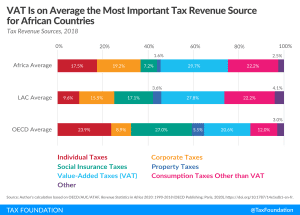

A 15 Percent VAT Rate Is Possible by Scrapping Reduced Rates

A VAT tax reform that eliminates VAT reduced rates would decrease compliance costs and allow for a more rapid economic recovery. Policymakers should focus on simplifying VAT rules and making them more efficient and neutral by broadening their tax bases and eliminating reduced rates and unnecessary tax exemptions.

4 min read