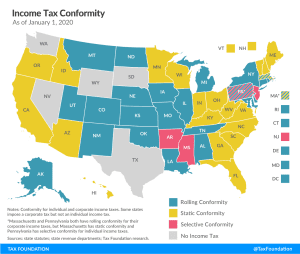

State Income and Sales Tax Revenues Slide in Second Quarter

Today marked the release of second-quarter GDP data and provides a new glimpse into early changes in state and local revenues and spending. All told, second-quarter state and local tax receipts came in about 3.8 percent lower than they did in the same quarter a year ago. Income and sales taxes fell considerably while property and excise tax collections remained stable.

3 min read