The nine legislative measures released by the House Ways and Means CommitteeThe Committee on Ways and Means, more commonly referred to as the House Ways and Means Committee, is one of 29 U.S. House of Representative committees and is the chief tax-writing committee in the U.S. The House Ways and Means Committee has jurisdiction over all bills relating to taxes and other revenue generation, as well as spending programs like Social Security, Medicare, and unemployment insurance, among others. under the budget reconciliation instructions begins to put legislative text to Congress’ next round of pandemic relief.

The nine measures comprise more than half of the $1.9 trillion in additional coronavirus-related relief put forth by congressional Democrats and President Biden. The Ways and Means measures would extend many relief programs already in place and expand other provisions, including the child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. and earned income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. credit.

Economic Impact Payments (Direct Payments)

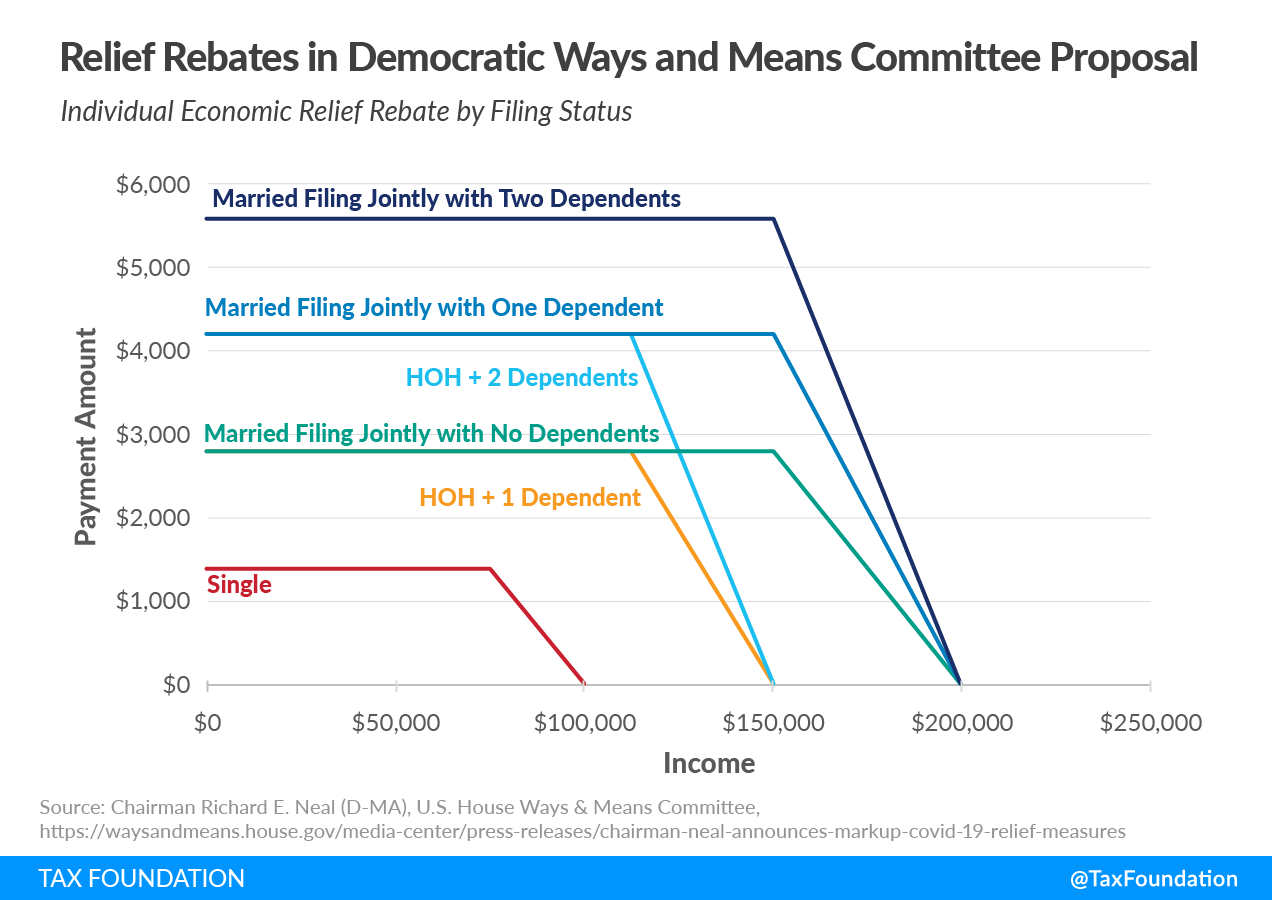

Single individuals with an adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” less than $100,000, heads of household under $150,000 and joint filers below $200,000 would receive a third round of economic impact payments. Each adult and dependent would be provided $1,400, phasing out beginning at $75,000 for single filers, $112,500 for heads of household, and $150,000 for joint filers.

The phaseout rates vary depending on filing status and number of dependents. For example, filers with dependents face a higher phaseout rate than filers without dependents in order for their payments to reach zero by the fixed phaseout threshold for their filing status (see Figure 1). The design shares similarities with the proposed payments in the House Democratic HEROES Act, introduced last spring.

Unlike the previous two rounds that excluded adult dependents, adult dependents would be eligible for the $1,400 payments.

Using the Tax Foundation General Equilibrium Model, we estimate that the bottom 20 percent would experience a 24.7 percent increase in after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. s, while the top 1 percent would receive little benefit due to the phaseouts; 93.3 percent of filers would receive a payment, with an average rebate of $2,229.

| Income level | Percent Change in After-Tax Income | Share of Filers with a Rebate | Average Rebate Amount |

|---|---|---|---|

