Janelle Fritts

Janelle Fritts was a Policy Analyst with the Tax Foundation’s Center for State Tax Policy. She is the lead researcher on the annual State Business Tax Climate Index and was one of the lead authors of Pro-Growth Tax Reform for Oklahoma. Her work has been cited in The New York Times, the Associated Press, Bloomberg, and numerous state media outlets across the country.

Before joining the Tax Foundation team, Janelle interned at the Mackinac Center for Public Policy, the Reason Foundation, and the Illinois Policy Institute. She graduated from Dordt College (Sioux Center, Iowa) with a bachelor’s degree in English with a writing emphasis and a minor in Chemistry.

Janelle was born and raised in Midland, Michigan, which is near Lake Huron and about halfway up the “mitten.” In her free time, she enjoys rock climbing, hiking, swing dancing, and singing. You’ll also find her rocking out to metal in Roxanne, her bright yellow Celica.

Latest Work

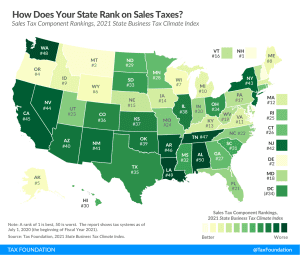

Ranking Sales Taxes on the 2021 State Business Tax Climate Index

An ideal sales tax applies to a broad base of final consumer goods and services, with few exemptions, and is levied at a low rate. Broad-based, low-rate tax structures minimize tax-induced economic distortions that can occur when people change their purchasing behavior because of tax differences.

3 min read

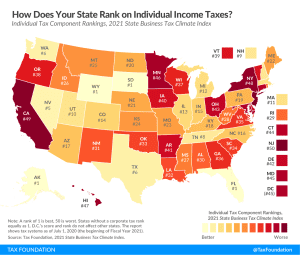

Election Analysis: Why Voters Split the Difference on Income Tax Measures

Illinois voters rejected a high graduated rate income tax (“Fair Tax”) while Arizonans embraced a large income tax rate increase for high earners, among the many attention-grabbing results from Tuesday’s elections.

7 min read

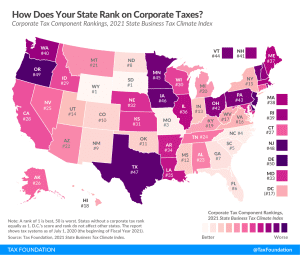

Ranking Corporate Income Taxes on the 2021 State Business Tax Climate Index

The corporate tax component of our Index measures each state’s principal tax on business activities. Most states levy a corporate income tax on a company’s profits (receipts minus most business expenses, including compensation and the cost of goods sold), while some states levy gross receipts taxes, which allow few or no deductions for a company’s expenses.

2 min read

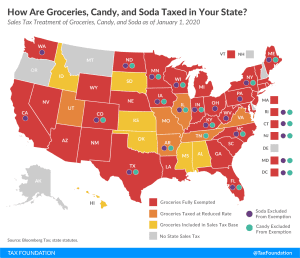

Tax Treatment of Groceries, Candy, and Soda Can Get Tricky

Even in 2020, jack-o’-lanterns and fake skeletons have popped up in neighborhoods as they do every October, although Halloween may look and play out differently this time around.

4 min read

2021 State Business Tax Climate Index

166 min read

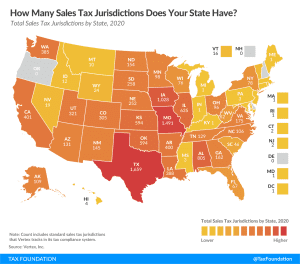

How Many Sales Tax Jurisdictions Does Your State Have?

Following the Wayfair decision, states’ move to tax online sales has increased the importance of simplicity in sales tax systems, as sellers now have to deal with differing regulations in multiple states. There are over 11,000 standard sales tax jurisdictions in the United States in 2020

2 min read

Arizona Proposition 208 Threatens Arizona’s Status as a Destination for Interstate Migration

Significantly raising the income tax through Proposition 208 will only serve to make Arizona less competitive, especially at a time when individuals and small businesses are already struggling. If Arizona is looking for a long-term way to increase education funding, it would do well to avoid overburdening struggling taxpayers and look toward more broad-based, stable sources of revenue.

5 min read

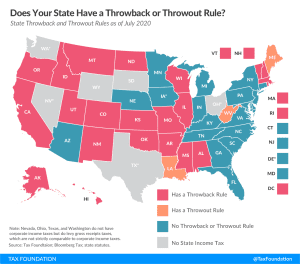

Throwback and Throwout Rules by State, 2020

State throwback and throwout rules may not be widely understood, but they have a notable impact on business location and investment decisions and reduce economic efficiency for the states which impose such rules.

