Blog Articles

Putting the Pieces Together on BEPS

Taxes matter for decisions to be made by businesses, individuals, and families, and it is important for policymakers to understand that rules can be designed to be neutral rather than distortionary.

6 min read

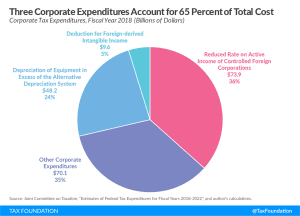

Not All Tax Expenditures Are Equal

The debate in Washington, D.C. often centers around tax expenditures, so-called corporate loopholes, in the tax code. But not all tax expenditures are created equal. Some represent neutral tax treatment and should be left alone, while others are distortionary and should be repealed. Understanding what a tax expenditure represents is essential for understanding how our tax code works for both businesses and individuals.

4 min read

What’s Going on With the Kiddie Tax?

2 min read

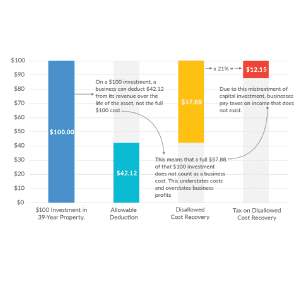

Depreciation Requires Businesses to Pay Tax on Income That Doesn’t Exist

While tax rates matter to businesses, so too does the measure of income to which those tax rates apply. The corporate income tax is a tax on profits, normally defined as revenue minus costs. However, under the current tax code, businesses are unable to deduct the full cost of certain expenses—their capital investments—meaning the tax code is not neutral and actually increases the cost of investment.

3 min read

Taxes on Capital Income Are More Than Just the Corporate Income Tax

The United States’ statutory corporate income tax rate is now more aligned with the rates of other nations . However, taxes on capital income, or corporate investment, are more than just the corporate income tax. Shareholder-level taxes, such as those on dividends and capital gains, also affect incentives to save and invest.

3 min read

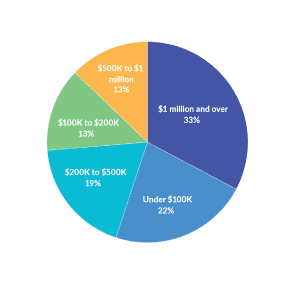

Pass-Through Businesses Q&A

Pass-through businesses are the dominant business structure in America. Pass throughs file more tax returns and report more business income than C corporations. Pass-through businesses are not subject to the corporate income tax, but instead report their income on the individual income tax returns of owners. This blog will address some frequently asked questions about pass-through structure and taxation.

4 min read

Taxable Income vs. Book Income: Why Some Corporations Pay No Income Tax

Why do some companies appear to be profitable but pay little or no federal income taxes? It’s largely due to differences between book and taxable income.

4 min read

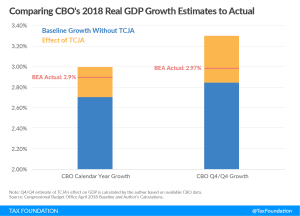

The Lowered Corporate Income Tax Rate Makes the U.S. More Competitive Abroad

One of the most significant provisions in the Tax Cuts and Jobs Act was the reduction of the U.S. corporate income tax rate from 35 percent to 21 percent. Over time, the lower corporate rate will encourage new investment and lead to additional economic growth. It will make the U.S. more attractive for companies by increasing after-tax returns on investments and will discourage companies from shifting profits to low-tax jurisdictions.

2 min read