Elke Asen was a Policy Analyst with the Tax Foundation’s Center for Global Tax Policy, focusing on international tax issues and tax policy in Europe. Prior to joining the Tax Foundation, Elke interned with the EU Delegation in Washington, D.C., the German Development Agency, and a social startup in Munich, Germany. She holds a BS in Economics from Ludwig Maximilian University of Munich.

Elke was born and raised in a small town of 500 people outside of Salzburg, Austria, and loves to travel. Road tripping and backpacking are her favorites.

Latest Work

Tax Treaty Network of European Countries

1 min read

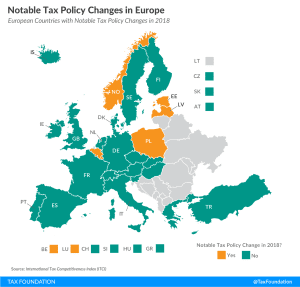

Notable Tax Policy Changes in Europe

2 min read

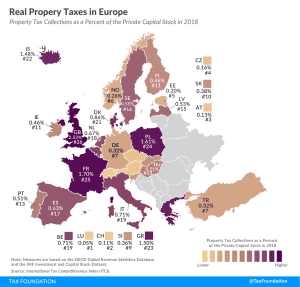

Real Property Taxes in Europe, 2019

3 min read

Capital Cost Recovery across the OECD, 2019

Capital cost recovery, though often overlooked, can have a significant impact on investment decisions—with far-reaching economic consequences.

24 min read

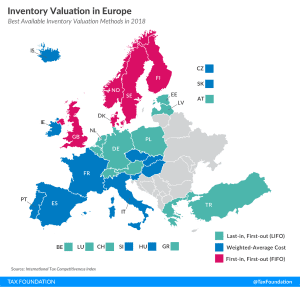

Inventory Valuation in Europe

2 min read

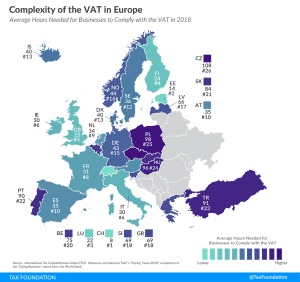

Complexity of the VAT in Europe

2 min read

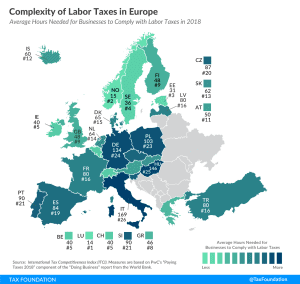

Complexity of Labor Taxes in Europe

3 min read

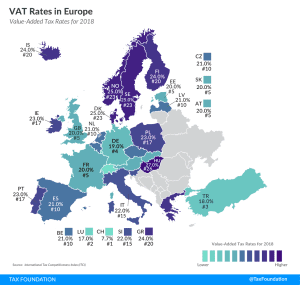

VAT Rates in Europe, 2019

4 min read

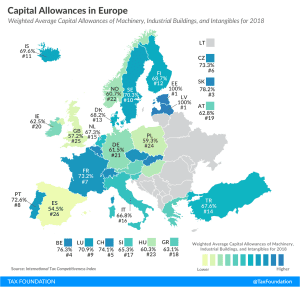

Capital Allowances in Europe, 2019

3 min read