Bracket creep occurs when inflation pushes taxpayers into higher income tax brackets or reduces the value of credits, deductions, and exemptions. Bracket creep results in an increase in income taxes without an increase in real income. Many tax provisions—both at the federal and state level—are adjusted for inflation.

An Example for Bracket Creep

Imagine Beth has an annual income of $50,000 in 2000 and that her income grows to $75,000 by 2020. One might point out that Beth’s salary grew by 50 percent in nominal terms. However, the cumulative rate of inflation between 2000 and 2020 was about 50 percent. That means Beth’s higher 2020 salary actually buys her the same amount of goods and services in today’s economy. In other words, her purchasing power has stayed the same.

Now, imagine Beth faces a simple, two-rate tax schedule where a 10 percent rate is levied on the first $50,000 of her income, and a 20 percent tax rate is levied on income above $50,000. Suppose, now, that these bracket thresholds were adopted 20 years ago and have not changed since Beth was making $50,000.

Even though Beth’s 2020 salary now buys her the same amount of goods and services, she has been pushed into a higher tax bracket, resulting in higher tax liability. The bracket thresholds have not kept pace with inflation.

Preventing Bracket Creep at the Federal and State Level by Inflation Indexing

To prevent such bracket creep, many tax provisions that have a progressive structure (and are thus affected by bracket creep) get adjusted for inflation on an annual basis.

At the federal level, the IRS adjusts more than 40 tax provisions for inflation, including rates (by way of bracket widths) and bases (deductions, exemptions, and other provisions), such as the federal income tax brackets, the standard deduction, or the Earned Income Tax Credit (EITC).

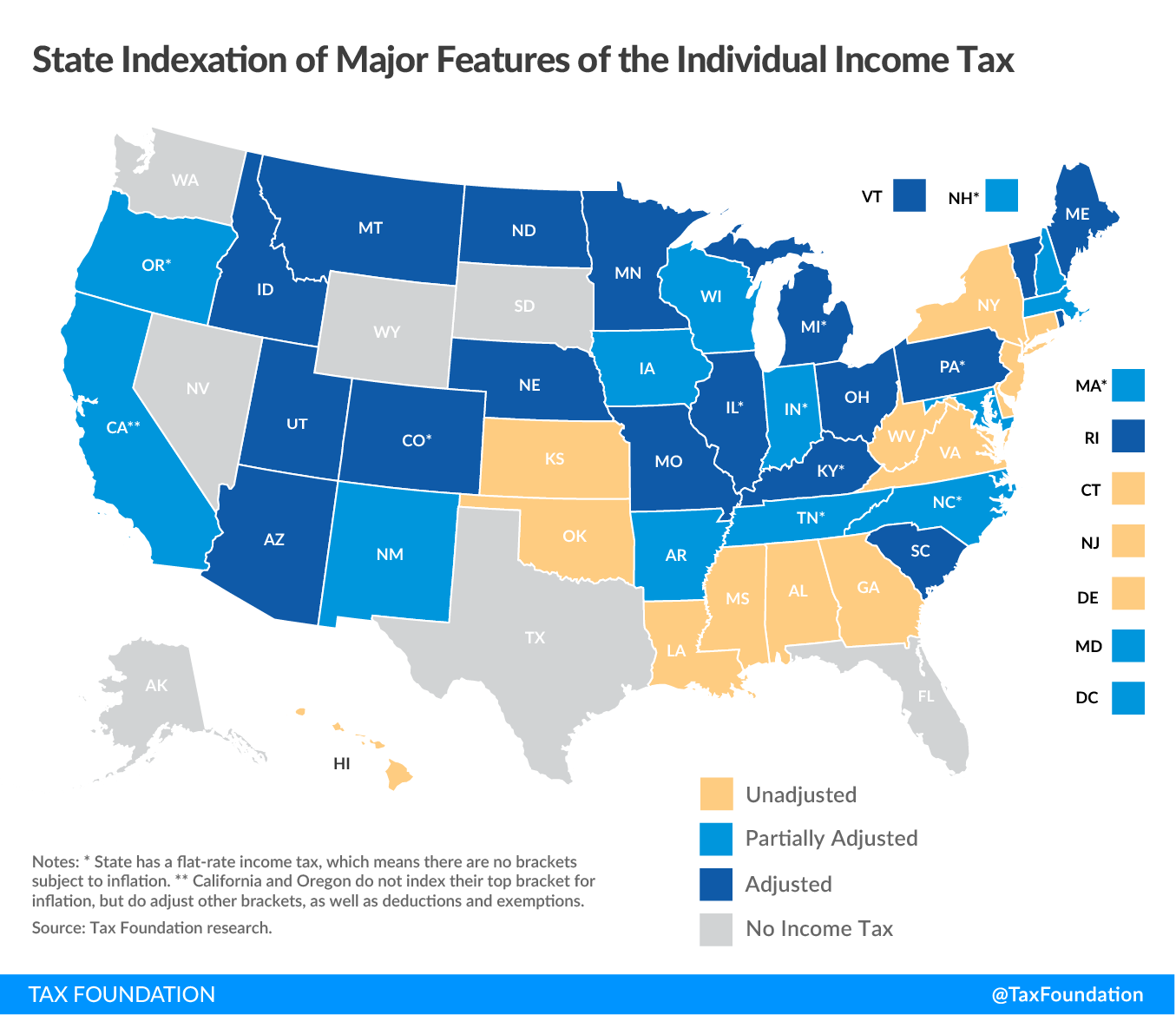

Many states build a cost-of-living adjustment into their individual income tax brackets, standard deductions, personal exemptions, and other features of their tax codes. A movement that began with three states—Arizona, California, and Colorado—in 1978 has now expanded to half of all states.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe