Elke Asen was a Policy Analyst with the Tax Foundation’s Center for Global Tax Policy, focusing on international tax issues and tax policy in Europe. Prior to joining the Tax Foundation, Elke interned with the EU Delegation in Washington, D.C., the German Development Agency, and a social startup in Munich, Germany. She holds a BS in Economics from Ludwig Maximilian University of Munich.

Elke was born and raised in a small town of 500 people outside of Salzburg, Austria, and loves to travel. Road tripping and backpacking are her favorites.

Latest Work

FAQ on Digital Services Taxes and the OECD’s BEPS Project

What is a digital services tax (DST)? What countries have announced, proposed, or implemented a DST? What are some of the criticisms of a DST? What are alternatives to a DST? What is the OECD BEPS project and what is its main objective? What is the main objective of OECD Pillar 1? What is the main objective of OECD Pillar 2?

8 min read

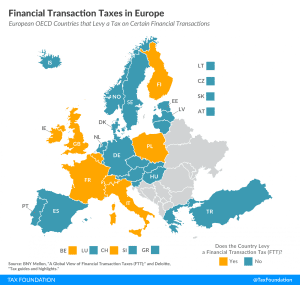

Financial Transaction Taxes in Europe

2 min read

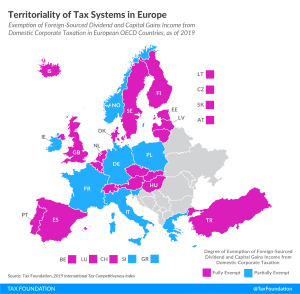

Territoriality of Tax Systems in Europe

3 min read

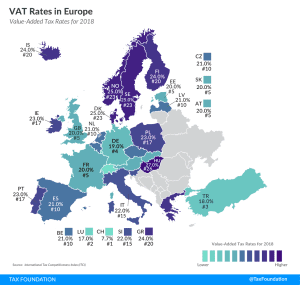

VAT Rates in Europe, 2020

4 min read

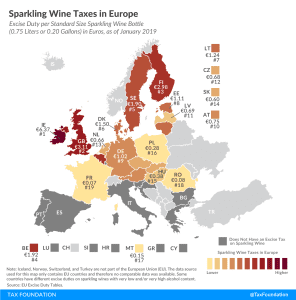

Sparkling Wine Taxes in Europe

1 min read

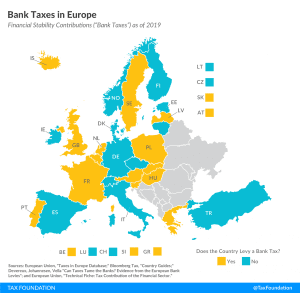

Bank Taxes in Europe

2 min read

Corporate Tax Rates around the World, 2019

Since 1980, corporate tax rates have consistently declined on a global basis. More countries have shifted to taxing corporations at rates lower than 30 percent, with the United States following this trend with its tax changes at the end of 2017.

15 min read

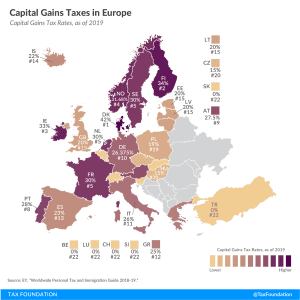

Capital Gains Taxes in Europe, 2019

2 min read

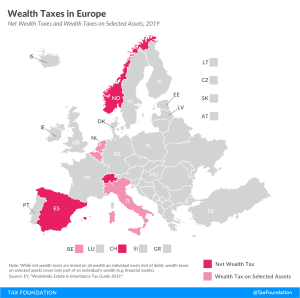

Wealth Taxes in Europe, 2019

Only three European countries levy a net wealth tax, namely Norway, Spain, and Switzerland. Belgium, Italy, and the Netherlands levy wealth taxes on selected assets, but not on an individual’s net wealth per se.

3 min read

Welcome to the Index, Lithuania!

5 min read

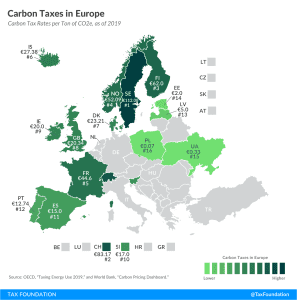

Carbon Taxes in Europe, 2019

3 min read

Carbon Tax and Revenue Recycling: Revenue, Economic, and Distributional Implications

In our new report, we explore the design implications of a carbon tax and provide estimates for revenue, economic, and distributional effects of three potential carbon tax and revenue recycling proposals. Each proposal faces different trade-offs and achieves different policy goals.

23 min read