State Sales Tax Breadth and Reliance, Fiscal Year 2021

The sales tax is too important a part of states’ revenue toolkits to be permitted further erosion, making sales tax modernization a vital project of the 2020s.

17 min readJared Walczak is Vice President of State Projects at the Tax Foundation. He is the lead researcher on the annual State Business Tax Climate Index and Location Matters, and has authored or coauthored tax reform guides on Alaska, Iowa, Kansas, Louisiana, Nevada, New York, Pennsylvania, South Carolina, West Virginia, and Wisconsin.

Jared’s work is regularly cited in The New York Times, The Wall Street Journal, The Washington Post, Los Angeles Times, Politico, AP, and many other prominent national and state outlets.

He previously served as legislative director to a member of the Senate of Virginia and as policy director for a statewide campaign, and consulted on research and policy development for a number of candidates and elected officials. In his free time, Jared enjoys hiking and has a goal of visiting all 63 national parks.

The sales tax is too important a part of states’ revenue toolkits to be permitted further erosion, making sales tax modernization a vital project of the 2020s.

17 min read

Learn more about the FDA’s proposal to ban the sale of menthol cigarettes and flavored cigars. Including its effect on revenue & public health measures.

4 min read

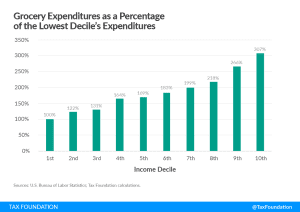

Exempting groceries from the sales tax base reduces economic efficiency without achieving its objective of enhancing tax progressivity.

19 min read

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read

States are flush with cash, but taxpayers’ purchasing power is being eroded by high inflation. Tax rebates, gas tax holidays, and other temporary tax expedients have the potential to add to existing inflation—but good intentions do not always make for good policy.

5 min read

Digital advertising taxes are poor tax policy and legally dubious in the extreme. Maryland has a long fight ahead of it—all for the right to enact a tax for which lawmakers struggle to even articulate a rationale.

5 min read

Even if 2022 sees many tax reforms, the scope of Iowa’s tax relief measures is likely to stand out. With the most recent reform package, Iowa lawmakers have made a significant investment in a more competitive tax climate for an increasingly competitive era.

6 min read

A gas tax holiday may be good politics, but it’s unlikely to achieve its aims. There are far better ways to provide tax relief—short- or long-term—than an inefficient gas tax suspension.

4 min read

While Missouri has room for improvement, the state is making waves, positioning itself as an increasingly attractive location for business investment. And as ongoing reforms further enhance the competitiveness of the state’s tax code, more businesses will take notice.

8 min read

States will continue to cut taxes because revenues are skyrocketing. But some will also be keeping a close eye on litigation targeting this dubious restriction on states’ fiscal autonomy.

8 min read

Practically doubling state taxes—even if the burden is partially offset through state-provided health coverage—could send taxpayers racing for the exits.

6 min read

States are unprepared for the ongoing shift to remote and flexible work arrangements, or for the industries and activities of today, to say nothing of tomorrow. In some states, moreover, existing tax provisions exacerbate the impact of high inflation and contribute to the supply chain crisis.

40 min read

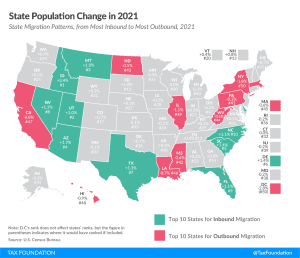

The pandemic has accelerated changes in the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

6 min read

While there are many ways to show how much is collected in taxes by state governments, our State Business Tax Climate Index is designed to show how well states structure their tax systems and provides a road map for improvement.

169 min read

In most states, you don’t have to visit for long before you start accruing tax liability.

5 min read

Temporary tax relief measures, like refund checks or gas tax holidays, are not necessarily bad, and can be justified as ways to return excess revenues to taxpayers, but they often miss an opportunity to do better by taxpayers in the long run.

7 min read

Mississippi lawmakers should deliver tax relief in 2022, but they need not take an all-or-nothing approach. There are many ways to improve the state’s tax code, even if full income tax repeal doesn’t remain on the table.

6 min read