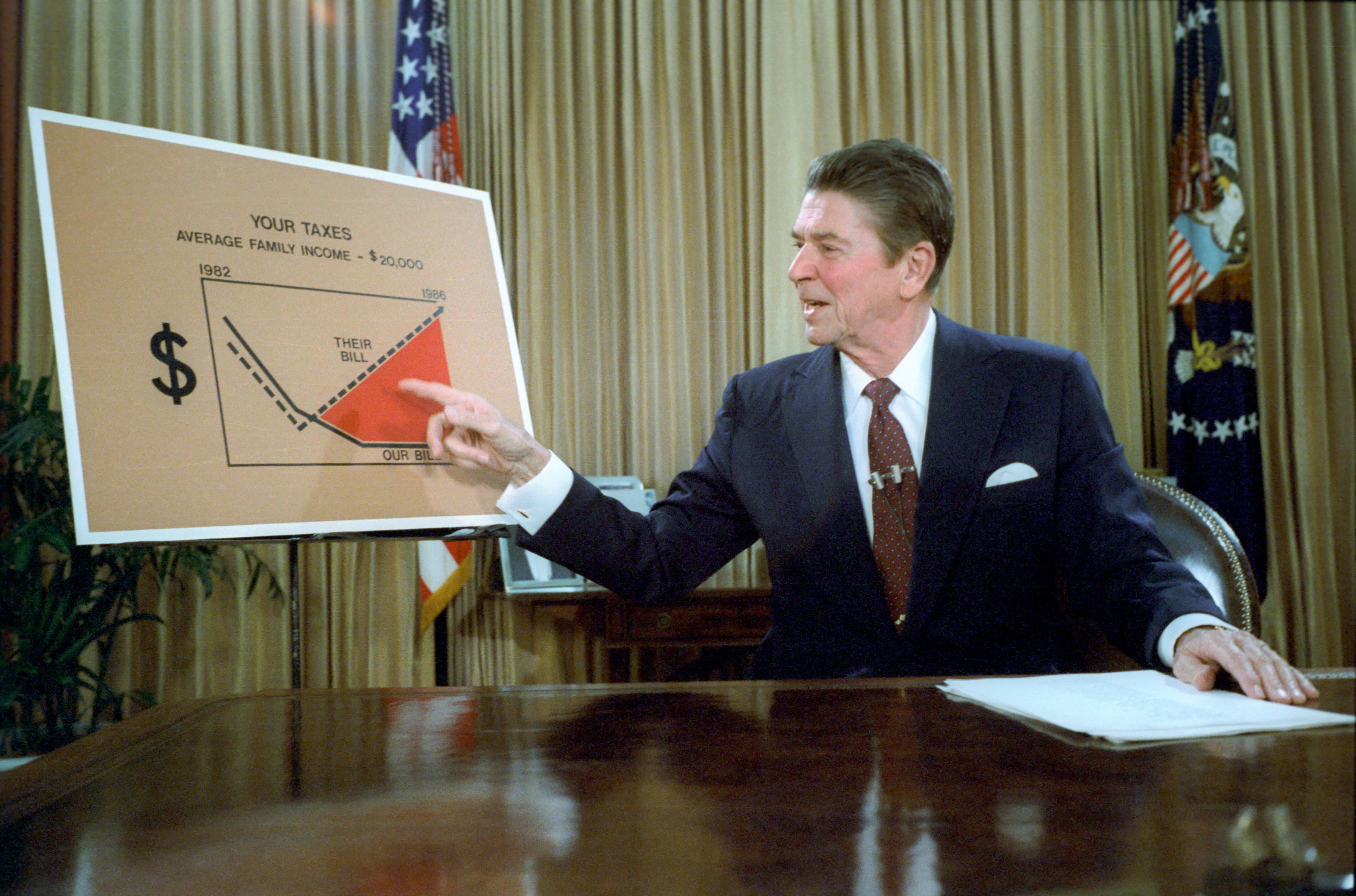

Indeed, President Reagan used the chart that Steve drew for him during a televised address asking Americans to call their members of Congress and demand they index the tax code. People did. And it worked.

It would be interesting to go back and estimate how much indexing has saved American taxpayers since the 1980s, particularly in recent months with near-record high inflation.