3 min read

State and Local Tax Ballot Measures to Watch on Election Day 2020

Here are the state tax ballot measures to watch on Election Day 2020. Explore the most notable 2020 state tax ballot measures in 15 states.

4 min read

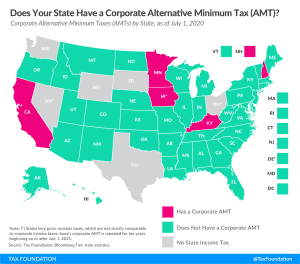

Does Your State Have a Corporate Alternative Minimum Tax?

Five states currently collect corporate AMTs: California, Iowa, Kentucky, Minnesota, and New Hampshire. This is a significant drop from the eight states that levied AMTs in tax year 2017.

2 min read

Seventh Time’s the Charm: New Jersey Passes Millionaires Tax

After six unsuccessful tries at passage, it appears the coronavirus crisis has tipped the scales in favor of Gov. Phil Murphy’s (D) millionaires tax. New Jersey may be feeling the financial squeeze right now, but this large income tax change will not solve budget problems and may exacerbate funding issues by making the state even unfriendlier to businesses.

3 min read

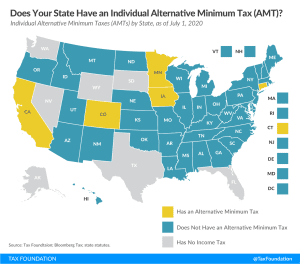

Does Your State Have an Individual Alternative Minimum Tax (AMT)?

Under an individual AMT, many taxpayers are required to calculate their income tax liability under two different systems and pay the higher amount.

2 min read

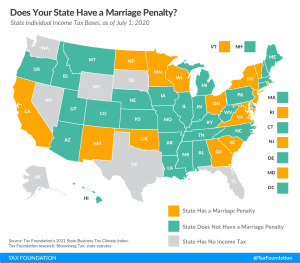

Does Your State Have a Marriage Penalty?

A marriage penalty exists when a state’s income brackets for married taxpayers filing jointly are less than double the bracket widths that apply to single filers.

2 min read

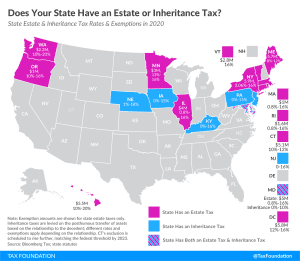

Estate and Inheritance Taxes by State, 2020

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

3 min read

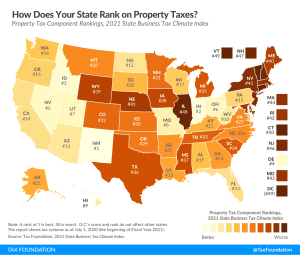

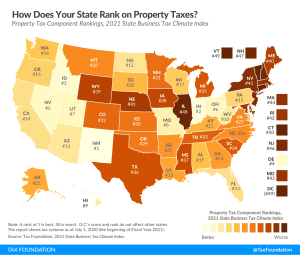

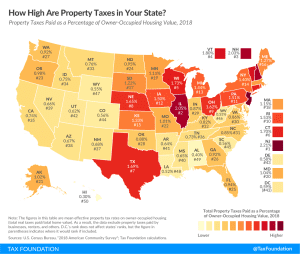

How High Are Property Taxes in Your State?

New Jersey has the highest effective rate on owner-occupied property at 2.21 percent, followed closely by Illinois (2.05 percent) and New Hampshire (2.03 percent).

2 min read

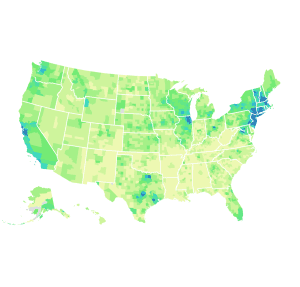

Property Taxes by County, 2020

The five counties with the highest median property tax payments are all located near New York City and have bills exceeding $10,000.

3 min read

Nevada Hoping to Extract Revenue with Mining Tax Increase Amendment

Nevada is not alone in its need to find revenue, but it should take care not to embrace bad tax policy in the process. Significant rate increases, a shift in the tax base, and provisions which make it easier to hike taxes than to cut them would heavily burden the mining industry in the state.

3 min read

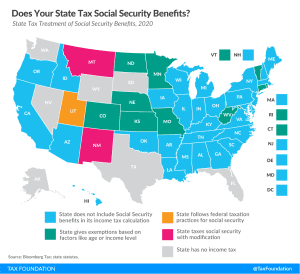

Does Your State Tax Social Security Benefits?

The question, “Does my state tax Social Security benefits?” may be simple enough, but the answer includes a lot of nuance. Many states have unique and specific provisions regarding the taxation of Social Security benefits, which can be broken into a few broad categories.

3 min read