High marginal income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates can disincentivize individuals from earning more or cause them to vote with their feet by moving to another location with lower tax rates on personal income. At 55 percent, Austria currently has one of the highest top marginal income tax rates in Europe. This rate applies to earnings over €1 million ($1.1 million US).

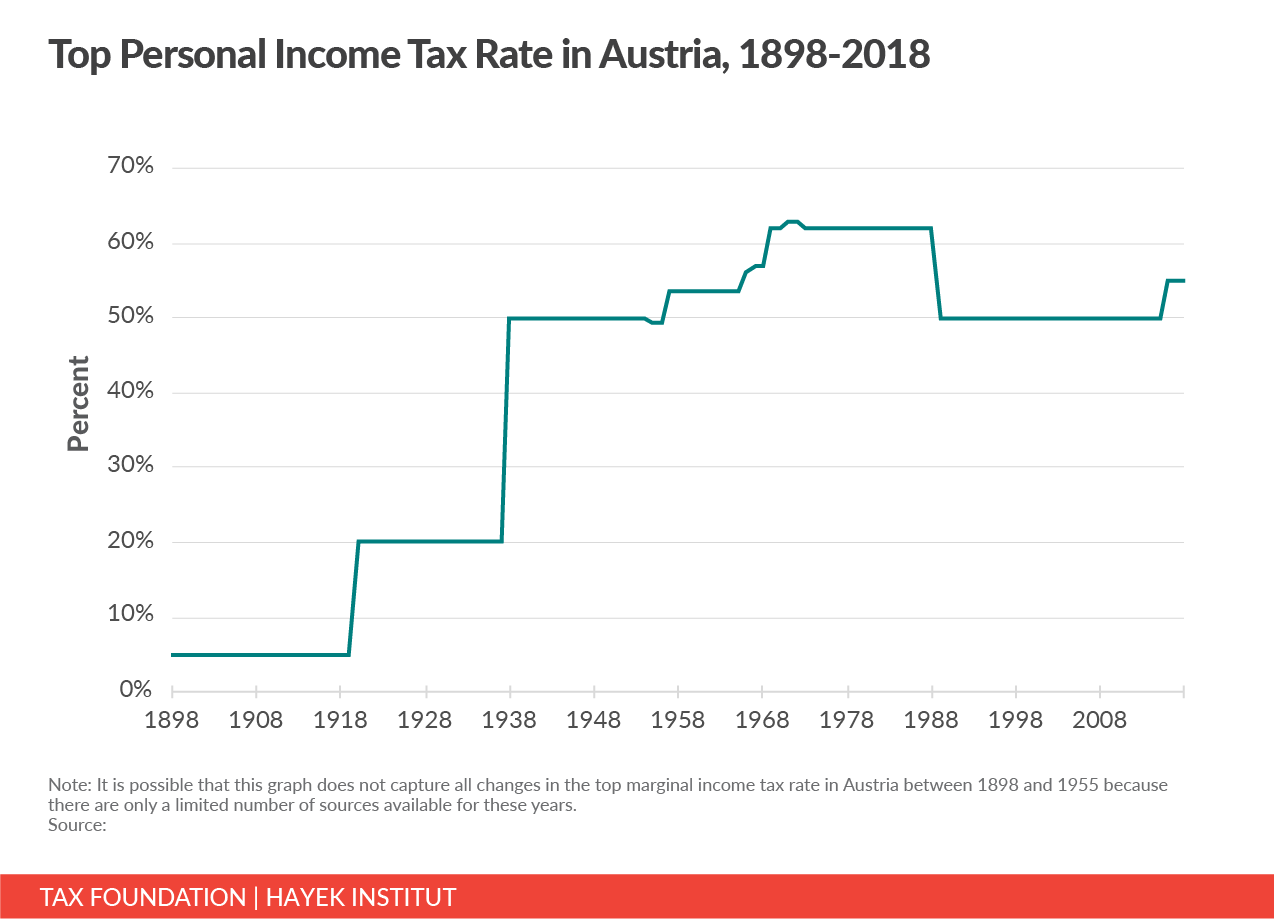

Austria has had an income tax for hundreds of years. Though the data are sparse for some periods, we were able to find sources to identify the top marginal income tax rate from 1898-2018 and a few earlier years.[1]

The top rate has climbed significantly over the last 120 years. In 1898, the top marginal rate was just 5 percent and applied to incomes above approximately €571,000 (measured in today’s currency, $642,000 US).[2] As mentioned, today the top marginal rate stands at 55 percent and applies to incomes over €1 million ($1.1 million US.).

