Blog Articles

Retail Glitch Awaits Congressional Fix

2 min read

Next Steps from the OECD on BEPS 2.0

The continuation of this work is important, but the OECD and policymakers around the world should carefully consider whether these proposals will lead to more certainty, or if they will undermine that goal by simply be a step toward more unilateralism. The impact on cross-border investment will also be a critical issue to consider, and the ongoing impact assessment by the OECD is an important part of the work.

6 min read

Better than the Rest

2 min read

Legislation Introduced to Cancel R&D Amortization

Canceling the amortization of research and development costs would reduce federal revenue, but policymakers have a variety of options to offset the costs.

3 min read

Booker’s Plan to Eliminate Step-up in Basis and Expand the Estate Tax

Removing step-up in basis would encourage taxpayers to realize capital gains and it would plug a hole in the current income tax, while increasing federal revenue. Combined, however, with the estate tax, this would result in a significant tax burden on certain saving by requiring both the appreciation in and total value of transferred property to be taxed at death

2 min read

Senator Sanders Proposes a Tax on “Extreme” Wealth

Bernie Sanders recently became the second major Democratic presidential candidate to propose a wealth tax.

2 min read

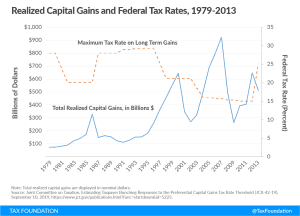

JCT Report Shows Capital Gains are Sensitive to Taxation

JCT’s report on capital gains elasticities reminds us that capital gains realizations, at least under a tax system that allows deferral, are sensitive to tax rates. Moving to mark-to-market taxation of all capital gains would remove this sensitivity by taxing capital gains annually.

4 min read

Senator Bennet’s Plan to Expand the EITC

3 min read

OECD Tackling Harmful Tax Practices

Countries around the world often design their tax policies to become attractive targets for foreign investment. These policies can be anything from a system with special preferences for certain industries to a well-designed tax system based on principles of sound tax policy. Systems that are rife with special preferences and complexities can create distortions in local jurisdictions and across the global economy.

3 min read

No Good Options as Chicago Seeks Revenue

Facing an $838 million budget shortfall, a looming pension crisis, and an aggressive spending wish list, some Chicago policymakers and activists are expressing interest in a laundry list of new and higher taxes that could, collectively, raise as much as an additional $4.5 billion a year.

6 min read

Evaluating Senator Wyden’s “Mark-to-Market” Capital Gains Tax

Wyden’s “mark-to-market” proposal strives to subject capital gains to the same treatment as ordinary income. While the plan resolves the “lock in effect” issue and would make the tax code more progressive, it would increase the tax burden on savers and increase tax code complexity.

2 min read

Standard VAT Rate on German Meat?

2 min read