Pro-Growth Tax Reform for Oklahoma

Our new study identifies a number of deficiencies in Oklahoma’s tax code and outlines possible solutions for reform that would create a more neutral tax code and encourage long-term growth in the state.

6 min readJared Walczak is Vice President of State Projects at the Tax Foundation. He is the lead researcher on the annual State Business Tax Climate Index and Location Matters, and has authored or coauthored tax reform guides on Alaska, Iowa, Kansas, Louisiana, Nevada, New York, Pennsylvania, South Carolina, West Virginia, and Wisconsin.

Jared’s work is regularly cited in The New York Times, The Wall Street Journal, The Washington Post, Los Angeles Times, Politico, AP, and many other prominent national and state outlets.

He previously served as legislative director to a member of the Senate of Virginia and as policy director for a statewide campaign, and consulted on research and policy development for a number of candidates and elected officials. In his free time, Jared enjoys hiking and has a goal of visiting all 63 national parks.

Our new study identifies a number of deficiencies in Oklahoma’s tax code and outlines possible solutions for reform that would create a more neutral tax code and encourage long-term growth in the state.

6 min read

Through 10 ballot measures across four states—Colorado, Louisiana, Texas, and Washington—voters will decide significant questions of state tax policy.

7 min read

The intentions behind federal deductibility are undoubtedly pro-taxpayer. Unfortunately, that is not what happens in practice. Tax liability is not reduced. It is distorted.

7 min read

On May 4th, Gov. Jay Inslee (D) signed legislation creating a 7 percent capital gains tax, to take effect next year. On November 2nd, Washington lawmakers will learn what voters think about it.

5 min read

Inflation is often called a hidden tax, but in many states it yields a far more literal tax increase as tax brackets fail to adjust for changes in consumer purchasing power.

5 min read

Kentucky and Tennessee won an important legal victory Friday when a federal court ruled that the American Rescue Plan Act (ARPA)’s restrictions on state fiscal autonomy were unconstitutional and enjoined (blocked) the enforcement of those provisions against both states.

7 min read

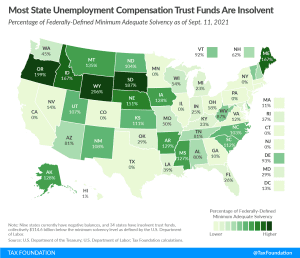

Given the restrictions on the use of federal relief funding, and the significantly higher tax burdens on employment that will result if trust funds are not replenished, applying federal aid to these trust funds should be an urgent priority.

11 min read

Whether spurred by a belief that government is improperly favoring religious institutions, an antipathy to wealthy celebrity pastors, or a hope that taxing houses of worship could bring down personal tax bills, the taxation of religious bodies is hotly debated online, but barely on the radar of actual elected officials. But is that true? How much, if any, tax revenue is forgone, and what do the policies look like?

7 min read

Earlier this year, Maryland legislators overrode Governor Larry Hogan’s (R) veto of HB732, approving a digital advertising tax, the first of its kind in the country. But legislators punted several crucial questions to the state comptroller, who last week submitted proposed regulations for the digital advertising tax to the state Joint Committee on Administrative, Executive, and Legislative Review.

9 min read

Neither Anchorage, Alaska, nor Portland, Oregon, impose any state or local sales taxes. Honolulu, Hawaii, has a low rate of 4.5 percent and several other major cities, including Milwaukee and Madison, Wisconsin, keep overall rates modest.

13 min read

Even as lawmakers in eleven states have cut income taxes this year, the D.C. Council has responded to surpluses and growth by voting to include substantial income tax increases in the budget.

7 min read

As states close their books for fiscal year 2021, many have much more revenue on hand than they anticipated last year. Eleven states have responded by reducing income tax rates and making related structural reforms as they strive to solidify a competitive advantage in an increasingly competitive national landscape.

29 min read

Tax reform has paid off for the Tar Heel State. North Carolina features one of the nation’s most competitive tax environments for businesses across the industry spectrum, and the state currently boasts the nation’s third-best effective tax rates for newly established firms and fifth-best rates for mature firms, according to a new analysis conducted by the Tax Foundation and KPMG LLP.

7 min read

Montana adopted structural reforms to both individual and corporate income taxes during the recently adjourned legislative session, enacting three bills reducing individual tax rates, simplifying the state’s individual tax system, repealing 16 tax credits, and changing the apportionment factor for corporate income tax.

5 min read

Today, the U.S. Treasury issued an interim final rule on the $350 billion in State and Local Fiscal Recovery Funds provided under the American Rescue Plan Act (ARPA). The proposed rule resolves several important questions but continues to involve the federal government in state finances at an extraordinary level.

7 min read

Digital advertising, social media, and data tax proposals have been introduced in nine states following enactment of Maryland’s digital advertising tax, which has since been postponed a year due to administrative and legal challenges.

14 min read

Location Matters is an account of tax complexity and the ways that tax structure affect competitiveness. For policymakers, it represents an opportunity to explore the seemingly more arcane tax provisions that can have a significant impact on business tax burdens, and to discover how their tax code—often completely by accident—picks winners and losers.

4 min read

A landmark comparison of corporate tax costs in all 50 states, Location Matters provides a comprehensive calculation of real-world tax burdens, going beyond headline rates to demonstrate how tax codes impact businesses and offering policymakers a road map to improvement.

8 min read

State and local tax policy have always mattered, but the rise of remote work is bringing tax burdens and economic competitiveness to the forefront. It is a development that states cannot afford to ignore.

5 min read