There are a few earlier data points that we uncovered in our research. In 1799, for example, the top marginal rate was 20 percent.[3] The same was true in 1849.[4] In 1895, the top rate was 4.5 percent prior to the reform that increased the top rate to 5 percent in 1898.[5]

The highest top marginal rate over the time period from 1898-2018 was during 1971 and 1972, when it was approximately 63 percent. This high rate came after a series of top rate increases and during a time period when individual income taxes were a growing source of Austrian tax revenue. The top rate stayed above 60 percent until a reform brought the rate down to 50 percent in 1989.

In our recent study with the Hayek Institut, we recommended several options for reforming the Austrian individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. to lower the tax burden and improve the competitiveness of the Austrian tax system. The most ambitious option would be to adopt a flat tax of 20 percent on a broad base. Alternatively, the government could simply remove the current top rate, leaving in place a progressive structure with a top rate of 50 percent. Policymakers should also adopt other reforms like indexing the tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. to inflation to eliminate bracket creep and improving the tax treatment of savings.

Austria has a long history of taxing individual income. This historical data should lead policymakers to question whether top marginal rates have been too high for too long.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Data for 1898-1913 are from Rudolf Sieghart, ”The Reform of Direct Taxation in Austria,“ The Economic Journal 8, no. 30 (June 1898): 173-182, https://www.jstor.org/stable/2957358?seq=1#page_scan_tab_contents.

Data for 1914-1919 are from Otto Szombathy, “Die österreichische Einkommensteuerreform von 1914,“ FinanzArchiv/Public Finance Analysis 32, no. 2 (1915): 101-189, https://www.jstor.org/stable/40906035?seq=1#page_scan_tab_contents.

Data for 1920-1937 are from Republik Österreich, “Gesetz über Abänderungen des Personalsteuergesetzes vom 25. Oktober 1896, R. G. B. Nr. 220 (Personalsteuernovelle vom Jahre 1920),” Staatsgesetzblatt 1920, no. 110 (Vienna, 1920): 1541-1542, http://alex.onb.ac.at/cgi-content/alex?aid=sgb&datum=1920&page=1623&size=45.

Data for 1938-1944 are from Reichsministerium des Innern, “Bekanntmachung der neuen Fassung des Einkommensteuergesetzes,” Reichsgesetzblatt 1938, Teil 1 (Berlin, 1938): 138, http://alex.onb.ac.at/cgi-content/alex?aid=dra&datum=1938&page=316&size=45.

Data for 1945-1954 are from Republik Österreich, “Anwendung der Vorschriften über die öffentlichen Abgaben,“ Staatsgesetzblatt 3, no. 12 (Vienna, 1945): 17, https://www.ris.bka.gv.at/Dokumente/BgblPdf/1945_12_0/1945_12_0.pdf.

Data for 1955-1999 are from Margit Schratzenstaller and Andreas Wagener, ”The Austrian Income Tax TariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers that raise prices, reduce available quantities of goods and services for US businesses and consumers, and create an economic burden on foreign exporters. , 1955-2006,“ Empirica 36, no. 3 (August 2009): 309-330, https://link.springer.com/article/10.1007/s10663-008-9087-y.

Data for 2000-2018 are from OECD, Table I.1., “Central government personal income tax rates and thresholds,” OECD, Paris, https://stats.oecd.org/index.aspx?DataSetCode=TABLE_I1.

[2] Author’s calculations based on data discussed in Rudolf Sieghart, “The Reform of Direct Taxation in Austria”; a long-term inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. calculator, at http://www.in2013dollars.com/1898-GBP-in-2017?amount=4000; and current exchange rates.

[3] Emil von Fürth, Die Einkommensteuer in Österreich und ihre Reform (Leipzig: Duncker & Humblot, 1892), 12 and 46.

[4] Id.

[5] Max Menger, Die Reform der direkten Steuern in Oesterreich (Vienna: Alfred Hölder, 1895), 94-96.

Share this article