| 0% to 20% | 24.70% | 100% | $2,172 |

| 20% to 40% | 10.81% | 100% | $2,537 |

| 40% to 60% | 6.41% | 100% | $2,431 |

| 60% to 80% | 4.21% | 99.9% | $2,620 |

| 80% to 90% | 2.48% | 98.2% | $2,261 |

| 90% to 95% | 0.77% | 58.2% | $971 |

| 95% to 99% | 0.03% | 9.4% | $57 |

| 99% to 100% | 0.00% | 0.1% | $0 |

| Total | 3.8% | 93.3% | $2,229 |

|

Source: Tax Foundation General Equilibrium Model, January 2021 |

|||

The Joint Committee on Taxation (JCT) estimates the third round of payments will cost $422 billion.

Federal Unemployment Insurance

The Ways and Means measures would extend the three federal unemployment insurance (UI) expansions (Pandemic Unemployment Assistance, Federal Pandemic Unemployment Compensation, and Pandemic Emergency Unemployment Compensation) through August 29, 2021. Federal funding will also be extended for states waiving their waiting week for benefits.

Pandemic Unemployment Assistance (PUA) provides unemployment benefits to gig-economy workers, independent contractors, and others who would not otherwise be eligible. The measures would increase the total number of weeks of benefits available to individuals who cannot return to work safely from 50 to 74, matching the expiration of the broader UI benefits.

Federal Pandemic Unemployment Compensation (FPUC) provides a federal supplement on top of state unemployment insurance. The measures would increase FPUC from its current level of $300 a week to $400 a week, for weeks beginning after March 14 and before August 29, 2021.

Pandemic Emergency Unemployment Compensation (PEUC) allows workers to continue receiving benefits if they fully exhaust their state-level benefits. The measures would increase the number of PEUC weeks from 24 to 48 while extending the period a worker can use the program to August 29, 2021.

The UI expansions diverge from President Biden and Senate Finance Chair Ron Wyden’s (D-OR) desire to extend the programs through September. This will be an area of potential compromise between the two chambers and the White House over the coming weeks.

Individual Tax Credits

The measures would also expand the Child Tax Credit (CTC) in 2021 from $2,000 to a fully refundable $3,600 for children 6 and under and $3,000 for children over 6. It would be sent out as monthly payments based on income tax returns on file with the Internal Revenue Service (IRS) for 2019 or 2020. The JCT estimates the one-year expansion of the credit would reduce federal revenue by $109.5 billion. We’ve summarized more details on the CTC changes here.

