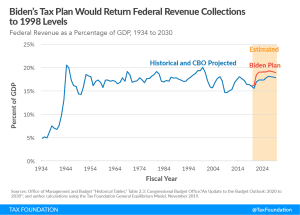

Placing Joe Biden’s Tax Increases in Historical Context

If we consider Biden’s tax plan over the entire budget window (2021 to 2030) as a percentage of GDP—1.30 percent—it would rank as the 6th largest tax increase since the 1940s and and one of the largest tax increases not associated with wartime funding.

6 min read