Jared Walczak is Vice President of State Projects at the Tax Foundation. He is the lead researcher on the annual State Business Tax Climate Index and Location Matters, and has authored or coauthored tax reform guides on Alaska, Iowa, Kansas, Louisiana, Nevada, New York, Pennsylvania, South Carolina, West Virginia, and Wisconsin.

Jared’s work is regularly cited in The New York Times, The Wall Street Journal, The Washington Post, Los Angeles Times, Politico, AP, and many other prominent national and state outlets.

He previously served as legislative director to a member of the Senate of Virginia and as policy director for a statewide campaign, and consulted on research and policy development for a number of candidates and elected officials. In his free time, Jared enjoys hiking and has a goal of visiting all 63 national parks.

Latest Work

Seattle Officials Return with New Proposal for Taxing Employment

Seattle’s city council are again gearing up for an effort to increase taxes on the city’s largest employers, intended to generate revenue for cash assistance to low-income households impacted by the COVID-19 crisis, among other reasons.

4 min read

D.C. Council to Consider Tax Hike Despite Balanced Budget

Despite a balanced budget and and revenue shortfalls arising from the coronavirus crisis, the D.C. Council will consider proposals to raise income taxes to fund newly proposed spending projects.

5 min read

New York Lawmakers Float New Data Tax Proposal

Taxes on digital services, digital advertising, and the sale or utilization of consumer data, which were already emerging before the #coronavirus crisis, look increasingly attractive to cash-strapped states and localities.

7 min read

California Considers Business Head Tax Plan that Seattle Repealed

With California’s unemployment rate approaching 25 percent, it is somewhat surprising to find policymakers contemplating a literal tax on jobs.

3 min read

Tax Changes in California Governor’s Budget Could Stand in the Way of Economic Recovery

While other states are starting to think about the recovery, California is contemplating tax policies that would stand in the way of economic expansion once the health crisis abates. California’s shortfall is all too real, but tax policies which impede recovery are a hindrance, not a help.

5 min read

Breaking Down State and Local Aid under the SMART Act

The SMART Act, sponsored by Senators Bob Menendez and Bill Cassidy and Rep. Mikie Sherrill, would provide $500 billion in flexible funding to state and local governments.

6 min read

Under the HEROES Act, State Budgets Could Soar as the Economy Suffers

The HEROES Act, proposed by House Democrats as a next round of fiscal relief during the coronavirus outbreak, contains about $1.08 trillion in aid to states and localities. That would bring the pandemic total to $1.63 trillion—an amount so large that it might overwhelm their ability to spend it and could reward fiscal irresponsibility.

8 min read

How the HEROES Act Would Allocate State and Local Aid for Coronavirus Relief

The HEROES Act would provide more than $1 trillion to state and local governments. Here’s how funding would be distributed and provisional estimates of how much aid each state would receive.

5 min read

Designing a State and Local Government Relief Package

The COVID-19 pandemic and accompanying economic downturn will wreak havoc on state and local tax revenues, with projections of a 15-20 percent decline in state revenues. Our new report provides a framework for how to design an effective state and local relief package.

35 min read

Gov. Hogan Vetoes Maryland Digital Advertising Tax Legislation

Gov. Hogan vetoed a proposed first-in-the-nation digital advertising tax that would have imposed rates of up to 10 percent on digital advertising served to Marylanders.

3 min read

Watch: State Tax Policy and COVID-19

What could the next phase of relief look like and what role does tax policy play in ensuring the U.S. and countries around the world make a strong economic recovery?

1 min read

New Guidance on State Aid Under the CARES Act

The U.S. Department of the Treasury recently issued new guidance on allowable expenses using the $150 billion in state aid provided under the CARES Act, a point on which there has been considerable confusion.

3 min read

Tax Policy After Coronavirus: Clearing a Path to Economic Recovery

Governments at all levels must work to remove the tax policy barriers that stand in the way of economic recovery and long-term prosperity following the COVID-19 crisis. Our new guide outlines several comprehensive options that policymakers can take at the federal and state levels.

26 min read

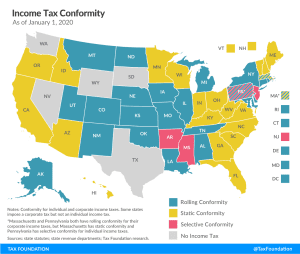

Will States Tax the Federal Government’s COVID-19 Lifeline to Small Businesses?

If states fail to update their income tax conformity, they will wind up taxing the federal lifeline to small businesses in the CARES Act: the Paycheck Protection Program (PPP) loans.

3 min read

States’ Unemployment Compensation Trust Funds Could Run Out in Mere Weeks

Six states, which collectively account for over one-third of the U.S. population, are currently in a position to pay out fewer than 10 weeks of the unemployment compensation claims that have already come in since the start of the COVID-19 pandemic.

3 min read

These States Could Tax Your Recovery Rebates

Due to a quirk of some state tax codes, the recovery rebates in the CARES Act could increase your income tax liability in six states: Alabama, Iowa, Louisiana, Missouri, Montana, and Oregon.

4 min read

Watch: Tax Foundation Experts Discuss Short-term Coronavirus Relief Packages

What could the next phase of relief look like and what role does tax policy play in ensuring the U.S. and countries around the world make a strong economic recovery?

1 min readState Rainy Day Funds and the COVID-19 Crisis

State revenue stabilization funds, often called rainy day funds, are better funded now than they were at the start of the Great Recession and can be a valuable tool as states face a sharp pandemic-linked economic contraction.

18 min read

Tracking State Legislative Responses to COVID-19

Many states are racing to pass budgets, emergency COVID-19 supplemental appropriations, and other must-pass legislation as quickly as possible. We’re tracking the latest state legislative responses to the coronavirus crisis.

66 min read