And the benefits of a tool like inflation-indexing are not limited to just federal tax policies. As our experts have pointed out, it can also protect taxpayers at the state level. In fact, half of states build a cost-of-living adjustment into their individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. brackets, standard deductions, personal exemptions, and other features of their tax codes.

Another Notable Contribution: Dynamic ScoringDynamic scoring estimates the effect of tax changes on key economic factors, such as jobs, wages, investment, federal revenue, and GDP. It is a tool policymakers can use to differentiate between tax changes that look similar using conventional scoring but have vastly different effects on economic growth.

Steve had another remarkable contribution to tax policy: popularizing “dynamic scoring”—the concept that policymakers should consider how taxes affect the economy when analyzing a tax bill.

After his time at the Department of the Treasury, Steve went to work under the legendary tax economist Norman Ture at the Institute for Research on the Economics of Taxation (IRET). Steve would go on to become President and CEO of IRET while also developing a simple dynamic tax model with Mike Schuyler.

At that time, dynamic analysis of tax bills was considered “voodoo economics.” The conventional way of assessing tax bills was to ignore their economic consequences and consider only whether the bill would raise revenues or cut revenues. People scoffed at the idea of measuring the impact of taxes on the broader economy and what impact that would have on the actual amount of tax revenue collected.

Steve’s view, of course, was that taxes have a big impact on the cost of capital and the willingness of people to work, save, and invest. Ultimately, these factors determine the size of the economy. For Congress to ignore these effects was legislative malpractice.

Dynamic scoring estimates the effect of tax changes on key economic factors, such as jobs, wages, investment, federal revenue, and GDP. It provides lawmakers with more context they can use to understand the effects of tax policies on a complex, multidimensional U.S. economy by accounting for a policy’s macroeconomic and behavioral effects, whereas conventional scoringConventional scoring (static scoring) is a method of estimating the revenue effects of tax policy while holding nominal national income constant. In other words, conventional scoring uses an assumption that tax changes will not impact the overall size of the economy. Because of this assumption, conventional scoring does not provide a complete picture of how a tax change will affect revenues because it ignores changes in work and investment. simply predicts the increase or decrease in revenue.

Accounting for these behavioral and macroeconomic changes under dynamic scoring shifts the tax debate past a simple argument over how much revenue we should raise to a more important debate over how we should raise revenue.

Building One of the Most Robust Tax Models in the Nation

Steve and his colleague Mike Schuyler joined the Tax Foundation in 2011, bringing with them a simple dynamic tax model they had been developing for years. Since then, the Tax Foundation has prioritized making dynamic modeling a reality.

Building upon Steve’s legacy, economists and software developers with our Center for Economic Analysis have significantly expanded upon one of the most robust (and trusted) federal dynamic tax models in the nation—and we changed the tax world as a result.

For example, dynamically scoring the 2017 Tax Cuts and Jobs Act (TCJA) helped educate federal policymakers on the importance of improved cost recoveryCost recovery refers to how the tax system permits businesses to recover the cost of investments through depreciation or amortization. Depreciation and amortization deductions affect taxable income, effective tax rates, and investment decisions. , leading them to temporarily shift to full expensing for equipment investments in addition to reducing the federal corporate tax rate.

Continuing a Remarkable Tax Legacy

Today, Steve’s views on how taxes impact the cost of capital and economic growth are infused in our Taxes and Growth Macroeconomic Model. And his lessons continue to influence how our economists assess tax policy every day.

We felt that the best way to recognize Steve’s lasting contributions to American taxpayers and this organization was to create a permanent position here at the Tax Foundation—the Stephen J. Entin Fellowship in Economics. Steve was flattered to be honored in such a way.

With the fellowship in place, we wanted to fill it with someone who would continue to uphold Steve’s principles of sound tax policy. That person is Will McBride, the Tax Foundation’s Vice President for Federal Tax and Economic Policy. Will leads our modeling and analysis of federal tax policy and maintains the intellectual standards of those efforts.

Will received his PhD in economics from George Mason University. Will served as our chief economist from 2011 to 2015, before accepting a position on the economics team at PwC. Will returned to the Tax Foundation in 2020.

We are thrilled to announce Will as the first Stephen J. Entin Fellow in Economics. Congratulations to both Will and Steve for honors well deserved.

And cheers to a rich legacy of smarter, sounder tax policy that continues to this day.

We are open to other naming opportunities at the Tax Foundation, including named positions and programs. Learn more here.