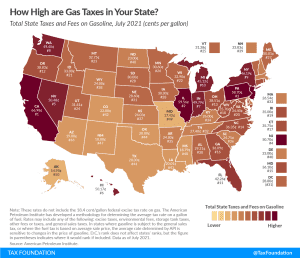

How High are Gas Taxes in Your State?

California pumps out the highest state gas tax rate of 66.98 cents per gallon, followed by Illinois (59.56 cpg), Pennsylvania (58.7 cpg), and New Jersey (50.7 cpg).

2 min read

Janelle Fritts was a Policy Analyst with the Tax Foundation’s Center for State Tax Policy. She is the lead researcher on the annual State Business Tax Climate Index and was one of the lead authors of Pro-Growth Tax Reform for Oklahoma. Her work has been cited in The New York Times, the Associated Press, Bloomberg, and numerous state media outlets across the country.

Before joining the Tax Foundation team, Janelle interned at the Mackinac Center for Public Policy, the Reason Foundation, and the Illinois Policy Institute. She graduated from Dordt College (Sioux Center, Iowa) with a bachelor’s degree in English with a writing emphasis and a minor in Chemistry.

Janelle was born and raised in Midland, Michigan, which is near Lake Huron and about halfway up the “mitten.” In her free time, she enjoys rock climbing, hiking, swing dancing, and singing. You’ll also find her rocking out to metal in Roxanne, her bright yellow Celica.

California pumps out the highest state gas tax rate of 66.98 cents per gallon, followed by Illinois (59.56 cpg), Pennsylvania (58.7 cpg), and New Jersey (50.7 cpg).

2 min read

Although state budgets may be in unusual places this year, sales tax holidays remain the same as they always have been—ineffective and inefficient.

4 min read

States can enhance tax neutrality across industries by reforming tax structures that penalize certain business activity, leaning less on generous incentives, and focusing more on creating a tax code that provides for low and competitive burdens for all comers.

5 min read

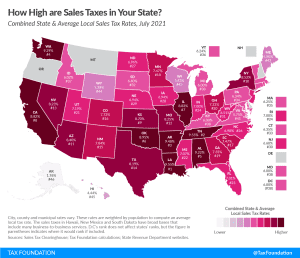

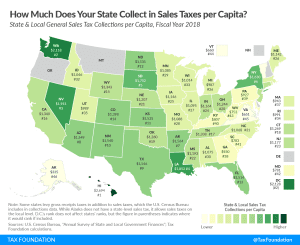

The highest average combined state and local sales tax rates are in Louisiana (9.55 percent), Tennessee (9.547 percent), Arkansas (9.48 percent), Washington (9.29 percent), and Alabama (9.22 percent).

12 min read

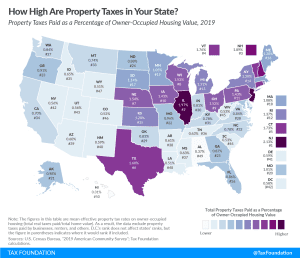

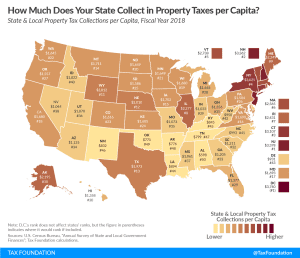

Because property taxes are tied to housing values, it makes sense that the actual dollar amounts of property taxes tend to be higher in places with higher housing prices. This map takes housing value into account to give a broader perspective for property tax comparison.

3 min read

Michigan lawmakers are considering lowering the corporate income tax rate to alleviate the tax burden on businesses still emerging from the pandemic and to make the state more competitive.

2 min read

While high top tax rates may provide “sticker shock” for corporations looking for a state to call home, they are just one of several important drivers of businesses’ tax burdens and tax compliance costs.

5 min read

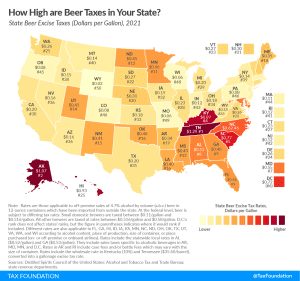

2021 state beer excise tax rates vary widely: as low as $0.02 per gallon in Wyoming and as high as $1.29 per gallon in Tennessee. Missouri and Wisconsin tie for second lowest at $0.06 per gallon, and Alaska is second highest with its $1.07 per gallon tax.

