State Aid in American Rescue Plan Act Is 116 Times States’ Revenue Losses

Here’s each state’s estimated revenue gains or losses in 2020, alongside the state and local aid that would be allocated to each under the American Rescue Plan Act.

8 min readStay informed with quick and accessible analysis of today's top tax policy topics. Read Tax Foundation's Tax Policy Blog for insight from our experts on tax policies across the U.S. and abroad.

To find our most recent research papers and data, click the links below.

Here’s each state’s estimated revenue gains or losses in 2020, alongside the state and local aid that would be allocated to each under the American Rescue Plan Act.

8 min read

The UK’s Chancellor of the Exchequer Rishi Sunak released the 2021 budget, and most important for near-term growth is the significant boost to capital allowances.

5 min read

The international experience with wealth taxes should serve as a warning to the U.S. A wealth tax would reduce the size of the economy, shrink national income, and significantly distort international capital flows.

4 min read

While the UK is looking at ways to raise tax revenue to cover the revenue shortfalls and additional spending resulting from the COVID-19 pandemic, short- as well as long-term, investment will be crucial in getting the economy back on track and ensuring economic growth.

3 min read

Amid a debate over water extraction from Florida’s springs, Florida Sen. Annette Taddeo (D) has introduced a bill (SB 562) which, if enacted, would establish an excise tax on water extraction beginning July 1.

4 min read

A new study illustrates how overlooking an important element of the tax system—the structure of the tax base—can lead to an incomplete understanding of how tax reform impacts the economy.

4 min read

Tax hikes or spending cuts implemented early in the year might undermine the desirable rapid recovery of the economy. The UK should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting business investment and employment while increasing its international tax competitiveness.

4 min read

Under the budget introduced by Gov. Tom Wolf, Pennsylvania’s flat personal income tax rate would increase by 46 percent, partially offset by an outsized increase in the poverty credit, which would see a family of four eligible for partial relief due to poverty until they reached $100,000 in taxable income—four times the poverty line.

6 min read

Learn more about the recent Alabama tax reform measures (House Bill 170), which combines pandemic-era tax policy responses with broader tax policy reforms.

4 min read

At least four states—Connecticut, Hawaii, New York, and Washington—are considering statewide excise taxes on sugary drinks this year.

4 min read

West Virginians would face extraordinarily high taxes on vapor products in state if Senate Bill 68 becomes law. The bill would increase taxes on liquid used in vapor products from 7.5 cents per milliliter (ml) to $1 per ml—an increase of over 1,300 percent.

3 min read

Approximately $78 billion might be owed in federal and state income taxes on the unemployment compensation payments made since the pandemic began.

3 min read

The coronavirus relief legislation passed out of the House Ways and Means Committee would significantly expand the child tax credit for 2021, from its current $2,000 maximum to a fully refundable $3,600 for children 6 and under and $3,000 for children over 6.

4 min read

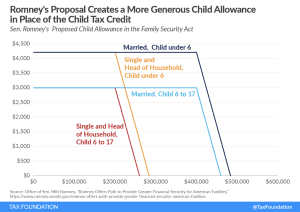

Sen. Mitt Romney’s Family Security Act would replace the Child Tax Credit with a monthly child allowance administered by the Social Security Administration, making the benefit more generous and accessible to low-income households without earned income.

4 min read

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

As the House Ways and Means Committee continues working on the latest round of fiscal relief amid the pandemic, one curious provision in the legislation is a tax hike on multinational companies. One section of the legislation would repeal a provision in current law that allows U.S. multinationals to choose to allocate their interest costs on a worldwide basis (more on that in a moment).

4 min read

The House Ways and Means Committee measures would further extend the relief measures created by the CARES Act and the Consolidated Appropriations Act of 2021, and would go further by significantly expanding existing tax credits and making changes to the international tax system.

7 min read

The potential override of Gov. Larry Hogan’s (R) veto of a digital advertising tax (HB732) looms large over the current legislative session in Maryland, though it is only one of many tax proposals under consideration in the state.

7 min read

House Ways and Means Democrats recently released a proposal to expand the child tax credit for one year as part of President Biden’s larger $1.9 trillion economic relief package.

5 min read

Sen. Mitt Romney (R-UT) recently proposed the Family Security Act, which features a new, more generous child allowance for families with children while reforming other sources of aid for low-income individuals.

5 min read