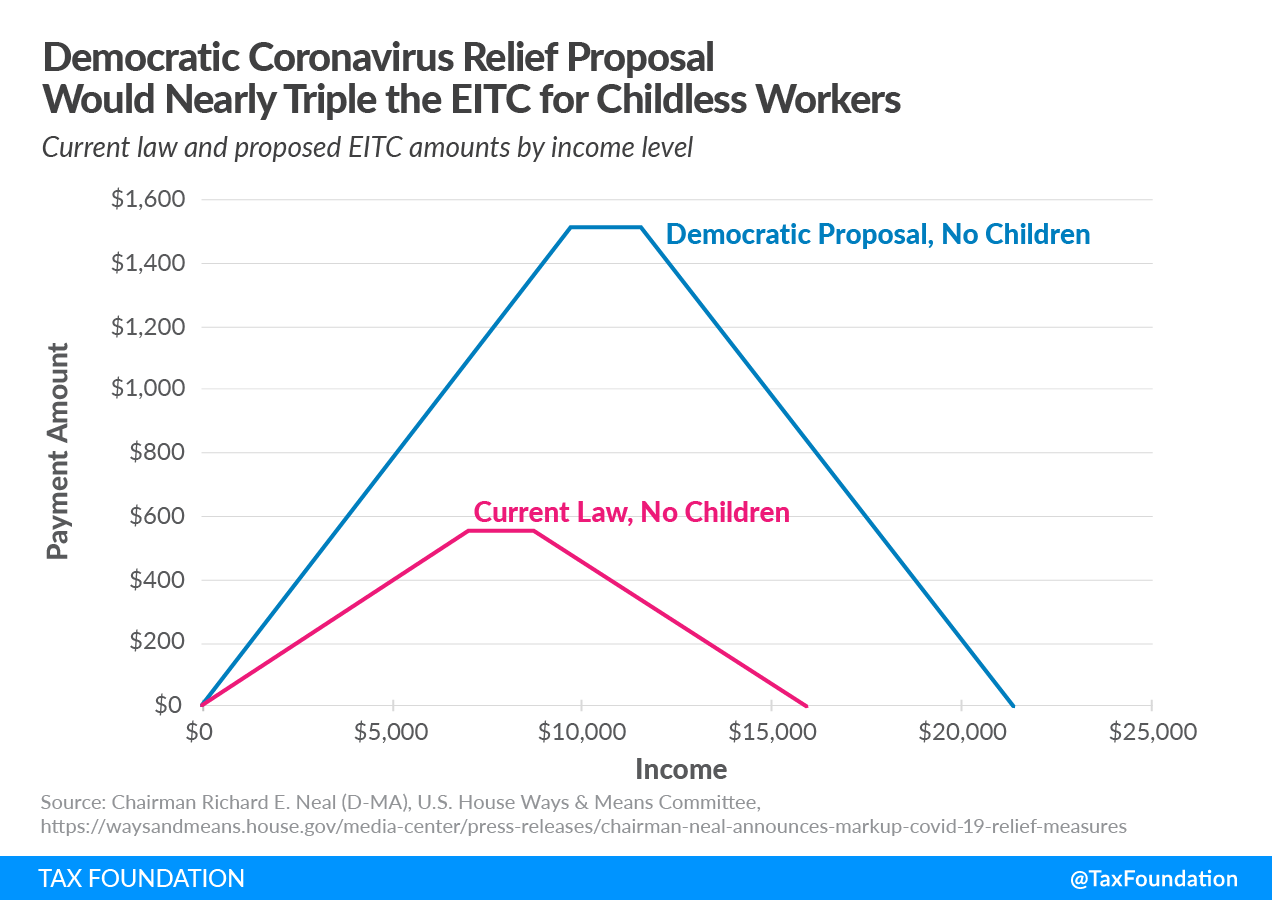

The Earned Income Tax Credit (EITC) for childless workers would be expanded for 2021. The minimum age to claim it would be reduced from 25 to 19, and the upper age limit, up to age 65, would be eliminated. The maximum credit amount would increase from $543 under current law to $1,502 under the measures by increasing the credit rate at which the credit phases in and out and the income level where the max credit is reached and begins phasing out ($9,820 and $11,610, respectively, for non-joint filers).