3 min read

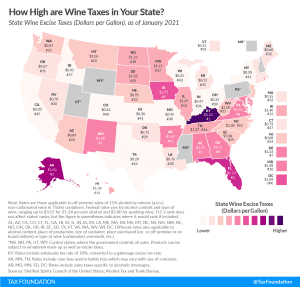

States tend to tax wine at a higher rate than beer but at a lower rate than distilled spirits due to wine’s mid-range alcohol content. You’ll find the highest wine excise taxes in Kentucky at $3.23 per gallon, far above Alaska’s second-place $2.50 per gallon. Those states are followed by Florida ($2.25), Iowa ($1.75), and Alabama and New Mexico (tied at $1.70).

2 min read

New Hampshire lawmakers are scheduled to take up a budget conference report which contains several tax reforms negotiated by both chambers that would ultimately make New Hampshire the ninth state to impose no tax on individual income. These reforms floated at the beginning of the 2021 session found their way into HB 2, including rate reductions in the Business Profits Tax (BPT) and Business Enterprise Tax (BET) and a phaseout of the interest and dividends tax.

4 min read

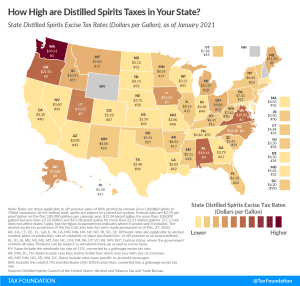

Of all alcoholic beverages subject to taxation, stiff drinks—and all distilled spirits—face the stiffest tax rates. Like many excise taxes, the treatment of distilled spirits varies widely across the states.

3 min read

It took until the last day of the session, but Louisiana lawmakers succeeded in passing a tax reform package Thursday that would simplify a complicated tax code and make the state more economically competitive.

4 min read

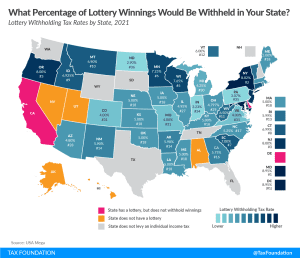

Krispy Kreme may have started the vaccine incentive ball rolling, but many states are putting big money into the effort with vaccine lotteries. Unlike a normal lottery, no one is paying for tickets—but the tax collector still gets paid when someone wins.

2 min read

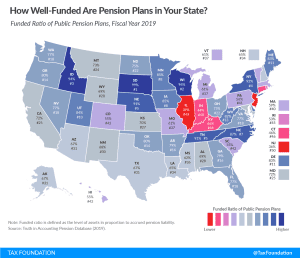

Although most states are on solid financial footing following the coronavirus crisis, pension liabilities are a deep-seated problem that long predates the pandemic.

2 min read

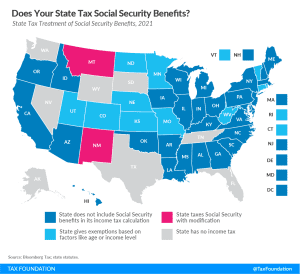

Thirteen states tax Social Security benefits, a matter of significant interest to retirees. Each of these states has its own approach to determining what share of benefits is subject to tax, though these provisions can be grouped together into a few broad categories.

4 min read

Last Friday, Oklahoma Governor Kevin Stitt (R) signed House Bills 2960, 2962, and 2963 into law as part of a budget agreement, bringing the legislature’s tax plans across the finish line. These bills will reduce the state’s corporate and individual income tax rates beginning in tax year 2022.

3 min read

Property taxes are an important source of revenue for local and state governments. In FY 2018, property taxes generated over 30 percent of total U.S. state and local tax collections and over 70 percent of local tax collections.

2 min read

Rightsizing a state’s sales tax base can not only make the tax more equitable and better align it with the modern economy but also generate revenue that can be used to pay down the rates of more harmful taxes. That is why sales tax base broadening, which is favored by public finance scholars across the political spectrum, features in many tax reform plans.

3 min read

A landmark comparison of corporate tax costs in all 50 states, Location Matters provides a comprehensive calculation of real-world tax burdens, going beyond headline rates to demonstrate how tax codes impact businesses and offering policymakers a road map to improvement.

8 min read

While many of the tax proposals work in tandem, some conflicts continue to exist. If lawmakers were able to repeal federal deductibility, reduce income tax rates, finish the job on inventory taxation, and phase out the capital stock tax, this would represent a marked improvement in the state’s tax climate, eliminating several of the most uncompetitive features of the current code.

6 min read