Jared Walczak is Vice President of State Projects at the Tax Foundation. He is the lead researcher on the annual State Business Tax Climate Index and Location Matters, and has authored or coauthored tax reform guides on Alaska, Iowa, Kansas, Louisiana, Nevada, New York, Pennsylvania, South Carolina, West Virginia, and Wisconsin.

Jared’s work is regularly cited in The New York Times, The Wall Street Journal, The Washington Post, Los Angeles Times, Politico, AP, and many other prominent national and state outlets.

He previously served as legislative director to a member of the Senate of Virginia and as policy director for a statewide campaign, and consulted on research and policy development for a number of candidates and elected officials. In his free time, Jared enjoys hiking and has a goal of visiting all 63 national parks.

Latest Work

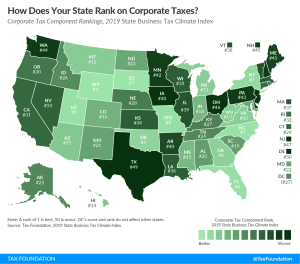

2019 State Business Tax Climate Index

Our 2019 State Business Tax Climate Index compares each state on over 100 variables including corporate, individual, property, and sales taxes. How does your state rank?

17 min read

Pennsylvania: A 21st Century Tax Code for the Commonwealth

Policymakers from across the spectrum recognize that Pennsylvania’s tax code has not kept up with a 21st century economy. Here are comprehensive solutions for how Pennsylvania can achieve a more competitive tax code.

13 min read

What to Expect from IRS Guidance on SALT Deduction Cap Workarounds

While a few are hoping for a different outcome, most observers expect the IRS to disallow these new, intentional SALT workarounds that have been adopted by New York and a handful of other states.

7 min read

State Tax Implications of Federal Tax Reform in Virginia

Virginia has an opportunity to improve its tax competitiveness following the Tax Cuts and Jobs Act. Inaction will result in higher taxes.

14 min read

Enhancing Tax Competitiveness in Connecticut

Connecticut has failed to live up to the expectations of 1991. Changes intended to make tax collections more stable, combined with constraints intended to promote fiscal prudence, have strayed far wide of the mark. To turn things around, Connecticut needs a more competitive tax code.

32 min read

Taxation, Representation, and the American Revolution

James Otis’s rallying cry of “taxation without representation is tyranny!” became the watchwords of the American Revolution and remain familiar to our ears. American independence, which we celebrate each year, was born of a tax revolt.

6 min read

States Can’t Just Hit Pause on Implications of Federal Tax Reform

The new federal tax law left states with some important decisions to make. If they delay, their residents could face confusion come filing time.

4 min read

What’s in the Iowa Tax Reform Package

Iowa Gov. Kim Reynolds is on the verge of signing tax reform legislation that would greatly improve the state’s needlessly complex tax code.

6 min read