Janelle Fritts

Janelle Fritts was a Policy Analyst with the Tax Foundation’s Center for State Tax Policy. She is the lead researcher on the annual State Business Tax Climate Index and was one of the lead authors of Pro-Growth Tax Reform for Oklahoma. Her work has been cited in The New York Times, the Associated Press, Bloomberg, and numerous state media outlets across the country.

Before joining the Tax Foundation team, Janelle interned at the Mackinac Center for Public Policy, the Reason Foundation, and the Illinois Policy Institute. She graduated from Dordt College (Sioux Center, Iowa) with a bachelor’s degree in English with a writing emphasis and a minor in Chemistry.

Janelle was born and raised in Midland, Michigan, which is near Lake Huron and about halfway up the “mitten.” In her free time, she enjoys rock climbing, hiking, swing dancing, and singing. You’ll also find her rocking out to metal in Roxanne, her bright yellow Celica.

Latest Work

Kansas Tax Modernization: A Framework for Stable, Fair, Pro-Growth Reform

Our new report outlines various policy recommendations for Kansas to consider in order to begin a robust and bipartisan conversation about modernizing the state’s tax code to suit a 21st century economy.

15 min read

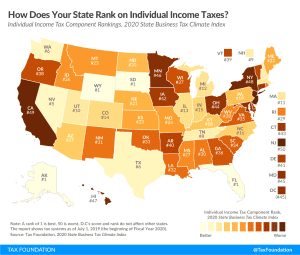

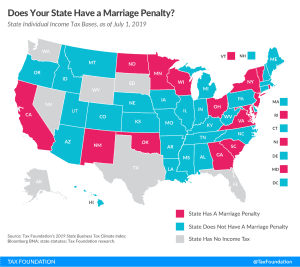

Does Your State Have a Marriage Penalty?

A marriage penalty is when married couples filing jointly face a higher effective tax rate than they would if they filed as two single individuals with the same amount of combined income.

2 min read

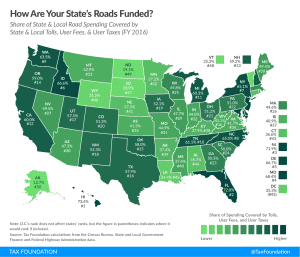

Road Taxes and Funding by State, 2019

4 min read

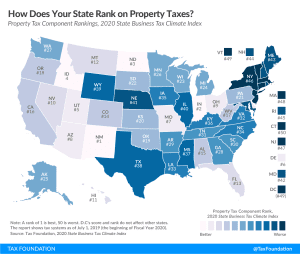

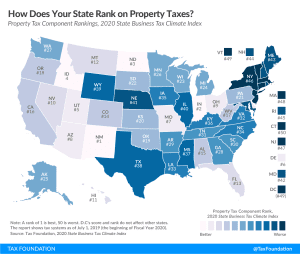

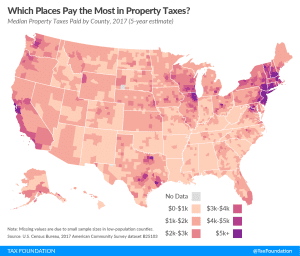

Property Taxes by County, 2019

3 min read

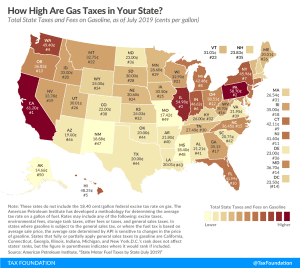

Gas Tax Rates by State, 2019

3 min read

Sales Tax Holidays by State, 2019

If a state must offer a “holiday” from its tax system, it is an implicit recognition that the state’s tax system is uncompetitive.

44 min read

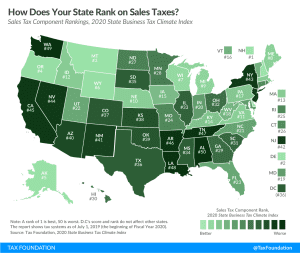

State and Local Sales Tax Rates, Midyear 2019

The role of competition in setting sales tax rates is often overlooked. One study shows that per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s, while per capita sales in border counties in Vermont have remained stagnant.

13 min read