Blog Articles

New Jersey May Be the First State Without an Excise Tax Levy on Recreational Marijuana

New Jersey’s tax design adds another element to the ongoing experiment with legal recreational marijuana in the states.

3 min read

Prospects for Federal Tax Policy After the 2020 Election

President Biden and Congress should concentrate on areas of common ground, finding incremental places to improve the tax code. A bipartisan bill recently introduced to help retirement savings is a good model for what incremental reform may look like.

4 min read

Election Analysis: California and Colorado Voters Resist Temptation to Shift More of Property Tax Burden to Businesses

In Tuesday’s election, voters in two states—California and Colorado—were tasked with deciding whether to amend their states’ constitution to change how the property tax burden is distributed. In many ways, the ballot measures were mirror images of each other, but the outcomes were similar.

3 min read

Election Analysis: Why Voters Split the Difference on Income Tax Measures

Illinois voters rejected a high graduated rate income tax (“Fair Tax”) while Arizonans embraced a large income tax rate increase for high earners, among the many attention-grabbing results from Tuesday’s elections.

7 min read

Election Analysis: Recreational Marijuana Now Legal in Four More States

Voters in four states, Arizona, Montana, New Jersey, and South Dakota, approved ballot measures legalizing recreational marijuana.

7 min read

Results of 2020 State and Local Tax Ballot Measures

See the results of the most notable state and local tax ballot measures during Election 2020 with our curated resource page.

11 min read

Biden’s Call for More Tax Credits Further Complicates the Tax Code

Over the course of the 2020 presidential election campaign, Democratic nominee Joe Biden has proposed new tax credits for health insurance, child care, elderly care, and homeownership, in addition to expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC).

3 min read

Bipartisan House Bill Introduced to Further Encourage Retirement Savings

The Securing a Strong Retirement Act seeks to encourage retirement savings by simplifying and expanding the use of different types of retirement accounts.

3 min read

Spain’s Recovery Budget Comes with Tax Hikes

While other countries in Europe are working towards introducing tax cuts and stimulating economic recovery by supporting business investment and employment, Spain is putting more fiscal pressure on households and businesses.

4 min read

The Unintended Consequences of Higher Corporate Taxes on Income Inequality

Increasing the corporate tax rate is often offered as a solution to income inequality because higher-income individuals tend to own more corporate shares than others and may bear the burden of a tax increase on corporate income.

4 min read

Zoom Calls Not a Taxing Matter

Zoom Video Communications announced that, come November, the company will start collecting and remitting local utility and communications taxes in California, New York, Maryland, and Virginia.

5 min read

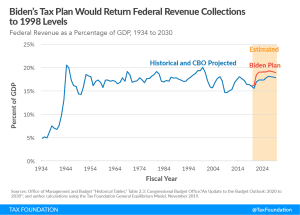

Placing Joe Biden’s Tax Increases in Historical Context

If we consider Biden’s tax plan over the entire budget window (2021 to 2030) as a percentage of GDP—1.30 percent—it would rank as the 6th largest tax increase since the 1940s and and one of the largest tax increases not associated with wartime funding.

6 min read

The UN Approach on Digital Taxation

The UN tax committee will be considering a change to the UN’s model tax treaty that, if adopted and implemented, could result in digital companies paying more taxes in countries where their customers are located even if those companies do not have physical locations there.

5 min read

Biden-Harris Proposals Can Raise Taxes on the Middle Class

If we look at both the legal incidence of the Biden-Harris policy proposals and their economic incidence, we find both direct and indirect tax increases on many taxpayers who earn less than $400,000.

2 min read

Two Roads Diverge in the OECD’s Impact Assessment

The difference that the OECD presents between the potential impact in the context of agreement compared to a harmful tax and trade war should show policymakers the value of continuing multilateral discussions.

6 min read

Top Rates in Each State Under Joe Biden’s Tax Plan

President Joe Biden’s tax plan would yield combined top marginal state and local rates in excess of 60 percent in three states: California, Hawaii, and New Jersey (also New York City).

4 min read

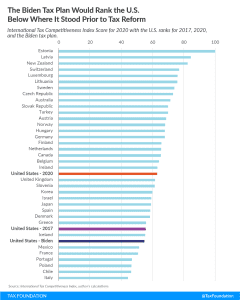

How Would Biden’s Tax Plan Change the Competitiveness of the U.S. Tax Code?

While the Biden campaign is certainly focused on increasing taxes on U.S. businesses and high-income earners, it is important that policymakers also understand what that reversal might do to U.S. competitiveness, and the competitive global environment in which U.S. companies and U.S. workers operate.

3 min read

Role of the 2017 Tax Reform in the Nascent U.S. Economic Recovery

While there is still plenty of work to be done to get unemployed Americans back to work, the U.S. economy as a whole is now recovering strongly from the pandemic-induced economic downturn, outperforming forecasts from earlier in the year and outperforming most other developed countries.

4 min read

Reviewing the Commitment to American GROWTH Act

House Republicans recently introduced HR 11, the Commitment to American GROWTH Act, outlining an alternative to Democratic presidential nominee Joe Biden’s tax vision. The proposal would address upcoming expirations of the 2017 Tax Cuts and Jobs Act (TCJA) and create or expand other tax provisions designed to boost domestic investment.

5 min read