Janelle Fritts

Janelle Fritts was a Policy Analyst with the Tax Foundation’s Center for State Tax Policy. She is the lead researcher on the annual State Business Tax Climate Index and was one of the lead authors of Pro-Growth Tax Reform for Oklahoma. Her work has been cited in The New York Times, the Associated Press, Bloomberg, and numerous state media outlets across the country.

Before joining the Tax Foundation team, Janelle interned at the Mackinac Center for Public Policy, the Reason Foundation, and the Illinois Policy Institute. She graduated from Dordt College (Sioux Center, Iowa) with a bachelor’s degree in English with a writing emphasis and a minor in Chemistry.

Janelle was born and raised in Midland, Michigan, which is near Lake Huron and about halfway up the “mitten.” In her free time, she enjoys rock climbing, hiking, swing dancing, and singing. You’ll also find her rocking out to metal in Roxanne, her bright yellow Celica.

Latest Work

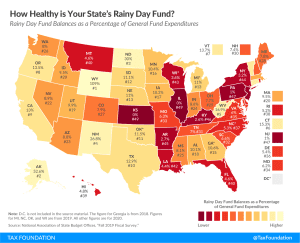

State Rainy Day Funds and the COVID-19 Crisis

State revenue stabilization funds, often called rainy day funds, are better funded now than they were at the start of the Great Recession and can be a valuable tool as states face a sharp pandemic-linked economic contraction.

18 min read

Tracking State Legislative Responses to COVID-19

Many states are racing to pass budgets, emergency COVID-19 supplemental appropriations, and other must-pass legislation as quickly as possible. We’re tracking the latest state legislative responses to the coronavirus crisis.

66 min read

How Healthy is Your State’s Rainy Day Fund?

Rainy day funds have increasingly emerged as a standard component of states’ budgeting toolkits. Economic cycles can have significant impacts on state revenue, but states can prepare for the inevitable downturns during good times by putting away money in a revenue stabilization fund.

2 min read

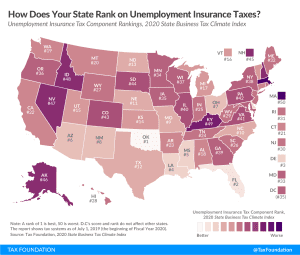

Facts and Figures 2020: How Does Your State Compare?

Our updated 2020 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

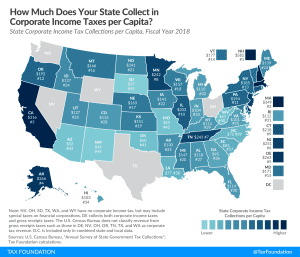

State Corporate Income Tax Rates and Brackets, 2020

Forty-four states currently levy a corporate income tax. Rates range from 2.5 percent in North Carolina to 12 percent in Iowa. Over the past year, several states, including Florida, Georgia, Indiana, Mississippi, Missouri, and New Jersey, implemented notable corporate income tax changes.

7 min read

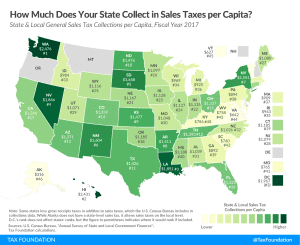

State and Local Sales Tax Rates, 2020

While many factors influence business location and investment decisions, sales taxes are something within lawmakers’ control that can have immediate impacts.

12 min read

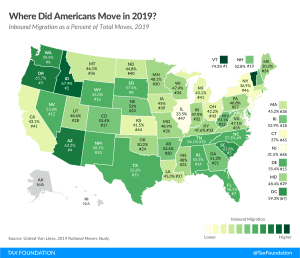

Where Did Americans Move in 2019?

2 min read

State Sales Taxes in the Post-Wayfair Era

Our new report explores the choices states have made regarding sales taxes following the South Dakota v. Wayfair Supreme Court online sales tax decision heading into calendar year 2020, outlines legal pitfalls states should seek to avoid, and offers up a few best practices for designing reliable, equitable, legally-sound remote sales tax regimes.

58 min read