How the CARES Act Shifted the Composition of Tax Expenditures Towards Individuals

The increase in expenditures associated with COVID-19 relief is another illustration of using the tax code to administer social spending.

3 min readStay informed with quick and accessible analysis of today's top tax policy topics. Read Tax Foundation's Tax Policy Blog for insight from our experts on tax policies across the U.S. and abroad.

To find our most recent research papers and data, click the links below.

The increase in expenditures associated with COVID-19 relief is another illustration of using the tax code to administer social spending.

3 min read

Since 1987, unemployment compensation benefits have been subject to federal income tax and, in most states, to state income tax. According to the Congressional Research Service, such treatment—including unemployment compensation benefits in taxable income—is common across industrial nations.

4 min read

The EU recently launched a consultation to reform the business tax system, which will outline the priorities for corporate taxation over the coming years to meet the needs of a globalized economy that struggles to recover from the consequences of the COVID-19 crisis. It will also set EU actions regarding the ongoing international discussion on the taxation of the digital economy and a global minimum tax.

3 min read

Limiting addiction to nicotine is a laudable goal, but lawmakers should exercise caution with the methods employed. Using gross receipts taxes on businesses to effectively levy an excise tax introduces complexity to an already flawed tax design. It is better to let the excise tax internalize externalities and the business tax raise general revenue.

3 min read

The IRS recently announced the extension of tax filing and payment deadlines from April 15th to May 17th to help taxpayers navigating the many tax changes amid the pandemic and give the IRS opportunity to clear its backlog of tax returns and correspondence.

7 min read

As the Biden administration and Congress consider making the expanded child tax credit permanent, a nearly $1.6 trillion expansion of tax code-administered benefits, they should consider financing it in a way that doesn’t create significant headwinds to economic recovery.

3 min read

Many members of Congress have taken issue with the 2017 tax reform. However, the reasoning that has led some to believe that GILTI provides a path to offshoring investment and jobs is flawed.

6 min read

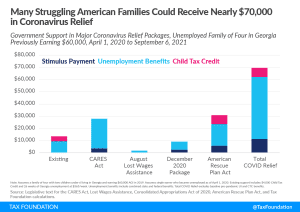

During the pandemic, an unemployment family of four previously earning $60,000 will have received $50,840 in federal and state unemployment benefits from April 1, 2020 to September 6, 2021, plus $11,400 in stimulus payments, plus $7,200 in Child Tax Credit, totaling $69,440 in combined COVID-19 relief benefits.

4 min read

In Pennsylvania, Gov. Tom Wolf (D) has proposed phasing out the gas tax as the main funding mechanism for the state’s highway fund, and he has established a commission to recommend options for replacing it with alternative revenue sources. In a statement, the governor called the current motor fuel tax burdensome, outdated, and unreliable.

5 min read

Both the Biden campaign and some Democratic members of Congress have recommended changes to GILTI, but before doing that, policymakers should consider how GILTI’s design can have ramifications for many U.S. companies and their tax burdens.

6 min read

As lawmakers evaluate how to respond to the global semiconductor shortage, they should consider allowing full cost recovery across all types of capital investment—inventories, machinery and equipment, structures, and R&D.

4 min read

The major tax-related benefits in the $1.9 trillion economic relief plan are a third round of direct payments, extended unemployment insurance (UI) benefits and a $10,200 unemployment insurance income exemption for 2020, and an expansion of the Child Tax Credit.

6 min read

As the Biden administration turns toward infrastructure, Sen. Ron Wyden (D-Or.) has suggested including reforms to the way the tax code subsidizes energy production in such a package, eliminating 44 “tax breaks” for various activities in the energy sector and replacing them with only three.

3 min read

Senate amendments to the American Rescue Plan Act prohibit using any of the $350 billion in State and Local Fiscal Recovery Funds to cut taxes, but many are concerned that states which accept the funds could be prohibited from implementing tax cuts between now and 2024—an astonishing level of federal interference in states’ fiscal affairs.

8 min read

The Biden administration has signaled its openness to raising the corporate tax rate, potentially by phasing in an increase over several years. While phasing in a tax increase, as opposed to hiking immediately, may seem like a reasonable middle ground, it would be the worst of both worlds because it provides old investment with a lower rate while penalizing new investment.

2 min read

For the fourth year in a row, a comprehensive infrastructure funding reform bill has been introduced in Kentucky, with the centerpiece being a gas tax increase of 8.6 cents per gallon (cpg). Like many states, Kentucky faces a backlog of road maintenance and construction projects, and existing transportation taxes and user fees are failing to keep pace with funding needs.

4 min read

As the Senate debates the relief package and makes progress in the budget reconciliation process, policymakers should keep in mind the trade-off between targeted economic relief and increasing marginal tax rates in the tax code, which can distort incentives to earn income and induce taxpayers to creatively adjust their AGI to receive a payment in the next tax season.

4 min read

A year ago, it seemed possible that New Hampshire was headed toward a triggered tax increase. Instead, lawmakers may trim business tax rates and begin the phaseout of the state’s tax on interest and dividend income, which would take away the asterisk and make New Hampshire the ninth state to forgo an individual income tax altogether.

4 min read

Policy changes to attract foreigners are not without benefits, but governments should carefully weigh the costs of the tax incentives against opportunities to implement broader tax reforms. A more efficient income tax system is a better objective than just focusing on incentives for foreigners to change their tax residence.

4 min read

With several states entertaining proposals to tax the financial transactions of savers and investors who don’t even live in their states, some members of Congress see an interstate commerce question worthy of a federal response.

6 min read