The JCT estimates expanding the childless EITC for one year would reduce federal revenue by $11.8 billion.

The measures would also repeal a provision that currently prevents otherwise qualified taxpayers from claiming the EITC if they fail to meet the child identification requirements. In those instances, taxpayers could still be eligible for the childless EITC. The measures would also allow a married but separated individual to be treated as not married for purposes of the EITC if a joint return is not filed. Most EITC errors are related to children not meeting the qualification rules, according to the IRS.

The amount of investment income that would disqualify a person from receiving the EITC would be increased from $3,650 (in 2020) to $10,000 (adjusted for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. going forward).

A lookback period would be used for filing taxes in 2021. The lookback would allow filers to substitute their 2019 income levels for 2021 when calculating the EITC amount if 2021 income dropped below 2019.

Together, the JCT estimates the proposed EITC changes would reduce federal revenue by $25.9 billion from 2021 through 2031.

The maximum tax credit for child and dependent care (CDCTC) would increase from $1,050 for one child and $2,100 for two or more children under current law to $4,000 and $8,000 under the measures.

The credit would also be fully refundable and start to phase out for taxpayers with adjusted gross income above $400,000. It would completely phase out for taxpayers with AGI above $500,000.

The CDCTC expansion would be available for only 2021. The JCT estimates the one-year CDCTC expansion would reduce federal revenue by $8 billion.

Business Tax Credits

The measures would also extend the business tax credits for paid sick and family leave through September 30, 2021. The credits were created in the Families First Coronavirus Response Act. The measures would expand the credits by increasing the annual wages an employer may claim the credit for from $10,000 to $12,000 and allowing paid leave to be used for receiving a COVID-19 vaccine. Other changes include resetting the 10-day limitation for sick days after March 31, 2021 and allowing the credit to be used again hospital insurance tax. The JCT estimates it would cost $5.2 billion.

The measures would also extend the Employee Retention Tax Credit (ERTC) through December 31, 2021, including the changes made to the credit in the Consolidated Appropriations Act of 2021 passed in December 2020, and allow the credit to be taken as a refundable credit against the hospital insurance tax beginning after June 30, 2021. The JCT estimates it would cost $8.8 billion.

The measures would increase the Affordable Care Act’s premium tax credits for 2021 and 2022 and provide other healthcare-related subsidies. The JCT estimates expanding the premium tax credits would reduce federal revenue by $45.6 billion.

Miscellaneous

The measures also contain additional funding for programs related to vulnerable populations, the elderly, skilled nursing facilities, and provisions addressing multiemployer pension plans.

International Tax Changes

The measures include repealing worldwide interest allocation rules as a revenue offset. The election to allocate interest and other expenses on a worldwide basis became effective for taxable years beginning after December 31, 2020 after being delayed several times. Amid the delays, the Tax Cuts and Jobs Act of 2017 overhauled the way multinational corporations are taxed. Repealing the worldwide allocation relative to current law would result in a tax hike, but at the same time, allocating U.S. expenses using a worldwide apportionmentApportionment is the determination of the percentage of a business’ profits subject to a given jurisdiction’s corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders. rule does not make sense if the goal is to have a territorial tax systemA territorial tax system for corporations, as opposed to a worldwide tax system, excludes profits multinational companies earn in foreign countries from their domestic tax base. As part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation towards territorial taxation. . The interactions between the proposed tax change and the current tax system would be complex and costly. The JCT estimates it would increase federal revenue by $22.3 billion from 2021 through 2031.

Conclusion

Some of the measures outlined here further extend the relief measures created by the CARES Act passed last year and most recently extended again in December by the Consolidated Appropriations Act of 2021. The measures go further by significantly expanding existing tax credits and making changes to the international tax system.

Related Resources

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe